Key Notes

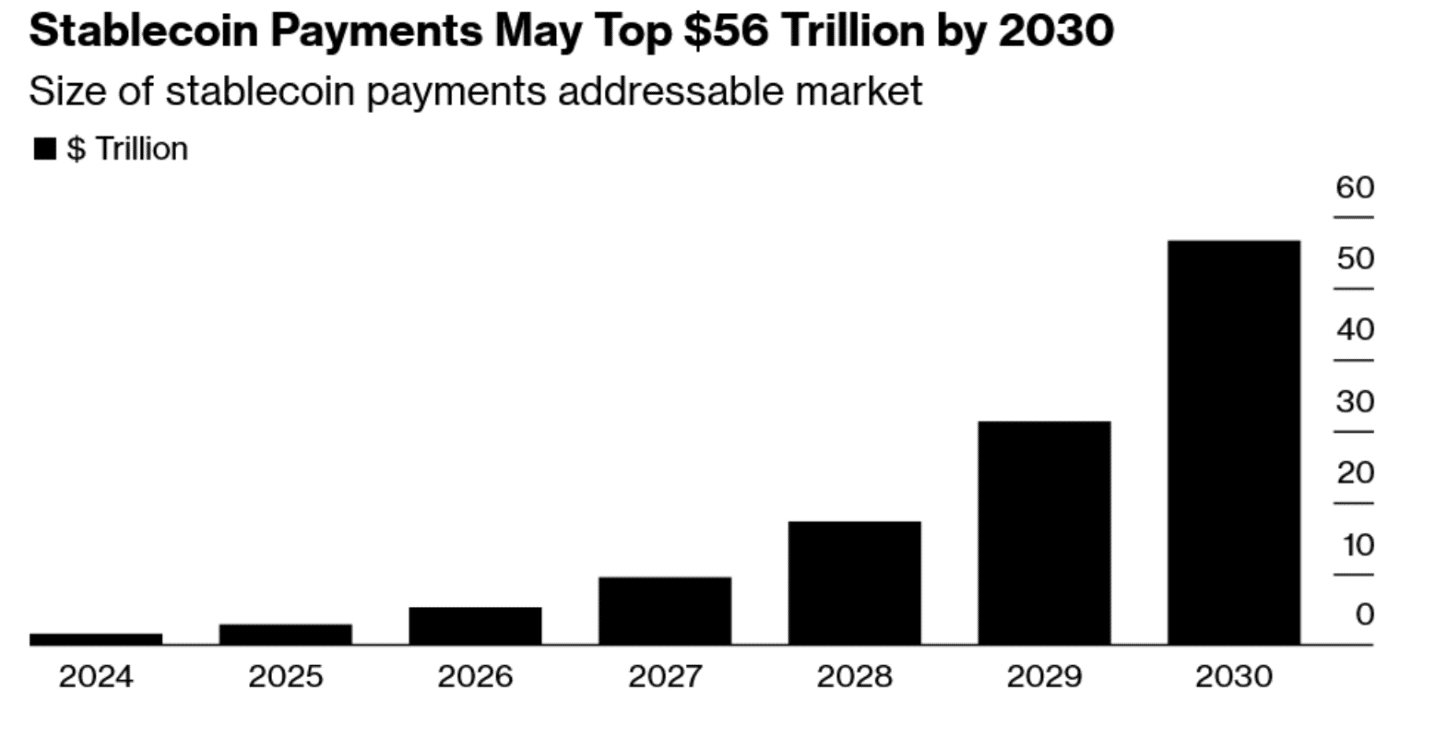

- Stablecoin payment flows could reach $56.6 trillion by 2030.

- Global stablecoin transaction value hit $33 trillion in 2025.

- USDC led transaction volume with $18.3 trillion, but USDT dominated the market.

Stablecoin payment flows could reach $56.6 trillion by 2030, according to new estimates from Bloomberg Intelligence. The blockchain-backed tokens are seemingly on a path to become one of the largest payment rails in global finance.

According to a Bloomberg report, total flows reached $2.9 trillion in 2025, indicating a compound annual growth of roughly 80% if the projection is met.

Stablecoin Activity on the Rise

Bloomberg data shows that global stablecoin transaction value surged to $33 trillion in 2025, a 72% increase year-on-year. Activity continued to accelerate into the fourth quarter, with $11 trillion processed in Q4 alone, up from $8.8 trillion in Q3, based on figures compiled by Artemis Analytics.

Stablecoin payments growth by 2030 | Source: Bloomberg

Growth is being driven less by speculative trading and more by real-world usage, particularly in cross-border payments, business settlements, and savings in inflation-hit economies.

USDC Leads Transaction Volume

Circle’s USDC was the most-used stablecoin by transaction flow in 2025, processing $18.3 trillion, compared with $13.3 trillion for Tether’s USDT. Together, the two assets accounted for over 95% of all stablecoin volume last year.

Despite USDC’s lead in transaction activity, USDT remains dominant by valuation, with a market cap of $186.9 billion, more than double USDC’s $74.9 billion.

Bloomberg noted that USDT is still preferred for day-to-day payments, business transactions, and as a store of value, while USDC remains the stablecoin of choice across decentralized finance platforms.

Artemis co-founder Anthony Yim told the media outlet that the growing demand for US dollar exposure in emerging markets is one of the major driving factors for stablecoin growth. Inflation, capital controls, and geopolitical instability have also contributed.

Banks and Governments Enter the Stablecoin Race

Traditional finance is no longer observing from the sidelines. Barclays has taken an equity stake in Ubyx, a US fintech building clearing infrastructure for stablecoins. This was Barclays’ first direct exposure to stablecoin technology, focused on making stablecoins function like digital cash equivalents to bank deposits.

At the government level, Wyoming has launched the Frontier Stable Token (FRNT), the first fiat-backed stablecoin issued by a US state. Backed by US dollars and short-term Treasurys, FRNT will return interest earned on reserves to the state, funding public services while lowering transaction costs.

On the other hand, JPMorgan announced plans to bring its bank-issued deposit token, JPM Coin, natively to the Canton Network, a privacy-enabled public blockchain already selected by DTCC for tokenizing traditional financial instruments.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.