Flory/iStock Editorial by way of Getty Photos

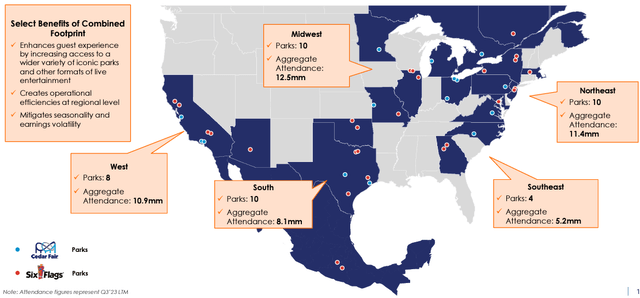

Six Flags (NYSE:SIX) operates theme parks and water parks in the US, Mexico, and Canada. The corporate is seeking to merge with Cedar Honest (NYSE:FUN), an amusement park, water park, and lodge operator. Within the proposed merger, seeking to be accomplished throughout the first half of 2024, Six Flags’ shareholders look to personal around 48.8% of the brand new firm, HoldCo, with Cedar Honest’s shareholders proudly owning 51.2% of the brand new firm. The brand new firm shall be named Six Flags, however will take Cedar Honest’s ticker.

Each Six Flags’ and Cedar Honest’s shares have carried out modestly previous to the Covid pandemic that disturbed the businesses’ operations fully. Because the pandemic disturbed earnings, the shares have been left at decrease ranges. Each corporations have traditionally paid out dividends, however with the pandemic, the businesses stop funds to safe the monetary place. Whereas Cedar Honest has resumed dividend funds at a decrease stage, Six Flags hasn’t accomplished so.

SIX Ten-Yr Inventory Chart (In search of Alpha)

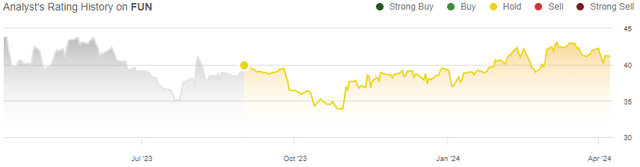

I’ve beforehand written an analysis on Cedar Honest, revealed on the 31st of August previous to the merger announcement, with a maintain score. Since, the inventory has had a complete return of 5%, barely decrease than the S&P 500’s appreciation of 15% in the identical interval.

My Score Historical past on FUN (In search of Alpha)

Mixed Financials

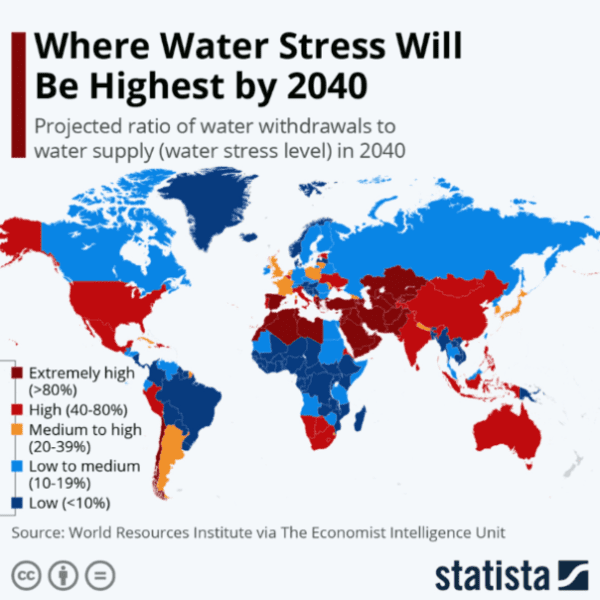

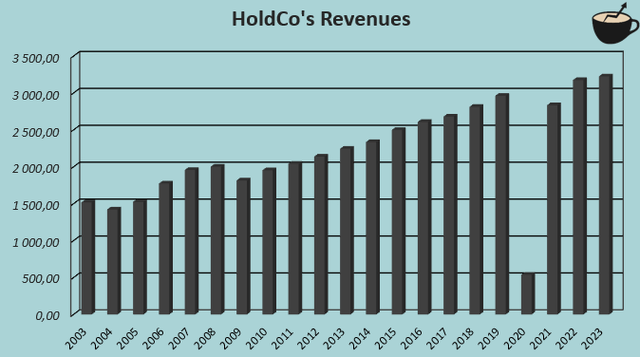

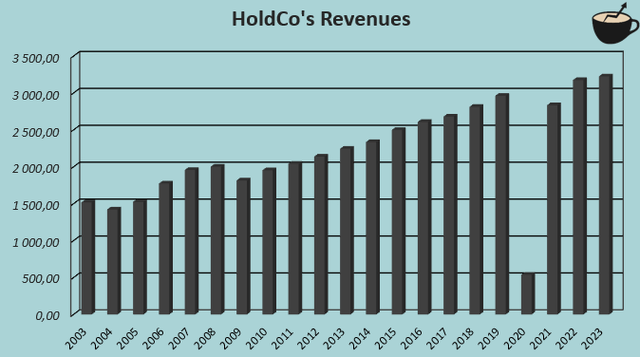

The Covid pandemic disturbed Six Flags’ and Cedar Honest’s operations with the in depth lockdowns. The mixed entity’s, HoldCo’s, revenues decreased by -81.8% in 2020 because of this. Since, revenues have recovered effectively, although, and HoldCo’s professional forma CAGR from 2003 to 2023 stands at a reasonably good stage of three.8%. More moderen development has been carried principally by Cedar Honest’s CAGR of 5.9% from 2018 to 2023, as Six Flags’ revenues have been stagnant over the identical interval. Whole revenues for HoldCo stand at $3225 million for 2023.

Writer’s Calculation Utilizing TIKR Information

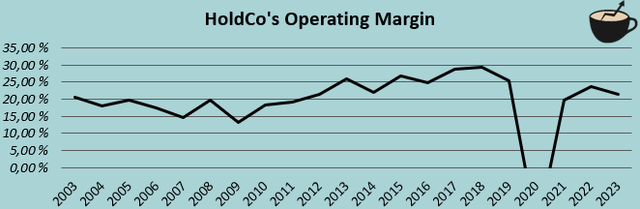

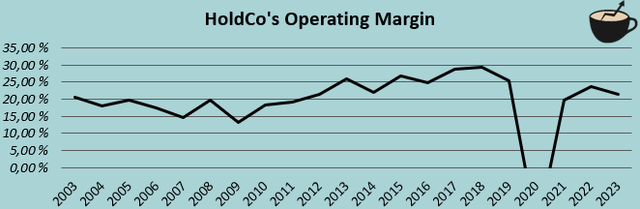

Working margins have been nice for each corporations, and mixed, HoldCo has an working margin of 21.4% in 2023. The margin nonetheless trails from the pre-pandemic stage. The businesses anticipate vital synergies because the merger is accomplished, although; the margin is very more likely to rise because the merger’s synergies are applied.

Writer’s Calculation Utilizing TIKR Information

Focused Synergies

Six Flags and Cedar Honest goal vital synergies with the merger. The businesses anticipate $120 million in run-rate value financial savings from company prices, promoting, IT, procurement, and different working efficiencies inside two years of the merger being accomplished. As well as, the businesses anticipate $80 million in incremental EBITDA from an improved providing. Season passes and quick lane packages are enhanced with the mixed providing, and the parks’ providing is enhanced with prolonged mixed mental property, in addition to improved meals & merchandise choices.

The whole focused synergies of $200 million present nice earnings upside for shareholders – in 2023, the Six Flags’ and Cedar Honest’s mixed internet revenue solely stood at $164 million. Whereas the synergies aren’t as large when in comparison with present working revenue, each corporations’ heavy curiosity bills leverage the synergies’ worth to shareholders.

Mixed Geographic Footprint (Cedar Honest & Six Flags Merger Presentation)

Many geographically complimentary theme park areas supply the chance to boost the mixed providing. Nonetheless, I consider that some warning in regards to the focused $200 million in complete synergies is cheap – the incremental $80 million in EBITDA from an enhanced providing appears to be based mostly upon a major variety of assumptions and will show to supply much less advantages than presently anticipated.

Mixed Valuation: Synergies Pose Upside

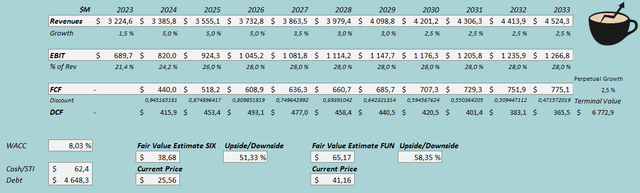

To estimate a good worth for the shares, I constructed a reduced money stream mannequin with mixed financials. Within the DCF mannequin, I estimate the expansion to be fairly good because the gross sales synergies are acted upon, with 2024-2026 annual income development of 5%. Afterwards, I estimate the expansion to decelerate, first to three.5% and regularly right into a perpetual price of two.5%. The whole CAGR of three.4% from 2023 to 2033 is sort of consistent with the businesses’ long-term development price.

I additionally estimate good margin leverage from the focused $120 million in value synergies – ultimately, I estimate the mixed firm’s EBIT margin to rise into 28.0% from a determine of 21.4% in 2023 and 24.2% in 2024 as synergies are realized. The corporate ought to have a reasonably good money stream conversion, though the expansion ought to take up some capital investments. Six Flags additionally pays out a minority curiosity, with $47.5 million paid in 2023. In my DCF mannequin, I estimate the minority curiosity as worsening the brand new firm’s money stream conversion. The particular dividend of $1.00 for every Six Flags share has been added to the worth of the inventory and subtracted from the mixed firm’s money stability.

With the talked about estimates together with a value of capital of 8.03%, the DCF mannequin estimates Six Flags’ inventory’s honest worth at $38.68 and Cedar Honest’s inventory’s honest worth at $65.17. The Cedar Honest inventory appears to have barely extra upside at round 58% with the assumed possession construction of 48.8% for Six Flags and 51.2% for Cedar Honest. Each shares appear to have quantity of undervaluation with the anticipated synergies, with Cedar Honest being the marginally higher deal at present inventory costs.

DCF Mannequin (Writer’s Calculation)

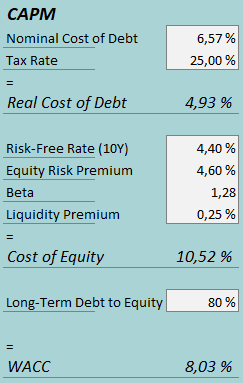

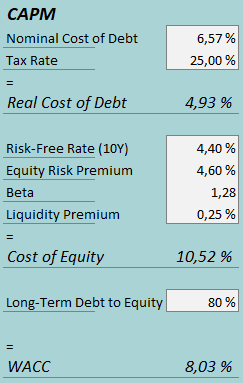

The used weighed common value of capital is derived from a capital asset pricing mannequin:

CAPM (Writer’s Calculation)

In This fall/2023 Six Flags & Cedar Honest had $76.4 million in mixed curiosity bills. With the businesses’ present quantity of interest-bearing debt, Six Flags’ annualized rate of interest comes as much as 6.57%. The businesses have a heavy debt burden; as such, I estimate a excessive long-term debt-to-equity ratio of 80%. The businesses plan to deleverage the stability sheet after the merger, however I consider that deleveraging will take fairly a very long time.

For the risk-free price on the price of fairness facet, I exploit the US’ 10-year bond yield of 4.40%. The fairness danger premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the US, up to date on the 5th of January. Six Flags’ five-year beta is presently estimated very excessive, which I assume to be primarily as a result of Covid pandemic that Six Flags suffered from terribly extremely. Within the pre-pandemic market, the corporate’s beta was estimated at 1.28, which I estimate to be a extra honest assumption. Cedar Honest’s beta presently stands at 1.42 based on Yahoo Finance, fairly close to Six Flags’ pre-pandemic stage, however I exploit the estimate of 1.28. Lastly, I add a small liquidity premium of 0.25%, creating a value of fairness of 10.52% and a WACC of 8.03%.

Takeaway

Six Flags and Cedar Honest want to full the businesses’ merger. The mixed HoldCo may have a historical past of fixed modest development with nice margins, and house for good development by way of an enhanced providing and margin enlargement by way of value synergies. Whereas the focused $200 million in complete synergies needs to be taken considerably critically in the intervening time, I consider that the synergies present nice room for upside for shareholders. The DCF mannequin estimates good present upside for each shares, though Cedar Honest appears to be the marginally higher deal at present inventory costs. In the interim, I’ve a purchase score for each shares.