It’s one other blended bag for Snap Inc. in its latest performance update, with the platform including extra customers, although not in its most profitable markets, whereas income additionally elevated, although not on the ranges anticipated.

Thus is the theme of Snap’s efficiency, a yin-yang of strengths which might be additionally weaknesses, in just about each component.

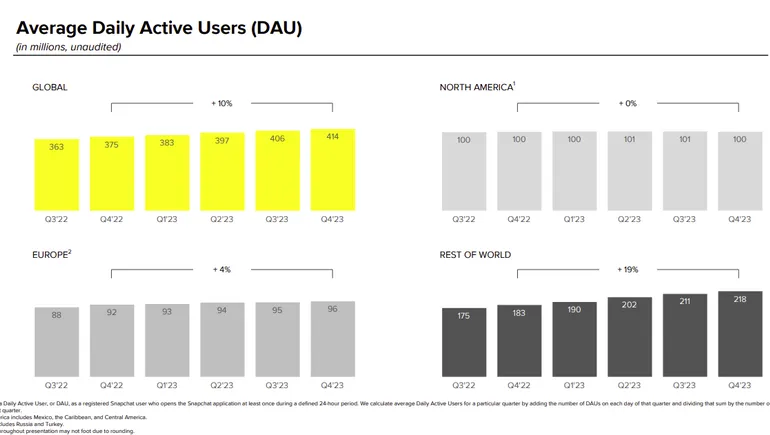

First off, on utilization. Snapchat rose to 414 million each day energetic customers in This autumn, a ten% YoY improve.

Which is a constructive, although as you possibly can see, Snap really misplaced one million customers in North America, which is a major notice over the vacation interval.

Nearly all the platform’s progress as soon as once more got here within the “Rest of the World” phase, which has been the identical story over the previous 12 months. Snapchat’s seen rising curiosity in India, which had been a spotlight of its growth push, however it now says that it’s going to alter its strategy to hone in on “more mature” markets.

As per Snap:

“While we see significant long-term potential for community growth in Rest of World, we are shifting more of our focus toward community growth in our more mature geographies like North America and Europe. Over the past several years, we’ve driven significant growth in DAU by focusing on Android performance in large emerging markets, including India. We will continue to build on our momentum in the APAC region while increasing our investment in improving the product experience for our community in North America and Europe.”

Certainly, final week, Snap launched a new ad campaign in North America, through which it pitches itself as “the antidote to social media”.

Whether or not that may get extra individuals utilizing the app stays to be seen.

By way of consumer engagement, Snap says that complete time spent watching its TikTok-like Spotlight feed elevated greater than 175% year-over-year, whereas Highlight common month-to-month energetic customers elevated greater than 35% year-over-year.

Which isn’t any shock given the broader reputation of short-form video, although additionally it is price noting that Snap has discontinued funding for its Snap Originals programming, probably on account of extra curiosity in cheaper, user-generated content material.

As an alternative of Originals, Snap’s as an alternative trying to work with standard creators on new initiatives, and it did see progress on that entrance, with public Tales posted by Snap Stars rising 125% year-over-year within the U.S. Snap’s additionally trying to assist creators parlay their platform popularity into brand deals, as a method to determine a extra sustainable course of for creator income share.

AR additionally stays a key space of alternative for the platform, with over 350,000 creators and builders now having constructed nearly 3.5 million AR Lenses for the app. On common, 300 million Snapchatters have interaction with AR day-after-day, and if Snap can convert that into expanded enterprise choices, that would nonetheless play a key function in its future.

Although it’s additionally taken a step again on that entrance, with Snap shutting down its third-party AR development platform ARES late last year as a part of its cost-cutting measures. Which is the problem of its broader enterprise struggles, in that it wants income to gas growth, however it wants to scale back prices to rationalize the enterprise.

Which brings us to its newest income outcomes:

As you possibly can see, Snap introduced in $1.36b in income for the quarter, a rise of 5% year-over-year. Which is comparatively good given the broader market circumstances, however inferior to the market was anticipating.

An enormous drawback for Snap, as famous, is that whereas it’s rising, it’s struggled to develop its viewers in its key income markets, with utilization in North America and EU remaining comparatively flat. Which is a giant concern while you take a look at these charts:

Snap’s common income per consumer is just not solely method decrease within the “Rest of the World” class, the place just about all of its progress is coming from, however it’s additionally declined during the last 12 months. So once more, whereas it’s increasing its viewers, which ought to current future alternatives, its present market potential isn’t rising, which displays poor capitalization on that progress.

That might counsel flaws in Snap’s evolving marketing strategy. And as reported by CNBC, at the moment’s report additionally marks six consecutive quarters of single-digit progress or decline on the app.

Snap does have potential, and at 414 million energetic customers, and rising, there must be extra worth there. However one other problem for the app is that it’s nonetheless not ageing up with its audience, and never resonating past its core demographic.

As you possibly can see on this chart, no person over 30 is energetic on Snap, with the app seeing the second lowest mixed general utilization amongst older audiences of the foremost social apps (solely simply beating out Reddit). Snap has been trying to improve on this, however so far, it stays a distinct segment viewers platform. Which can be its key power in lots of respects, and one thing that it has utilized in its advert associate pitch prior to now. But it surely does additionally restrict its enterprise potential, as fewer manufacturers want to attain this market.

And with its AR ambitions seemingly additionally taking a success as a result of lay-offs and different cost-cutting measures, it does appear to be Snap’s alternatives are restricted, and can stay that method for a while.

At one stage, it regarded like Snap can be the chief of the AR race, with its Spectacles glasses set for an AR improve in future. However now, Apple and Meta are shifting into gear with their AR choices, and with far bigger useful resource swimming pools for respective growth, it’s laborious to see Snap getting again into this race.

Perhaps it will probably. Spiegel has additionally mentioned that its AR ambitions remain a key focus, regardless of its value slicing, although Spiegel has additionally criticized the broader metaverse push from Meta, which it sees as the following stage of digital connectivity.

So once more, there are lots of contradictions inside Snap, and for each constructive, there’s additionally a notice of potential unfavorable as properly, sustaining its less-than-ideal market steadiness.

Is it nonetheless a very good future guess? For customers, Snap stays a key connector, and a crucial instrument for teen connection specifically. However for buyers, it could be much less precious, a minimum of until it will probably get its income again on a strong monitor.