DNY59

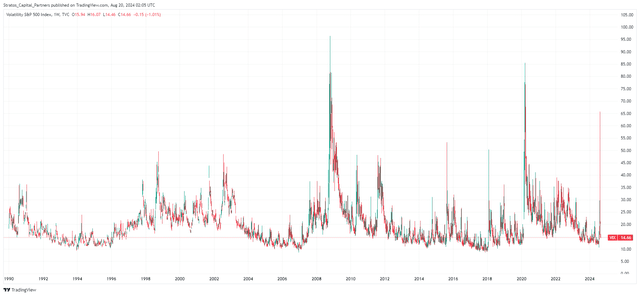

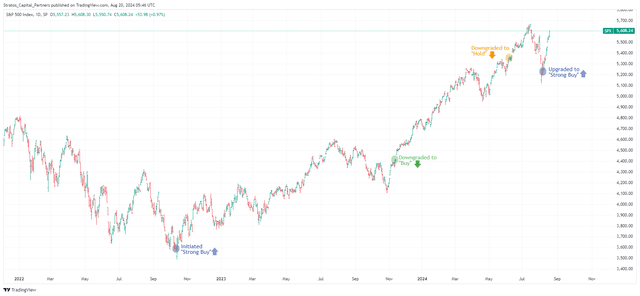

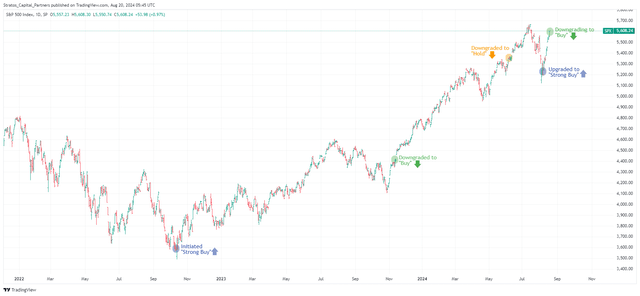

U.S. equities have rebounded forcefully after witnessing some abnormal volatility earlier this month. The dramatic selloff in the S&P 500 Index (SPX), which unfolded alongside the unwinding of the Japanese Yen carry trade, was also accompanied by a massive spike in the CBOE Volatility Index (VIX) to 65 points on August 5 (the third-highest spike on record since 1990).

When the market descended into panic, we advised our readers to stick to good investing principles and fight the urge to overreact to fear. We also reassessed the macroeconomic landscape and market psychology behind the selloff and concluded that it was mainly driven by fear and margin calls rather than legitimate concerns over the health of the U.S. economy.

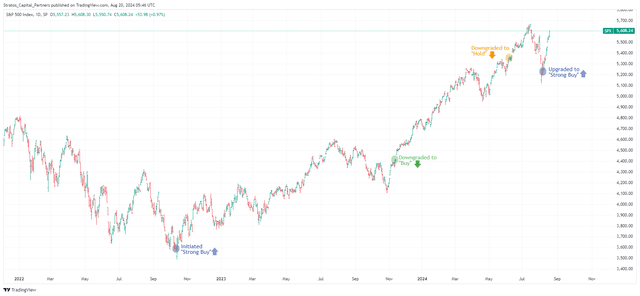

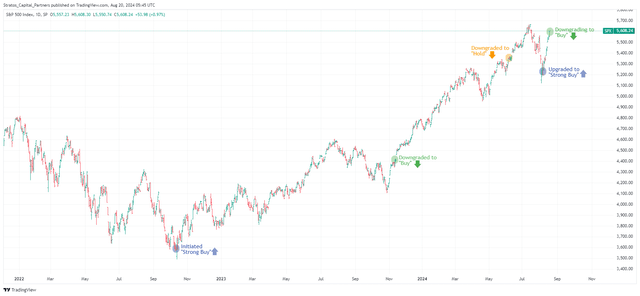

Our decision to capitalize on the panic and upgrade our SPX rating from “Hold” to a “Strong Buy” has paid off. The SPX has gained 6.2% since that article was published on August 6, a pretty decent return in just two weeks.

TradingView, Stratos Capital Partners

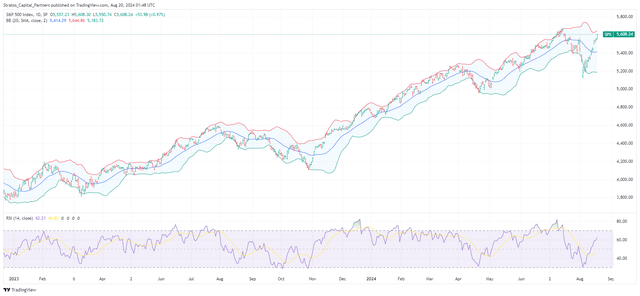

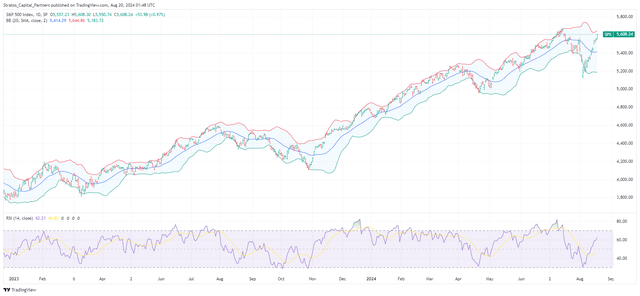

Markets Are Near Overbought

Admittedly, we were somewhat surprised at how quickly the SPX has rebounded and more than recovered from losses accumulated during the selloff. With the SPX back near all-time highs, we seem to be back to square one, with valuations on large-cap equities being stretched and most of the upside potential on the SPX being fully priced in.

From a technical analysis point of view, the Relative Strength Index (RSI) and Bollinger Bands show that the SPX is not yet overbought at current levels. However, given the strong run-up over the past two weeks, both indicators are getting close to flashing a sell signal.

TradingView, Stratos Capital Partners

Not Too Late To Invest, But Avoid Chasing Winners

From a fundamental perspective, we remain constructive on the SPX as the U.S. economy is just about to enter the early stages of a fresh monetary easing cycle. We argue that such an environment has historically been favorable for risky asset classes such as equities and real estate.

We also see limited downside risks to the SPX even in the scenario where the economy enters a recession. Furthermore, we believe that a recession (not our base case for now) will be mild. Especially given that the Federal Reserve (Fed) is currently in a great position to respond with monetary policy with the target Fed funds rate running at 5.25%-5.50%, there is ample scope for rate cuts if needed.

Nonetheless, we believe it prudent to tone down our bullish view on U.S. large caps and refocus on selecting for value and quality. As sentiment turns increasingly bullish on the SPX, we also think it might be a good time to be slightly more cautious.

Analysts at Goldman Sachs have warned that expectations for corporate sales next year are too high given their outlook for moderating economic growth and a weaker dollar. The team at Goldman Sachs is forecasting S&P 500 sales to rise by 4% in 2025 compared with 6% this year. In contrast, according to data compiled by Bloomberg, consensus forecasts are pencilling in a 5.8% increase in sales in 2025.

This is in line with our view that expectations for sales and earnings for AI-themed technology names may be too optimistic and that share prices for these companies may already be priced for perfection.

TradingView, Stratos Capital Partners

Accordingly, we are lowering our rating on the SPX from “Strong Buy” to “Buy.” We reiterate our overall constructive view on U.S. equities but prefer undervalued themes such as real estate, biotechnology, and healthcare to outperform.

Indeed, we continue to see compelling valuations in some of our favorite picks, including Teck Resources (TECK), D.R. Horton (DHI), Mid-America Apartment (MAA), Camden Property Trust (CPT), SPDR® S&P Biotech ETF (XBI), and Pfizer (PFE).

And for readers who are determined to add more technology exposure to their portfolios, we suggest leaning towards laggards such as Snowflake (SNOW), which have become even more attractive after the recent selloff.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.