Anadolu/Anadolu through Getty Pictures

Sociedad Química y Minera or SQM (NYSE:SQM) is a Chilean chemical firm at present within the information for its lithium enterprise. At the moment nearly all of their revenues come from their lithium enterprise, and they’re one of many huge 5 lithium producers.

Their share efficiency will likely be carefully tied to the worth of lithium. They’ve a sturdy aggressive benefit of their lithium asset: the Salar de Atacama. They’ll do very nicely because the rising EV increase creates future demand for lithium. Nevertheless, I consider that the corporate shares will not be but on the backside as lithium costs will stay depressed for at the very least one other quarter.

Their Companies

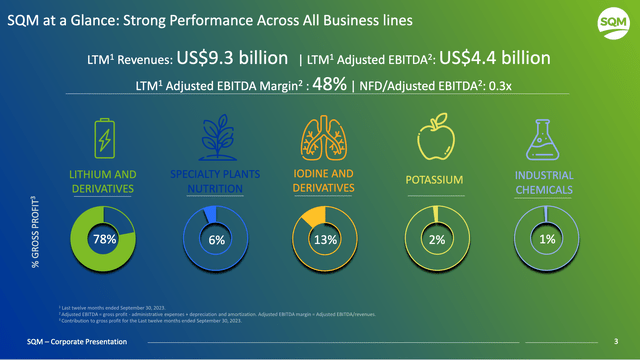

SQM has a diversified portfolio of chemical companies. Aside from lithium, they’ve an iodine enterprise, a potassium enterprise, a fertilizer enterprise, and a small chemical compounds enterprise.

SQM Income Breakdown (SQM Presentation)

A couple of years in the past they started specializing in lithium. At the moment lithium is over 75% of their income, and this quantity ought to enhance as they’re making massive investments in spodumene mines in Australia.

The Salar de Atacama

The crown jewel of the corporate is its brine asset, the Salar de Atacama. The salar is an underground reservoir of salt water positioned within the mountainous flats in North West Chile. The brines are salty waters excessive in a number of chemical compounds, together with lithium and potassium. The corporate pumps the salty brine into evaporation ponds the place the liquid sits for 12-24 months. There the liquid evaporates away water, making a lithium focus. The corporate additionally provides chemical compounds that eliminate impurities.

Salar de Atacama (SQM web site)

The lithium focus is trucked to a different location in Antofagasta, the place it’s transformed into lithium carbonate, the primary sale product. Some are additionally transformed into lithium hydroxide.

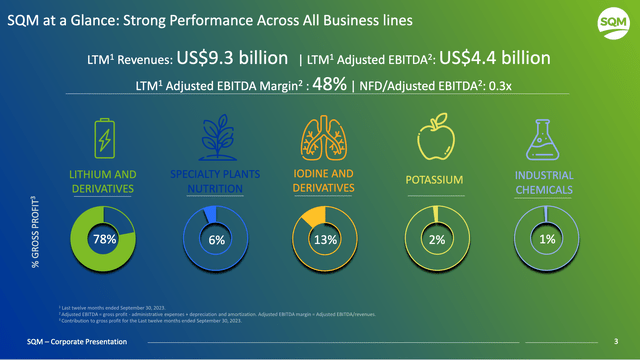

Basically, high-quality brines are the most cost effective approach to produce lithium chemical compounds. The Salar de Atacama is the premier lithium brine asset on the earth as a result of it has the very best focus of lithium. The Hombre Meurto salar in Argentina has grades round 700 mg/L. That is the second highest on the earth. Many corporations are salars with concentrations which are beneath 200 mg/L. The Salar de Atacama has 1,840 mg/L.

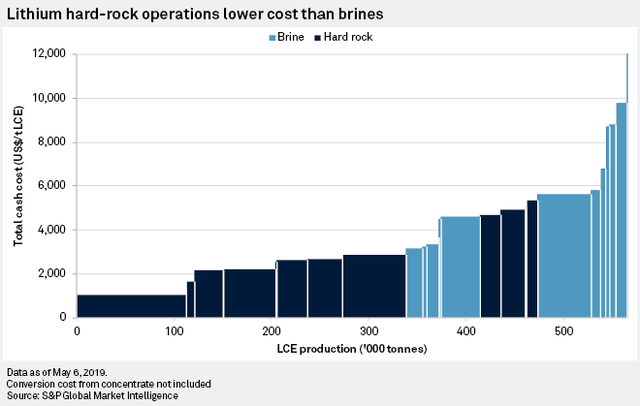

Beneath is an image of the lithium value curve. The mine sitting on the very left is the Salar de Atacama. Albemarle (ALB) and SQM are the 2 corporations working right here, with SQM producing ~4X greater than Albemarle from the salar.

Lithium Price Curve (S&P International Market Index)

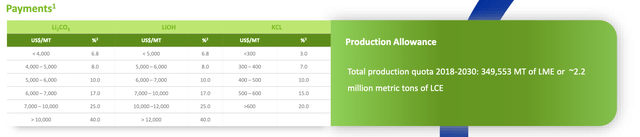

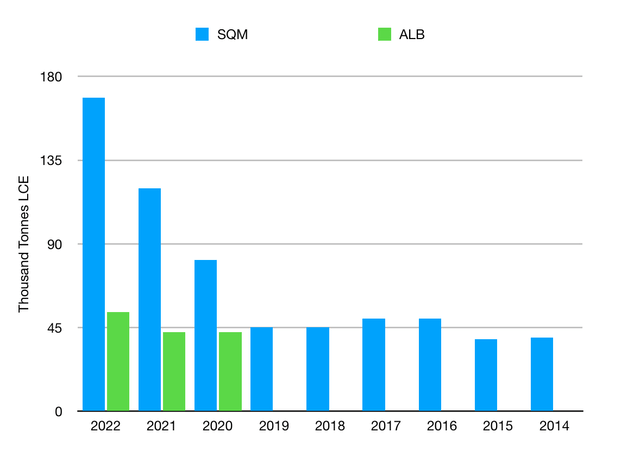

This graph have to be instantly certified although. This graph is the money value of working, not the all-in-sustaining value. The AISC contains royalties and transport prices. Within the case of SQM, the corporate operates the Salar in Chile beneath a particular lease. The corporate pays an astounding 40% royalty on any lithium gross sales over $10,000/t. In 2022 This fall their common sale value was $59,000/t, so that they had been paying this huge royalty on most of their lithium gross sales. In comparison with the three% royalty in Argentina, that is very excessive.

SQM Royalty Construction (SQM Presentation)

The result’s that SQM pays a variety of taxes. In 2022 they paid $5 billion in taxes when you embrace the royalty, virtually half of their $10.7 billion in income. By Sept 2023 their TTM whole taxes had been $2.4 billion which is %25.8 of their $9.3 billion TTM income. The altering percentages replicate the truth that lithium costs have fallen.

SQM Taxes and Royalties (SQM Presentation)

At any time when the lithium costs are low SQM will stay on the backside of the price curve and be worthwhile for lithium. However additionally they look extra like a diversified chemical compounds enterprise then. When lithium costs are excessive they seem like a lithium producer that pays a variety of taxes and has a aspect chemical compounds enterprise.

My opinion is that though the taxes are so excessive, the Salar is so good that SQM stays a lovely long-term enterprise with a sturdy aggressive benefit.

Salar Growth

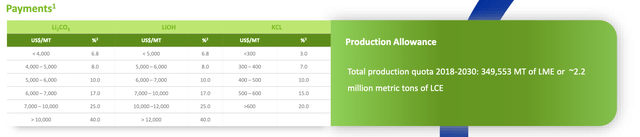

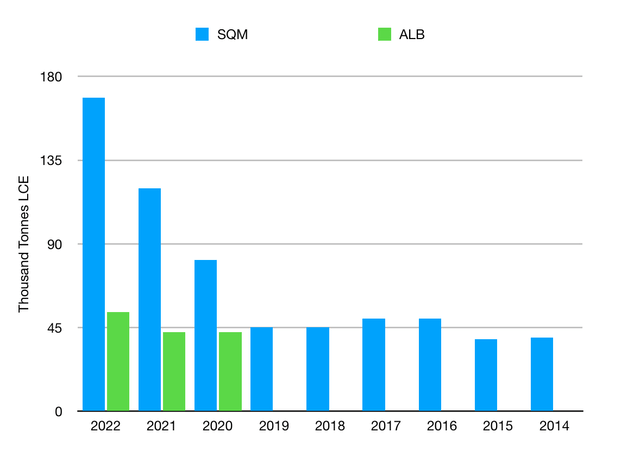

Over the previous few years, SQM has enormously expanded its lithium operations within the Salar de Atacama. They’ve been spending CAPEX since 2019 and have grown from round 45,000 tpa to 160,000 tpa. We are able to see that SQM’s output was flat from 2014 to 2019. Throughout 2020, the worth of lithium began to take off.

SQM and Albemarle historic lithium manufacturing (Creator Chart)

SQM operates on the Atacama with a lease from the federal government. This lease has a cap on the entire quantity of lithium they’ll extract. Nonetheless, the graph above reveals that SQM has the operational potential to develop manufacturing at the very best asset on the earth.

Future Lithium Growth

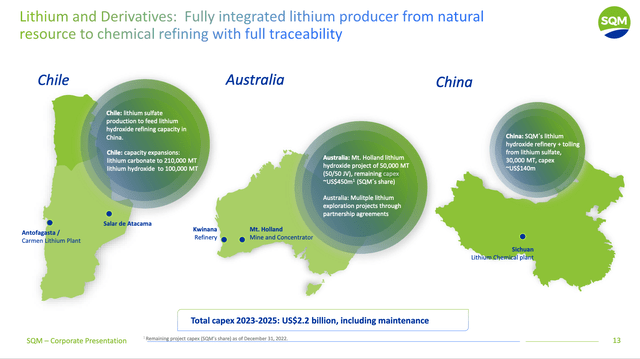

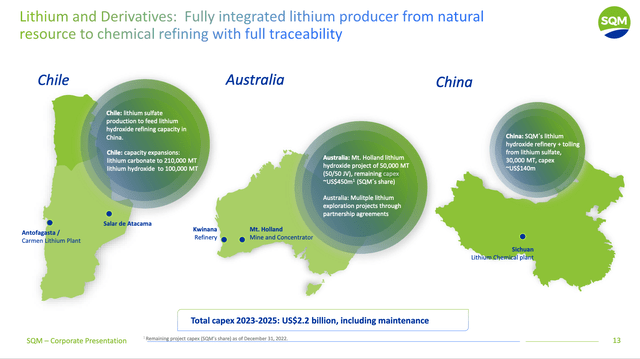

SQM has demonstrated they’re in search of to develop their lithium enterprise to fulfill future demand. In 2021 SQM launched a 50/50 JV with Australian firm Wesfarmers (OTCPK:WFAFF) on the Mt Holland lithium venture in lithium Western Australia. This will likely be mining spodumene and refining it into lithium hydroxide within the Kwinana location, additionally in Australia.

In 2021 SQM started constructing a lithium hydroxide plant in China.

SQM World Operations (SQM Presentation)

Additional, SQM has just lately made a proposal bid to buy the Andover Asset, additionally in WA, from Azure Minerals (OTCPK:AZRMF) valued at round AUD 1.7 billion. This can be a massive, high-grade spodumene deposit, that’s nonetheless within the exploration part. SQM will buy the corporate as a JV with Gina Rinehart.

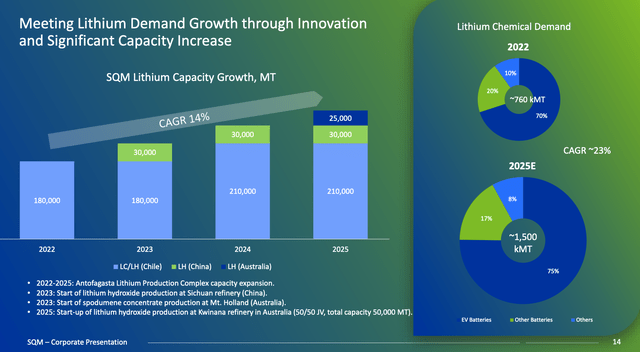

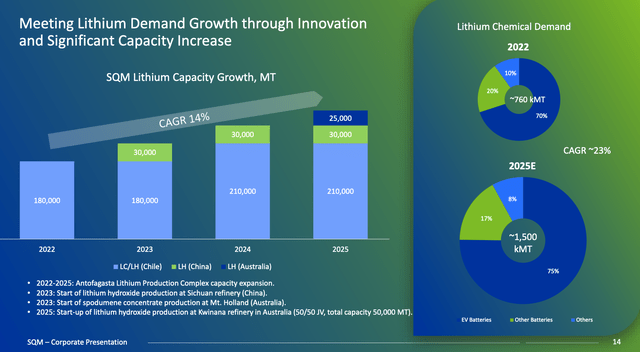

You possibly can see from the chart beneath they’re growing their lithium capability at a price of round 14% annually.

SQM Lithium Capability (SQM Presentation)

General the image that emerges is that the corporate is rising its lithium enterprise and in search of to diversify its asset portfolio and asset jurisdiction.

SQM and Chile

It’s value realizing somewhat concerning the political historical past earlier than investing in Chile. The e-book Volt Rush by Henry Sanderson explains that within the 80’s SQM was a dying nationwide operation. It was made a non-public enterprise in 1983 and management was given to Julio Ponce Lerou who had household hyperlinks to the president of Chile. The e-book additionally mentions that the evaporation ponds of SQM are round 44 sq. km or 10873 acres.

Final yr, there have been fears concerning the proposal to nationalize the lithium trade in Chile. The concern was that SQM could also be taken over as a authorities asset after their lease ran out in 2035. Not too long ago, SQM inked a new deal to proceed their Atacama operations till 2060.

One of many outcomes of the brand new Chilean coverage is that the nation is in opposition to evaporation ponds. These at the moment are thought-about environmentally unfriendly, so new expansions ought to embrace DLE. SQM has announced they may create a brand new DLE operation, spending $1.5 billion in capex.

My opinion is that it will decelerate their lithium development in Chile. DLE continues to be a know-how in improvement, and the capex numbers appear very massive. The evaporation pond know-how works nicely for the Atacama!

The Lithium Worth

So SQM has an excellent lithium enterprise that’s rising and diversifying. They’re one of many massive lithium gamers and can proceed to develop. The issue for them within the quick time period is that the worth of lithium has crashed.

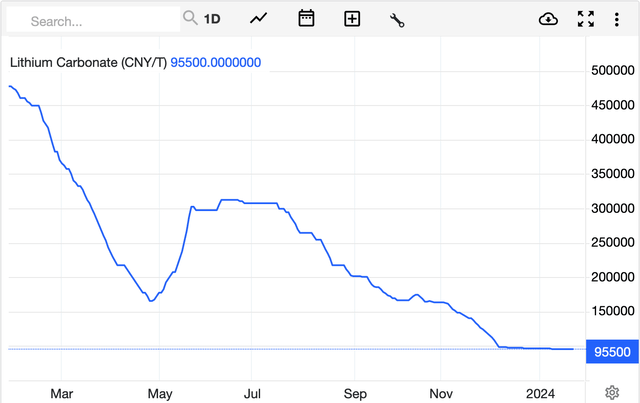

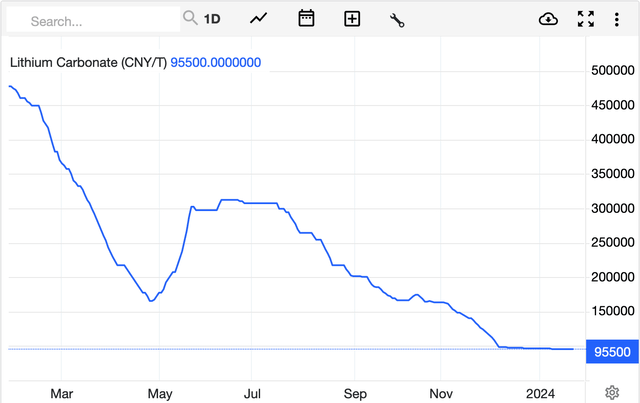

Lithium Carbonate Spot Worth (Buying and selling Economics)

The corporate final reported in November, when the worth was round 160000 CNY/t or $22,000/t. The worth has now fallen to round 95000 CNY, or $13,000/t. SQM’s lithium value is partly related to contacts and partly related to the spot costs. This means that SQM’s value within the subsequent quarter needs to be decrease within the November quarter.

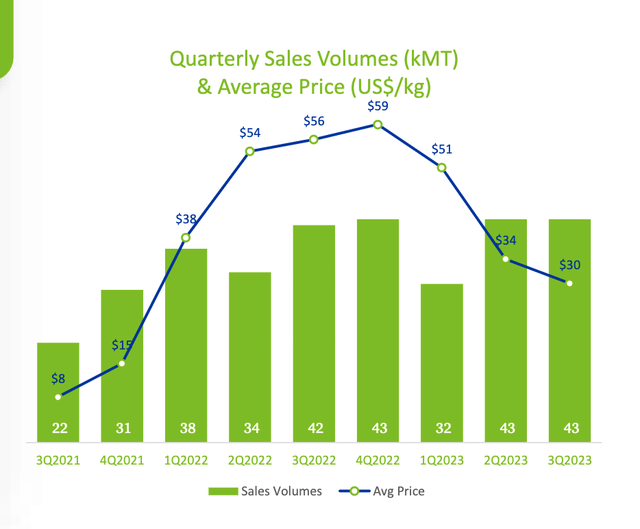

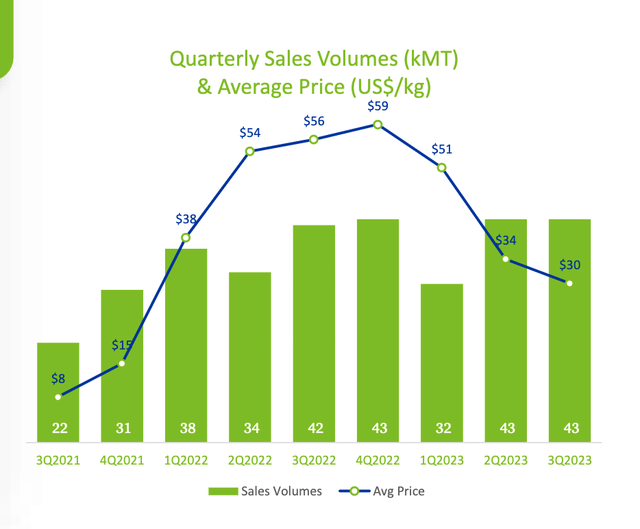

SQM Lithium Gross sales Worth (SQM Presentation)

Within the final quarter, they reported $30/kg, or $30,000/t. They’ll publish their subsequent earnings on Feb twenty eighth. I anticipate a drop within the prime and backside line related with a drop within the value of lithium.

Steadiness Sheet and CAPEX

Within the final quarter, the corporate had $2.7 billion in money and equivalents and $2.5 billion in long-term debt. They did simply open a brand new 750 million greenback debt facility of unsecured notes with a 6.5% rate of interest. Presumably, that is to assist their Azure bid.

The corporate expects to pay $2.2 billion in capex over three years, 2023-2025, that means a mean of $733 million a yr, or $183 million 1 / 4.

SQM CAPEX Numbers (SQM Presentation)

SQM produced $419 million in working money stream final quarter. I anticipate this to be a lot much less within the subsequent few quarters, however they need to be capable to maintain their CAPEX.

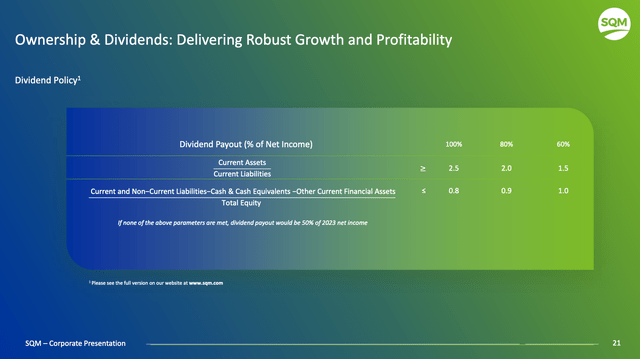

Dividend Coverage

SQM has a transparent dividend coverage. The quantity they pay is said to their debt ratios and their earnings. As of the final report they’d $6.2 billion in property and $2.7 billion in liabilities, however I anticipate the liabilities to extend to $3.4 billion. Subsequently their Asset-Legal responsibility ratio is 1.8, that means that they might pay as much as 60% of their web revenue. If ratios fall decrease they pay a minimal of fifty%.

SQM Dividend Coverage (SQM Presentation)

Final yr they paid a complete of $5.0234/share in dividends. I anticipate this to be much less for the approaching yr as the worth of lithium has been dropping.

The Earnings Name

Talking of earnings name: right here are some things to look out for. Firstly, I anticipate that the worth of lithium may keep low for just a few extra quarters. SQM usually offers forward-looking commentary. They often communicate concerning the long-term image, however they might additionally discuss concerning the value for the following few quarters.

Additionally, look out for any modifications in capital spending. There are a selection of corporations which are starting to chop capital prices as the worth of lithium tanks. Albemarle has accomplished this. Liontown has simply accomplished this. It might not make sense to carry Mt. Holland on-line if the mine simply as the worth of spodumene falls would make the mine unprofitable. Core Lithium has come into care and upkeep.

Conclusion

SQM is an organization with nice operations in an incredible lithium asset. They’ll proceed to become profitable from their lithium enterprise because the world wants extra of the white metallic to make batteries for EVs and storage options.

Their enterprise has some benefits and drawbacks. Their great asset implies that they are going to be a low-cost producer, making income even when the worth of lithium is down. They would be the one man left standing for the worth of lithium tanks. Nevertheless, their upside is capped by the big Chilean royalty.

For the longer term, their Atacama asset would not seem like it is beneath risk from nationalization, however they might not develop an excessive amount of right here. They wish to diversify their lithium portfolio with expansions in Australia and China.

SQM will likely be positioned to develop within the subsequent 5 years, persevering with its place as a lithium main. I price this firm a maintain, nonetheless, as a result of within the quick time period, the worth of lithium has fallen, and may keep fallen for just a few extra quarters. If the share reaches a value as little as $38 I’ll purchase extra.