RapidEye/E+ via Getty Images

Despite offering a double-digit dividend yield, Stellus Capital Investment Corporation’s (NYSE:SCM) has been struggling to outperform the S&P 500 in total returns. I believe this trend is likely to continue because the potential impact of rate cuts, significant share issuance and increasing non-accruals could be the biggest headwinds for its financial growth and returns. Moreover, share price upside also appears limited because of a valuation-related factor. Therefore, I maintain my hold rating on Stellus Capital.

Stellus Capital Q2 Results: Positive Factors

Stellus Capital recently reported second quarter earnings of $0.48 per share, topping expectations by $0.03 per share. The key driver of its earnings exceeding expectations was the waiver of $1.6 million or $0.06 per share of incentive fees during the quarter. Excluding this, the company’s earnings would have been around $0.42 per share, slightly higher than its quarterly dividend of $0.40 per share.

SCM’s earnings were also backed by its strategy of increasing the portfolio size. Stellus invested $66.3 million in new opportunities. Its portfolio value is currently standing around $900 million, with expectations that portfolio value could hover in the range of $920 million and $940 million by the end of the September quarter. Moreover, the company anticipates it has the potential to push its portfolio value to around $960 million by the end of the year, given its existing capital base. Another important feature of its portfolio is the diversification factor. As of the end of June quarter, its portfolio is composed of 100 investments with an average loan per company is $9.5 million.

In addition, Stellus Capital’s improving liquidity positions it to ramp up its portfolio growth strategy. As of the end of June quarter, the BDC had $169.4 million in outstanding borrowings under the Credit Facility. In addition, its cash position increased to $36 million compared to $26 million in the previous year quarter. Stellus Capital’s cash position has been improving due to its share issuance strategy. During the last quarter, it received gross proceed of $25.8 million against 1,855,356 shares.

SCM’s Growth and Asset Quality Risk

Besides the fact that the business development company reported better than expected earnings, the growth factor is likely to deteriorate in following quarters and years because of declining spreads and potential rate cuts. Stellus Capital and other business development companies reported a substantial increase in their profits in the previous quarters due to robust demand and floating rate portfolios. However, the interest rate spreads began to decline across the private credit market because of increasing competition as new players along with established credit providers are seeking to benefit from the flourishing private credit market. In the case of SCM, its weighted average portfolio yield at a fair value declined to 11.7% in the June quarter from 11.9% in the previous quarter. Fitch also raised concerns over increasing competition and declining spreads. Here is what the rating agency stated:

Intensifying competition for deals is likely in the coming months as private credit lenders continue to grow and banks re-enter the space, which could pressure deal terms. The larger sizes of BDCs and affiliated platforms have allowed them to increase participation in middle market deals, but banks are taking back market share in recent months.

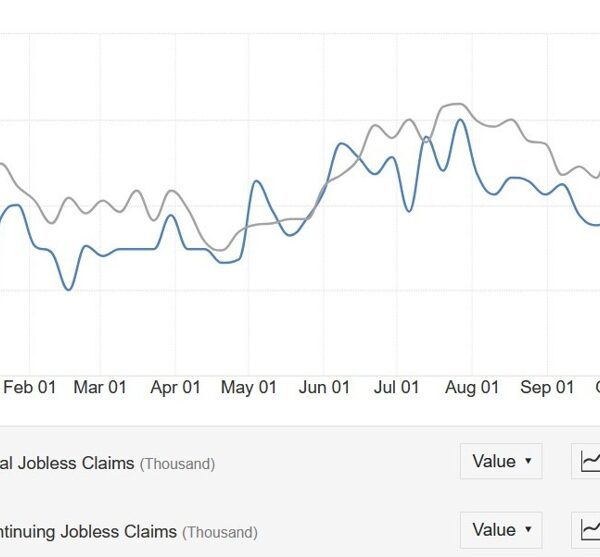

Another risk factor for BDCs like Stellus Capital is the impact of potential rate cuts on their floating rate portfolios. SCM’s 98% of portfolio loan investment were at floating rates as of the end of the June quarter. Recently, the Fed Chair Powell signaled to begin cutting rates in September. Meanwhile, forecasts are suggesting more rate cuts later in 2024 and throughout 2025. The Wall Street analysts expect SCM to experience a high single-digit percentage decline in earnings in 2024 and 2025 due to rate cuts and competition.

Declining asset quality could also be a headwind for its earnings and net asset value growth. As of the end of the second quarter, 23% of its portfolio investments were performing better than expectations, down from 25% in the previous year quarter. In addition, 15% of its portfolio investments were not meeting expectations, up from 13% in the year ago period. Furthermore, non-accruals increased to 2.9% of the total portfolio value, up from 1% in the year ago quarter and 2% in the previous quarter. The industry average is hovering slightly above 1%.

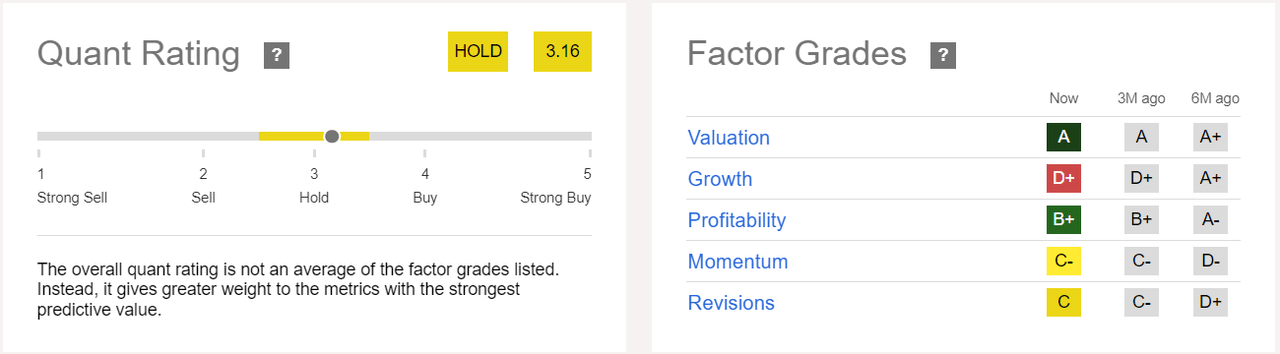

Valuations, Dividends and Quant Rating

Stellus Capital Vs S&P 500 price return (Seeking Alpha)

Stellus Capital’s share price has been struggling to generate healthy returns for shareholders since the bull run began in 2023. Its stock price soared nearly 4% compared to the S&P 500’s monstrous 40% rally. The significant underperformance is blamed on its sluggish net asset value performance, increased asset quality risk and share issuance. In the latest quarter, its net asset value declined to $13.36 per share compared to $13.41 per share in the previous quarter and $14.01 per share at the end of 2022. With prospects of negative earnings growth, high non-accruals and share issuance, its net asset value is expected to remain under pressure in the coming quarters. Therefore, I believe SCM’s shares are overvalued, trading around $13.80 per share compared to its net asset value. The stock also appears slightly expensive given its price to earnings ratio of 10.74x compared to the industry average of 8x.

Meanwhile, its dividends appear completely safe. In the latest quarter, its earnings per share of $0.48 exceeded dividend payments of $0.40 per share. The BDC has sustained its quarterly dividend of around $0.40 per share since 2023, and I do not expect a dividend hike in the following quarters and year because of negative earnings growth. Its earnings are expected to decline to $1.64 per share in 2025, leaving a little room for a dividend hike.

Stellus Capital received a hold rating based on Seeking Alpha quant analysis. The grades on its key quant factors – valuation, growth and profitability – declined in the past six months. It earned a D-plus grade on the growth factor, which is also in-line with my fundamental analysis. The B-plus grade on a profitability factor also declined compared to 6 months ago. Its profitability factor is likely to decline further in the coming quarters due to the impact of potential rate cuts on its margins. Although revision and momentum factors improved slightly compared to 6 months ago, a negative C or C grade still appears unattractive.

In Conclusion

Stellus Capital might not be a perfect investment vehicle for investors seeking to generate market-beating returns. Its dividend alone wouldn’t help investors generate lofty returns unless they are accompanied by a solid share price gains. At present, its share price upside appears limited because of high valuations and negative growth. Investors seeking to benefit from the private credit market by investing in high-yielding BDCs may look at other options such as Crescent Capital (CCAP) and Barings BDC (BBDC). Crescent Capital’s total returns in the past twelve months were around 20% while Barings generated 31% in total returns. According to SA quant rating, Main Street Capital (MAIN) is among the top investment vehicles in the BDC industry.