honglouwawa

Earnings season kicks off this week, and we preview the S&P 500 2024 Q2 earnings season in granular detail, providing both aggregate and company-level insights using data from I/B/E/S, StarMine, and Datastream, which are all found in the desktop solution LSEG Workspace.

Earnings Commentary

Q2 aggregate earnings are forecasted to reach a new all-time high, with a current estimate of $492.8 billion (+10.1% y/y, +4.4% q/q). Growth expectations have only declined moderately by 40 basis points (BPS) heading into earnings season, much less than the typical 300 bps downward revision we usually find. Energy saw the largest downgrade of 450 bps, followed by Materials (310 bps), while Information Technology has seen the largest upgrade (150 bps).

The Magnificent-7 are once again expected to play a significant role, boasting an aggregate earnings growth rate of 29.8%. Excluding the Mag-7, the S&P 500 (SPX) Q2 earnings growth declines to 6.6%. The Mag-7 have an aggregate revenue growth rate of 13.4%, compared to 4.1% for the overall index.

From a guidance perspective, we have seen 70 negative Q2 EPS pre-announcements compared to 35 positives, resulting in a negative/positive ratio (n/p) of 2.0. This is below the long-term average of 2.5 and just below the prior four-quarter average of 2.1.

Net profit margins have remained stable heading into earnings season, with a Q2 estimate of 11.6%. The 2024 and 2025 full-year estimates are currently 11.7% and 12.6%, respectively, while the forward four-quarter estimate is 12.1%.

The S&P 500 forward 12-month P/E ratio (time-weighted basis) shows a current reading of 21.6x, ranking in the 91st percentile (since 1985) and representing a 19.3% premium to its 10-year average of 18.1x.

Part 1 – Earnings Growth and Contribution

Using data from the July 5th publication of the S&P 500 Earnings Scorecard, Q2 blended earnings (combining estimates and actuals) are forecasted at $492.8 billion (+10.1% y/y, +4.4% q/q) while revenue is forecasted at $3,874.6 billion (+4.1% y/y, +2.1% q/q).

Ex-energy, earnings growth is forecasted at 10.0%, marking the fifth consecutive quarter of positive growth. Ex-energy, revenue growth is forecasted at 3.9%.

At a sector level, Industrials is expected to snap its streak of positive y/y earnings growth at thirteen consecutive quarters, the longest of any sector. Consumer Discretionary, Consumer Staples, and Financials are all expected to see a sixth consecutive quarter of growth. Materials is expected to post an eighth consecutive quarter of earnings decline. Finally, Health Care is expected to end its streak of six quarters of negative y/y earnings growth.

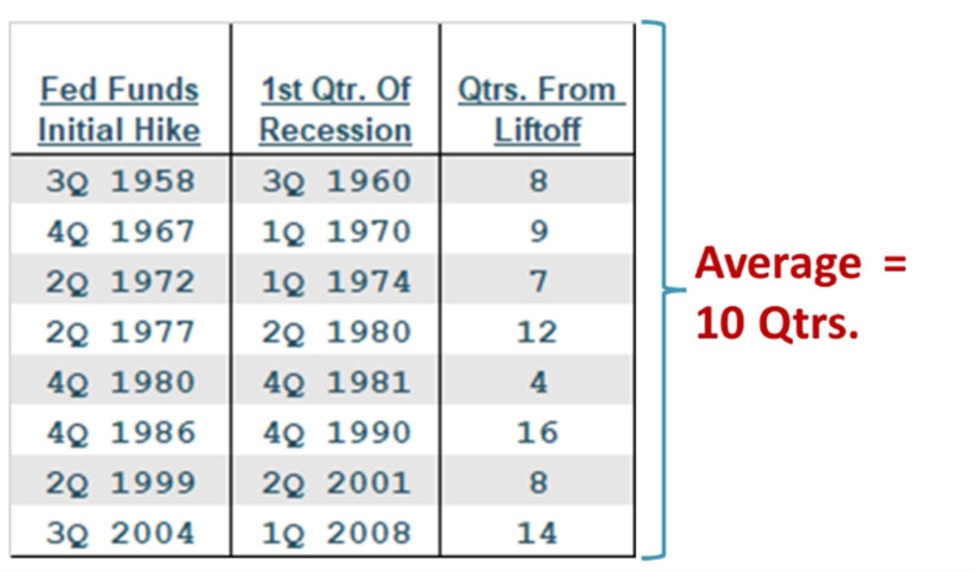

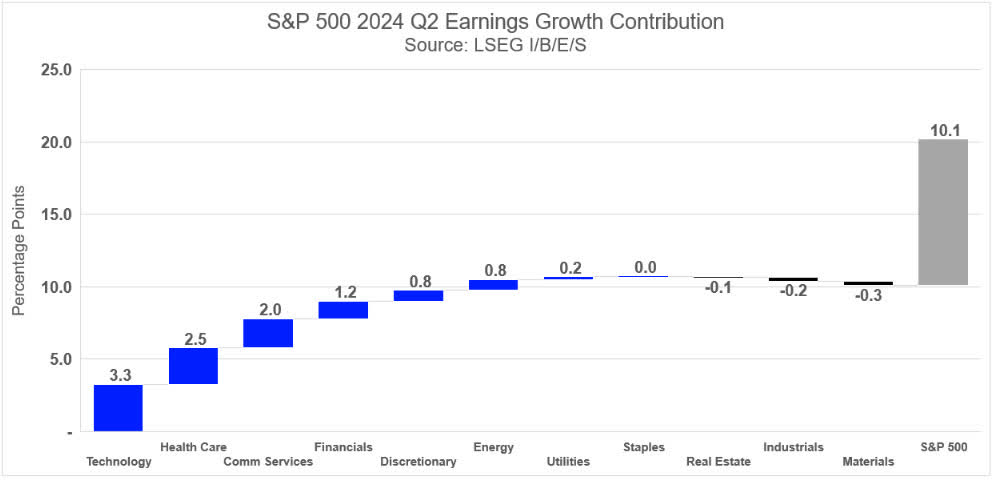

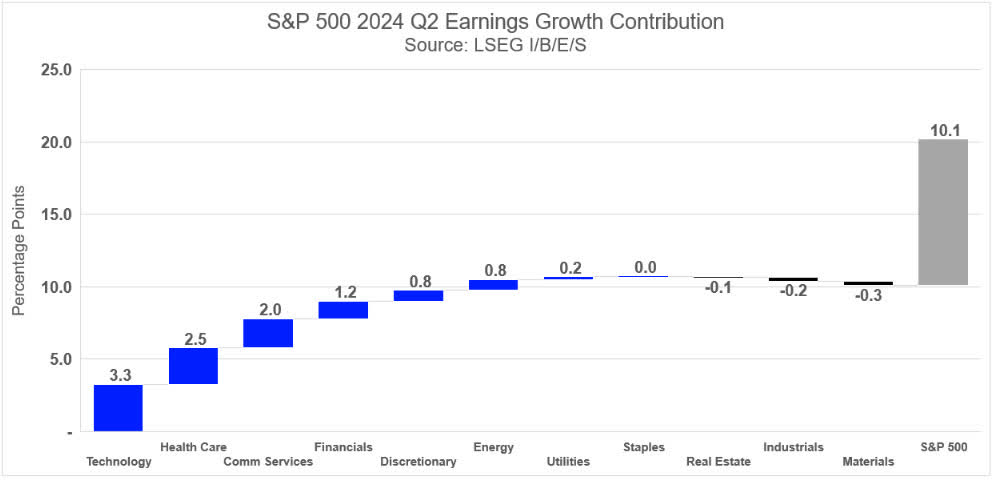

Exhibit 1 highlights earnings growth contribution, showing eight sectors with positive earnings contribution and three sectors with negative earnings contribution.

Information Technology has the largest growth contribution of any sector, forecasted to contribute 3.3 percentage points (PPT) towards the index growth rate of 10.1%. Health Care (2.5 ppt) and Communication Services (2.0 ppt) are the next largest contributors, while Materials (-0.3 ppt), Industrials (-0.2 ppt), and Real Estate (-0.1 ppt) are the largest detractors to earnings growth this quarter.

Exhibit 1: S&P 500 2024 Q2 Earnings Growth Contribution

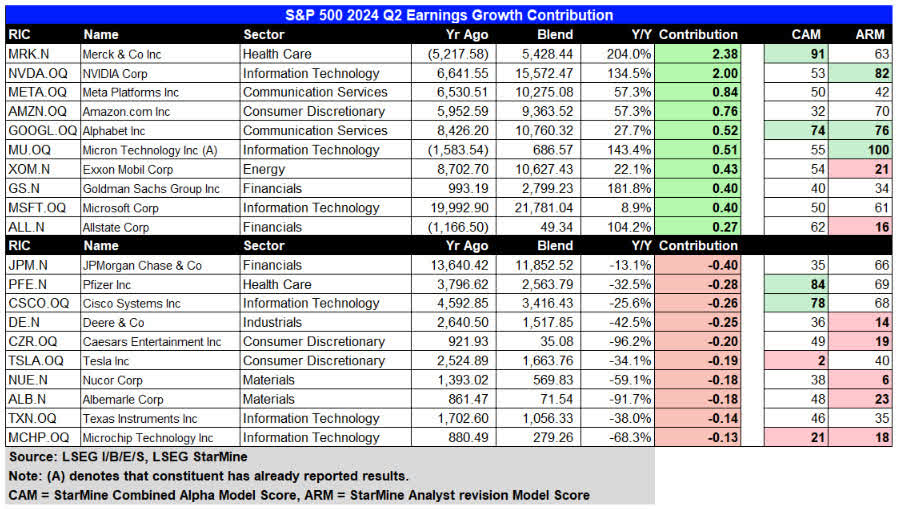

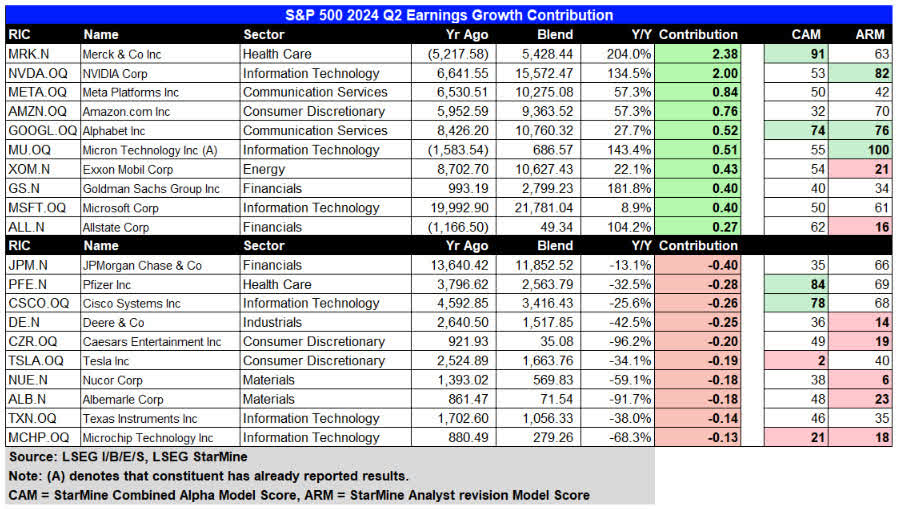

We also examine earnings growth contribution at the constituent level in Exhibit 1.1, highlighting the top 10 and bottom 10 contributors. Merck & Co is expected to deliver the lion share of earnings growth for Health Care, influenced by an easier year-over-year comparison. Nvidia (NVDA, NVDA:CA), Micron (MU), and Microsoft (MSFT, MSFT) lead the way for Information Technology, while Amazon (AMZN, AMZN:CA) stands out in Consumer Discretionary, and Meta (META, META:CA) and Alphabet in Communication Services. In other words, the “Magnificent Seven” will once again be a key group to watch this quarter, with five of the seven appearing in the top 10.

The last two columns in Exhibit 1.1 highlight the StarMine Combined Alpha Model (CAM) and StarMine Analyst Revision Model (ARM) scores for each constituent. StarMine model scores are ranked from 1-100 (percentile) with scores above 70 indicating a bullish signal while scores below 30 indicate a bearish signal.

Both Merck & Co (MRK) and Pfizer (PFE, PFE:CA) have the highest CAM scores in the group, while Tesla (TSLA, TSLA:CA) and Microchip Technology have the lowest CAM scores. CAM combines all available StarMine alpha models in an optimal, static, linear combination.

Micron, Nvidia, and Alphabet have the highest ARM scores, while Nucor (NUE), Deere (DE), and Microchip Technology (MCHP) have the lowest ARM scores. Over the last 30 days, Allstate (ALL), Goldman Sachs (GS), and Exxon Mobil (XOM) have seen the largest declines in the ARM scores. ARM is a stock ranking model that is designed to predict future changes in analyst sentiment by looking at changes in estimates across EPS, EBITDA, Revenue, and Recommendations over multiple time periods.

Exhibit 1.1: S&P 500 2024 Q2 Earnings Growth Contribution

Part 2 – Market Cap vs. Earnings Weights

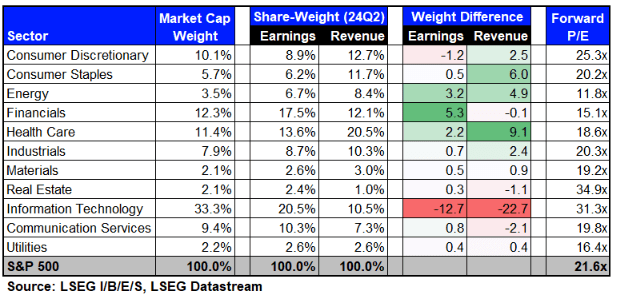

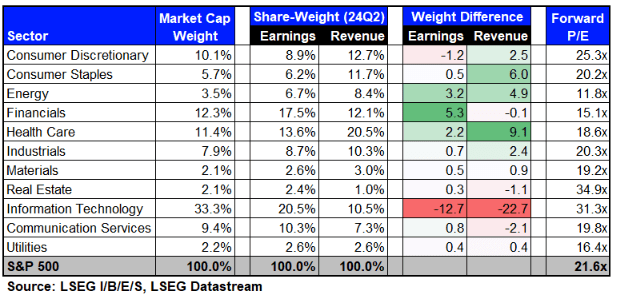

Exhibit 2 compares the difference between ‘market-cap’ and ‘share-weighted’ weights for the S&P 500 sectors. The S&P 500 Earnings Scorecard utilizes a share-weighted methodology.

Information Technology has the largest earnings weight this quarter at 20.5%, which is about 12.7 percentage points lower than its market-cap weight of 33.3%. This results in the largest negative weight differential of all sectors, highlighting the premium on the sector, which has a forward P/E of 31.3x (45.0% premium vs. S&P 500).

Financials has the second-largest positive earnings weight differential at 5.3% with a forward P/E of 15.1x.

While Energy’s positive weight differential has declined compared to prior quarters, the sector continues to overdeliver on earnings relative to its market cap weight (which has doubled since September 2021) and trades at the cheapest valuation of any sector at 11.8x.

The Magnificent Seven group – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla has a market cap weight of 33.4% compared to earnings and revenue weights of 18.0% and 10.2%, respectively. The Mag-7 has an aggregate forward four-quarter P/E of 33.0x, a 53% premium to the overall index. When excluding the Mag-7, the forward P/E declines to 18.0x.

Exhibit 2: Market Cap vs. Share-Weight for S&P 500 Sectors

Part 3 – Analyst Sentiment and Revisions Heading into Earnings Season

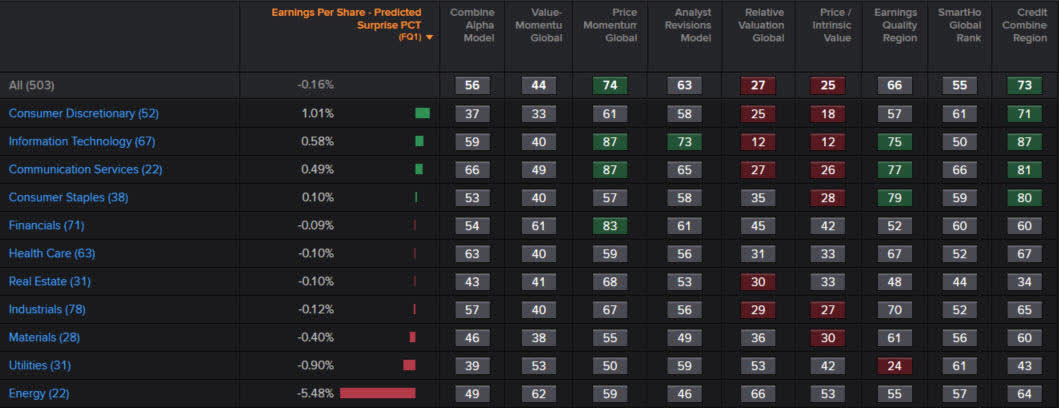

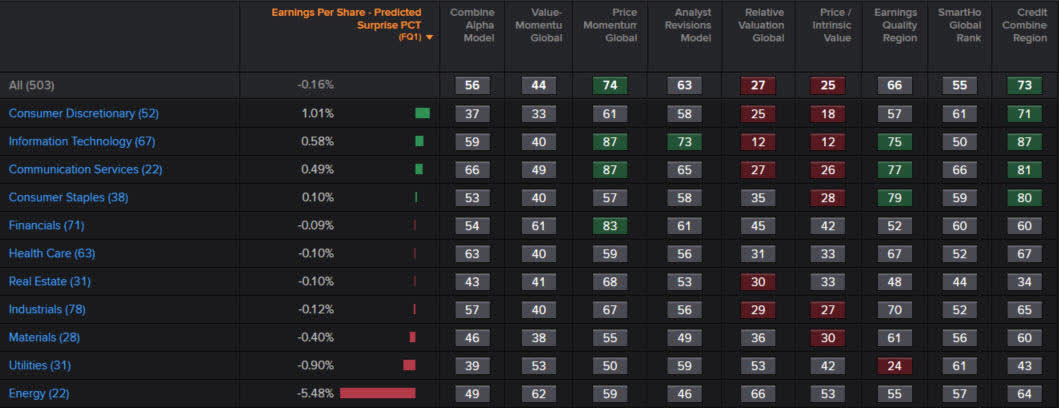

Using the Aggregates app in LSEG Workspace, we can aggregate individual company data to a sector level and overlay various StarMine quantitative analytics, providing an insightful top-down view as shown in Exhibit 3.

The first column displays the StarMine Predicted Surprise (PS%), which compares the SmartEstimate© vs. Mean Estimate. The PS% is a powerful quantitative analytic that accurately predicts the direction of earnings surprise 70% of the time when the PS% is greater than 2% or less than -2%. The SmartEstimate© places a higher weight on analysts who are more accurate and timelier, thus providing a refined view of consensus. The SmartEstimate© is also used as an input to many of the StarMine models.

Energy has an aggregate PS% of -5.48% which highlights that most companies in this sector are expected to miss earnings vs. analyst expectations. Specifically, 12 of the 22 constituents have a PS% less than zero, while only two have a PS% above 2%.

In terms of Analyst Sentiment, Information Technology has the highest ARM score of 73, driven by high expectations around artificial intelligence. Apple, Nvidia, Broadcom, and Qualcomm all have ARM scores above 80. This sector has seen many high-flyers, making it ‘expensive’ according to the Relative Valuation and Intrinsic Valuation models. As prices increase (as indicated by the Price Momentum model), valuation becomes stretched, shown by a Price Momentum score of 87 and a Valuation score of 12.

Earnings Quality (EQ) measures the reliability and sustainability of the sources of a company’s earnings sources. Information Technology has the highest score of 87, attributed to the strong earnings and cash flow profiles of mega cap tech companies generating significant free cash flow.

The Combined Credit Model (CCR) projects the 12-month forward-looking probability of default (or bankruptcy) based on equity market data, analyst estimates, company financials, news, and announcements. Information Technology again has the highest score of 87 (indicating a low risk of default), followed by Communication Services, Consumer Staples, and Consumer Discretionary.

Exhibit 3: Aggregates App – StarMine Analytics for S&P 500 Sectors

Source: LSEG Workspace

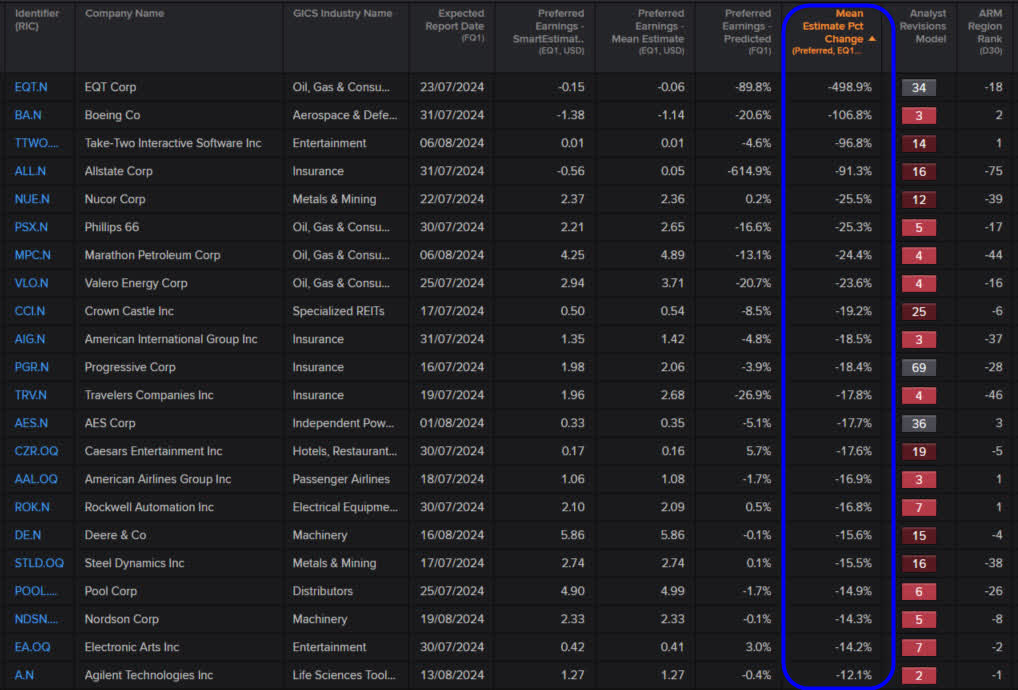

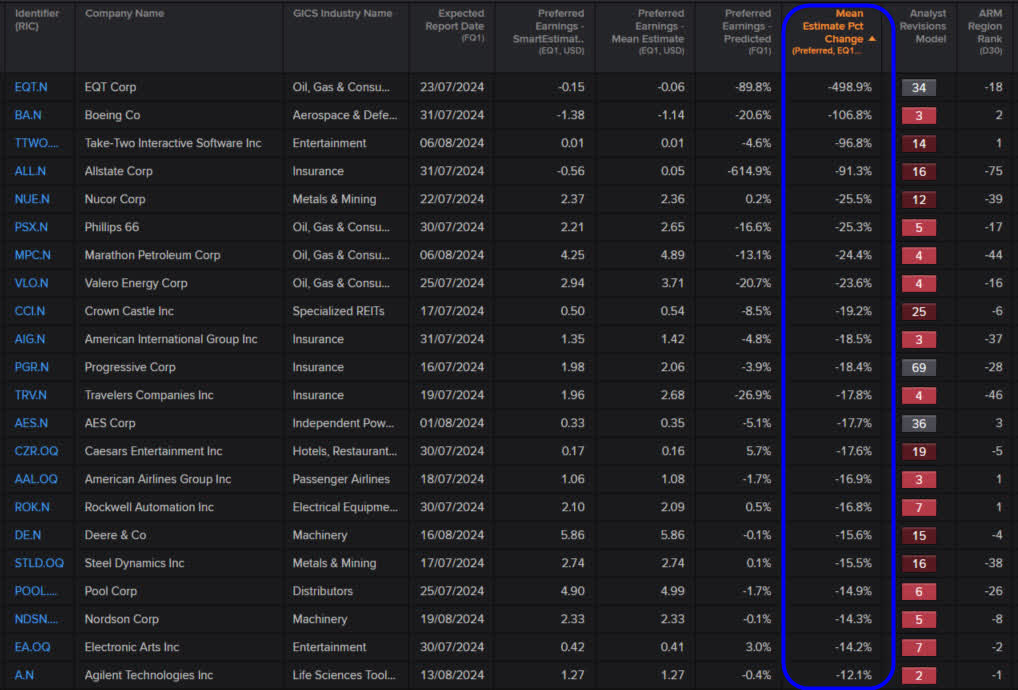

Next, we use the Screener app in LSEG Workspace to identify yet-to-report constituents that have experienced the largest upgrades and downgrades heading into earnings season. Exhibit 4 highlights companies that have seen earnings downgrades, defined by the 60-day mean estimate change in ‘EQ1 Preferred Earnings’.

Preferred Earnings is defined as EPS for most companies except for Real Estate where it can be either EPS or FFOPS depending on analyst coverage.

EQT has seen the largest downgrade in EPS estimates over the last 60 days (-498.9%) followed by Boeing (-106.8%), Take-Two Interactive Software (-96.8%), Allstate (-91.3%), and Nucor (-25.5%). Note: values less than -100% occur when an EPS estimate turns from positive to negative.

Exhibit 4: Largest Negative Revisions for 2024 Q2

Source: LSEG Workspace

We observe a positive correlation between constituents that have seen a large downgrade and a corresponding negative PS%. Additionally, there is a positive correlation between the mean estimate change and the ARM score, indicating that companies with significant downward earnings revision also tend to have low ARM scores.

Examining the PS% and ARM columns can be very useful during earnings season to assess the likelihood of companies beating or missing earnings, while also gauging analyst sentiment.

The screener app provides a powerful workflow tool for Analysts and Portfolio Managers, enabling them to parse through hundreds of companies during earnings season to identify thematic trends.

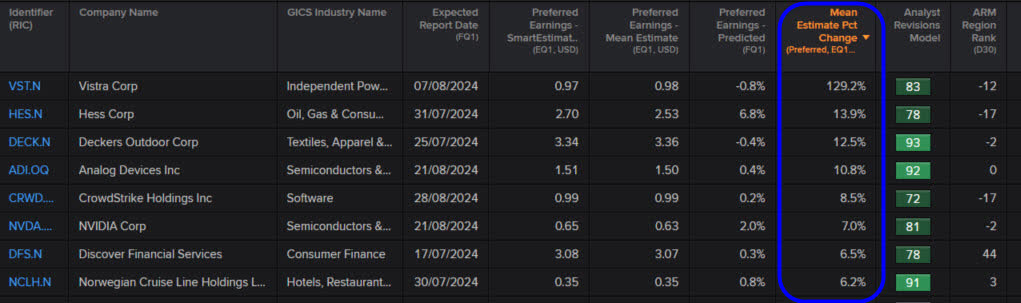

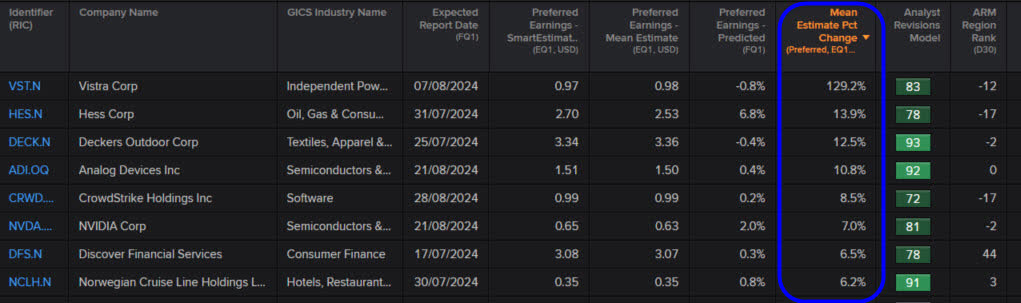

Exhibit 4.1 displays the same data for constituents with the largest upgrades heading into earnings season.

Exhibit 4.1: Largest Positive Revisions for 2024 Q2

Source: LSEG Workspace

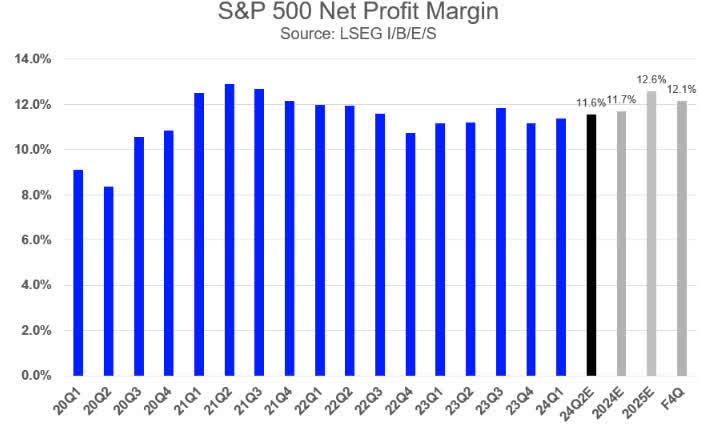

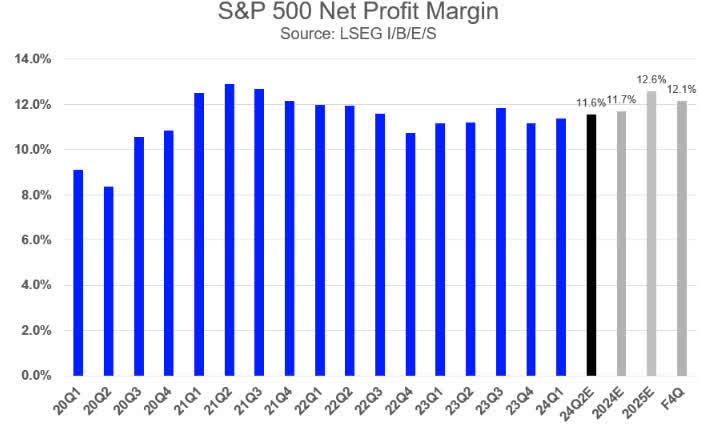

Part 4 – Net Profit Margin Expectations

Using data from the S&P 500 Earnings Scorecard, we examine quarterly net profit margins (Exhibit 5).

The Q2 blended net profit margin estimate has remained stable at 11.6% over the last three months and may mark the third consecutive quarter of rising net margins.

Over the past three months, seven sectors have seen net margin estimate decline, while four have seen increases. Energy experienced the largest decline in margin expectations (-100 bps, current value: 9.7%), followed by Materials (-37 bps, 10.7%), and Industrials (-32 bps, 10.2%). Communication Services saw the largest improvement in margin expectations (35 bps, 12.5%).

The 2024 and 2025 full-year estimates are currently 11.7% and 12.6%, respectively, while the forward four-quarter estimate is 12.1%.

The Magnificent Seven has an aggregate Q2 net margin estimate of 22.4%.

Exhibit 5: S&P 500 Net Margin Expectations

Part 5 – Forward P/E & PEG Ratio

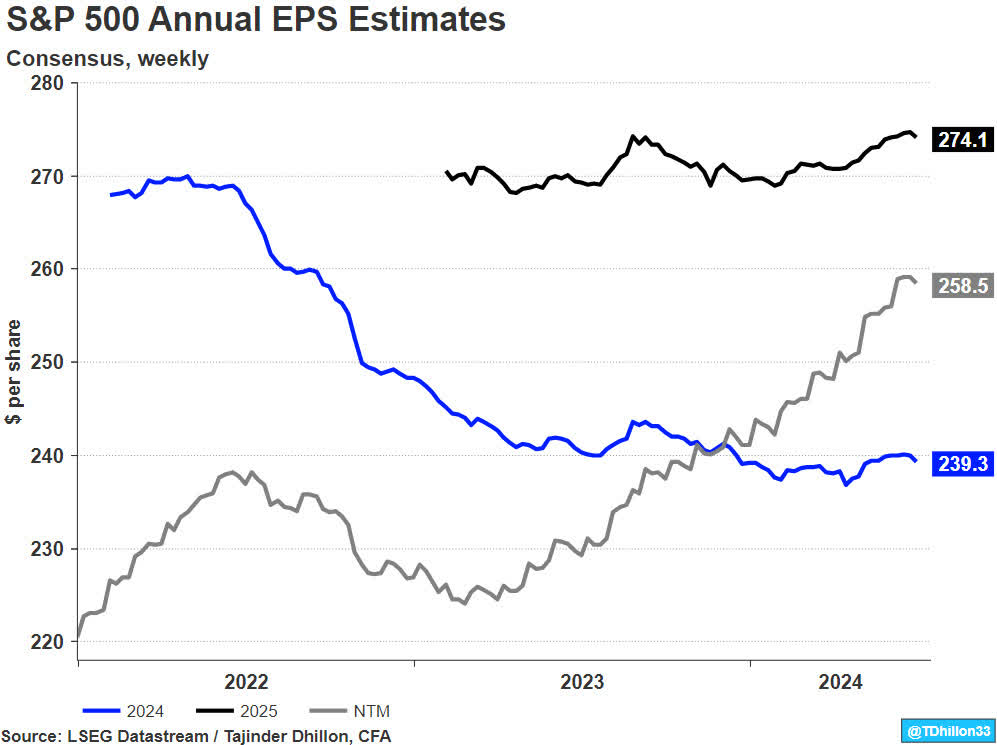

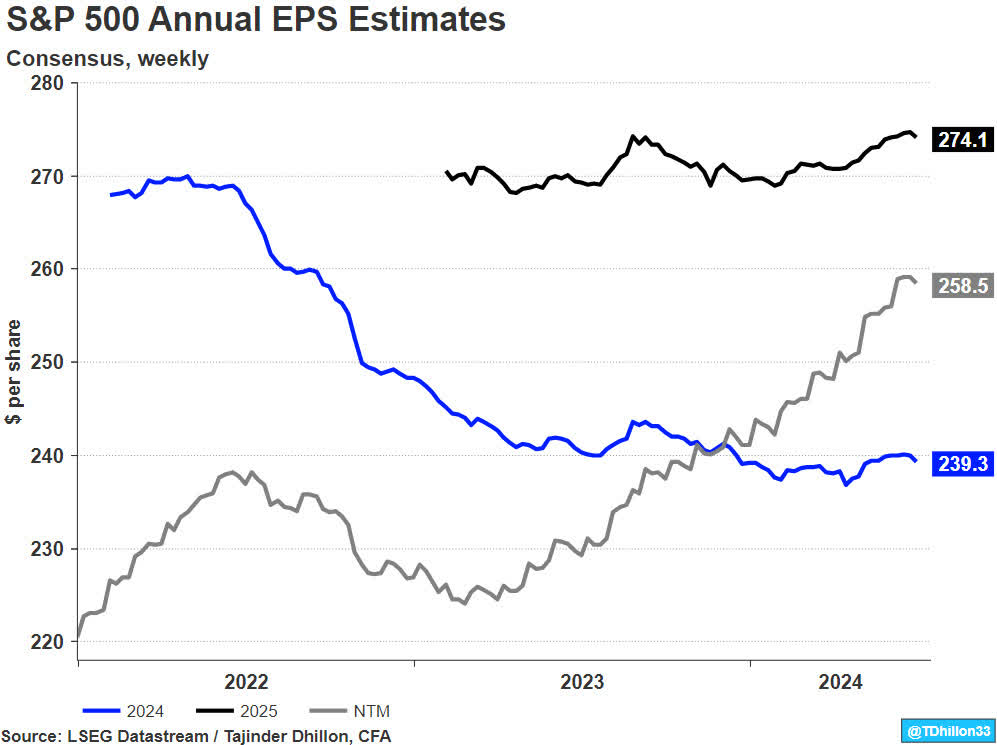

Using LSEG Datastream, the forward 12-month (F12) EPS is $258.50 per share (Exhibit 6), positioning it at the mid-point of the 2024 and 2025 estimates as we reach the hallway point of the calendar year.

Over the past year, the 2024 EPS estimate has declined by 0.3%, while the 2025 estimate has risen by 1.9%. In comparison, the S&P 500 has risen by approximately 27% over the same period, leading to an expansion in the forward P/E multiple.

The S&P 500 forward 12-month P/E ratio (time-weighted basis) is currently 21.6x, ranking in the 91st percentile since 1985 and representing a 19.3% premium to its 10-year average of 18.1x. For reference, the trough forward P/E during the last four recessions were as follows: 10.1x (Oct 1990), 17.3x (Sept 2001), 8.9x (Nov 2008), and 13.0x (March 2020).

Additionally, the S&P 500 ‘PEG’ ratio is currently 1.26x, ranking in the 53rd percentile since 1985 and at a 10.0% discount to its 10-year average of 1.40x.

Exhibit 6: S&P 500 EPS Estimates

Conclusion

Q2 estimates have been stable heading into earnings season, potentially setting a lower bar for corporations to beat analyst expectations and surprise to the upside.

We continue to monitor top-line strength to see if Q2 can show any improvement to analyst expectations. Although earnings season has just started, only 47.4% of constituents that have reported thus far have beaten revenue expectations set by analysts.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.