Snapchat has published its first performance report of 2025, showing a steady increase in users, and improved business performance, as a result of its efforts to better engage SMBs.

Though concerns remain about its constrained growth, which suggests that Snap could have reached saturation point in its key markets, meaning that it now needs to focus on capitalizing on the attention that it has in these revenue segments to maximize its business opportunities.

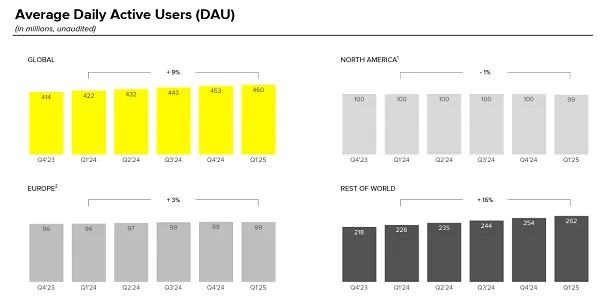

First off, Snapchat reached 460 million daily actives, an increase of 38 million year-over-year, while it’s also hit a new milestone of 900 million monthly active users.

The fact that Snap is closing in on a billion MAU is significant, though as you can see, all of Snap’s growth is coming in the “Rest of the World” segment, with the platform actually losing audience in the U.S.

That points to future opportunities in developing markets, and underlines the ongoing popularity of Snap, which does have a higher churn rate as younger users age-up.

But it remains a broader concern for the app’s business prospects, given that Snap makes all of its money in the U.S. and EU.

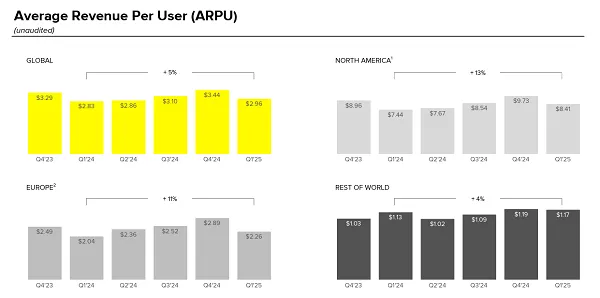

As you can see in these charts, Snap’s average revenue per user is way lower in Europe than it is in America, and way lower again in the “Rest of World” segment.

Snap’s seen significant growth in India, as connectivity evolves in that market, and again, that does bode well for future potential. But as Snap notes, its lack of growth in its main user markets means that it has to get better at monetizing what it has, as opposed to relying on growth for revenue impact.

“We continue to see robust growth in our global community driven by ongoing adoption of visual communication in less mature markets. To continue to grow our community in North America and Europe, we are prioritizing innovation in three key areas: enhancing our core product value of visual communication, investing in our AI and ML models for better content ranking and personalization, and strengthening our creator ecosystem.”

That’ll remain a concern for market analysts, that Snap, while it remains popular, is also limited in its key audience bases, in revenue terms. That’s why Snap’s been putting a bigger focus on new ad opportunities, with updates like its Affiliate Program, which incentivizes Snap users to help drive ad sales.

Essentially, Snap’s growth is impressive, and it is worthy of note. But it needs to either accelerate its business development in emerging markets, or show that it has the potential to squeeze more revenue out of what’s increasingly looking like a constrained core revenue base.

Which it is doing. On the revenue side, Snap brought in $1.36 billion in Q1, up 14% year-over-year.

It’s not a massive boost, but Snap is expanding its opportunities, despite, again, that stagnant user base in the U.S. and EU.

Snap says that growth in its direct response advertising solutions, and its continued focus on SMBs, has helped to boost its revenue intake, while Snapchat+ also continues to see good take-up, helping to drive more income for the app.

Indeed, Snapchat+ is now closing in on 15 million subscribers, representing a 59% increase in take-up year-over-year.

Snapchat+ has been the most successful of the new wave of social subscription offerings, beating out X Premium and Meta Verified in terms of overall take-up, and underlining Snapchat’s nous for audience understanding, and providing features that its users actually want (and will pay for).

And that’s provided a welcome boost to Snap’s coffers:

“This helped contribute to Other Revenue growing 75% year-over-year to reach $152 million in Q1 at a just over $600M annualized run rate.”

It’s a lesser revenue element, overall, but it’s offered another opportunity for Snap to maximize its intake in its key markets, and could become a bigger focus in this respect.

In terms of engagement, Snap cays that global time spent watching content increased year-over-year in Q1, which it believes reflects its evolving AI and machine learning models for better content ranking and personalization.

“To further deepen content engagement, we implemented fresher, more responsive machine learning models, doubling the pace at which they integrate new trends and user interaction signals. While we anticipate that it will take several quarters to reach our ultimate goal of near real-time model refreshes, we are encouraged by the results we have achieved to-date.”

Also, as with every social app, short form video is working, with views on Spotlight videos less than 24 hours old doubling year-over-year.

That’s also helping Snap enhance its appeal with emerging creators, by ensuring more attention and reach in the app.

Which is another element of focus:

“Over the past year, we onboarded thousands of creators to our Snap Star program, driving strong momentum, with the number of Spotlight posts by Snap Stars growing more than 125% year-over-year in North America in Q1.”

More influencer-originated content means more engagement, and Snap will continue to focus on enhancing its revenue and exposure opportunities to keep these users posting in the app.

Overall, it’s another mixed report card for Snap. I mean, double-digit growth, in tough market conditions, likely indicates strong performance either way, but the fact that Snap hasn’t been able to grow in its key revenue markets remains a black spot on an otherwise positive story.

Maybe Snap has reached its limit, and maybe that’s not so bad, but it will mean that app’s business prospects are also limited along the same parameters. Unless it injects more ads, which risks turning people off.

Or its bet on AR glasses actually pays off, which, given competition from Meta, I highly doubt.

Either way, it’s what I would call an average report card from Snap, which shows that engagement is increasing, which could be of value for marketers.