SimonSkafar/E+ by way of Getty Photos

Typically talking, experiencing income development is a optimistic factor for corporations. Nonetheless, it does not at all times imply that backside line enchancment will observe. And on the finish of the day, it is the income and money flows of an enterprise that decide its worth, not the quantity of gross sales it brings in. A great instance of a divergence between development and profitability may be seen by automotive retail agency Sonic Automotive (NYSE:SAH). Again in October of 2022, I wrote a bullish article in regards to the firm due to how low cost the inventory was. A number of the agency’s monetary outcomes had been lower than perfect. However that was acceptable given how inexpensive models had been on the time. After score the corporate a ‘purchase’, the inventory went on to attain upside for shareholders of 25.9%. For just a little over a 12 months, that’s a improbable quantity of appreciation. Having stated that, the upside did fall in need of the 35% seen by the S&P 500 over the identical window of time.

The issue, I imagine, has to not do with something from a development perspective. And it’s true that shares are very attractively priced at this cut-off date. The truth is, they’re amongst the bottom on this market. Having stated that, income and money flows have pulled again because the finish of 2022. The excellent news is that administration is working to rectify these points. And in the event that they do, the tip consequence for traders may very well be very optimistic. As a result of we have now but to see significant progress on this as of but, I’ve determined to maintain the enterprise rated solely a ‘purchase’. However given how low cost the inventory is, I may grow to be much more bullish on it if backside line outcomes begin to enhance materially.

The image has modified

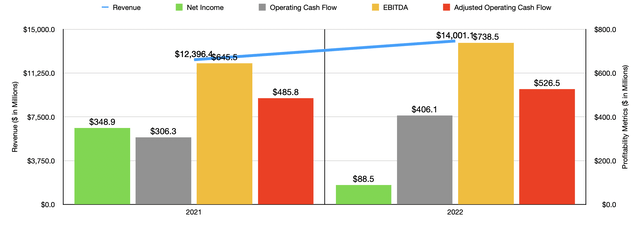

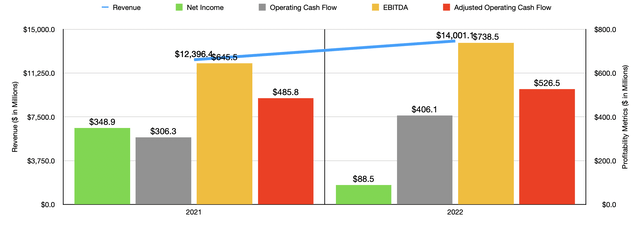

In case you had been to evaluate the funding worthiness of Sonic Automotive by solely its annual outcomes, you would be perplexed as to why the agency has fallen in need of the broader market. Income in 2022 got here in at a slightly sturdy $14 billion. That is 12.9% above the $12.40 billion generated in 2021. In the case of the brand new autos the corporate sells, the variety of models dropped barely from 103,486 to 103,283. Nonetheless, income per new unit bought jumped round 12% from $49,456 to $55,402. This isn’t shocking in case you have adopted the automotive retail house intently. General unit gross sales had been down in comparison with the 12 months prior with regards to the US market a minimum of. Automotive strikes, mixed with provide chain points when it comes principally to issues like microprocessors, induced unit gross sales to drop and costs to rise.

Creator – SEC EDGAR Information

On the used retail aspect, there was a a lot bigger drop of round 6% with regards to variety of models bought. They declined from 183,292 to 173,209. Nonetheless, this didn’t cease income per unit from growing. It jumped round 20% from $26,609 to $31,842. This was accompanied by a 4% decline in wholesale car models bought from 36,795 to 35,323. And on this case, income per unit jumped round 38% from $9,980 to $13,727. Pushed largely by three $120.4 million of impairment fees, income for the corporate declined from $348.9 million to $88.5 million. Nonetheless, because the chart above illustrates, the entire different profitability metrics for the enterprise improved from 2021 to 2022.

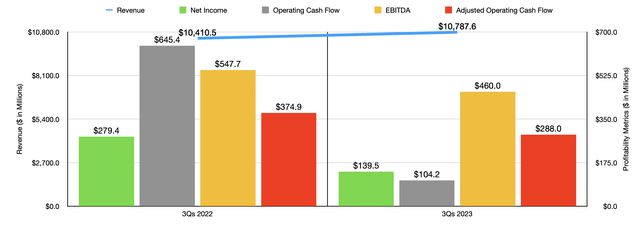

Creator – SEC EDGAR Information

That image began to alter once we entered into the 2023 fiscal 12 months. Income continued to extend 12 months over 12 months, climbing from $10.41 billion within the first nine months of 2022 to $10.79 billion within the first 9 months of final 12 months. New unit gross sales really elevated throughout this time, and income per new unit rose modestly. However the price of procuring these autos rose much more considerably, inflicting gross revenue per new unit to drop about 26%. On the used car aspect of issues, the corporate reported a 4% enhance in quantity bought. On this case, income per unit dropped by about 8%. And that, mixed with the next price of procurement, despatched gross revenue per unit down round 25%. On account of these components, internet revenue plummeted from $279.4 million to $139.5 million. If it had been simply that, it might be comprehensible. However because the chart above illustrates, all three money movement metrics that I checked out additionally worsened 12 months over 12 months.

Final 12 months, administration acknowledged that a few of the firm’s issues associated to the EchoPark section of the corporate, which focuses largely on the sale of used autos. In June of 2023, the corporate indefinitely suspended operations at eight of these areas, in addition to 14 associated supply and purchase facilities. This was adopted up by another asset closures in a while within the 12 months. Administration has additionally labored onerous to get the full days price of provide at this unit right down to between 30 and 40. It is now right down to 37 in comparison with the 57 that it was on the identical time one 12 months earlier. The issue with the unit, for my part, is that while you’re coping with low priced autos, margins are already tight. Administration pitches the section as a spot the place shoppers can get used autos priced at as much as $3,000 beneath market worth. For context, for the 2022 fiscal 12 months, used car gross sales and wholesale gross sales mixed accounted for 43% of the corporate’s income however for under 8% of its gross revenue. It is a radically completely different technique than the posh manufacturers that comprise about 52% of the corporate’s income and the import manufacturers that make up 18%.

For 2023, the image was wanting even worse. It’s true that the biggest of the corporate’s segments, the Franchised Dealerships section, was experiencing weak spot on the underside line 12 months over 12 months, with section income dropping from $472.2 million to $357.2 million. Nevertheless it was undoubtedly the used car aspect of the corporate, the EchoPark section, that was within the crimson. It went from a section lack of $100.6 million within the first 9 months of 2022 to a lack of $116.5 million the identical time of 2023. Even whereas administration continues to chop prices and focuses on rising gross sales related to the Franchised Dealerships a part of the enterprise, it plans to get to EBITDA breakeven for the troubled EchoPark section by the primary quarter of the 2024 fiscal 12 months. If they will obtain that, then upside potential may very well be slightly significant seeing as how administration views the addressable market alternative as representing about 2 million car gross sales annually.

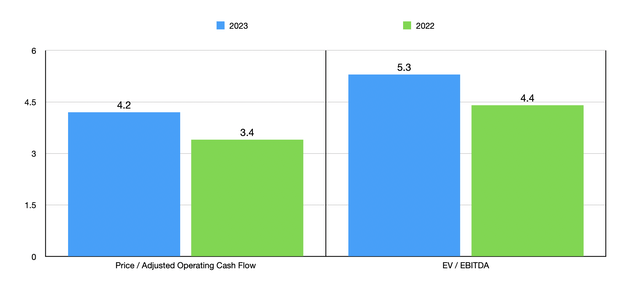

Creator – SEC EDGAR Information

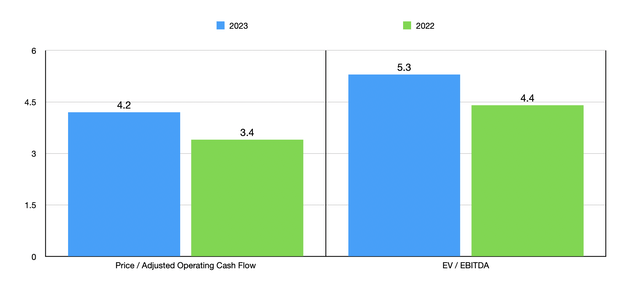

We do not actually know what to anticipate for the ultimate quarter of 2023. But when we annualize the outcomes seen for the primary 9 months of the 12 months, we might count on adjusted working money movement of $435.8 million and EBITDA of $620.2 million. Utilizing these outcomes, I used to be then capable of worth the corporate as proven above. The 2023 knowledge does present that the inventory is dearer than if we had been to make use of the info from 2022. However in each instances, shares look slightly engaging. I then, within the desk beneath, in contrast the corporate to 5 related companies. When it comes right down to the worth to working money movement method, Sonic Automotive ended up being the most cost effective of the group. And when it entails the EV to EBITDA method, it was tied with one different as the most cost effective.

| Firm | Worth / Working Money Stream | EV / EBITDA |

| Sonic Automotive | 4.2 | 5.3 |

| Group 1 Automotive (GPI) | 9.5 | 6.6 |

| Asbury Automotive Group (ABG) | 16.7 | 5.3 |

| Lithia Motors (LAD) | 24.4 | 8.5 |

| AutoNation (AN) | 6.8 | 6.7 |

| Penske Automotive Group (PAG) | 8.0 | 7.7 |

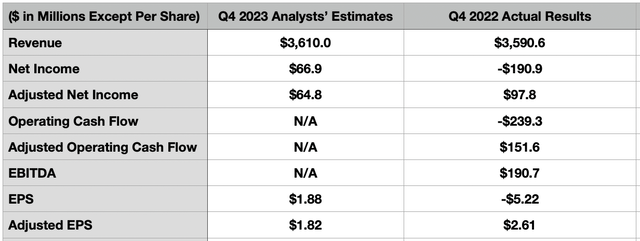

It’s price noting that the image can at all times change. The subsequent alternative for such a change is simply across the nook. Earlier than the market opens on February 14th, the administration workforce on the enterprise is predicted to announce monetary outcomes masking the ultimate quarter of the 2023 fiscal 12 months. Analysts expect income to come back in at $3.61 billion. However that will be solely marginally increased than the $3.59 billion reported one 12 months earlier. Earnings per share are anticipated to be $1.88, translating to income of $66.9 million. That may stack up properly towards the $5.22 loss per share reported one 12 months earlier. On an adjusted foundation, nevertheless, earnings are anticipated to fall from $2.61 per share to $1.82. That may convey adjusted income down from $97.8 million to $64.8 million. Neither administration nor analysts gave forecasts when it got here to different profitability metrics. However within the desk beneath, you possibly can see what a few of these had been for the ultimate quarter of 2022. In all chance, the ultimate quarter of 2023 can have regarded a bit worse.

Takeaway

There isn’t a denying that Sonic Automotive is dealing with some points from a profitability standpoint at the moment. That’s slightly unlucky. Nonetheless, the long-term outlook is nearly actually going to be optimistic. A bigger inhabitants ought to result in extra automotive gross sales over time. Money flows are nonetheless engaging even regardless of the weak spot and the inventory is amongst the most cost effective on the market with regards to this trade. Administration is also making the most of this chance. In the course of the first quarter of 2023, the agency allotted $90.7 million towards shopping for again inventory. They didn’t purchase again any throughout the second quarter however did go on to purchase again $86.8 million price within the third quarter. That also leaves the corporate $286.8 million price of capability underneath its current share buyback program. The truth is, since 2019, the corporate has repurchased round 21% of its excellent models. Though I’m not an enormous fan of buybacks myself, I really like seeing them when shares are this low cost.

All issues thought-about, this knowledge suggests to me that Sonic Automotive must be a superb prospect for worth oriented traders. And due to that, I’ve no downside preserving it rated a ‘purchase’ for now.