Final

Friday, the S&P 500 pulled again as a scorching US PPI report

weighed in the marketplace. The truth is, the Treasury yields rose, and the speed cuts

expectations bought trimmed some extra as fears of stickier inflation began to

creeping in. The Fed members although carry on dismissing the newest figures as

one thing anticipated and proceed to repeat that the disinflationary pattern

stays intact. This implies that the Fed will not be even contemplating fee hikes

and within the worst-case state of affairs might simply delay fee cuts. The market may

proceed to love this so long as the financial knowledge stays good. In the present day the

market can be closed for the Presidents Day and can resume buying and selling tomorrow.

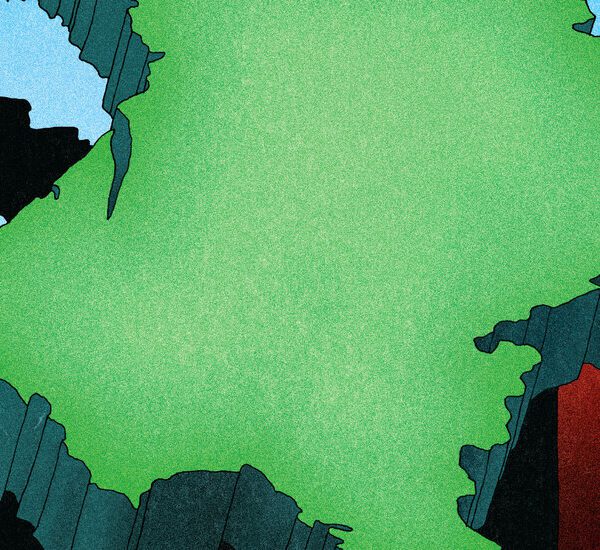

S&P 500 Technical

Evaluation – Each day Timeframe

S&P 500 Each day

On the every day chart, we are able to see that the S&P 500

final Friday fell into the shut following a scorching US PPI report. The market

just lately bounced on the trendline because the

patrons proceed to pile in at each pullback to place for brand spanking new all-time

highs. The sellers ought to look forward to the worth to interrupt beneath the trendline and

the purple 21 moving average earlier than

even contemplating shorting this market.

S&P 500 Technical

Evaluation – 4 hour Timeframe

S&P 500 4 hour

On the 4

hour chart, we

can see that we had additionally the 61.8% Fibonacci

retracement stage including additional confluence round

the trendline. There’s not a lot to glean from this timeframe so we have to zoom

in to get some extra particulars.

S&P 500 Technical

Evaluation – 1 hour Timeframe

S&P 500 1 hour

On the 1 hour chart, we are able to see that we

have a support zone

across the 4995 stage the place we are able to discover the confluence with the purple 21 shifting

common and the 38.2% Fibonacci retracement stage. That is the place the patrons

will doubtless pile in once more with an outlined threat beneath the trendline to place

for a brand new all-time excessive. The sellers, then again, will need to see the

worth breaking beneath the trendline to place for a drop into the 4923 stage

and in case of a break decrease, goal the 4846 stage subsequent.

Upcoming Occasions

This week is principally empty on the information entrance with simply

the discharge of the FOMC Assembly Minutes on Wednesday adopted by the US Jobless

Claims and the US PMIs on Thursday.