Monty Rakusen

There’s been a lot of focus on semiconductors as AI mania has run wild in investors’ minds for the past year and a half. Nvidia (NVDA) has obviously been the biggest beneficiary here, but there are plenty of other companies in the industry worth considering and getting exposure to. If you’re still bullish on semis despite the huge run-up that’s already taken place, then you may want to consider the iShares Semiconductor ETF (NASDAQ:SOXX). This fund lets you invest in the semiconductor industry, which forms the base of modern tech and looks set to grow a lot in the next few years. Benchmarked against the NYSE Semiconductor Index, SOXX has become a go-to fund for access to all things related to the design, manufacture, and distribution of semiconductors.

The question is if it makes sense to buy this fund, or just get access to the largest semiconductor stocks directly instead.

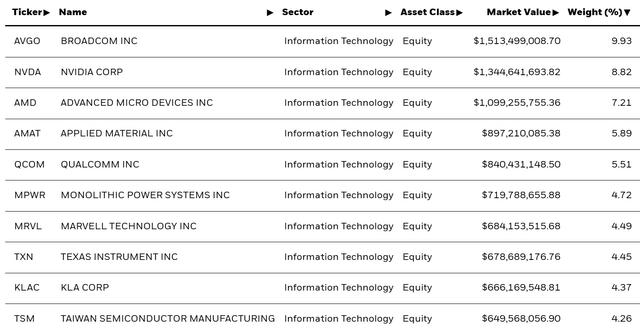

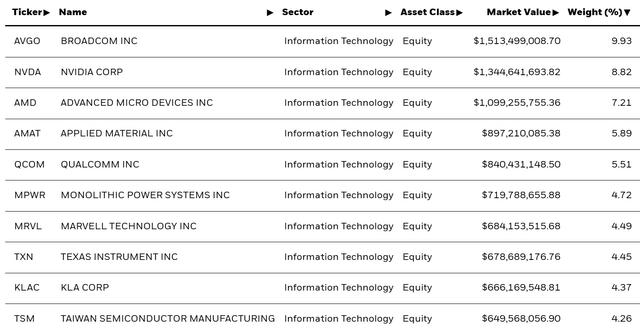

A Look At The Holdings

As one would expect when dealing with an industry-specific fund like this, there’s quite a bit of concentration at the top. Broadcom and Nvidia make up the largest position sizes, accounting for nearly 20% of the portfolio overall. Not a surprise given how huge these companies are, but still a risk.

ishares.com

These holdings show how SOXX focuses on companies that lead their fields and play key roles in the wider semiconductor world. These holdings also clearly explain the momentum seen in the group. The problem with that? Momentum, when it turns, can get ugly, and any kind of disappointment or slowdown in semiconductor demand from the AI side of things could significantly hurt SOXX’s go-forward performance potential. With just 30 names, and a P/E of 33x, it’s clear there’s a lot more risk here than people may realize by looking at a chart alone. And a beta of 1.59 may work great in a bull market, but certainly hurts when in a bear.

Sector Weightings and Global Allocation

SOXX puts all its eggs in one sector basket in the Tech sector, clearly. Within that though, semiconductor companies make up 77% of the fund, with equipment makers making up the remainder. While SOXX invests in U.S. companies, it also includes global giants like Taiwan Semiconductor and ASML, which are vital to the semiconductor supply chain.

Peer Comparison

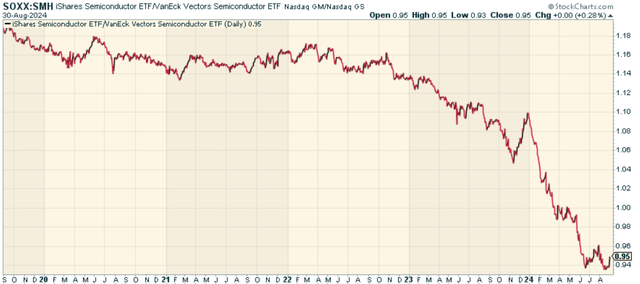

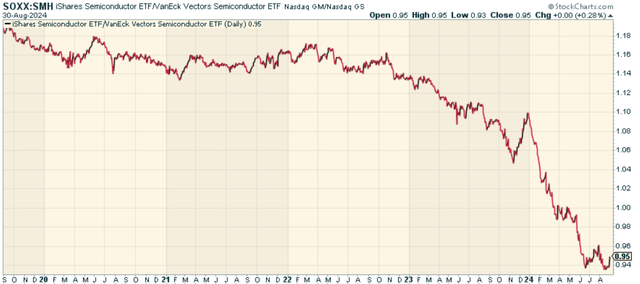

One popular fund worth comparing SOXX to is the VanEck Semiconductor ETF (SMH). SMH actually hew fewer holdings (26 positions) and very high concentration at the top of the portfolio as well. The biggest difference though is in the makeup, with SMH having Nvidia as the largest allocation at 21% of the fund, followed by Taiwan Semi coming in 2nd at 14%. When we look at the price ratio of SOXX to SMH, we find that SOXX has dramatically underperformed. Clearly this is due to the relative weightings at the top, particularly when it comes to Nvidia. I will say that I suspect the ratio has bottomed here, so I’d probably personally prefer SOXX to SMH going forward if I were considering between the two.

stockcharts.com

Pros and Cons

On the plus side, the fund’s exposure to the chip industry puts it in a good spot to gain from long-term growth tailwinds. New tech and more need for chip parts drive these trends. And while concentrated, there’s a good mix of stocks here that cover the semiconductor value chain overall. The momentum is there, and the love affair for semis so far doesn’t seem to be abating as far as narrative goes.

But there are risks to think about. The chip industry goes up and down a lot, and companies in this field see big changes in demand and prices. Also, fights between countries and problems getting supplies can hurt how chip companies do, which can change risk dynamics with the fund. And let’s face it – this isn’t a new story, and certainly isn’t cheap fundamentally. This would be a big source of selling pressure for whenever stocks eventually do have some sustained correction.

Conclusion

To wrap up, the iShares Semiconductor ETF gives investors a way to invest quickly in the semiconductor industry’s growth. Some may prefer choosing individual stocks like Nvidia, but this does have merit given the broad exposure afforded here. SOXX has a good mix of holdings, and focuses on top companies in the field without as much concentration as what you see in SMH. This puts it in a good spot to bring in strong returns in the coming years. While putting money into semiconductors has its risks, the possible payoffs make this fund worth thinking about for investors with an eye on the future.

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a limited time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.