Marko Hannula/iStock Editorial via Getty Images

Dear readers/followers,

I’ve been covering the Swedish construction sector for a number of years, and invested successfully in it as well. The companies we’re looking at in this sector are primarily two – Skanska (OTCPK:SKBSY) (OTCPK:SKSBF) and the company NCC, which I recently wrote about. When it comes to Skanska, you can find my last article on that particular business here.

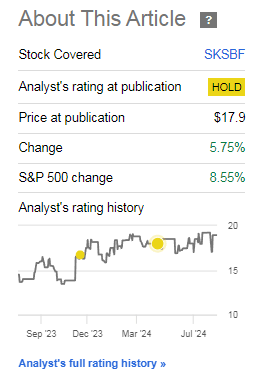

The company has also underperformed a bit, which is in line with my expectations for the company, given my “Hold” rating.

Seeking Alpha Skanska RoR

Skanska is more interesting than NCC at a good valuation, in my opinion, because it’s a very solid sort of business with considerable international profiling to its operations as well. It has very solid financials and good fundamentals, and if we find ourselves at below 150 SEK/share, significantly attractive.

However, it’s also a cyclical company – because construction, real estate, and infrastructure are inherently cyclical. So this needs to be kept in mind as well when investing. There is 2Q24 at this time, and this warrants an update – but don’t expect me to change my rating because that’s not something I’m interested in doing here given the valuation of the stock.

Skanska – The upside for the company requires a lower valuation, and results on the quarterly basis show continued pressure here.

Cyclical construction is a good play when it’s cheap. I’ve been covering this with both cash-secured puts, as well as covered calls when I’ve been in a position to do so (like early this year). Now, as things stand as of mid-2024, I no longer have any sort of position in Skanska – and I don’t plan to initiate one either.

The challenges we find in Skanska are similar to challenges in other businesses in this field, including NCC. We’re talking about cyclicality and valuation – and in the case of Skanska and NCC, the Swedish construction and real estate market, is currently not in a great place.

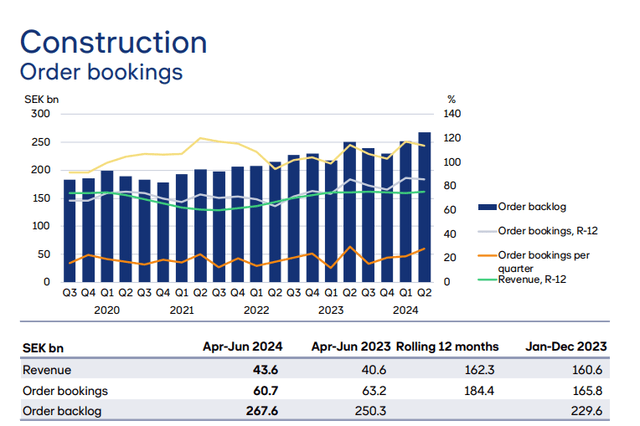

2Q24 confirms this for us. While many of the company’s KPIs were solid, many were not. The company characterizes it as a solid performance, and in some ways it certainly was. Construction saw a good order intake and a solid operating margin. However, the ROCE is a project development and investment properties as well as the RoE is still low for the company.

In fact, for Project development, it’s even dropped to negative levels, at negative 1.3% compared to 2.3% YoY, at an R-12 level. To say that this company, or any construction company in Sweden is out of the slump yes is too far. Only recently we got our most recent inflation numbers, and these show that this is far from over, to the degree where this might influence near-term rate decisions coming out of our Central bank.

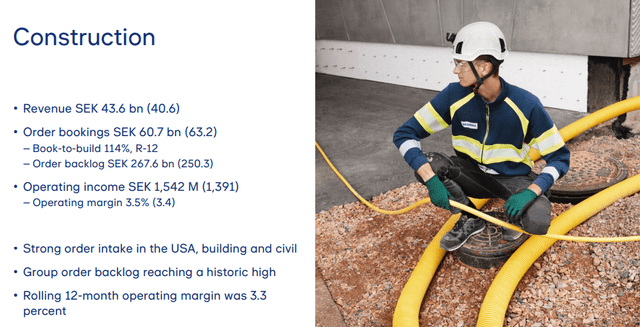

Construction was strong though – and remains one of the more solid sectors because exactly of what you see above – the US sector and international fields, which cushions the more volatile European market. Margins are okay – not record-level, but good enough.

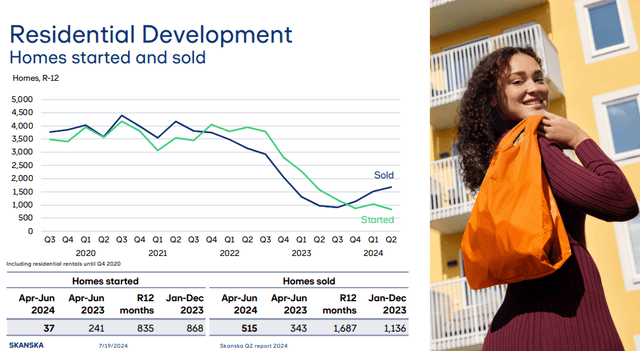

Residential development, while still poor, is showing some signs of at least maybe coming close to some sort of recovery. Not yet – only initial signs in the form of improved top-line results for the company. Operating income has now turned negative, which it wasn’t before, and ROCE has dropped from 0.2% to negative 5.2%, a massive drop. BoKlok, the company’s attempt at cost-effective living, is still loss-making to the tune of 167M and is responsible for most of the negative here. Excluding that, the company’s operating margin would be close to 8% for the quarter. Revenue was up to 2.2B SEK, with 515 homes sold, and 37 started (though this last number is down).

CRE is the other issue. Top-line is definitely improving, operating income is slowly showing better trends, and is moving up to 1B SEK in operating income with some good sales gains. But the problems that we saw in our NCC article for the CRE, with low rates of leasings and pre-let rates, we see that for Skanska as well. The company has 23 completed projects to the tune of 11.3B SEK in total investment, of which only 77% is leased. That’s well below most high-quality office REITs in the US (which isn’t necessarily the greatest comparison, but it’s a comparison). The company also only managed to divest four external projects and one internal. While the company considers the leasing activity solid, I would only consider it solid in context, and this is not the greatest environment for leasing.

Investment properties are looking slightly better, but this is one of those segments where I look and think, “What are you thinking here?”. Because office, unless it’s specialized like my investments into Alexandria Real Estate Equities (ARE), are not typically known to generate “stable cash flows”. There’s usually much more volatility in the office sector.

Overall, things are looking “okay”. But this is really part of the problem – they’re looking “okay”, but the company is trading as though they are looking far better than okay.

“Okay” really isn’t good enough to where Skanska should be trading above 14-15x P/E, and that is currently what Skanska actually does.

The most positive that can be said for this quarter is a clear uptick and recovery in residential development. But the ultimate effects of this will likely be some quarters coming. More importantly, the market is already taking this recovery in consideration when pricing Skanska. The result of this is that there’s little actual upside to be had from here and from the company for this. And to say that this recovery is as of yet “significant” is also false. Just take a look at what sort of recovery we’d need for that to be true nationally.

For that reason, I consider anything that isn’t construction and infrastructure here to be a risk-add, not necessarily a de-risking factor. And when you put this all together into a thesis where you’re looking to estimate what this company could actually achieve, and say “This is how much growth I expect from Skanska”, you come to one conclusion when you look at the company’s valuation.

Skanska Valuation – The price is not favorable

As the heading says, the price is not favorable here. Skanska typically, to give you an idea, trades at around 12-13x P/E. I have no issue with that multiple. The problem is that 2023A was a major downer year, which saw company earnings halve and push the company to a current P/E of almost 25x P/E if you look at the company’s 2023A results. Now, 2023A isn’t indicative of the long-term potential of the business, this much is true.

But how much more can you expect from the company even as it recovers now that it trades at 200 SEK on a per-share basis?

Even if the company recovers, 200 SEK represents an 11.5x 2025-2026E multiple. That means, to put it clearly, that the company is already trading close to its 5-year average for the expectation of 2025-2026E at this time. This in turn means that the upside to that valuation is at this time not much more than the yield, which comes to around 6.5% per year, or less than 15% total RoR for this investment.

And by the way, that’s including an estimated EPS recovery and growth of over 90% this year, and over 20% for 2025E. So that’s quite some results that the company has to achieve right there in order even to achieve that 6.5% annualized rate of return.

So with that logic, I believe the company is being priced at a much too-high level here, and I would say that the company is not buyable unless it goes below 160-170 SEK. In my previous article, I made a case for Skanska being worth around 160 SEK, and this is still the valuation and price I have my eye on for the time being.

While there is considerable potential EPS upside here, most of that is already priced into the share price. The yield for Skanska at this time is no more than 2.74%. This yield is not currently expected to materially improve for the coming year either (Source: FAST Graphs paywalled link).

So what should we expect from Skanska here? Well, current analyst expectations for the company are somewhat split. My expectation is that the recovery could be likely, but it doesn’t matter – because the price is already at a level where I consider any upside priced at this point.

Other analysts give the company a low of 160 SEK, my share price, and a high of 252 SEK, with an average of 218 SEK. Out of 8 analysts, 4 have the company at a “BUY” with this sort of target. It’s important to note though that less than a year ago, the low was 122 SEK, the high was 200, and the average was below 170 SEK. So what I see here is analysts basically following the volatility and the cycles of the company. I’m not interested in doing that. I want to invest counter-cyclically. So when it’s cheap, I buy, and when it’s expensive, like now, I sell. Or at most, I’ll do some covered calls. But since I have no shares at this time, that’s not really something I can do here.

What I can do is point out the fact that I view the company as overvalued here. Skanska may report good results in the next few quarters. I even view this as likely. But this is already priced in, as things look now, and because it’s priced in, I say “no” here.

For US investors, the relevant ADR for Skanska is SKSBF. This is a 1:1 Share ADR, meaning we can just use a straight translation of the share price target, which for this company comes to around $15.3/share. Above that, I’m not interested. CSPs haven’t been interesting here for some time.

As such, my updated thesis for the company is as follows.

Thesis

- Skanska is a very solid construction company with plenty of upside at the right price. The company moves in clear cycles that are macro, not micro/company-based.

- At this time, we’re down because construction is working well, but everything having to do with property or leasing is in a tight spot, despite an overall tight leasing market due to low supply in some of its core areas.

- The overall stance on Skanska is no longer positive and still a “HOLD” here. Before you invest, you should make sure that you’re not exposing yourself to unfavorable risk/reward situations – and in this case, I believe you may be doing so.

- I believe Skanska may drop down this year to 160-150 SEK/share, which would enable us to slowly start allocating in the business once again. As of August of 2024, that’s not the case. I say “Hold” here.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversion.

I view the company as a “Hold” rating here because it does not fulfill my valuation-related criteria at the time of publishing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.