The ecosystem for tokenized real-world assets (RWAs) on Solana has officially surpassed $1.66 billion in value, establishing a new all-time high for the high-throughput blockchain. This milestone was achieved on February 15, and the network signals a definitive shift toward institutional-grade utility.

Could this also positively affect the price? Probably not immediately.

Solana’s RWA ecosystem just hit a new ATH: $1.66B+ in tokenized value 🔥 pic.twitter.com/2P6rKbcccZ

— Solana (@solana) February 15, 2026

EXPLORE: What is the Next Crypto to Explode in 2026?

The Role of RWAs: Connecting Traditional Finance to On-Chain Mechanics

Real-world asset tokenization involves migrating off-chain financial instruments, ranging from private credit and real estate to government treasuries, onto blockchain infrastructure to enhance settlement speed and liquidity. This sector has expanded aggressively across the industry, with institutional players increasingly seeking networks that offer low transaction costs and high capacity. The momentum on Solana mirrors similar innovations on Ethereum, where projects like EthZilla are tokenizing jet engines, bridging the gap between heavy industrial finance and decentralized ledgers.

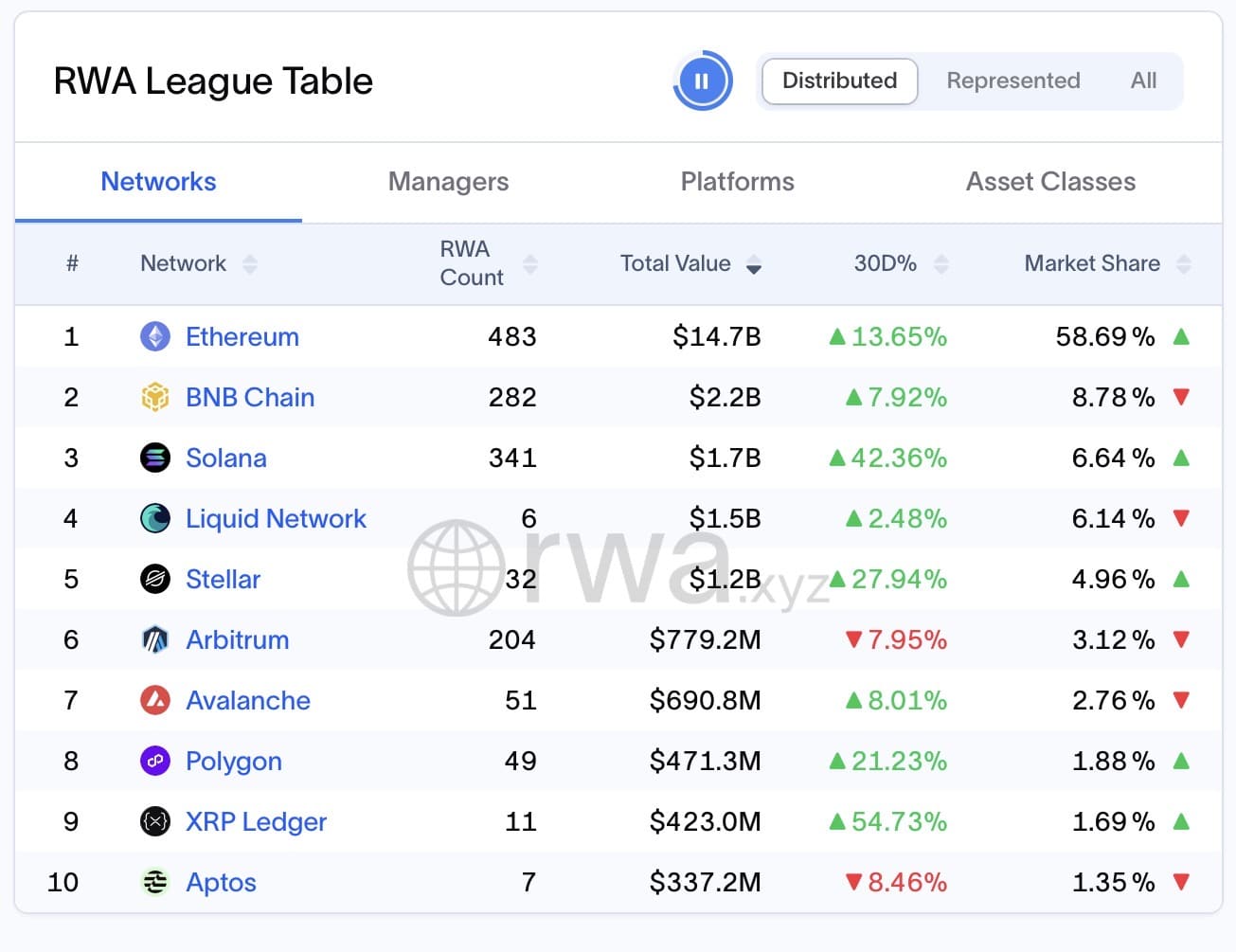

While the total value of RWAs across all blockchains currently sits near $296.5 billion, Solana’s recent surge highlights its growing market share. The network now commands approximately 6.64% of the global RWA market, solidifying its position as a serious competitor to established leaders like Ethereum and Polygon.

RWA League Table Solana Source: RWA

DISCOVER: Best Solana Meme Coins By Market Cap 2026

RWA Growth Metrics and Institutional Drivers Fo r Solana

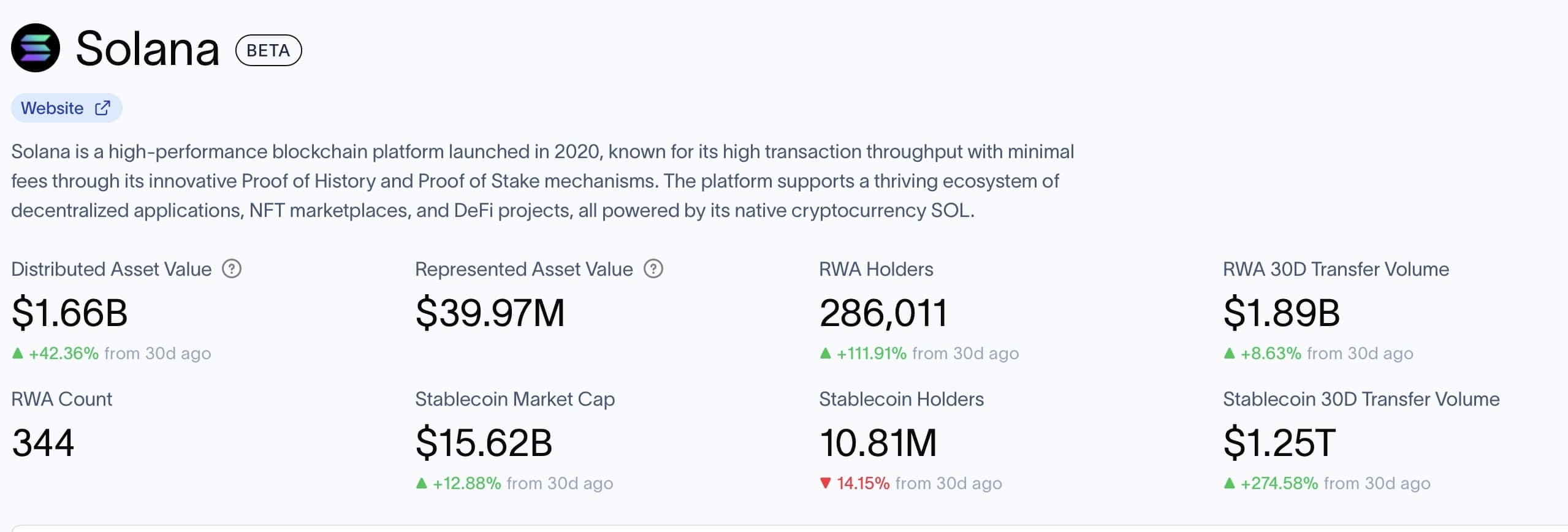

Solana’s tokenized asset value jumped over 42% in the last 30 days alone. This growth trajectory brings the total to the record $1.7 billion figure, supported by a substantial increase in user participation. The number of RWA holders on the network surged by more than 112% to reach 286,011, while 30-day transaction volumes climbed to $1.89 billion.

Solana RWAs Source: RWA

This expansion is fueled by new protocols like Multiliquid and Metalayer, which have introduced instant redemption facilities to improve liquidity for on-chain assets. These developments align with a sector-wide push for better infrastructure, similar to MetaMask’s integration with Ondo Finance, which facilitates access to tokenized securities.

The Institutional Utility of RWAs Could Be A Boost For Solana in The Long Term

The recent rise in the RWA value provides a welcome contrast to the SOL token’s poor performance over the past few months. However, where lies the potential upside? The decoupling of fundamental network usage from token price suggests a maturing landscape where utility drives long-term value. Analysts note that as more assets settle on-chain, the demand for blockspace becomes less dependent on retail trading cycles.

Less short-term excitement, more stability long term.

This trend is reinforced by substantial capital flows within the ecosystem. Recent moves, such as investment deals settling in native assets, demonstrate that sophisticated actors are increasingly viewing Solana as a viable settlement layer.

The continued ranking of Solana as the third-largest chain for tokenized assets underscores its verified role in the future of digital finance.

EXPLORE: 10 New Upcoming Binance Listings to Watch in February 2026

As RWAs Rise on Solana, Bitcoin Hyper Pushes Bitcoin Toward Scalable Finance

As Solana’s real-world asset ecosystem grows and institutional activity increases, attention is also shifting toward infrastructure that expands blockchain utility. One project worth mentioning is Bitcoin Hyper, a Layer-2 network designed to bring faster transactions and lower fees to Bitcoin through a scalable architecture.

Unlike Ethereum, where Layer-2 networks already handle a large share of activity, Bitcoin Layer-2 solutions remain an early but meaningful growth area. Bitcoin’s base layer prioritizes security and decentralization, which limits throughput and can lead to higher fees during congestion. Layer-2 systems help reduce pressure on the main chain by processing activity off-chain while settling security back to Bitcoin.

Bitcoin Hyper aims to add smart contract functionality and faster execution while keeping Bitcoin as the settlement layer. Its native token supports transaction fees, staking, and governance, giving users practical utility within the ecosystem.

As tokenized finance expands across chains, projects focused on scaling Bitcoin may benefit from the same long-term trend: stronger on-chain utility supported by lower costs and better infrastructure.

The Bitcoin Hyper token is compatible with Best Wallet, widely considered the best crypto and Bitcoin wallet. HYPER is already featured in Best Wallet’s “Upcoming Tokens” section making it easy to buy track and claim once the token launches.

Be part of the Bitcoin Hyper community on Telegram and X.

DISCOVER: How to Buy Bitcoin Hyper – 2026 ICO Guide

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Neil is a professional cryptocurrency content writer with years of experience. He has written for various cryptocurrency websites to report on breaking news, and been hired by all sorts of cryptocurrency projects, to create content that would increase their exposure and attract more potential investors.