Solana (SOL) has skilled an distinctive uptrend, with a staggering year-to-date (YTD) surge of 652%. Nevertheless, the current surge in meme cash has additional amplified the blockchain’s development narrative.

Solana-based tokens resembling dogfight (WIF), Bonk Inu (BONK), and Boof of Meme (BOME) have witnessed exceptional development charges of 574%, 3200%, and 49%, respectively, in accordance with CoinGecko data.

Nonetheless, this unprecedented meme coin mania has its fair proportion of ramifications, together with elevated transaction failures, rising transaction charges, and the dominance of bot-driven actions.

Meme Coin Ecosystem Faces Challenges

The surge in meme coin reputation is clear via the rise in decentralized change (DEX) and meme coin quantity on Solana. On March sixteenth, main meme cash like BONK, WIF, TREMP, BODEN, and BOME recorded a cumulative quantity of $1.33 billion.

This surge in trading activity highlights traders’ important curiosity and participation within the Solana meme coin ecosystem.

Nevertheless, the inflow of bots in search of to use potential alternatives has resulted in a notable improve in failed transactions throughout the Solana community.

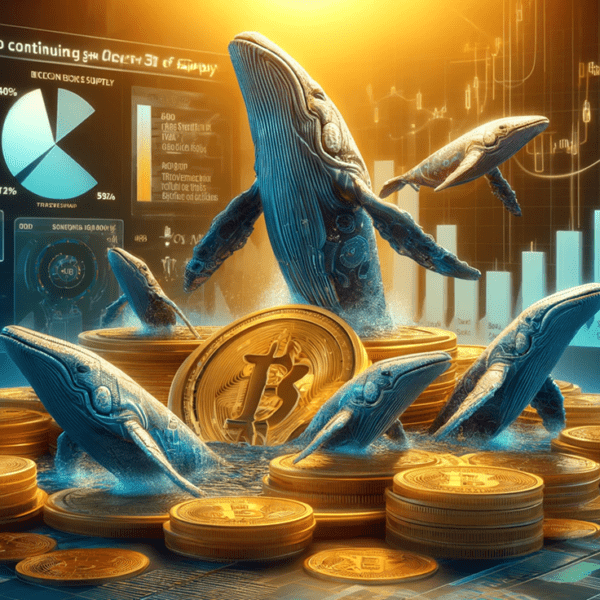

On-chain researcher and analyst Tom Wan reveals that 72% of the failed transactions might be attributed to bot actions. Though this excessive failure fee has impacted the community’s effectivity, the impact on natural customers has been comparatively much less extreme than bots.

Nevertheless, because the meme coin frenzy continues to grip Solana, the community has witnessed a considerable improve in common transaction charges.

Whereas common customers can nonetheless execute transactions with out paying precedence charges, Tom Wan highlights that the median transaction fee has tripled from 0.000005 SOL to 0.000016 SOL. Because of this, the common transaction payment has risen to $0.065, reflecting elevated demand and congestion on the community.

Finally, the surge in meme coin buying and selling exercise on Solana has introduced advantages and challenges. Whereas the DEX and meme coin quantity development signifies the rising adoption and curiosity in these tokens, it has additionally uncovered vulnerabilities throughout the community.

Solana Surpasses All Different Blockchain Ecosystems

The competitors between Ethereum (ETH) and Solana continues to accentuate, because the so-called “Ethereum Killer” seems to be the most recent to dominate world investor curiosity, outpacing different blockchain ecosystems.

In keeping with current research by CoinGecko, Solana’s rising reputation might be attributed to its current rally, which has propelled it to reclaim its 2021 highs.

This resurgence has captured the eye of traders worldwide, who’re drawn to blockchain’s potential for innovation and development. As well as, the success of notable tasks throughout the Solana ecosystem, resembling Pyth, has additional boosted investor confidence and curiosity within the platform.

Whereas Solana has emerged as the preferred blockchain ecosystem, Ethereum holds a big place within the business. CoinGecko’s knowledge reveals that Ethereum captures 12.7% of investor curiosity, rating it because the second hottest ecosystem 2024.

In keeping with the analysis, Ethereum’s continued relevance might be attributed to its well-established presence and familiarity amongst traders. Nevertheless, consideration throughout the Ethereum ecosystem is more and more dispersed to layer 2 options constructed on prime of the Ethereum community.

With a 5.4% share of investor curiosity year-to-date (YTD), the third hottest blockchain ecosystem is crypto change Binance’s BNB Good Chain ecosystem.

Presently, the worth of SOL stands at $171.80, reflecting a continuation of its value correction over the previous seven days, which quantities to a 5% decline. This correction has additionally persevered over the previous 24 hours, with an additional lower of 6.6% in value.

Featured picture from Shutterstock, chart from TradingView.com