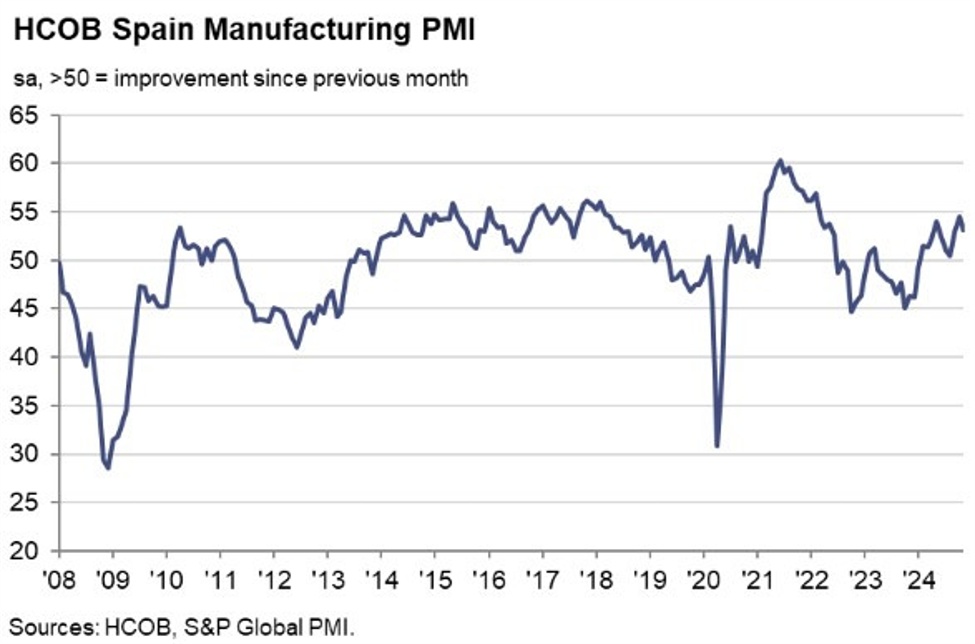

- Manufacturing PMI 53.1 vs 53.5 expected and 54.5 prior.

Key findings:

- Regional flooding reported to have limited growth

- Output, new orders and employment nonetheless rise solidly

- Confidence in outlook remains positive

Comment:

Commenting on the PMI data, Jonas Feldhusen, Junior Economist at Hamburg Commercial Bank, said:

“The Spanish manufacturing sector continued its expansion in November – albeit at a slower pace and despite the fatal

floods in the region of Valencia. The index fell a bit from 54.5 to 53.1 but still remained comfortably in growth territory. Output

and new orders continue to show expansion, albeit at a slower pace. New export order book growth even accelerated to the

highest level in over three years.

The Investment Goods sector is showing notable improvement, especially by orders growth. The positive development of

this sector comes as a surprise, especially given that the automotive sector across Europe is currently under significant

pressure. However, in Spain, growth in investment goods has improved noticeably. The reason behind this surge could be,

unfortunately, a sad one. According to media reports, a high five-digit number of cars were destroyed in the recent floods.

Replacing these ruined cars through insurance claims could have generated new demand.

The outlook for Spanish manufacturers remains above its long-term average, given the stable order situation and the hopes

that the global business environment improving next year. As production and orders remain high and manufacturers are

optimistic about their future business, additional staff was added for the third consecutive month. This should also help

reduce growing backlogs of work.

“Input delivery times have worsened, with panellists attributing this to the regional floods in Valencia. However, the current

supply bottlenecks are relatively moderate compared to the delivery delays we saw at the peak of the coronavirus pandemic,

as the latest PMI survey indicates. Input prices have ticked up a bit, but the culprit isn’t delivery times –it’s the rising cost of

raw materials. Moreover, higher input prices have not resulted in enhanced prices charged, as competition leaves little place

for rising prices.”

Spain Manufacturing PMI