Key Notes

- Solana price rebounds 5%, reclaiming its $100B market cap amid record DEX trading volumes.

- Solana-hosted perp DEXs process over $8B in volume during the liquidation event, signaling ecosystem resilience.

- SOL open interest climbs 6.9% to $10.2B, reflecting rising bullish reentry expectations.

Solana (SOL) price rebounded 3% on Sunday, October 8, reaching intraday highs of $190 and reclaiming its $100 billion market cap for the first time since early September. The recovery follows a week of volatility triggered by U.S. President Donald Trump’s renewed tariffs on China, which sparked record-breaking liquidations across global crypto markets.

Solana Price Rebounds Above $190 as DEX Activity Hits Record $8B

Despite the broader downturn, Solana’s decentralized ecosystem showed exceptional strength. On Saturday, Solana news aggregator data revealed that perpetual DEXs on the Solana network processed over $8 billion in trading volume during the market crash.

Notably, four Solana-based exchanges crossed $1 billion in 24-hour trading volume, led by Orca ($2.49B), Meteora ($1.7B), and Raydium ($1.5B).

📊Report: During last night’s massive liquidation event, @Solana DEXs processed over $8B in trading volume with @orca_so leading at $2.49B. Four Solana DEXs crossed $1B in 24-hour volume. pic.twitter.com/BJlG9Epth7

— SolanaFloor (@SolanaFloor) October 11, 2025

While the broader crypto market saw liquidity outflows, Solana’s DEX ecosystem retained and recycled capital, keeping network value locked within the chain. Increased transactional intensity during high-volatility periods often enhances validator fees and token burn activity, which may contribute to SOL’s price stability and faster rebound relative to rival layer-1 assets on Sunday.

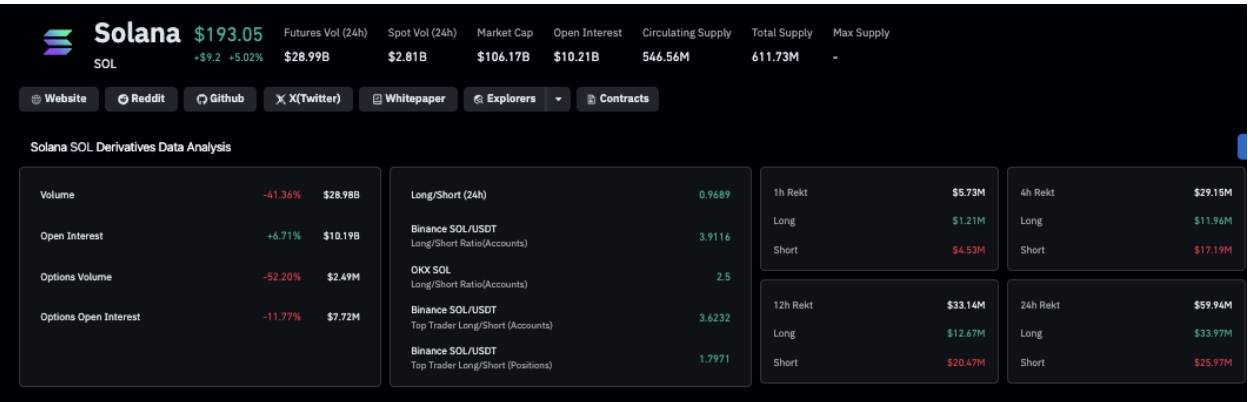

Solana Derivatives Market Analysis | Source: Coinglass

Derivatives trading also echoes optimism around Solana’s rebound prospects. Coinglass data shows that Solana open interest surged 6.9% to $10.2 billion on Sunday, even as prices only rose 5% to $192. This divergence suggests new long positions are being opened faster than spot demand, implying leveraged traders re-entry new positions after record-break forced liquidations on Friday.

Solana Price Forecast: Can SOL Sustain Momentum Above $200?

Solana’s technical indicators align with improving on-chain and derivatives data, suggesting that bulls are gradually regaining control. As seen below, Solana price bounced off the lower Bollinger Band support at $181.6, confirming renewed buying interest after the market-wide sell-off.

Solana (SOL) Technical Price Analysis | TradingView

SOL price has since reclaimed ground toward the mid-Bollinger level at $213.3, which now acts as the next key resistance zone. A decisive breakout above this midline could open the door toward the upper band at $244.9, aligning with the August swing high and serving as a key target for bulls this week.

Meanwhile, the Relative Strength Index (RSI) has risen modestly from oversold levels near 41.1 toward the neutral 49.7 mark, signaling that downside momentum is cooling. However, on the downside, a rejection from the $213 resistance could trigger a retest of $181 support.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.