shapecharge/E+ via Getty Images

As stock markets continue to rally to record heights, I continue to focus my tech stock portfolio on growth names that have fallen out of favor. I’m willing to take on names with some growth deceleration in exchange for cheap valuation multiples.

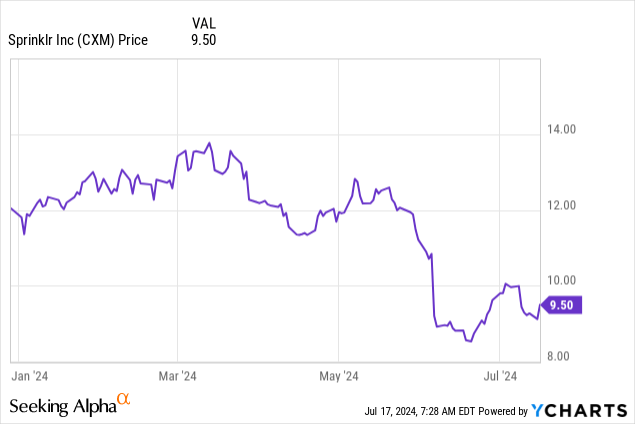

Sprinklr (NYSE:CXM), in my view, fits the bill perfectly here. This customer experience and social media management company has seen its share price slide ~20% this year, accompanying its recent fall in growth pace to the low teens. Still, in my view, the company offers a number of advantages and is overdue a rebound.

After watching the stock fall precipitously this year, I’m moving off the sidelines and initiating Sprinklr at a buy rating. In brief, there are a number of core factors that draw me to this stock:

- Broad, well-synergized product portfolio. Sprinklr offers companies a suite of customer experience and social media management tools. It aims to be a one-stop shop for companies to define and disseminate their brand message.

- Best in class and blue-chip customers. The company has routinely been highly ranked by Gartner Magic Quadrant, the software industry’s pre-eminent reviewer. It also has a number of enormous Fortune 500 customers that solidify and entrench its revenue base.

- Large TAM. Across its diverse product set, Sprinklr believes that it addresses a $60 billion market opportunity, according to its latest investor presentation.

- Attractive financials with recurring revenue built on top of high gross margins. Whole growth has certainly decelerated, Sprinklr runs a subscription business that has high 70%+ gross margins and is well positioned to scale. It’s also still reporting a mid-teens net expansion ratio, while many software companies have struggled on this front.

- Cheap valuation. This year’s decline has rendered Sprinklr at low single-digit revenue multiples.

In my view, it’s time to buy the dip here.

Attractive product portfolio with an established customer base

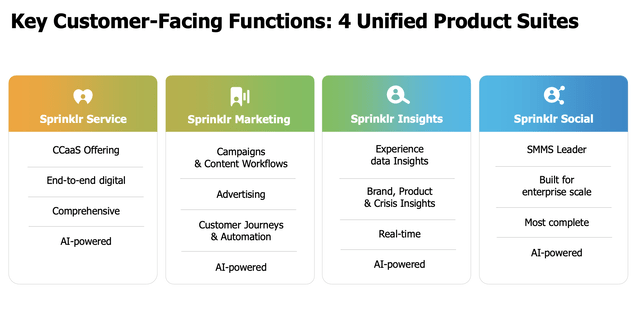

For investors who are newer to Sprinklr, the company develops four main products: Sprinklr Service, Sprinklr Marketing, Sprinklr Insights, and Sprinklr Social. Read brief descriptions of each in the snapshot below:

Sprinklr products (Sprinklr Q1 shareholder deck)

In a nutshell, Sprinklr is all about customer success and brand positioning. Its CX tools compete with the likes of Marketo (now owned by Adobe (ADBE)) and Salesforce’s (CRM) Pardot product, while its social media management tools offer functionality that competes with Sprout Social. Combining the marketing tools along with CRM-like functions in tracking customer journeys and feedback, as well as delivering data insights to marketing managers, is Sprinklr’s goal in integrating its product suite. Together, as previously mentioned, the company believes its portfolio addresses a $60 billion market opportunity.

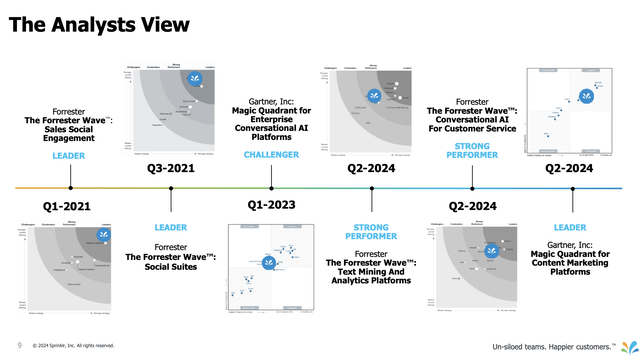

The company has consistently garnered high marks and praise. Gartner, the software reviewer responsible for the “Magic Quadrant” rankings (wherein a company positioned in the top-right corner is deemed the most innovative and the most capable of execution) has rated Sprinklr highly for several years in a row:

Sprinklr Gartner reviews (Sprinklr Q1 shareholder deck)

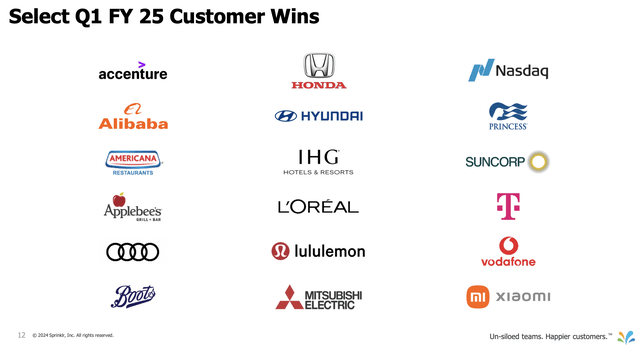

Ratings are one thing, installed customers are another. In Q1 alone, Sprinklr signed a number of name-brand customers across diversified industries, including Lululemon (LULU), Alibaba (BABA), Honda, and Accenture:

Sprinklr customers (Sprinklr Q1 shareholder deck)

In my view, Sprinklr has quite a mature, well-rounded business model that has already demonstrated ample reach with potential to expand further.

Slower growth, but expanding margins

Yes: Sprinklr’s growth is slowing. But that’s no reason to write the company off. Macro conditions must also be taken into account here. Amid budget pressures and the recent trend of layoffs, companies have been especially harsh on sales and marketing departments, slashing headcount at a time of lower growth. Lower headcount for a seat-based product, meanwhile, directly impacts Sprinklr’s results.

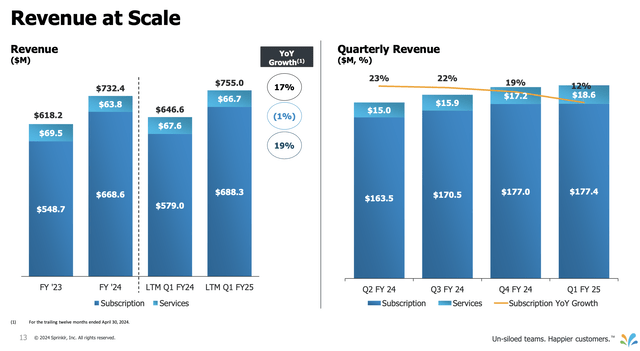

Sprinklr revenue trends (Sprinklr Q1 shareholder deck)

As shown in the chart above, in Sprinklr’s most recent quarter, revenue growth decelerated to 12% y/y, from 19% growth in the prior quarter. We do find it impressive, however, that the company has maintained a net revenue retention rate of 115% in Q1, whereas many more struggling software companies have seen retention rates drop below 110% and closer to 100% (where 100% indicates a balance between churn and expansion).

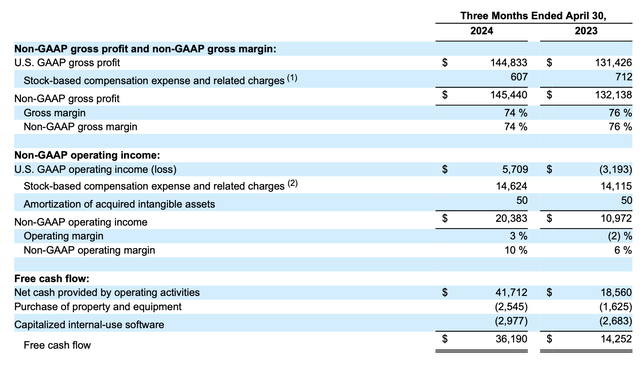

But amid the growth slowdown, Sprinklr has been boosting its profitability, built on a base of strong pro forma gross margins. As shown below, pro forma operating margins hit 10% in the most recent quarter, up four points from 6% in the year-ago Q1. It’s worth noting as well that FCF nearly tripled to $36.2 million in the quarter.

Sprinklr margins (Sprinklr Q1 shareholder deck)

Risks, valuation and key takeaways

The best draw to investing in Sprinklr: it’s quite a bargain at current prices. At current share prices near $9.50, the stock trades at a $2.52 billion market cap. After we net off the $610.1 million of cash and no debt (another reason to like the company: a huge net cash balance) on Sprinklr’s most recent balance sheet, the company’s resulting enterprise value is $1.91 billion.

Meanwhile, for the current fiscal year FY25 (the year for Sprinklr ending in January 2025), the company has guided to $779-$781 million in revenue, which represents 7% growth at the midpoint (which may be conservative if we consider 12% growth in Q1). Nevertheless, taking this estimate at face value, we get a valuation of just 2.4x EV/FY25 revenue – quite cheap for a company that is still just gaining tremendous operating leverage and boosting operating and FCF margins.

There are risks to consider, of course. Continued macro dampness is the ongoing issue for Sprinklr, as customers continue to both optimize sales and marketing headcounts while also potentially cutting and consolidating tech vendors. Competition is another risk: as previously mentioned, CX and social media management are crowded spaces, and some of Sprinklr’s key competitors are owned by much larger software companies with deeper pockets.

That being said, I’m optimistic about Sprinklr given healthy retention rates, a large TAM, growing margins, and a low valuation multiple that provides a buffer against risk. This is a great buy in an expensive market.