It’s not typically you see a longtime firm burn via three CEOs in lower than a yr. However via circumstances past its management, that’s what has occurred at Slack, the corporate Salesforce acquired in 2020 for $28 billion. In November, Slack launched Denise Dresser as the newest particular person to occupy the nook workplace.

Dresser acknowledges it wasn’t simple to step into the position below these circumstances, however she is settling in. “You know, like anything, it’s always hard to step into any new company and do it in a way that’s graceful, but I think the team gave me plenty of coaching, and we really saw the vision together,” Dresser instructed TechCrunch.

She grew up within the suburbs outdoors of Boston, was educated on the College of Massachusetts at Amherst the place she studied accounting and worked at Salesforce for the final dozen years in varied govt roles.

Her predecessor, Lidiane Jones, was simply 10 months into the job when she introduced she was leaving to be CEO at Bumble, pushed by the attract of working a stand-alone public firm. Jones herself had changed firm co-founder Stewart Butterfield when he introduced that he was leaving on the finish of 2022.

It’s troublesome changing a founder-CEO as Jones did. It may very well be much more difficult to take over simply 10 months later for his successor, however some govt turnover is anticipated within the years following an acquisition, says Arjun Bhatia, a William Blair analyst who follows Salesforce. “You want a stable leadership team, of course, and you want someone who’s focusing on it, but the CEO turnover we’ve seen is not concerning at this point,” Bhatia instructed TechCrunch. “If that becomes more recurring, certainly that view might change, but I think it’s a natural course after an acquisition like this for a company like Slack to find its place inside the Salesforce ecosystem.”

Dresser says that she’s merely constructing on what her predecessors did earlier than she acquired there, whereas bringing her personal persona to the job. “I ask a lot of questions, and I definitely am an accountant at heart,” she mentioned. “So I like to be organized and I’ll continue that on, but it’s not like it’s a big pull. I think the foundation is already there, and it’s an incredibly well-run organization.”

How has Slack fared at Large CRM?

Once you have a look at the worth that Salesforce paid to personal Slack, even giving some leeway for 2020 inventory costs and the over-exuberance of the interval, it nonetheless appears like a attain. The assumption on the time was that Slack may very well be the communication layer on high of all of the enterprise software program that Salesforce sells. It’s nonetheless the hope, the truth is, however income development has slowed dramatically at Slack since its acquisition.

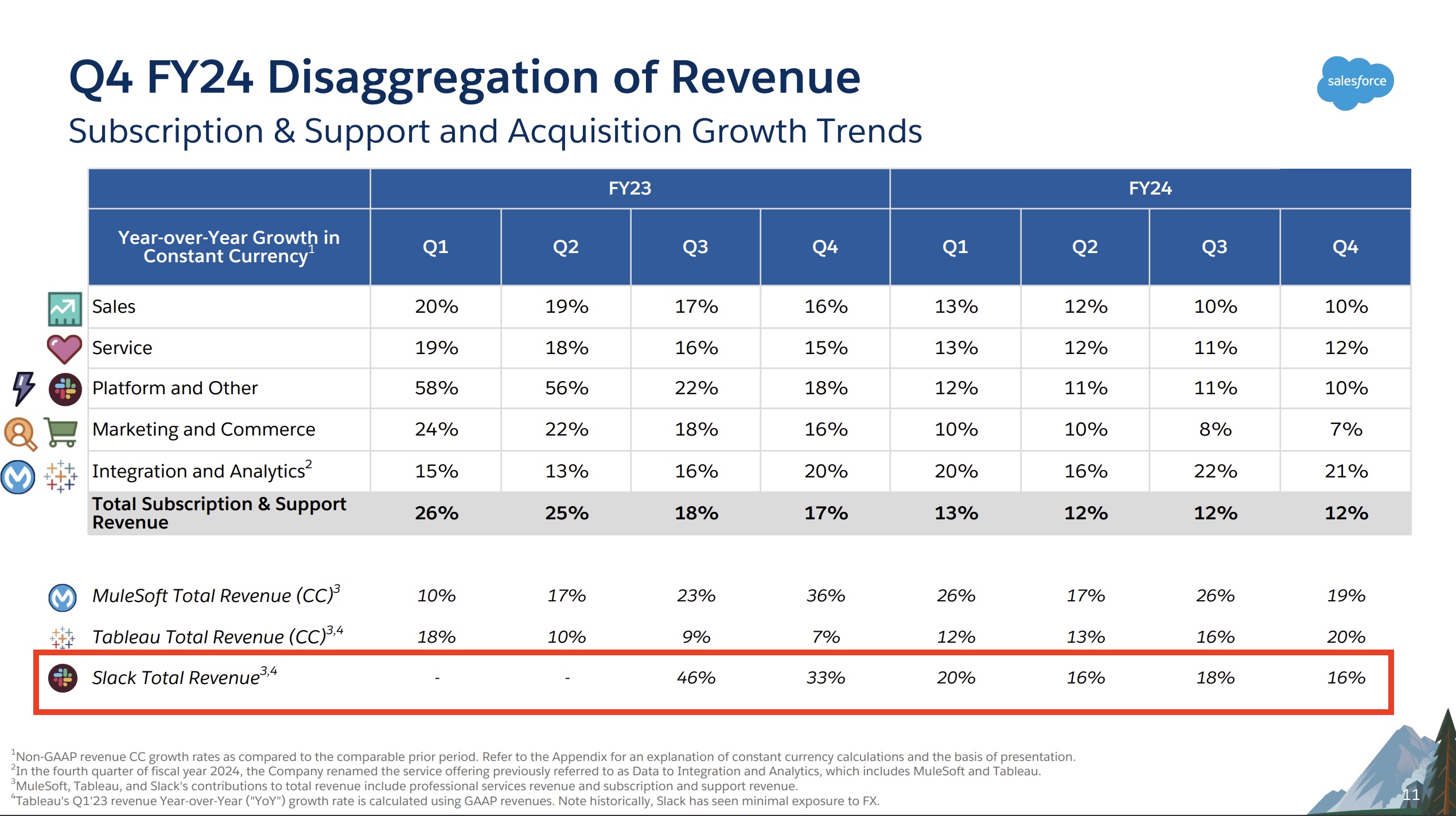

We don’t have actual income numbers as a result of Salesforce stopped reporting them final spring, however it does share the proportion of development from the prior yr. Development has slowed considerably from 46% YoY in Q32023 to only 16% in Q42024. For essentially the most half, the development has been down — and it’s as much as Dresser to show that round.

Picture Credit: Salesforce

Slack may change this development by discovering new enterprise alternatives and conserving current prospects pleased whereas on the similar time not being so carefully tied to Salesforce that it loses prospects who aren’t Salesforce-centric.

Dresser could also be caught between these seemingly conflicting necessities, says Brent Leary, principal analyst at CRM Necessities. He, too, has been monitoring Salesforce since its earliest days. “She’s got to be able to figure out what the right balance is between Slack as a standalone brand that continues to attract non-Salesforce customers, while enabling Salesforce customers to use Slack everywhere within the platform they need to collaborate,” Leary mentioned.

However Dresser doesn’t suppose it’s all that sophisticated. “I don’t know if I think it’s that tough. I think it was the original vision when the two companies came together,” she mentioned. “I think there’s a real recognition that there’s something very special here that we want to nurture and continue. And I think that’s been a pretty consistent theme from the very beginning.”

The potential of generative AI

One large change she must handle has been the event of generative AI in software program, in Slack and throughout the Salesforce household of merchandise. Dresser says that AI is a pure match for Slack as a result of as a communications platform with a lot of embedded data, it can assist customers harness, perceive and discover data nuggets within the mass of knowledge.

“When you think about it from a higher-level perspective, Slack has so much of the world’s conversations happening in unstructured data,” she mentioned. “And then you think about Salesforce having this incredible set of customer data, some of the world’s most valued data. The opportunity to bring structured and unstructured data into Slack and integrate those really creates this powerful platform for the future.”

All of that relies upon, in fact, on execution: You may’t simply sprinkle AI fairy mud on a product and hope it’s going to work. However Dresser claims that AI helped her rise up to hurry in her new place way more shortly than would have been attainable with out with the ability to entry summaries of lengthy product threads. Summarization is a giant promoting level for generative AI, and utilizing it to save lots of time understanding lengthy conversational threads may very well be a giant use case. However once more, it is determined by the standard of the summaries.

One other large concern Dresser faces is how you can compete with Microsoft, which brings Groups to the desk mixed with Workplace 365, Dynamics 365, and AI within the type of Microsoft Copilot rolled out throughout the platform, says J. P. Gownder, an analyst at Forrester Analysis. “It’s logical for Slack to try to expand its user base by integrating Salesforce more closely, but it must be careful not to alienate existing customers, who are tremendously loyal to what’s offered today. In the meantime, Microsoft Teams is a behemoth that has a chance to grab even more minutes via Copilot,” Gownder instructed TechCrunch.

However Bhatia factors out that Microsoft nonetheless works greatest contained in the Microsoft ecosystem, and Slack might have a bonus in that regard. “Microsoft doesn’t have that interoperability play as much. Their advantage by far is distribution. And two big advantages that Slack has in their market are interoperability and ease of use,” he mentioned.

Yet another diploma of problem for Dresser is that the remaining Slack co-founder, CTO Cal Henderson, left on the beginning of March, changed by none aside from Salesforce co-founder and CTO Parker Harris. Though Harris brings an extended historical past of constructing Salesforce, Slack is shedding an individual who has a deep understanding of Slack’s technical underpinnings.

Dresser actually understands that she faces these challenges forward, that she must win over staff and prospects and discover a solution to hold Slack rising and important contained in the huge Salesforce ecosystem. However she says her position is admittedly about making human connections, and the remaining will work itself out.

“I try to just help people understand that I’m here because I am deeply, deeply passionate about what we can do for the world, for our users, and our employees as well at Slack and the broader Salesforce — and I wouldn’t be here if I wasn’t.”