Vertigo3d

Snap Inc. (NYSE:SNAP) inventory not too long ago cratered by over 35% after reporting This fall earnings, briefly dipping under $11 because it missed income estimates by $20 million. The 1.5% income miss price the corporate a market cap plunge of almost $10 billion. I perceive that expectations are sky-high throughout the AI period, however is the market overreacting right here?

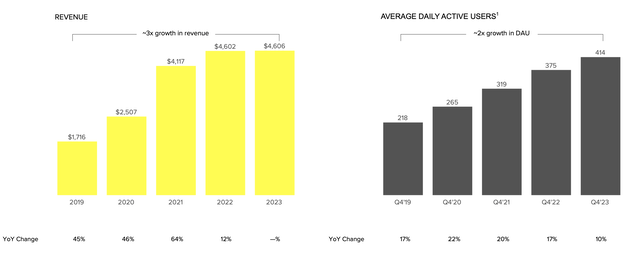

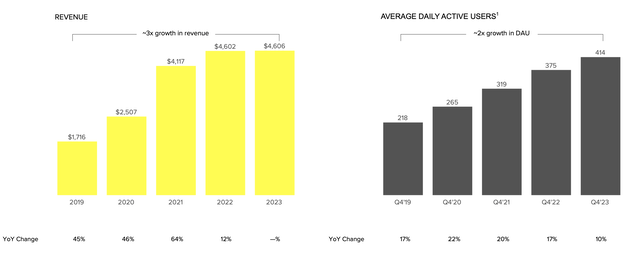

In spite of everything, Snap stays one of many solely vital social media corporations exterior of Meta Platforms’ (META) social networking monopoly management. Snap has a staggering variety of every day energetic customers, or DAUs (414 million on the finish of 2023). Furthermore, DAUs expanded by 10% YoY, illustrating stable development potential for Snap shifting ahead.

Additionally, Snap ought to proceed benefiting from its augmented actuality (“AR”) and AI initiatives. Snap faces transitory will increase in prices and margin compression related to R&D and the rollout of latest services, which ought to repay in the long run.

Moreover, the tender financial atmosphere continues to weigh on advert income revenue, limiting income development and profitability within the close to time period. Nonetheless, Snap can develop its person base and monetize it higher, resulting in better-than-expected development and a a lot larger inventory value in future years.

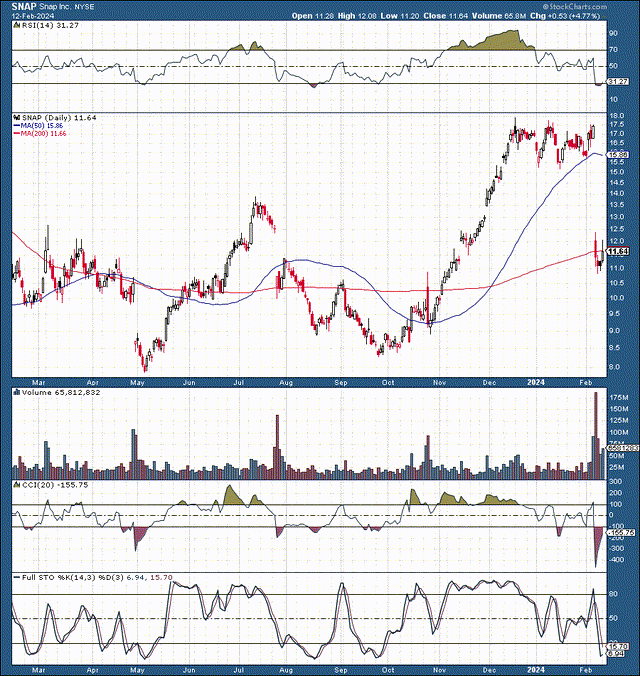

Snap – Technically, Purchase The Dip

I do not typically purchase Snap, however I comply with the corporate. I purchased the dip once I noticed shares drop by 35% on large quantity due to a minor income miss. Snap’s drop stuffed two gaps (one at $13 and one at $11). The RSI crashed under 30, and the CCI hit almost -500, illustrating massively oversold technical circumstances. Snap can also be round a vital assist stage of $12-10, and the draw back is probably going minimal from right here.

Additionally, let’s put issues into perspective. Snap turned massively overbought going into year-end. The inventory consolidated for 2 months however didn’t obtain the stellar outcomes for which it was priced. Now, Snap’s market cap is under $20 billion once more, exceptionally low cost for a corporation in Snap’s profitable place.

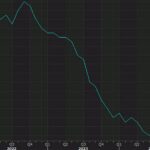

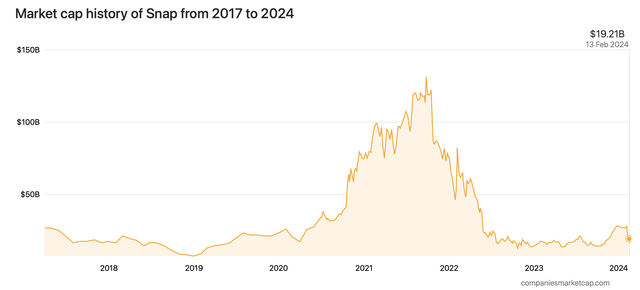

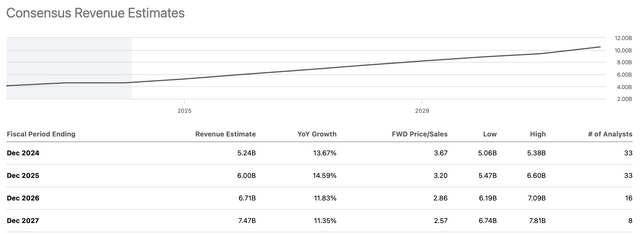

From $130 Billion to Under $20 Billion

Snap market cap (companiesmarketcap.com)

Snap’s market cap collapsed after the tech market peaked in 2021 and has but to get better. In the meantime, Snap’s inventory trades round 3.2 times ahead (2025) gross sales (consensus estimates) and has a 30-forward P/E ratio. Additionally, as a consequence of improved monetization, Snap’s earnings ought to proceed growing.

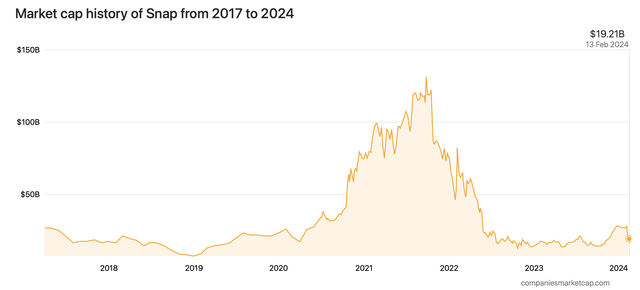

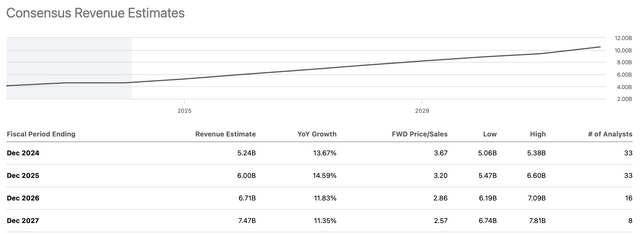

Revenues To Enhance Significantly

Income estimates (SeekingAlpha.com)

Snap is far smaller than Meta. Subsequently, its advert slowdown is taking longer to enhance throughout this sluggish financial section. Additionally, Snapchat+, Snap’s subscription service, has already reached over 7 million people and may proceed to ramp up, resulting in appreciable income development within the coming years. Consensus estimates are for $6 billion in gross sales subsequent 12 months, however Snap may surpass the forecast as extra accessible financial coverage, elevated development, and improved monetization propel revenues and profitability larger.

Subsequently, we may even see 12-15% income development or larger as we advance. Additionally, even with these modest gross sales estimates, Snap trades at solely 3.2x 2025 $6 billion gross sales expectation. 3.2 instances gross sales is comparatively cheap for Snap, as Meta trades at over 6x gross sales, and plenty of small and mid-cap tech corporations commerce at 7-10 instances gross sales or larger.

Earnings Ought to Enhance Considerably

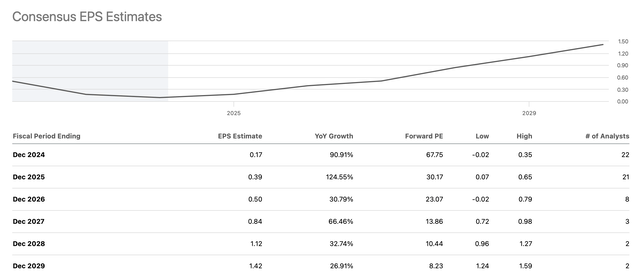

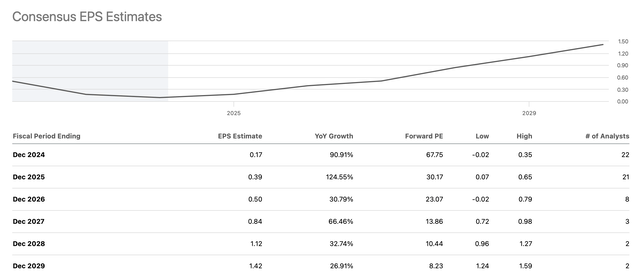

EPS estimates (SeekingAlpha.com )

Snap’s earnings ought to enhance considerably, and it has a excessive likelihood of outperforming consensus figures. Snap has solely missed EPS estimates as soon as within the final twenty quarters. That is going again 5 years. Snap’s 2025 Consensus EPS estimate is $0.39, implying that Snap trades at simply 30 instances ahead EPS estimates. Furthermore, Snap may outperform the forecast, and incomes 50 cents subsequent 12 months places Snap’s ahead P/E ratio at simply 22, which is filth low cost for a corporation in Snap’s rising place.

The Backside Line: A Bounce In Profitability Is Seemingly

Snap development (static.seekingalpha.com )

Snap’s DAUs elevated by 10% YoY and have roughly doubled since This fall 2019. Whereas income development slowed not too long ago, it’s possible a transitory slowdown. We additionally see that revenues have tripled since This fall 2019. Snap’s advancements in AI, Snap AR, Snapchat+, and different ventures may produce a surge in gross sales within the coming years. Snap must also proceed benefiting from person development and bettering monetization, resulting in larger common income per person, or ARPU, and a significantly larger inventory value.

The place Snap’s inventory might be sooner or later:

| 12 months | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Income Bs | $5.3 | $6.3 | $7 | $8 | $8.9 | $9.9 | $11 |

| Income development | 15% | 19% | 11% | 12% | 12% | 11% | 10% |

| EPS | $0.22 | $0.50 | $0.70 | $0.93 | $1.16 | $1.40 | $1.65 |

| EPS development | 144% | 127% | 40% | 33% | 25% | 20% | 18% |

| Ahead P/E | 30 | 31 | 32 | 33 | 32 | 31 | 30 |

| Inventory value | $15 | $22 | $30 | $38 | $45 | $51 | $58 |

Supply: The Monetary Prophet.

Dangers to Snap

Regardless of my bullish outlook, Snap faces dangers on a number of fronts. First, we should take into account the financial slowdown and its influence on advert spending and Snap’s backside line if the sluggish economic system persists. Additionally, Snap faces competitors from Meta, TikTok, and different social platforms. Snap additionally wants to keep up person development and may broaden ARPUs. In any other case, its inventory may head in reverse. There’s additionally the chance of worse or slower than anticipated profitability and worse than anticipated income development. Buyers ought to study these and different dangers earlier than investing in Snap.