Key Notes

- Stablecoin market cap surged 50.95% year-to-date to $309.83 billion, with Tether commanding 60% market dominance.

- Crypto derivatives saw $650 million liquidated in 24 hours, predominantly from long positions betting on price increases.

- Capital flows into stablecoins suggest investors await better entry points rather than exiting the crypto market entirely.

Stablecoin total market capitalization now approaches the $310 billion mark, reaching another all-time high despite poor market conditions as cryptocurrency prices crash and hundreds of millions of dollars are liquidated from leveraged positions in a long squeeze.

Coinspeaker retrieved data from DefiLlama on December 15 that shows a $309.83 billion market cap for stablecoins, up 0.44% in the last 24 hours and marking record high levels. Tether

USDT

$1.00

24h volatility:

0.0%

Market cap:

$186.28 B

Vol. 24h:

$83.33 B

dollar-pegged token is the leading stablecoin, dominating 60% of the market share.

This metric has grown 50.95% year-to-date, from the $205.24 billion registered on January 1, 2025, and has more than doubled from the values seen two years ago between December 2023 and January 2024.

Total Value Locked in Defi | Source: DeFiLLama

Overall, stablecoin market cap growth indicates direct capital inflow into this asset class, as the market cap rises together with the supply increase due to unity price stability. Effectively, this phenomenon means that more addresses are acquiring stablecoins in exchange for other financial assets, which can usually come from other cryptocurrencies or from USD injection into crypto markets.

For this reason, this can be an indicator of strong interest in crypto products despite current market conditions and price performance from volatile cryptocurrencies like Bitcoin

BTC

$86 105

24h volatility:

2.9%

Market cap:

$1.72 T

Vol. 24h:

$49.95 B

, Ethereum

ETH

$2 940

24h volatility:

5.0%

Market cap:

$355.15 B

Vol. 24h:

$29.20 B

, Solana

SOL

$125.2

24h volatility:

4.0%

Market cap:

$70.50 B

Vol. 24h:

$5.45 B

, and others. In summary, capital is not leaving crypto rails.

Crypto Market Crashes: Over $600M Liquidations

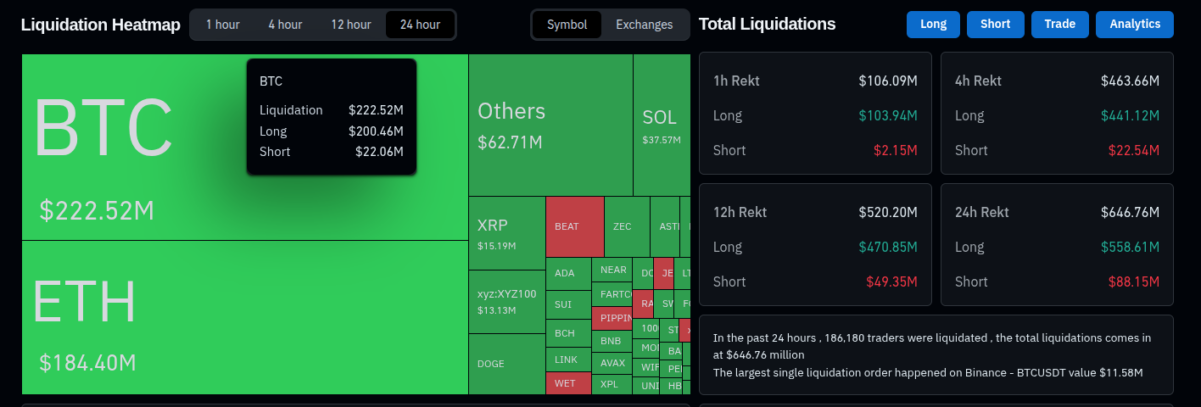

On Monday (Dec. 15), crypto markets saw another relevant crash that negatively affected over 185,000 traders. In the last 24 hours, derivative markets liquidated nearly $650 million of trading positions, most of which were longs, betting on a price rise, according data from CoinGlass.

Prices crashed and these positions were squeezed, accumulating $558 million in losses from the bulls alone. Bitcoin led the daily liquidations, with a total of $222 million, out of which $200 million were from long positions.

Crypto market liquidation heatmap | Source: CoinGlass

The Kobeissi Letter mentioned $100 billion in losses in market cap for BTC in 24 hours when total liquidations were at $400 million. This number has already increased as the price crash continues.

Leverage is a wild drug:

Bitcoin is now below $86,000, erasing -$100 billion in market cap in 24 hours.

Levered long liquidations over the last 4 hours are nearing $400 million.

It’s a wild time to be a crypto trader. pic.twitter.com/Lsdqa0lVJD

— The Kobeissi Letter (@KobeissiLetter) December 15, 2025

Nevertheless, while part of this capital is likely moving into fiat currencies outside the crypto market, a significant part flows into stablecoins—keeping its capitalization at all-time high levels and suggesting investors could be planning to buy back the crashing cryptocurrencies at better conditions, offering a grasp of hope for traders and investors who are still holding underwater positions.

Other signals also suggest promising market conditions despite the short-term bearish outlook, per earlier Coinspeaker reports.

Crypto investment products saw a third week of inflows as BTC attracted $522 million, while XRP

XRP

$1.90

24h volatility:

4.4%

Market cap:

$115.19 B

Vol. 24h:

$3.24 B

followed closely with $245 million. In particular, BitMine Immersion expanded its Ethereum treasury with a $320 million purchase, pushing total holdings to nearly four million ETH as the firm continues its strategic accumulation.

TradFi firms continue to invest and position themselves for crypto-related products, especially stablecoins. For example, Visa announced a stablecoin advisory practice for banks and fintechs, fostering adoption for this asset class.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.