syahrir maulana

SPDR S&P 600 Small Cap Value ETF (NYSEARCA:SLYV), launched on 09/25/2000 by State Street Global Advisors, Inc. and managed by SSGA Funds Management, Inc., is an ETF that tracks the performance of the S&P SmallCap 600 Value Index.

This fund’s approach is based on identifying the most undervalued stocks in the small-cap segment of the U.S. equity market and its methodology for doing that relies on several relevant indicators. It also affords us a chance to see how it performed against various alternatives over more than two decades and the results are consistent with the empirical research of the value performance spread. Having a small-cap bias is more risky than holding a total market portfolio or the S&P 500 but if someone is in the wealth accumulation phase and has conviction in the value approach, SLYV could also work as a core option.

Methodology

SLYV uses a sampling strategy to gain exposure to the S&P SmallCap 600 Value Index, which has certain selection criteria.

First of all, it includes stocks with a market cap between $850 million and $5.2 billion. It also selects stocks based on some liquidity criteria, such as an annual dollar value traded to float-adjusted market cap ratio of at least 0.75, a minimum amount of 250,000 shares traded in each of the 6 months leading up to the date of the selection, and a public float of at least 10%. Each company should also have positive TTM earnings as well as in the last quarter. Then, the index uses a ranking system to select the most undervalued stocks based on the book value to price ratio, earnings to price ratio, and sales to price ratio. Last, it attributes weights according to the market cap of each constituent and rebalances annually.

Performance & Cost

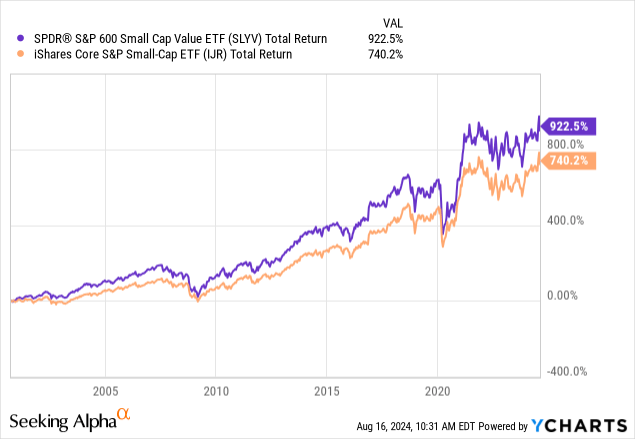

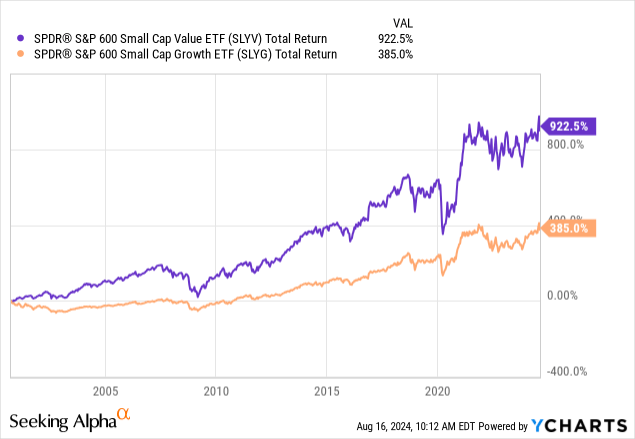

Since its inception, SLYV returned 10.54% per annum while the benchmark reflected an annualized return of 10.18%. Moreover, it has outperformed its vanilla counterpart in the long run by a substantial margin:

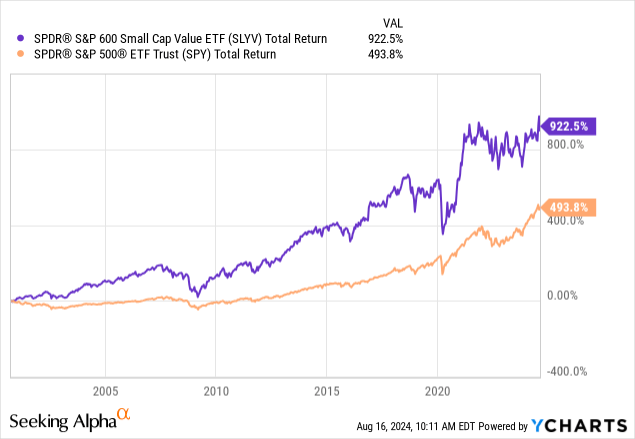

The outperformance becomes more pronounced when you compare SLYV’s returns to the large-cap segment:

I think that it’s also important to highlight the performance spread observed between SLYV and its growth counterpart because this serves as a good reminder that the best explanation for why value outperforms in the long run is the same one for why growth underperforms; the market’s expectations seem to be irrationally based on past performance alone and it expresses disappointment when growth stocks don’t live up to the expectations and surprise when issuers of value stocks deliver better results than expected.

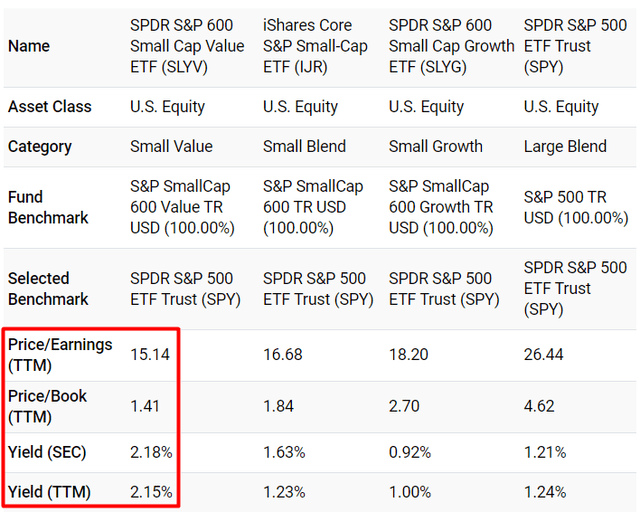

Now, the same reason that explains best the performance of funds such as SLYV is the same reason I expect those funds to continue providing the value they have up until now. This ETF’s P/E ratio is currently 15.14 and its price-to-book is 1.41; compared to the other relevant funds we have mentioned, the current portfolio of SLYV is undervalued.

portfoliovisualizer.com

Last, while the turnover ratio was recently reported at 46%, SLYV’s expense ratio is only 0.15%, which in the context of its past performance and its smart-beta offering makes investing in it cheap.

Risks

The most important risk that comes with funds such as SLYV is the small-cap bias, rather than the value one. Undervaluation based on indicators such as price relative to book value, earnings, sales, etc., while it may reflect the market’s opinion on the existence of some risks, there is no evidence that it represents actual risks. It appears to be the size factor that makes funds like SLYV riskier than broad-market index funds. Severe price swings are more frequently observed in this segment of the equity market and drawdowns can be highly stressful during economic downturns when you hold small-cap stocks. The only ways to handle this risk are to either have a very long investment horizon and high conviction in the value approach or not treat SLYV as a core option for your portfolio.

The other risk you should be aware of is concentration risk; right now, the ETF has 24.77% of the funds allocated to companies operating in the Financials sector. Though unlikely, if interest rates rise higher SLYV may prove to be more sensitive to that change.

Verdict

In conclusion, there’s not much to not like when it comes to SLYV. It’s the most classic form of a smart-beta value fund and it provides a track record that is actually relevant to the value versus growth debate. Therefore, I am rating it a buy.

What’s your opinion? Do you prefer some other value ETF, employ a completely different approach, or do you invest as an agnostic these days? Let me know below! Thank you for reading.