pablorebo1984

The aerospace and defense industry is a big one, and I am always looking for new companies to add to my coverage and reveal any value in the companies I add to my coverage. With this report, I am adding Singapore Technologies Engineering (OTCPK:SGGKF) (OTCPK:SGGKY) to my coverage. Since this is my first time covering the company, I will briefly discuss the companies activities followed by a discussion of the most recent results, discuss the risks and opportunities and establish multi-year price targets along with a rating for the stock.

What Does Singapore Technologies Engineering Do?

Singapore Technologies Engineering is a big company with a $10.6 billion market cap and a wide range of products and services. The company is active in the following end markets:

- Aerospace

- Defense

- Smart City

- Marine

- Digital Tech

So, if you are looking for a company with a broad product portfolio, STE definitely does tick the boxes. The Aerospace segment consists of Aerostructures and Systems, which includes cabin interior outfitting, freighter conversion, composite panel manufacturing and nacelle manufacturing. The MRO segment focuses on aircraft and engine services and the portfolio of supported platforms includes the CFM LEAP and CFM56 engines, which are the most popular turbofans in operation today. The third and final component of the aerospace business is the aircraft and engine trading business where ST Engineering trades and leases engines and aircraft.

The Defense and Public security segment includes Defense Aerospace, Digital Systems & Cyber, Land Systems and Marine. That is a big area of operations with land, air, sea solutions as well as C5ISR, homeland security, training, cybersecurity, data, AI and cloud solutions. The final segment is Urban Solutions and Satcom, which includes smart solutions for rail, road and urban infrastructure as well as satellite communications.

Mixed Results But Earnings Look Good

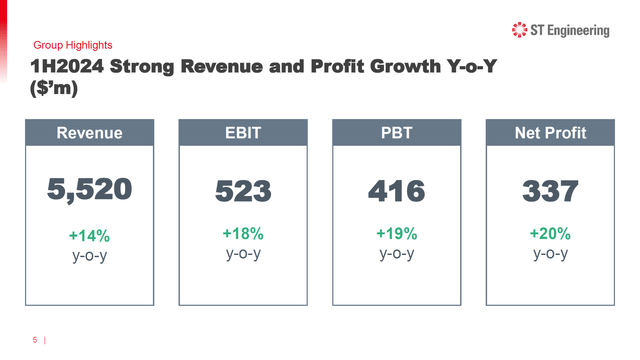

H1 2024 revenues grew 14% to SGD 5.5 billion. For reference purposes: A Singapore Dollar is around $0.77. This would mean that revenues were around $4.25 billion. EBIT grew 18% to SGD 523 million indicating margin expansion to 9.5% while pre-tax profit increased 19% and net profit increased 20%. The order book at the end of the first half of 2024 was SGD 27.9 billion.

Commercial Aerospace revenues grew 20% to SGD 2.2 billion while EBIT grew 7% to SGD 190 million. The revenue growth was driven by 32% higher sales for Aerospace MRO, 20% higher sales for Aerostructures & Systems and a 17% growth in assets under management. EBIT growth lagged sales growth and that was partially driven by lower asset sales. Excluding asset sales, EBIT would have grown 13% with some margin pressure due to part shortages resulting in lower part sales, elongated turnaround times in MRO and sales pressure for sales to original equipment manufacturers. Furthermore, an increase in freighter conversion activity which has lower margin also affected the composite margin.

Defense & Public Security sales grew 12% to SGD 2.4 billion while EBIT grew 8% to SGD 324 million. Defense Aerospace and Land System sales grew 5% while Digital solution sales increased 16% and Marine sales grew 19%. Also in the DPS segment, sales grew faster than margins and that was driven by SGD 16 million higher depreciation and amortization related to an acquisition which triggers an upfront amortization of the order book which is a standard practice.

Sales in the Urban Solutions & Satcom segment grew 3% to SGD 918 million while EBIT grew from a SGD 34 million loss to a SGD 9 million profit. The segment earnings display the challenges faced in the Satcom business where competition is intensifying and congestions of the low-earth orbit communications bandwidth is shifting some projects to function with satellites in a geostationary orbit, but that does change project costs and required funds. So, it is not an easy business to be in currently. The good news was that on lower revenue for the Satcom business, the results improved and that was driven by initiatives to drive cost efficiency.

Overall, the results showed strong demand in the aerospace segment. Satcom remains weak, but defense offers opportunities as international sales are accelerating which could also drive higher volumes which could bolster margins.

What Are The Risks And Opportunities For ST Engineering?

ST Engineering faces risks as well as opportunities. The first risk is the challenging environment for satellite communication services and equipment with the second risk being the part shortages which increase turnaround times for aircraft and engine shop visits and those part shortages are also resulting in lower OEM output. There also are opportunities. For the satcom business, there won’t be any growth overnight but the company is actively managing the costs while the part shortages are increasing demand to bring older airplanes back in service which drives the MRO business for ST Engineering. Furthermore, over the longer-term the OEM production rates will start improving which should benefit ST Engineering while more airplanes and engines will undergo routine maintenance which will also drive business results. In the freighter market, increased e-commerce demand will drive conversion activity and allow the company to expand margins. For the defense business, the current demand environment will also drive higher volumes which would allow for better fixed and variable cost absorption.

Singapore Technologies Engineering Stock Is A Buy

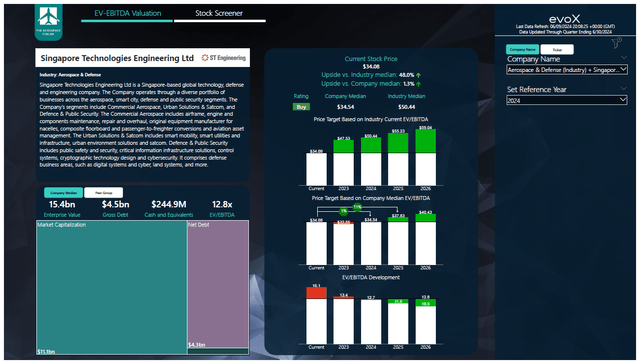

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows and the most recent balance sheet data. Each quarter, we revisit those assumptions and the stock price targets accordingly. In a separate blog I have detailed our analysis methodology.

ST Engineering is not a company that will significantly bring its gross debt down. Instead, it will likely continue refinancing debt. What I do like about the company, however, is the diverse end markets which have growth potential. Furthermore, I believe that EBITDA will growth at a CAGR of 7% and FCF will grow at a CAGR of 16%, which makes for a compelling investment case as the company continues to trade at a discount to peers. At current prices and with FY24 earnings in mind, the company offers little upside. However, I believe that at this point it is reasonable to look at FY25 earnings, which would imply 11% upside. With that in mind, I am marking the stock a buy with a $37.83 price target.

Conclusion: ST Engineering Could Offer Long-Term Value

I believe that ST Engineering is well positioned to offer long-term value. The company is seeing increased international demand for defense products that could drive volumes and margins, and that will likely remain the case for years to come. The demand for air travel is also a long-term trend that the company can capitalize on and with aircraft and engine MRO capabilities as well as exposure to OEM sales, the company is positioned well to capitalize on increasing demand for air travel and new airplanes.

Since the OTC tickers SGGKY and SGGKF lack volume of significance, which could make buying and selling at desired prices and in desired quantities challenging for those that are interested in buying the stock, I would recommend checking out the STEG.SI ticker on the Singapore Stock Exchange.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.