jittawit.21/iStock by way of Getty Pictures

Thesis

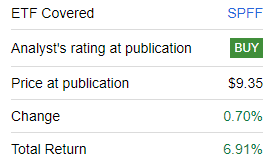

We began overlaying the International X SuperIncome Most popular ETF (NYSEARCA:SPFF) a yr in the past in the course of the regional banking disaster, by way of a bit rightfully entitled ‘SPFF: The Time Is Now‘. The fund is up nearly 7% on a complete return foundation since our preliminary protection:

Ranking (Looking for Alpha)

In our preliminary piece, we characterised SPFF as cyclical, and warned traders this fund shouldn’t be a real purchase and maintain, however extra of an instrument to be utilized throughout occasions of panic. As per our preliminary article, SPFF is pretty concentrated by way of its prime positions, a development which might introduce further volatility.

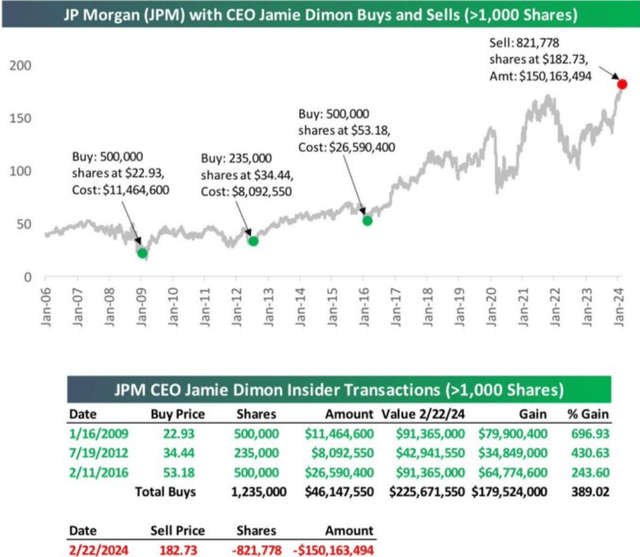

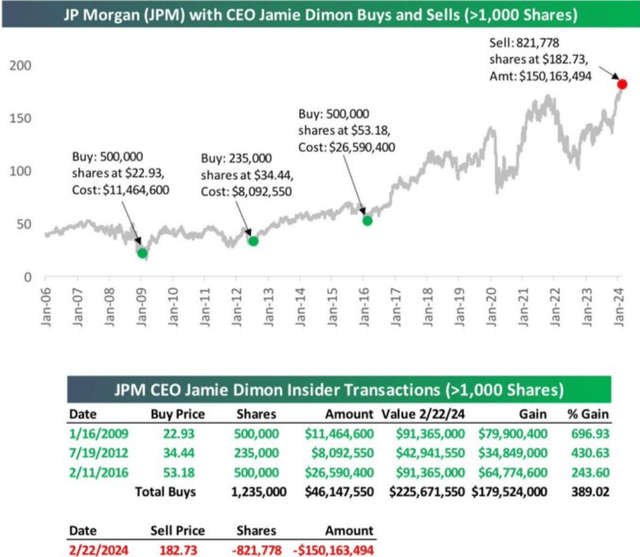

It’s attention-grabbing to note the present market developments – on one hand, one can witness retail traders affected by FOMO (concern of lacking out) coming into the market to revenue from tech mega-cap appreciation, all whereas insiders are assiduously selling equities. Probably the most attention-grabbing and pertinent insider promote for us is the Jamie Dimon one:

J. Dimon insider transactions (Bespoke Make investments)

Previously decade, Dimon has been a purchaser of JPMorgan (JPM) inventory, with impeccable timing for that matter. His promote coupled together with his feedback which revolve across the soundness of sure regional banks ought to present a warning signal for a lot of traders. Dimon doesn’t promote typically, and has by no means achieved so in such a measurement (over $150 million price of inventory).

On this article, we’re going to revisit SPFF and articulate why the present excessive charge surroundings and the ‘larger for longer’ mantra warrants a downgrade for this title.

Heavy financials fund

SPFF is a most well-liked shares fund which is chubby financials:

Holdings (Fund Reality Sheet)

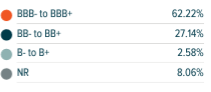

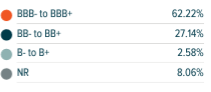

Financials characterize over 82% of the holdings, adopted by Communication Companies and Industrials exposures. The fund additionally takes vital credit score threat by way of its holdings, containing a big BB bucket:

Rankings (Fund Reality Sheet)

This fund is a cyclical one with a excessive focus in handful of names, and with a major bucketing for BB credit. At the moment, the ‘WFC 7 1/2 Perp’ safety represents 7.3% of the fund, intently adopted by the ‘BAC 7 1/4 PERP’ holding at 6.7% of the fund. These are Wells Fargo and Financial institution of America most well-liked shares.

30-day SEC yield has compressed to a paltry 5.8% whereas fund volatility is excessive

Most popular shares are purchased for yield, and generally the potential for capital appreciation following a dislocation in capital markets. SPFF has at present seen its 30-day SEC yield compress to a paltry 5.8%:

Yields (Fund Web site)

There are quite a few short-term company bond funds or AAA CLO ETFs that are yielding in extra of 6% in right now’s market, with us having coated quite a few them not too long ago:

These are all names with annualized volatilities sub 3%, and really restricted drawdown profiles. Conversely, SPFF concentrates on a really risky and lengthy period asset class, with the ETF recording an annualized volatility in extra of 14% as per the Looking for Alpha Risk tab.

Danger/reward is a vital metric, particularly when investing in a cyclical fund like SPFF. This metric turns into much more pertinent when threat free charges are above 5%.

At the moment, with spreads tight throughout the board and the fairness market pumping to new highs, we consider it’s only a matter of time till we now have a wholesome pull-back. There aren’t any compelling causes from a dividend yield perspective to nonetheless be a holder of SPFF on a risk-adjusted foundation in our view.

Greater for longer charges are dangerous for some banks

Whereas SPFF incorporates principally securities from giant systemically necessary banks, it’s nonetheless topic to cost dislocation on the again of a risk-off surroundings. We don’t see any of the big banks having any solvency points given stringent regulatory capital modifications after the nice monetary disaster of ’08-’09, however they are going to expertise unfold widening if extra regional banks expertise troubles.

Greater for longer charges have a really attention-grabbing manner of percolating down the system for banks. A excessive charges surroundings interprets into CRE loans points, troubles which aren’t going away any time quickly since property house owners are unable to re-finance at enticing charges. In lots of situations, they find yourself losing all their fairness in sure investments:

On the finish of final yr, the fund (Canada Pension Plan Funding Board) bought its 29% stake in Manhattan’s 360 Park Avenue South for $1 to one in every of its companions, Boston Properties Inc., which additionally agreed to imagine CPPIB’s share of the undertaking’s debt.

The impact on banks comes by way of bigger than regular provisions for credit score losses within the CRE area, provisions which might torpedo internet earnings and capital:

NYCB has not beforehand disclosed Munson’s departure early this yr, which sheds extra gentle on what occurred main as much as NYCB’s This autumn outcomes, which confirmed it put aside an enormous sum of money for potential actual property mortgage losses and slashed quarterly dividends by 70%.

NYCB noticed its widespread fairness expertise a -50% drop after the above outcomes have been introduced, all whereas its Sequence A most well-liked fairness (NYCB.PR.A) dropped an astounding -20%. The affect to its capital construction was swift and violent.

Greater for longer means there’s seemingly no reduction in sight, with extra debtors probably slated at hand of their keys to banks on a extra frequent foundation at valuations which may be decrease than the preliminary loans. This all interprets into mortgage loss provisions and lack of profitability for sure lenders.

Very giant and secure establishments like JPMorgan and Financial institution of America are capable of translate excessive charges into the next internet earnings margin by way of a really low curiosity fee on their deposits. For instance, JPMorgan at present pays beneath 1% for its financial savings and checking account. To be exact, it pays 0.01%.

When you will get 5.3% by parking that money in a single day and also you pay your depositors a token quantity, you may definitely make a internet earnings that can be utilized to offset a few of these CRE mortgage loss provisions. It’s not the case for a lot of mid-sized or small banks.

Conclusion

SPFF is a set earnings ETF centered on financials most well-liked fairness. We first began overlaying this title after the regional banks disaster in 2023, after we felt traders might reap the benefits of the systemic financials dislocation by way of this title. The fund is up nearly 7% on a complete return foundation since our score. With credit score spreads tight, and a re-setting of the fund’s 30-day SEC yield to a paltry 5.8% we really feel the preliminary commerce is now exhausted.

Greater for longer charges will translate into additional CRE weak point, which can present itself sometimes by way of vital mortgage loss provisions. We now have seen this story develop for NYCB, with a major affect to each its widespread and most well-liked shares. We count on extra tales to emerge just like NYCB’s which can put stress on financials’ most well-liked share spreads. With ample alternatives to get yields above 6% with de-minimis volatility at present, a retail investor is finest served to promote out of SPFF.