cemagraphics

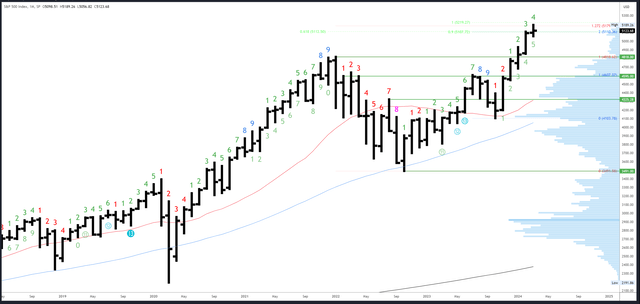

The S&P 500 (SPY) labored its strategy to one other new all-time excessive of 5189 this week, simply above the Fibonacci goal of 5179 outlined in my last article. To be trustworthy, I practically shut down my screens early on Friday because it surged increased – in any case, 16 out of the final 18 weekly closes have been increased and Fridays have been significantly sturdy. However then one thing totally different occurred – a reversal of 66 factors, which took the S&P500 right into a decrease weekly shut. Maybe extra importantly, the “Magnificent 7” misplaced its common, Nvidia (NVDA).

Friday’s reversal may very well be vital given the weekly exhaustion sign, or it might simply be a short drop like different corrections since late January (two of the final three corrections lasted just one session). This weekend’s article will take a look at the best way to inform these two situations aside. Numerous methods might be utilized to a number of timeframes in a top-down course of which additionally considers the main market drivers. The goal is to supply an actionable information with directional bias, necessary ranges, and expectations for future value motion.

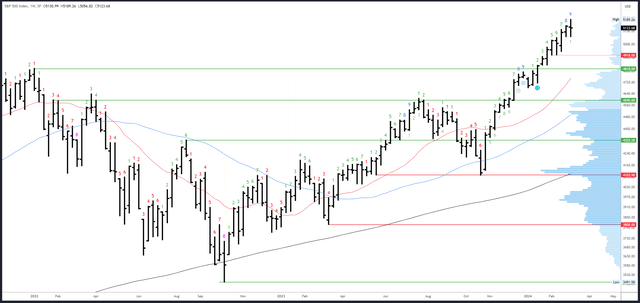

S&P 500 Month-to-month

The March bar has now tagged the 5179 stage, which is the 127% Fibonacci extension of the 2021-2022 drop. Now that new highs have been made this month, a bearish bar can type fairly simply with a drop again into the February vary under 5111. Nevertheless, it might want to shut under this stage and ideally a lot decrease to cement the reversal sample.

SPX Month-to-month (Tradingview)

Above the 5179 Fibonacci extension, there’s a measured transfer at 5219 the place the present rally from the October ’23 low might be equal to the October ’22 – July ’23 rally.

The 5096-5111 is the primary space of assist and will set the bullish/bearish tone for the remainder of March. 4818 is the primary main stage on the earlier all-time excessive.

There might be a protracted look ahead to the following month-to-month Demark sign. March is bar 4 (of a potential 9) in a brand new upside exhaustion depend.

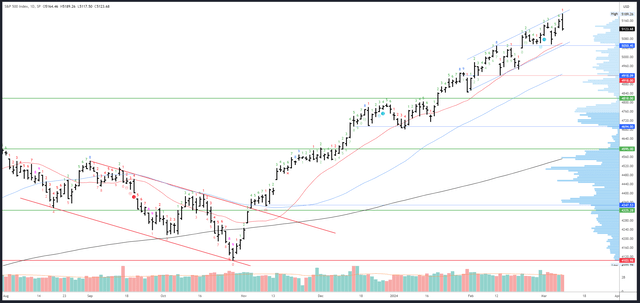

S&P 500 Weekly

Not solely did this week’s bar make a decrease shut, nevertheless it additionally made a short decrease low. Each have been marginal, however this was the primary weekly bar with a decrease low and decrease shut for the reason that first week of the 12 months. This alerts a change in character, however not an excessively bearish one, but. Certainly, the weekly sample shaped a “doji,” which is a sign of indecision. This may develop right into a reversal ought to the following bars maintain making decrease highs after which shut under the low of 5056.

The 5189 excessive is the one actual resistance.

5048-5056 is a key assist space. Beneath there, we might see 4918-20 fairly rapidly.

An upside Demark exhaustion depend accomplished on bar 9 (of 9) this week. This often results in a pause / dip of a number of bars (weeks).

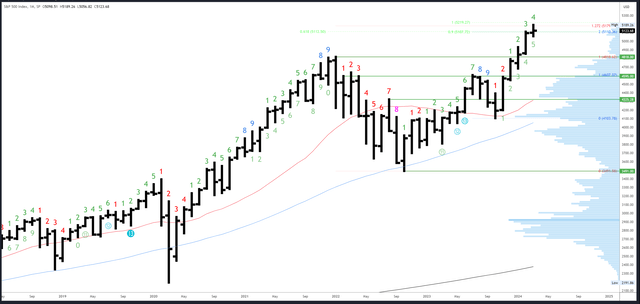

S&P 500 Day by day

Friday’s reversal got here from the highest of the each day channel in addition to the Fib extension. An “engulfing” bar shaped, which is a dependable reversal sample. Moreover, the shut close to the low of the each day vary tasks continuation early subsequent week.

The channel excessive is potential resistance and might be round 5200 on Monday.

Minor assist is 5105-111. Channel assist may be very close to the 20dma round 5060 (and rising).

No each day Demark exhaustion sign can full subsequent week.

Drivers/Occasions

Fed Chair Powell’s testimony should have been music to the bulls ears as he said the Fed expects the “Goldilocks” situation to play out.

“We expect inflation to come down, the economy to keep growing…If that’s the case, it will be appropriate for interest rates to come down significantly over the coming years,” he stated.

Powell’s dovish testimony gave the inexperienced gentle to sturdy knowledge and one other sizzling Jobs Report would have been one other constructive for the S&P500. Nevertheless, the indicators of cooling, revisions and weak spot within the Family Survey have been a destructive.

Subsequent week’s focus might be on CPI on Tuesday, which is anticipated to rise to 0.4% m/m. Inflation readings must be pretty simple when it comes to market response – excellent news (decrease inflation) must be good for the S&P500 and vice versa.

There are two bond auctions due subsequent week on Tuesday and Wednesday. Thursday is busy, with PPI, Retail Gross sales and Unemployment Claims.

Possible Strikes Subsequent Week(s)

Friday’s bearish bar tasks some observe by to the draw back early subsequent week. The 5105-5111 space is minor assist and will result in a bounce, however so long as decrease highs are made with 5189 to protect the weekly “doji” reversal sample, then we should always see a check of the extra necessary each day channel/20dma and the essential 5048-5056 space.

Given this space has marked the low within the final two weeks, there’s a good probability it breaks on the following check and this could result in 4918-4920 within the coming weeks. Nevertheless, I think value might spend a while across the 5000 space to create a balanced (quantity) profile mid-way between the 4818 break-out and the 5189 excessive.