Marlon Trottmann

Dear readers/followers,

Sika AG (OTCPK:SXYAY) is a company that I’ve looked at for a number of years, and invested in for about a year. My investment thus far has not outperformed the overall market – but the company is a solid investment option with strong fundamentals and market leadership in specialty chemicals. Specifically, Sika’s portfolio includes world-leading brands in bonding, sealing, damping, reinforcing, and protection, with impressive margins and market share.

It’s well-known enough that even I, who is not in any way a “handyman”, have used Sika’s products in some renovating and home projects.

In this article, I’ll update the quarterly report for Sika, and show you why I consider the company an attractive investment, even after this recent move in valuation (meaning upwards). 1Q24 was released in April of 2024. There were a number of items during the quarterly that I consider to be relevant for investors to be aware of.

Despite my recent modest RoR, because I invested relatively cheaply into the company, my position in Sika remains at a good overall RoR. I will however say that my article timing for the past few pieces has been less than ideal – but my buys have been done at very cheap levels, including some buys during the fall 2023 dip.

You can find my last piece on the company here.

Sika AG – Plenty to like about the fundamentals, and the long-term upside remains positive

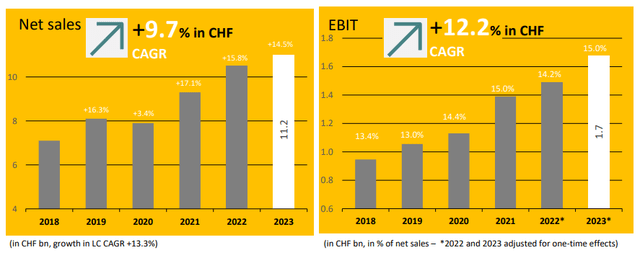

110 years of chemical history in crucial segments and sub-segments – that’s what Sika offers you, with activity in over 100 nations and over $10B in annual revenue from a market-leading portfolio of products. The company’s dividend of less than 1.5% has grown less appealing over the past few years as the risk-free rate has increased, so we must have, in my view, an upside of at least 15% annualized upside from the valuation here.

Sika is also the counterpoint to any typical cyclicality in chemicals. It has not for over 12 years recorded a single fiscal year of declining adjusted EPS. This supports a premium that is very atypical for the industrial/chemical sector – and also is one of the main reasons why I invest in the company.

However, it’s also crucial for me to show you that every investment should be made with a focus on your investment goals. By following my work on Sika, you also have a right, but above all the responsibility to know and to understand what my goals are and what I invest in – so that you do not make mistakes with regards to your own goals.

That being said, my goal is not typically to 10-20x my investment capital in a short time. If that was my goal, I wouldn’t invest in Sika, because Sika AG does not offer this (in my estimate). No, over 75% of my current portfolio is aimed at providing me with qualitative and above-average/relatively risk-free income, but also, at the same time, generating a potential capital appreciation from the valuation upside.

This has resulted in an average of 15-25% per year for the past few years, and it’s more than enough for me (even above my expectations). Only a very small portion of my portfolio is aimed at investments where I believe in 10x developments in a short timeframe.

Sika is, therefore, a combined income (low on the income side) and capital appreciation play, backed by what I view as incredible quality.

1Q24 had several milestones for the company.

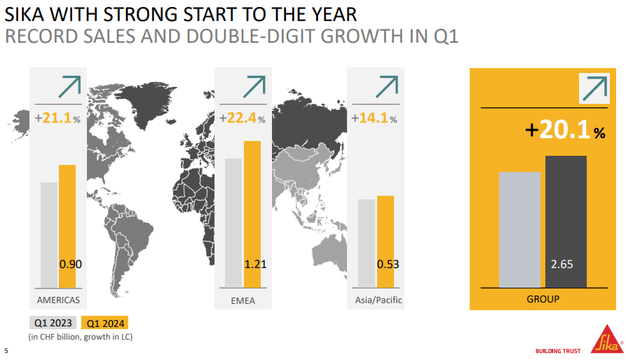

Looking at what you see here, this should be something you expect from Sika. Growth in all regions, solid trends. Double-digit 20.1% local currency growth, with a 13.8% growth in company-wide sales, and an M&A effect of almost 20% from one of the company’s recent major moves, the M&A of Kwik Bond, but above all, MBCC.

Sika was also able to confirm the 2024E goals, with sales growth close to double digits, and an over-proportional (the company’s own words) increase in EBITDA.

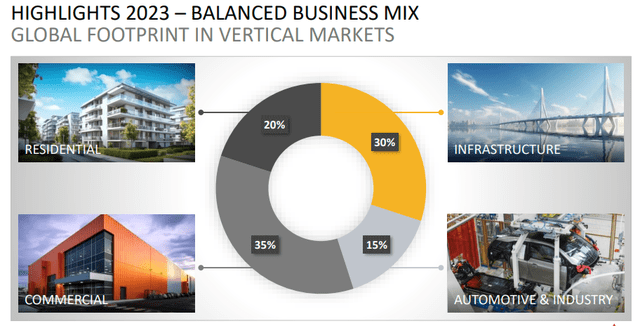

The company’s end markets remain tilted towards construction – 84% – with 16% Automotive and industrial exposure. Sika also acquired, in April, Kwik Bond Polymers, which is a manufacturer of polymer systems in the US. And while construction makes up for most of the end markets, the company’s more granular exposure is more interesting than this.

The company’s geographical mix remains very interesting, with 59% mature markets, providing very stable baseline stability against the 41% emerging market exposure, of which 55% is refurbishment. I believe this particular mix acts as a buffer against volatility, and the company’s trends, continuing into 2023, and seeming to continue into 2024 as well, confirm this.

Not only is Sika growing, it’s also growing faster than any of its peers.

MBCC was the largest M&A for Sika in some time, because it added 6,000 employees and over $2B in sales, in addition to already being a very strong portfolio. Synergy targets for the two companies have now been raised to 200M CHF for 2026, which will further improve Sika’s margins.

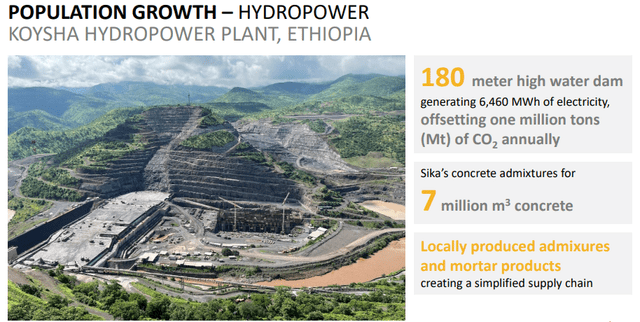

The company now expects EBITDA margins in the 20% range, up from 16-18% as they are at this particular time. The continued appeal of strong megatrends, including continued urbanization, climate change, digitization, increasing regulations, demographic changes, technological progress, scarcity of resources, and population growth, all speak to large, vertically integrated businesses like Sika doing well on a forward basis. The company’s ambition is a growth target of 6-9% per year, about 3% of which is set to come from M&A.

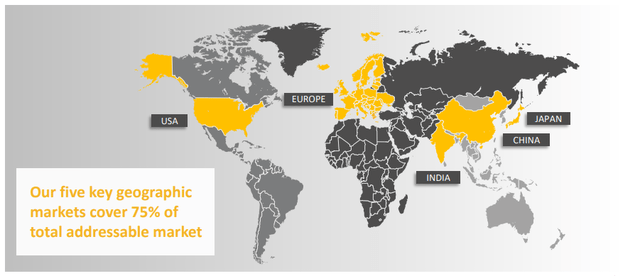

The company has already “chosen” its strategic markets – including where to be and more importantly where not to be (Sort of).

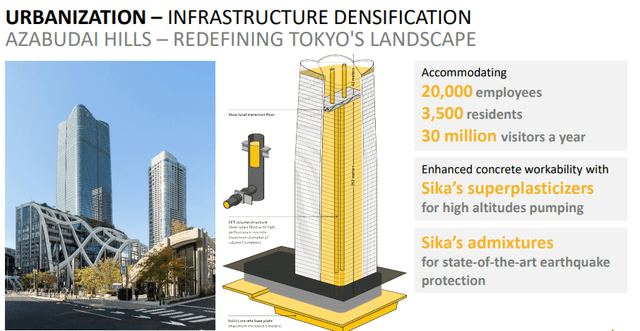

This is also where Sika is pushing its investments and where Sika products are being used. A few examples are here. All of the recent semiconductor plants such as Samsung in Texas, are using Sika’s product solutions.

Also, an interesting stat – no building above 187M in Tokyo is built without Sika’s products. 10 buildings are currently under construction – so the company’s solutions are being used to build all skyscrapers in all of Tokyo.

Tokyo, with its earthquake-prone geographies, is a very good example of how the company’s products are being used. India is a new growth market for Sika, with a construction market at a $600B size, expanding at 6% CAGR throughout all of 2026, with investments in transport, infrastructure, and maintenance. Sika is already leading the charge here, with solutions that allow the transition from site-mixed to pre-mixed mortars – a huge change.

The company recently got an order for concrete admixtures for 13M cubic meters of concrete across 20 site locations for the new Mumbai-Ahmedabad high-speed rail system in India.

And that is only one example, with plenty of more out there.

In short, Sika is firing on all cylinders, and all of the business trends that I can see here are telling me that the growth is actually likely to continue here.

And this influences company valuation and what we can expect to “get” for our investment here.

Valuation for Sika – Plenty of upside at the premium, and I believe the premium is warranted

As before, I believe a premium valuation for the company may be warranted here. But how high a premium, that’s of course the question.

The company’s yield is lower here even than it was before. At 0.62%, it’s almost fair to say the dividend is entirely negligible. We need growth.

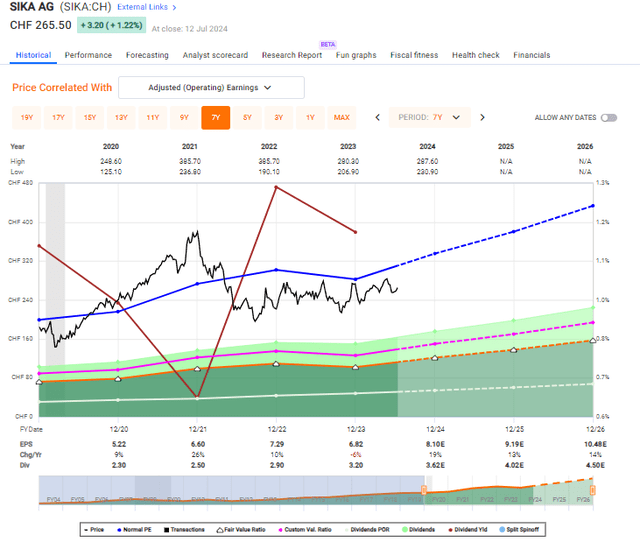

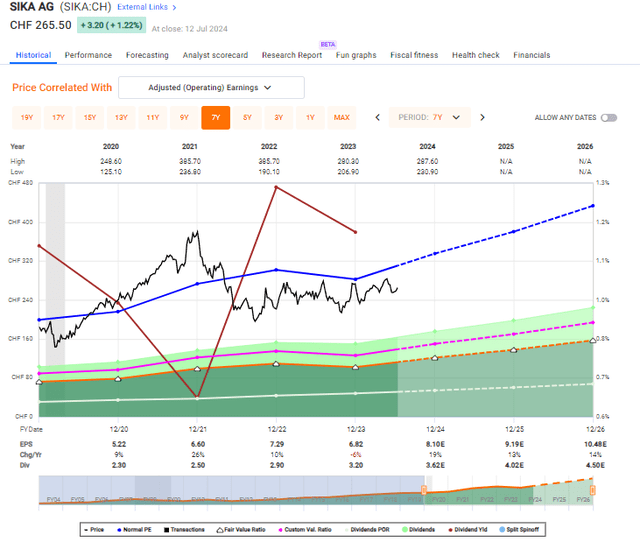

And thankfully, we have grown. Sika is A-rated and despite the recent bout of M&As, has only 40% of long-term debt to capital. The company is also expected to grow at an average of 15% per year over the next few years (Source: paywalled F.A.S.T graphs link)

And it’s no longer as insanely expensive as it was pre and during/after COVID-19. The company now trades at 35x, which might sound incredibly high (and from some perspectives, it is), but it’s also a company that both over the 5-year and 10-year average approaches a P/E of 40x.

It is, as I’ve said in other articles, the highest premium I allow for a company on the market today.

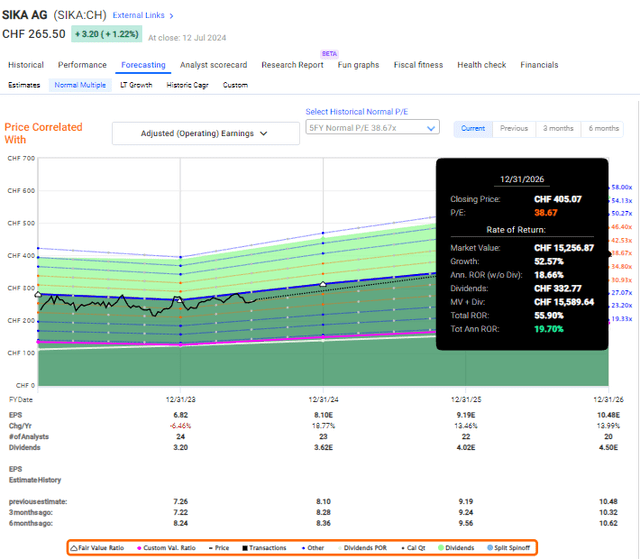

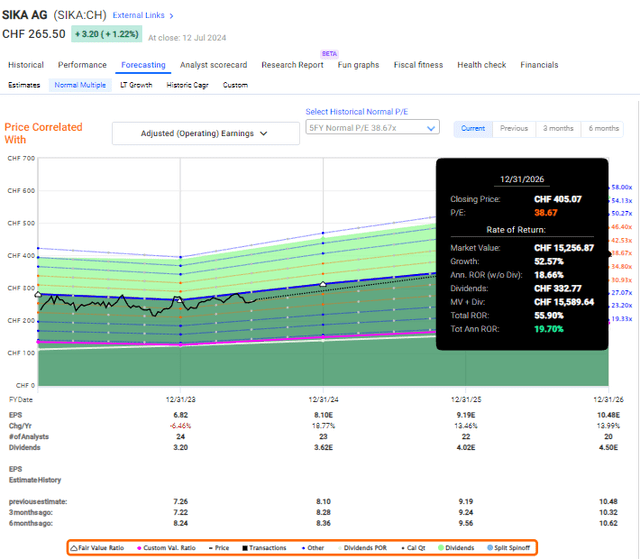

Sika Upside F.A.S.T graphs (Sika Upside F.A.S.T graphs)

Because, again, the company’s growth seems so certain. Sika never really misses estimates – it hits them or beats them, at least for the past 10 years. And forecasting Sika even at a 5-10-year discount of 36-38x P/E, gives us the following upside here.

Sika F.A.S.T graphs Upside (Sika F.A.S.T graphs Upside)

Some analysts believe that Sika is too expensive here. I believe Sika is expensive, but I also believe Sika to be worth some of the expense/multiple that is being demanded here.

In my last article, I went for a PT of around 300 CHF. That’s still an upside, but I am “upping” this target here, to at least 350 CHF, and this still includes a 15% annualized rate of upside.

On the risk side, the main company-specific risk I would say is the failure of integrating M&A’s and continuing to M&A successfully. However, given the company’s track record, I would view this risk as relatively remote. There’s also the risk of new entrants into the company’s markets – but again, I view this as remote given the relative market dominance and appeal presented here.

On the macro side, we find more risk – specifically, I would say that the global construction market, and the ebbs and flow of this market and how it goes up and down is the main risk to Sika. Even this risk is small though – and you don’t need to take my word for it. Just look at the largest 20-year decline in EPS on an annual basis. It was 27% back in 2011, and that was during the GFC. Not exactly a heavy risk, if at the worst crisis for decades, the company only lost a quarter (and gained 22% back in the following year). So, macro is tied to the sector risks – but for Sika, I view this at most coming in at lower growth rates than currently forecasted.

With that in the bag, I believe Sika AG has a significant upside here, and I could potentially invest more.

Thesis

- Sika AG is a world-leading specialty chemicals business with market-leading and superb brands. It has solid management, solid growth, solid profitability, solid fundamentals, and credit rating.

- The lack the company has when it comes to looking at it as an investment is primarily twofold. First off, the company’s dividend yield is sub-par and unlikely to change. Secondly, the company’s valuation is almost triple that of other chemical investments – and it is up to you whether this is something you want to go into.

- Provided you accept a very high premium, and you’re fine with the low dividend yield, then this is an investment for you.

- I do consider it a “BUY” – but my PT goes only to 300 CHF – and this is on a forward basis – so the upside is slim here, as I see it. It’s also based on a continued premiumization, which I do consider to be valid, but where I would still be careful – because the market might decide otherwise. I would limit exposure and try to buy below 30x P/E when possible.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

This means that the company fulfills all but one of my criteria, making it relatively clear why I view it as a “BUY” here – provided that the premiumization is something you can get on board with.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.