jetcityimage

Funding Thesis

I last covered Snap-on (NYSE:SNA) in October final yr. Whereas the corporate was doing alright for a while, the inventory has given up most of its beneficial properties after its recent earnings release. Snap-on Integrated confronted challenges associated to buyer demand modifications, particularly in its Instruments enterprise final quarter. Nonetheless, I imagine we’re close to the underside and the corporate’s revenues ought to see a restoration shifting forward with the assistance of easing Y/Y comparability, and strategic changes within the Instruments phase, like adopting a smaller ticket advertising strategy and launching progressive, faster payback merchandise to reply to altering buyer wants. In the long term, favorable demand traits within the automotive restore market, reminiscent of growing automobile complexity and electrification, ought to assist the corporate’s gross sales development.

On the margin entrance, the corporate ought to profit from a barely extra favorable combine because it launches extra faster payback gadgets that carry good margins, working leverage from gross sales restoration, and advantages from its RCI initiatives. The inventory is buying and selling at a reduction in comparison with its historic averages. This, coupled with enhancing development prospects, makes SNA’s inventory purchase.

SNA Income Evaluation and Outlook

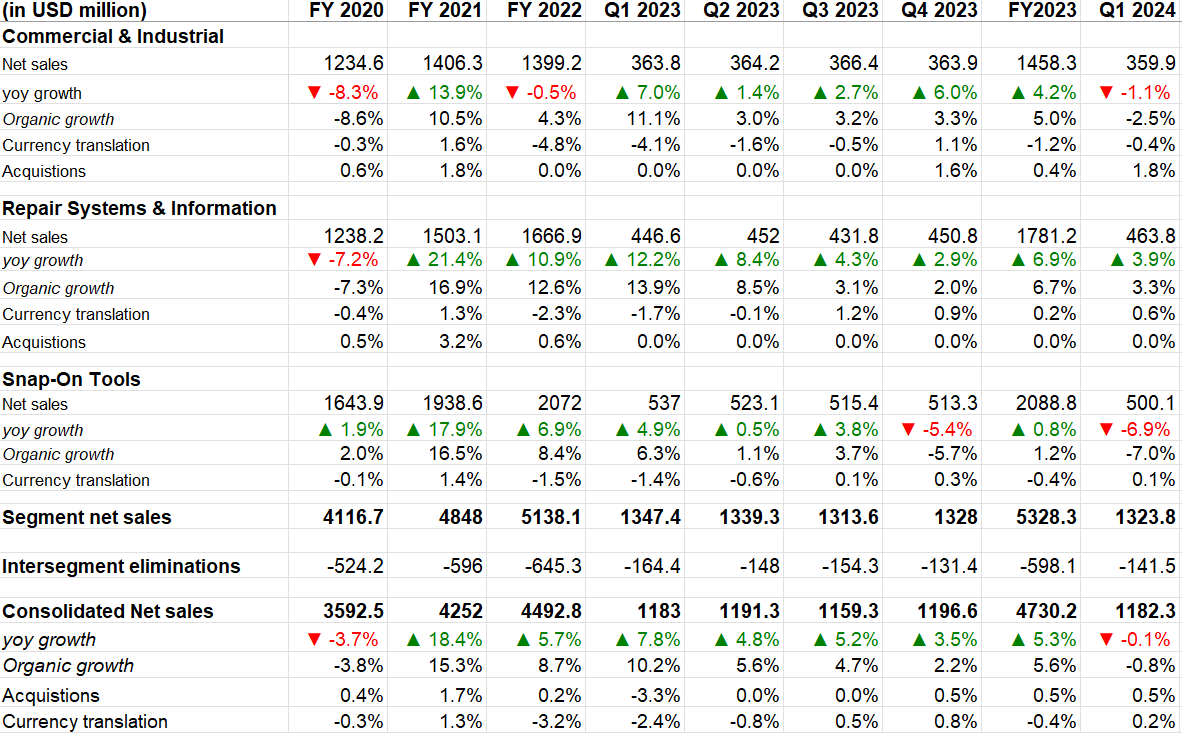

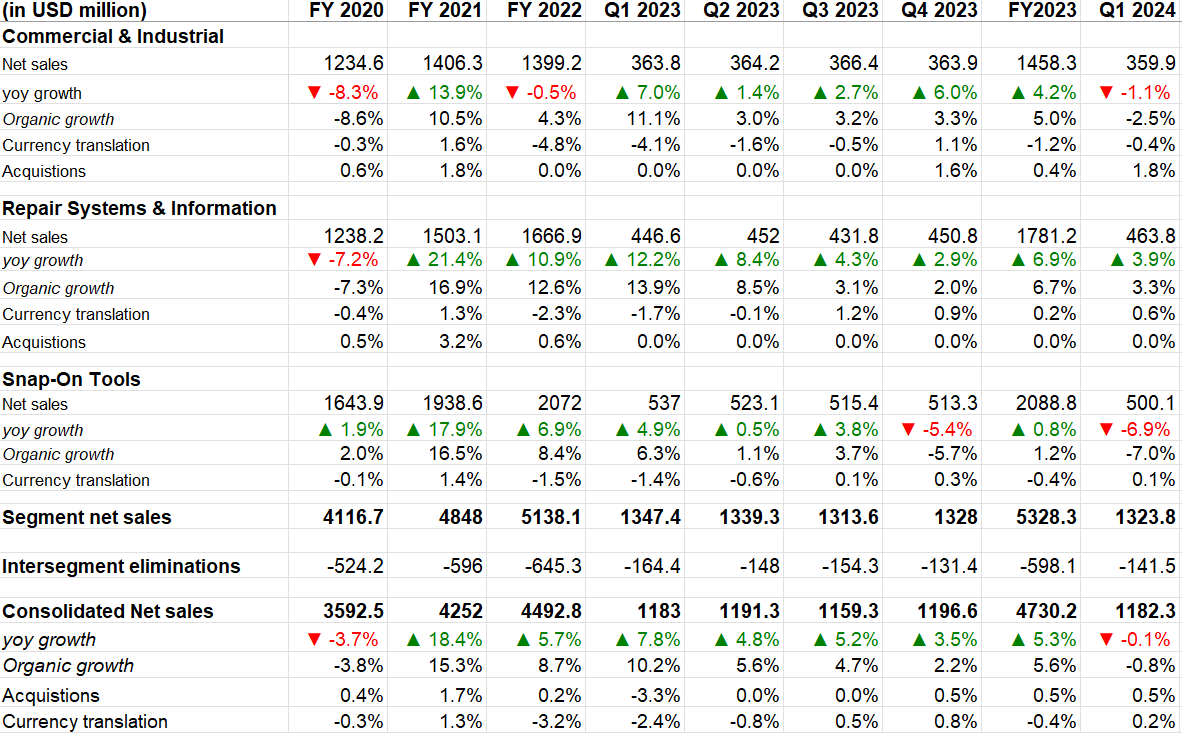

Snap-on has seen good development over the past couple of years, helped by robust end-market demand. Nonetheless, within the first quarter of 2024, the corporate’s gross sales have been negatively impacted as a result of decrease demand from automobile service and restore technicians for the corporate’s instruments and tools.

Consequently, the corporate posted a 0.1% Y/Y decline in web gross sales to $1.1823 billion within the first quarter. Excluding a 0.5% profit from acquisitions and a 0.2% favorable impression from FX translation, gross sales declined 0.8% Y/Y organically.

Section-wise, Snap-on Instruments Group’s gross sales declined 6.9% Y/Y as a result of a 7% Y/Y decline in natural gross sales, partially offset by a 0.1% favorable impression of FX translation. The decline in natural gross sales was attributable to decrease exercise within the U.S. operations, which greater than offset the upper gross sales within the phase’s worldwide operations.

Within the Business & Industrial (C&I) Group, gross sales declined 1.1% Y/Y pushed by a 2.5% natural decline and a 0.4% unfavorable impression of FX translation, partially offset by a 1.8% contribution from the Mountz acquisition. The natural gross sales decline was as a result of weak spot within the energy instruments enterprise and Asia Pacific operations, partly offset by greater buyer exercise clients in important industries.

However, gross sales within the Restore Programs & Info (RS&I) Group elevated by 3.9% Y/Y and three.3% Y/Y organically attributed to elevated exercise with OEM dealerships and elevated gross sales of under-car tools.

SNA’s Historic Income Development (Firm Information, GS Analytics Analysis)

Wanting ahead, the corporate’s near-term outlook is combined, however I imagine we’re near the underside. The corporate’s Instruments enterprise (Snap-on Instruments), which is the biggest phase by income, is a serious level of focus amongst buyers. This phase noticed a ~7% Y/Y natural income decline final quarter, which nervous buyers and resulted in a pointy sell-off post-earnings. An fascinating dynamic is taking part in within the phase. Whereas the common age of autos on the highway continues to extend, it’s not translating into a rise in demand for Snap-on Instruments. Snap-on Instruments primarily focuses on DIFM (Do-it-for-me) purchasers (technicians/mechanics) and as a result of rising inflation, there was a shift from DIFM to DIY demand. Even DIFM purchasers (technicians/mechanics) at the moment are specializing in faster payback gadgets reasonably than big-ticket/long-term investments.

The long-term demand drivers for DIFM enterprise stay in place, given the growing automobile complexity and electrification. Nonetheless, the inflationary headwinds have prompted a brief velocity bump. The corporate is controlling what it could possibly management and has not too long ago began specializing in launching and advertising new product traces with decrease payback intervals to handle present buyer preferences. This effort to redirect the Instruments group focus to fast payback gadgets ought to assist gross sales restoration within the coming quarters.

One other issue that may assist Snap-on Instruments’ natural gross sales restoration within the coming quarters is easing comparisons. In Q1 2023, Snap-on Instruments’ natural development was 6.3% Y/Y which slowed to 1.1% Y/Y in Q2 2023. So, we’ve got considerably simpler comparisons forward within the Snap-on Instruments phase.

The corporate’s C&I phase can be seeing comparable dynamics, with robust comparisons within the energy instruments enterprise. In comparison with 11.1% Y/Y natural development in Q1 2023, the corporate’s gross sales development was solely 3% Y/Y in Q2 2023. So, we’ve got a lot simpler comparisons shifting forward.

The corporate additionally launched new merchandise like PH3045B Air Hammer which hurdles the hammer 3500 occasions a minute and a brand new 18-volt nibbler designed for collision restore and metallic fabrication, that are getting good responses from clients and will assist gross sales shifting ahead.

Lastly, the corporate’s Restore Programs and Info phase is seeing good development with expanded attain in OEM packages in addition to elevated demand from dealerships and unbiased garages as they improve their providing to go well with new automobile platforms which might be coming. I count on this power to proceed within the close to to medium time period.

In a nutshell, whereas the corporate’s development was impacted as a result of some near-term headwinds, particularly within the Instruments enterprise, I imagine we’re close to the underside and long-term elementary drivers like growing complexity of autos and electrification will help drive good gross sales development for the corporate within the coming years.

Snap-on Margin Evaluation and Outlook

In Q1 2024, the corporate’s gross margin benefited from decrease materials and different prices, and financial savings from the Fast Steady Enchancment (“RCI”) initiatives leading to a 70 bps Y/Y gross margin enchancment to 50.5%.

The working margin earlier than monetary companies elevated by 90 bps Y/Y to 22.9% and the consolidated working margin expanded by 90 bps Y/Y to 26.5%. This was attributed to a 20 bps Y/Y decline in working bills as a proportion of web gross sales, primarily due to a good thing about $11.3 million for funds acquired associated to a authorized matter.

Section-wise, the working margin of the C&I and RS&I segments improved by 10 bps Y/Y and 90 bps Y/Y, respectively. Nonetheless, the Snap-on Instruments phase’s working margin decreased by 100 bps Y/Y pushed by decrease gross sales volumes.

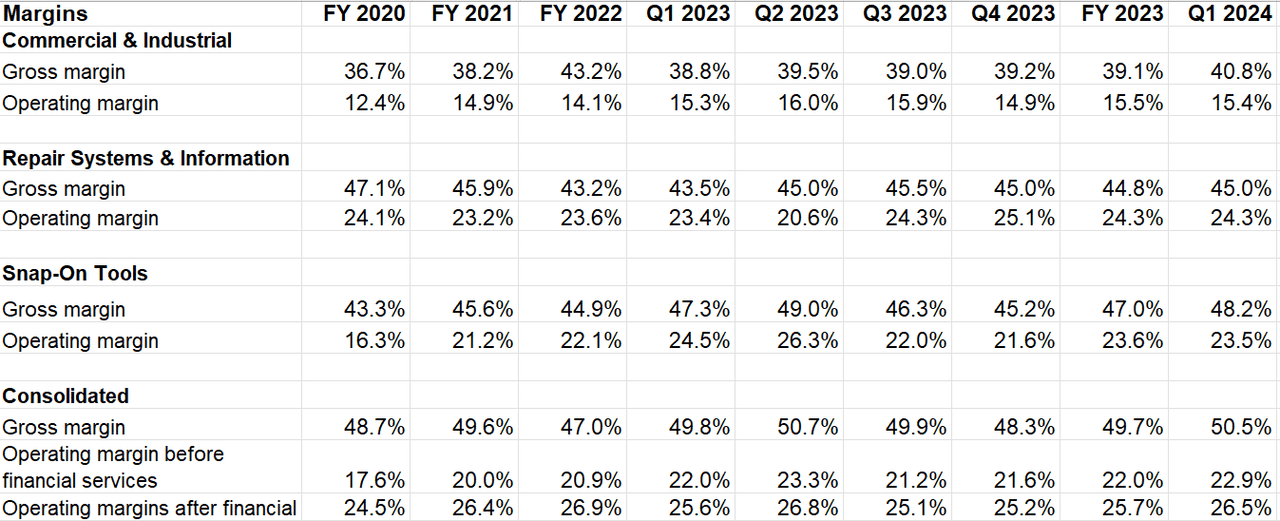

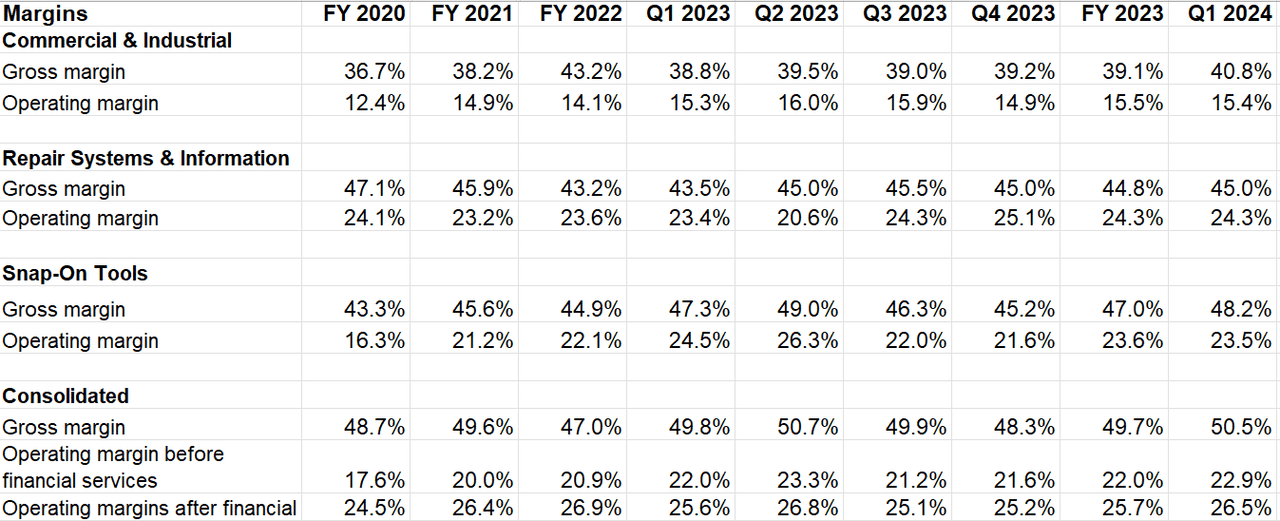

SNA’s Section-Sensible Margin Development (Firm Information, GS Analytics Analysis)

One fascinating factor that occurred final quarter was that the corporate was capable of enhance its gross and working margins regardless of decrease gross sales. Because the product combine within the quarter shifted in the direction of decrease payback interval merchandise, it signifies that these merchandise have engaging margin profiles. As Snap-on launches extra of those merchandise within the coming quarter, it could be barely constructive for the corporate’s combine. As well as, we’re doubtless close to the underside by way of gross sales and as gross sales get better within the coming quarters, the corporate can see advantages from working leverage. Additional, the corporate continues to concentrate on Fast Steady Enchancment (‘RCI’) initiatives, the place it applies a structured set of instruments and processes to eradicate waste and enhance operations and this steady enchancment philosophy ought to assist margin enchancment in the long term.

SNA Valuation and Conclusion

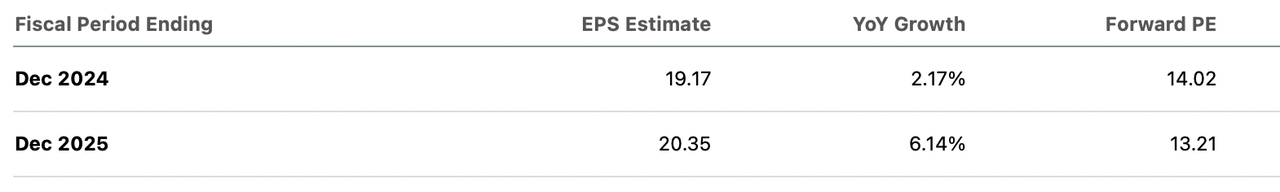

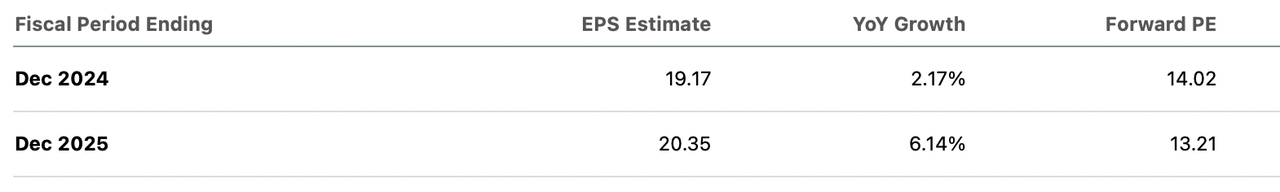

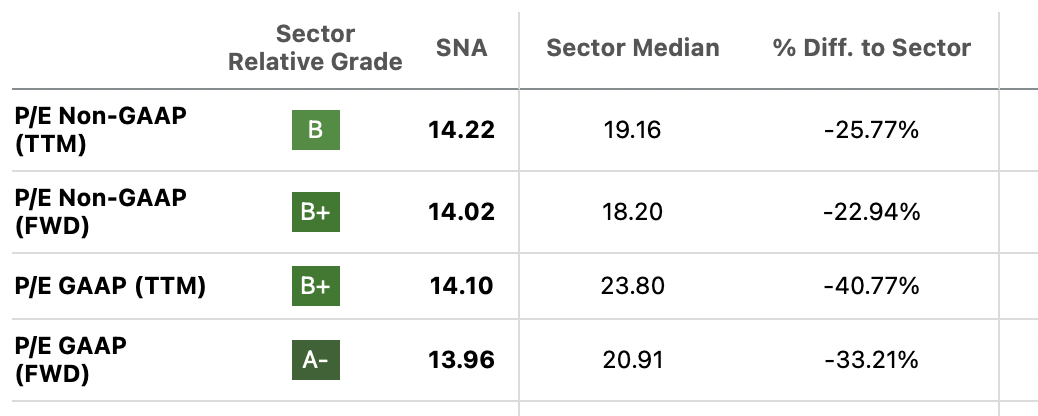

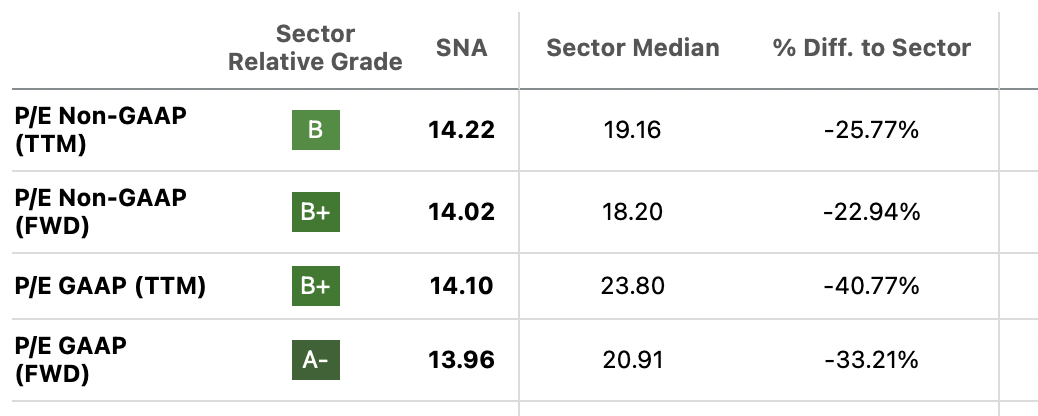

SNA is presently buying and selling at ~14.02x FY24 consensus EPS estimate of $19.17 and ~13.21x FY25 consensus EPS estimate of $20.35 which is decrease than its 5-year common ahead P/E of 14.55x.

SNA Consensus estimates and P/E (In search of Alpha)

The corporate’s valuation additionally compares favorably versus the sector median and the inventory gives a sexy 2.77% dividend yield..

SNA Valuation versus Sector Median (In search of Alpha)

Whereas the corporate faces near-term headwinds, significantly in its Instruments enterprise, I imagine we’re close to the underside and the corporate gross sales ought to see a restoration with the assistance of easing comps within the Snap-on Instruments and C&I segments and strategic changes within the Instruments phase, together with launching progressive, faster payback merchandise. The long-term fundamentals stay strong for the corporate, with favorable traits within the automotive restore market, such because the growing complexity of autos and electrification. The margins must also see beneficial properties from a barely extra favorable combine as the corporate launches faster payback gadgets, which carry good margins, working leverage as gross sales recovers, and advantages from RCI initiatives. The corporate’s valuation additionally appears to be like low cost in comparison with its 5-year historic averages. Therefore, I’ve a purchase score on the SNA’s inventory.

Dangers

- If the inflation stays excessive and the development from DIFM to DIY continues within the close to time period, the P/E a number of might stay depressed.

- The corporate’s C&I enterprise has substantial worldwide publicity and any incremental weak spot in Europe and China might impression the enterprise.