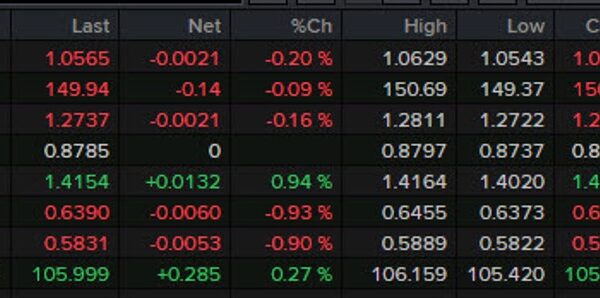

U.S. shares rose on Wednesday to get better a lot of their sharp losses from a day earlier than, triggered by worries that prime rates of interest might stick round for months longer than hoped.

The S&P 500 climbed 47.45 factors, or 1%, to five,000.62 and clawed again greater than two-thirds of its loss from Tuesday. A hotter-than-expected report on inflation compelled buyers to delay forecasts for when the Federal Reserve might start slicing rates of interest, doubtlessly into the summer time. Expectations for such cuts are a giant motive shares rallied to data just lately.

The Dow Jones Industrial Common gained 151.52 factors, or 0.4%, to 38,424.27 a day after after dropping 524 factors for its worst loss in almost 11 months. The Nasdaq composite jumped 203.55, or 1.3%, to fifteen,859.15.

The smallest shares, which took the toughest hit from worries about larger rates of interest on Tuesday, bounced again greater than the remainder of the market. The Russell 2000 index leaped 2.4%.

Serving to to maintain issues steadier on Wall Road was a calmer bond market. Treasury yields eased after taking pictures upward a day earlier on expectations the Fed would preserve charges excessive for longer. The central financial institution has already jacked its principal rate of interest to the best degree since 2001 in hopes of slowing the general economic system simply sufficient to grind excessive inflation all the way down to its goal.

The yield on the 10-year Treasury fell to 4.25% from 4.32% late Tuesday. It’s nonetheless nicely above its 3.85% degree in the beginning of this month.

Critics have been arguing that inventory costs might have run too far, too quick of their rally since October. A pullback could possibly be wholesome if it take among the “froth” out of the market, in accordance with JJ Kinahan, CEO of IG North America.

Kinahan mentioned he discovered it fascinating that large current winners like Nvidia and different chipmakers completed Tuesday nicely off their lows for the day. That makes him assume the day’s drop “was more about taking some profits than it was panic selling” by buyers.

Nvidia, which has been driving a mania round artificial-intelligence expertise, rose 2.5% Wednesday and was the one strongest power pushing up the S&P 500 index.

DaVita jumped 8.6% for one of many S&P 500’s bigger beneficial properties after the well being care firm reported stronger revenue and income for the most recent quarter than analysts anticipated.

Most firms within the S&P 500 have been topping analysts’ forecasts for the final three months of 2023. Hopes for stronger development in 2024 from a stable economic system have been another excuse the S&P 500 has set 10 data already this yr.

Lyft shares leaped 35.1% after a wild trip in off-hours buying and selling pushed partially by a typo in its newest earnings report. The ride-hailing firm reported stronger outcomes than analysts anticipated, however its press launch additionally mentioned it expects a key measure of profitability to enhance by 500 foundation factors, or 5 proportion factors. Later, it mentioned that ought to have been 50 foundation factors, or 0.5 proportion factors.

Lyft’s inventory rocketed by greater than 60% in after-hours buying and selling Tuesday following the typo.

Rival Uber Applied sciences rose 14.7% after its board licensed a program to purchase again as much as $7 billion of its inventory. Traders have a tendency to love such applications as a result of they ship money on to shareholders and might increase per-share income.

Robinhood Markets gained 13% after it reported a revenue for the most recent quarter, when analysts had been anticipating a loss. The inventory and crypto buying and selling platform additionally mentioned its complete internet income rose 24%, greater than analysts anticipated.

On the dropping finish, Akamai Technologies dropped 8.2% after it reported combined outcomes. Its revenue for the most recent quarter topped analysts’ forecasts, however its income fell quick.

On-line trip rental booker Airbnb slipped 1.7% after it reported losing $349 million within the fourth quarter on account of an revenue tax settlement with Italy. Analysts had been anticipating a revenue.

The corporate forecast first-quarter income that will meet or beat Wall Road expectations, nevertheless, Airbnb mentioned the tempo of bookings development is more likely to “moderate” from the fourth quarter into the primary.

In inventory markets overseas, London’s FTSE 100 rose 0.7% following a better-than-expected report on inflation in the UK.

Hong Kong’s Hold Seng index gained 0.8% after buying and selling reopened there, however markets remained closed in mainland China for the Lunar New Yr vacation. Shares fell elsewhere in Asia, with Japan’s Nikkei 225 down 0.7% and South Korea’s Kospi down 1.1%.

___

AP Enterprise Writers Yuri Kageyama and Matt Ott contributed.