On-chain information reveals the stablecoin provide has surged alongside Bitcoin’s newest break above $50,000, an indication that might be bullish for the market.

Each Bitcoin And Stablecoin Market Caps Have Surged

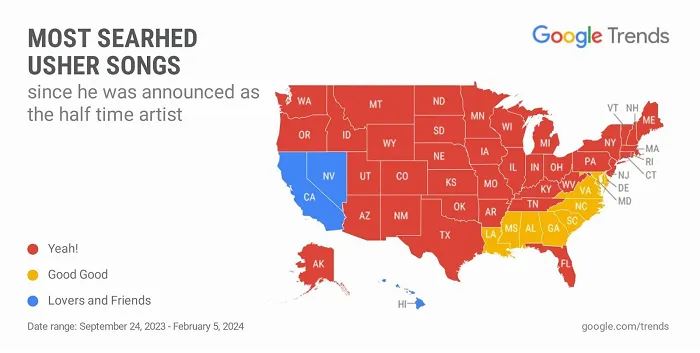

In keeping with information from the on-chain analytics agency Santiment, the stablecoin market cap has lately grown. The “stablecoin market cap” right here refers back to the mixed provide of the six largest stablecoins within the cryptocurrency sector.

Observe that as these stables are all tied to the USD (which means that their worth stays across the $1 mark), the market cap and provide are interchangeable of their context, as they might be equal (not like, say, within the case of Bitcoin, the place they denote various things as a result of a fluctuating USD worth).

The chart beneath reveals the stablecoin market cap development over the previous couple of months.

Seems to be like the worth of the metric has been on its method up in current days | Supply: Santiment on X

The graph reveals that the provision of stablecoins has been rising for some time now, suggesting that demand has been driving the issuance of extra of those fiat-tied tokens. For the reason that begin of the 12 months, the market cap of the stables has surged by nearly 5%, which is a fairly important worth.

The analytics agency additionally included information in the identical chart for the share of the stablecoin cap held by buyers with a minimum of $5 million of their wallets.

It could seem that this metric has additionally seen a pointy improve in the previous couple of weeks, as these whales have added 2.32% of the provision of the six largest stables to their addresses.

Now, what do these developments in these stablecoin indicators imply for Bitcoin and the broader sector? Their significance lies in why the buyers would select to put money into stables.

Merchants usually use these fiat-tied tokens to flee the volatility of cash like BTC. Nonetheless, such buyers solely plan to exit briefly; in the event that they wished to go away the cryptocurrency sector as a complete, they could have gone for fiat as a substitute.

When holders like these transfer into stables, the costs of Bitcoin and others naturally observe a bearish impact. Nonetheless, as soon as these buyers alternate again into these belongings, the costs really feel a shopping for strain as a substitute.

The stablecoin provide will be thought-about the accessible retailer of dry powder for Bitcoin and others. Shifts from these cash into the stables aren’t the one method this dry powder grows; nevertheless, recent capital inflows immediately into the stablecoins additionally increase their market caps.

These recent inflows are solely bullish for the sector, as they aren’t made on the expense of the opposite cash. Not too long ago, the stablecoin provide has grown, however on the identical time, the Bitcoin value has additionally blown up.

Given this simultaneous improve, it could seem {that a} web quantity of recent capital has entered into each asset varieties on this rally as if it had been only a rotation going down; one of many two might need gone the other method.

This mixture is of course essentially the most bullish potential for the sector, because it signifies that not solely has the Bitcoin market cap gone up, however a dry powder that will probably be deployed within the type of stablecoins has additionally risen on the identical time.

BTC Value

On the time of writing, Bitcoin is buying and selling slightly below $50,000, surging by greater than 16% prior to now week.

The value of the coin has sharply risen throughout the previous day | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Santiment.web, charts from TradingView.com