The crypto world witnessed a major chapter shut on December 20, 2023, as the US Court docket of Appeals finalized the forfeiture of 69,370 Bitcoin. This determination, stemming from the infamous Silk Highway case, marks some of the substantial forfeitures within the annals of digital foreign money.

Ultimate Chapter In Silk Highway Saga

Silk Highway, a now-defunct darkish net market, turned synonymous with BTC in its early days. Because the shutdown of this infamous darkish net market, US authorities have been actively working to confiscate the crypto assets amassed throughout its operation

Their efforts have seen vital progress, resulting in the latest growth reported. On Wednesday, the Ninth Circuit US District Court docket of Appeals confirmed the switch of the seized Bitcoin into federal possession.

This affirmation follows the US Division of Justice’s (DOJ) preliminary seizure of these assets in 2020, then valued at over $1 billion. This forfeiture features a numerous mixture of cryptocurrencies resembling Bitcoin (BTC), Bitcoin Money (BCH), Bitcoin Gold (BTG), and Bitcoin SV (BSV).

The court docket’s newest transfer finalizes the US authorities’s declare over these belongings, concluding a significant chapter within the historical past of Bitcoin.

Silk Highway’s Current Bitcoin Transactions

July 2023 witnessed intriguing actions related to Silk Road’s funds, with over 9,000 BTC transferred from addresses linked to the marketplace. These transactions had been believed to be a part of the DOJ’s efforts in managing the seized belongings.

This growth adopted the November 2021 seizure of fifty,000 BTC from Silk Highway’s hacker, James Zhong, who admitted to wire fraud in unlawfully buying BTC from Silk Highway in 2012. Zhong’s responsible plea and subsequent asset forfeiture by regulation enforcement marked a landmark second within the DOJ’s crypto enforcement historical past.

Zhong’s confession make clear the psychological points of his crime, revealing a quest for significance that sarcastically ended up benefiting the federal government financially. Regardless of the unresolved nature of the unique theft from Zhong’s residence, his arrest and conviction have introduced a way of closure to a pivotal crypto crime saga.

Regardless, BTC’s market efficiency has remained resilient amid these authorized developments. The digital foreign money has skilled a slight decline of 0.5% previously 24 hours and a 3% improve over the previous week.

On the time of writing, BTC is buying and selling above $43,000, with its buying and selling quantity having seen a considerable improve from $11 billion on Wednesday to over $26 billion as of at present. This uptick in exercise comes amid predictions from numerous business consultants and analysts who counsel that the present buying and selling value of BTC won’t be sustained for lengthy.

Particularly, Matrixport, a notable participant within the crypto finance sector, has projected that BTC may expertise a major surge, doubtlessly reaching $50,000 ranges by early 2024. This forecast hinges on the anticipated approval of spot Bitcoin ETFs by the US Securities and Change Fee (SEC), anticipated to happen by January.

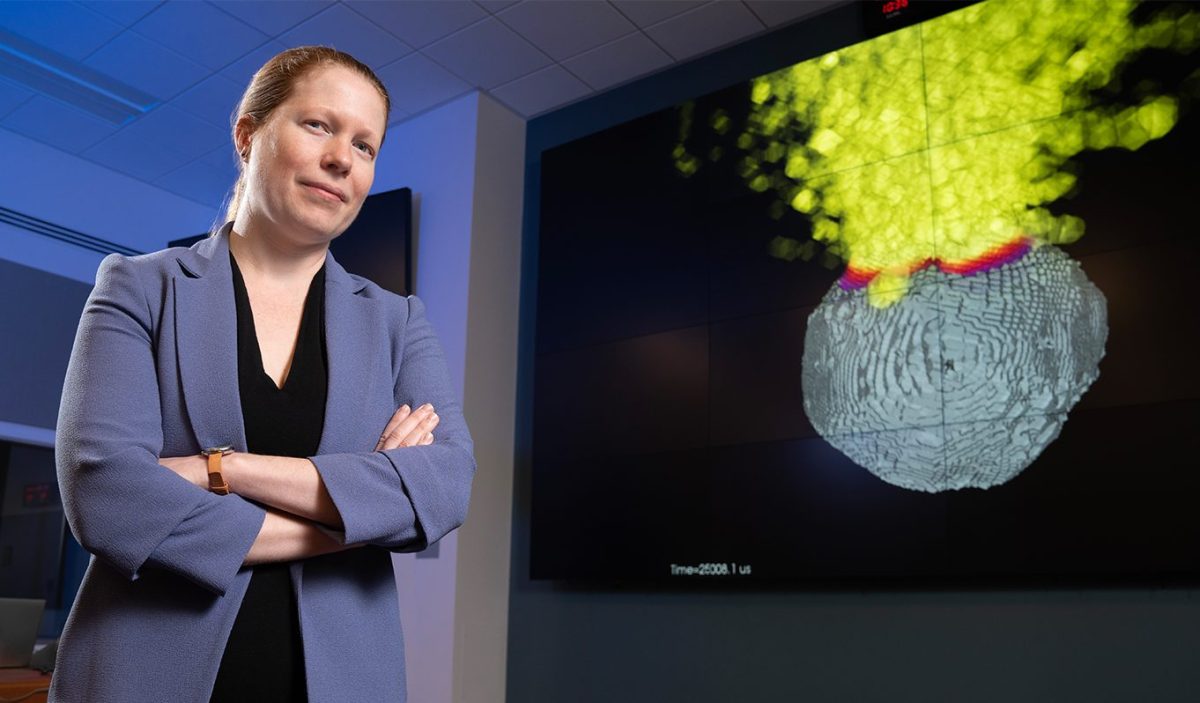

Featured picture from iStock, Chart from TradingView