gorodenkoff/iStock by way of Getty Photos

Stryker (NYSE:SYK) is a number one medical expertise firm with a diversified product portfolio. Goal markets embrace orthopedics, backbone, surgical devices, neurotechnology, and medical and surgical tools. Stryker has a robust place inside robotics for orthopedic surgical procedure and can be demonstrating stable progress throughout its different companies. Whereas the corporate’s valuation has risen considerably lately, that is in response to accelerating progress, bettering money flows and a rising recognition by the market of the standard of Stryker’s enterprise. Stryker’s future returns might not be as strong as previously, however the inventory ought to proceed to outpace the market on the again of excessive single digit income progress and margin enlargement.

Market

Stryker’s numerous product portfolio exposes the corporate to a variety of demand drivers. Stryker continues to observe strong demand throughout its product portfolio, which needs to be aided by easing monetary situations. Some friends have pointed in direction of a troublesome capital surroundings, which is probably going true to some extent however the discrepancy relative to Stryker highlights the power of Stryker’s enterprise. Hospital CapEx budgets reportedly stay wholesome and in consequence, Stryker’s capital order e book was elevated coming into 2024.

Orthopedics continues to learn from structural tailwinds, which Stryker expects to continue through 2024. These tailwinds embrace the adoption of robotic-assisted surgical procedure, demographics and a more favorable pricing environment than previously. Stryker expects giant joint finish market progress within the mid-single digits, which is above common consensus. Stryker has acknowledged that a few of this can come from procedural backlogs which have developed over the previous few years.

Geopolitical tensions and financial weak point in some geographies are weighing on Stryker’s gross sales although. Quantity primarily based procurement is frequent in China for high-priced and high-volume gadgets and has contributed to an 80-90% price reduction for hip and knee implants. China is simply roughly 2% of Stryker’s gross sales although, so the influence is minimal.

The current rise of weight reduction medication has created some uncertainty concerning future demand for joint alternative surgical procedure, however doubts look like unfounded. Whereas decrease weight problems charges might scale back the demand for joint surgical procedure in the long term, the speedy influence is prone to be optimistic as decrease BMIs assist to make extra individuals eligible for surgical procedure.

Stryker

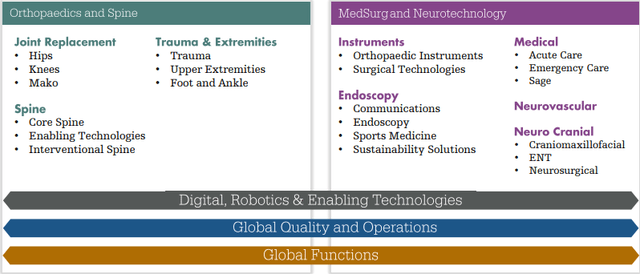

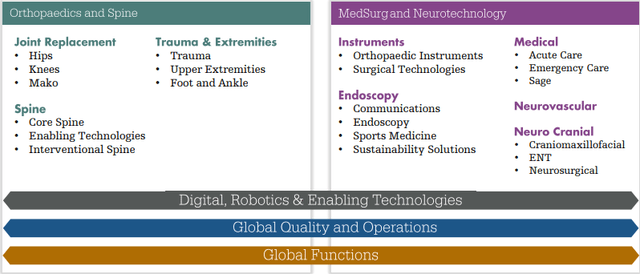

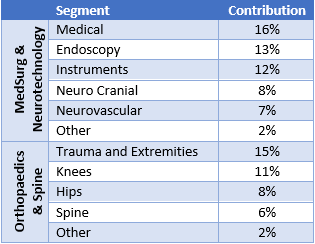

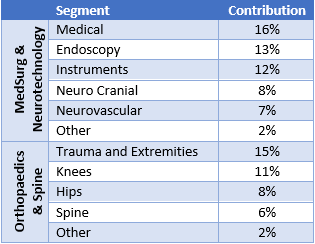

Stryker provides a various vary of merchandise that are broadly grouped underneath Orthopedics and Backbone and MedSurg and Neurotechnology. Whereas orthopedic surgical procedure constitutes a big a part of the enterprise and continues to steadily develop, Stryker’s income is changing into extra diversified. Specifically, Stryker is optimistic about the way forward for its Medical enterprise, largely as a consequence of Vocera.

Determine 1: Stryker’s Enterprise (supply: Stryker) Desk 1: Stryker Income Contribution by Phase (supply: Created by writer utilizing information from Stryker)

Stryker’s scale allows it to speculate a comparatively great amount in R&D (1.2 billion USD in 2022), supporting the corporate’s aggressive benefit. An instance of that is Stryker’s investments in additive manufacturing, which allows implant personalization, the creation of extra advanced elements and the manufacturing of implants that higher combine with a affected person’s tissue. In 2019 Stryker introduced plans to speculate 200 million Euro in R&D amenities in Eire. This included the corporate’s AMagine Institute, which develops additive manufacturing merchandise for Stryker’s backbone, craniomaxillofacial and joint alternative divisions. The 156,000 sq. foot facility in Eire was opened in 2022, creating capability for an additional 600 jobs.

Surgical robotics is one other vital a part of Stryker’s enterprise that’s being supported by R&D. Stryker entered this market via the acquisition of MAKO in 2013 for 1.65 billion USD and believes that it’s the clear market chief. MAKO is a pioneer in robotic assisted orthopedic surgical procedure, having been based in 2004. It was initially targeted on knees, however has since expanded to hips, shoulders and shortly spines.

Whereas the final pattern is in direction of robotic assisted surgical procedure, the power of the worth proposition varies throughout surgical procedure sort. Demand for robotics in knees was pushed by inconsistency. Inside hips, that is much less of a priority, making robotics a more durable promote. Shoulder surgical procedure is a posh process because of the quantity of sentimental tissue. The flexibility of robots to attenuate smooth tissue injury is subsequently a promoting level for shoulder surgical procedure.

Stryker achieved file MAKO placements within the fourth quarter of 2023, and can be driving larger utilization of its techniques, partially via DTC promoting. The corporate’s preliminary focus was on placements, however it’s now attempting to drive utilization of an more and more giant put in base. On the finish of 2023, 60% of the corporate’s knee surgical procedures within the US and 34% of hip surgical procedures have been carried out utilizing MAKO.

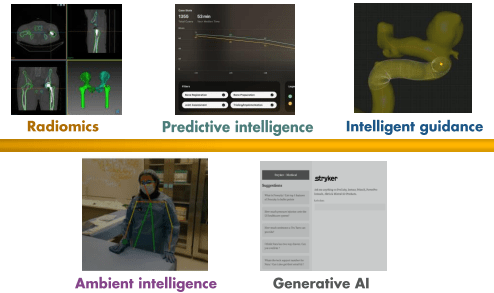

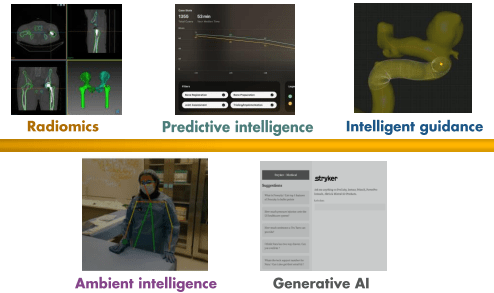

AI may be a tailwind for Stryker’s enterprise in coming years, with scale probably offering a sustainable information benefit. The breadth of Stryker’s enterprise signifies that AI could possibly be leveraged in numerous areas, however imaging and surgical planning and steerage are prone to be areas of explicit curiosity.

Determine 2: Stryker AI Alternatives (supply: Stryker)

Stryker’s R&D efforts contribute to a pipeline of latest merchandise, which ought to assist assist future progress. Upcoming product launches which Stryker believes have excessive potential embrace Pangea for the trauma enterprise and new defibrillator that’s pending FDA approval.

Determine 3: Stryker Platform Launches (supply: Stryker)

Along with inside improvement, Striker can be an lively acquirer, having carried out in excess of 50 acquisitions over the previous decade. Stryker accomplished the acquisition of Vocera Communications, a pacesetter in digital care coordination and communication, in early 2022. Vocera’s enterprise platform eliminates disparate communication gadgets, serving to to streamline communication. Stryker believes that its answer is the chief in a 1 billion USD market. The acquisition is anticipated to reinforce Stryker’s digital healthcare choices and the corporate’s concentrate on stopping antagonistic occasions. It offers Stryker with a platform on the intersection of medical gadgets, software program and scientific assist. After 2 years, integration actions at the moment are full, and Stryker is reportedly happy with Vocera’s double-digit sales growth.

Stryker additionally lately accomplished the acquisition of Cerus Endovascular. Cerus offers neurointerventional gadgets for the remedy of intracranial aneurysms. The acquisition is anticipated to strengthen Stryker’s hemorrhagic portfolio inside the Neurovascular enterprise. Stryker continues to be in search of approval within the US (seemingly nonetheless a number of years away) however has acknowledged that the acquisition is off to a good start to this point.

Stryker additionally plans on acquiring SERF, a joint alternative firm primarily based in France. SERF is understood for its improvements in hip implants and would assist to extend Stryker’s presence in Europe.

Monetary Evaluation

Stryker registered income progress of around 11% YoY within the fourth quarter of 2023. Natural gross sales progress was pushed by power in devices, endoscopy, medical, neuro cranial, hips, knees and trauma and extremities. Excluding China, Stryker’s worldwide progress was additionally sturdy, with Canada and Australia areas of explicit power. Demand for capital merchandise additionally stays resilient, with Stryker attaining double-digit natural progress in medical, devices and endoscopy.

- Endoscopy had US natural gross sales progress of 17.9%, with momentum from the launch of the 1788 digicam system

- Medical had US natural gross sales progress of 12.9%, led by Vocera, Acute Care and Sage

- Neurovascular had US natural gross sales progress of seven.6%, pushed by Stryker’s hemorrhagic enterprise

- Neurocranial had US natural gross sales progress of 14%

- Orthopedics and Backbone had natural gross sales progress of 10.9% within the US, with the knee and hip companies each performing nicely

- The Trauma and Extremities enterprise within the US grew 12.1% organically

Stryker is at the moment guiding to 7.5-9% income progress in 2024, which appears to be primarily based on its goal of outgrowing the market with a modest backlog tailwind.

Whereas Stryker is already a big firm, which naturally raises questions in regards to the sustainability of its progress, its income is kind of diversified, and progress is powerful throughout finish markets. Stryker’s finish markets are prone to assist long-term progress, and there stays a big worldwide enlargement alternative. Only 26% of Stryker’s revenue got here from exterior the US in 2022, indicating that the corporate is underneath penetrated internationally.

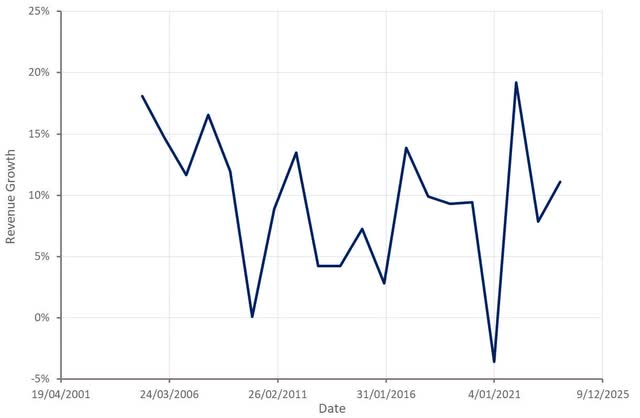

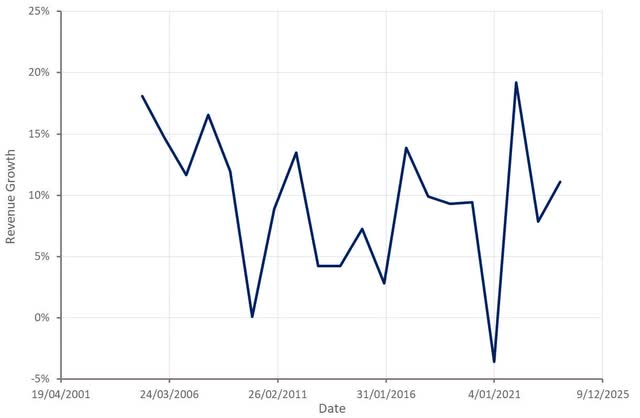

Determine 4: Stryker Income Development (supply: Created by writer utilizing information from Stryker)

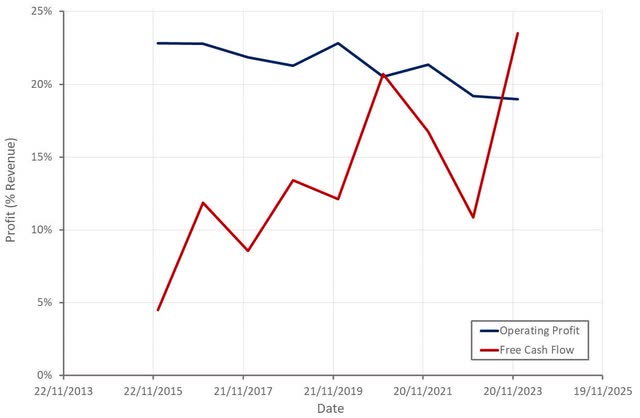

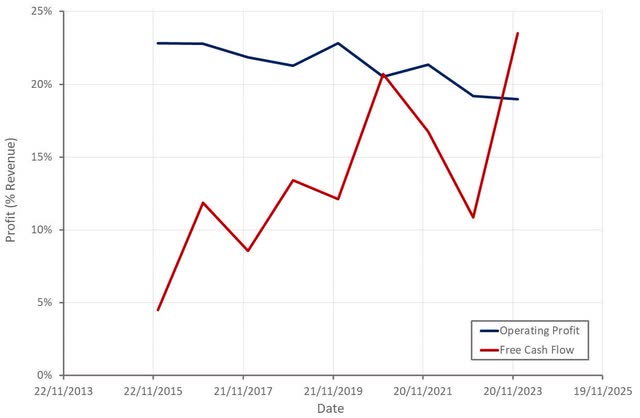

Stryker’s working revenue margin has been underneath strain lately, largely because of the amortization of goodwill and intangibles. Free money flows have been bettering although as Stryker’s enterprise has scaled and continued to mature. That is being aided by an easing of value pressures post-COVID and a extra favorable pricing surroundings, notably in Stryker’s MedSurg and Neurotech companies.

Determine 5: Stryker Profitability (supply: Created by writer utilizing information from Stryker)

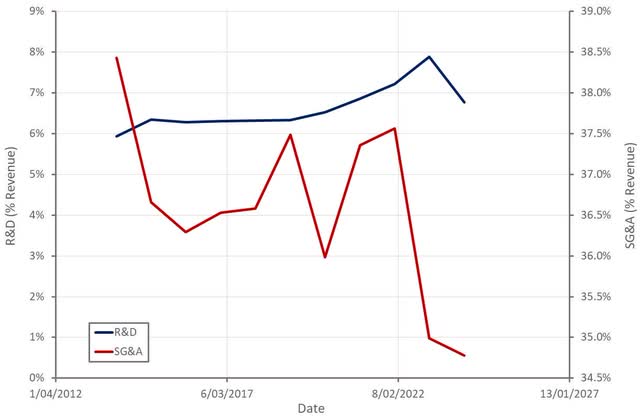

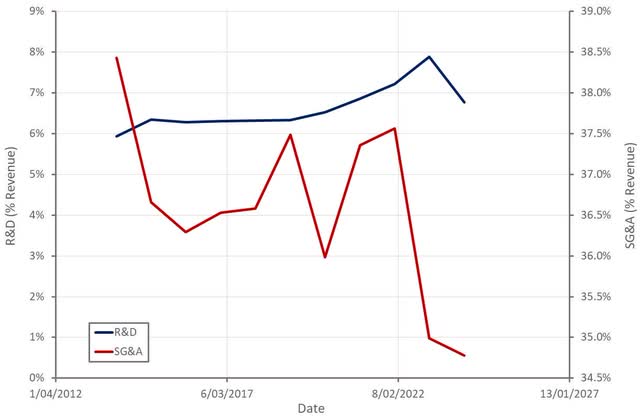

Stryker has elevated the tempo of funding in its enterprise lately, which is probably going not less than partly answerable for the rise in progress. Whereas Stryker stays targeted on driving progress via inside innovation and M&A, it seems to be reaching a profitability inflection level, which is supportive of the corporate’s long-term double-digit earnings progress goal.

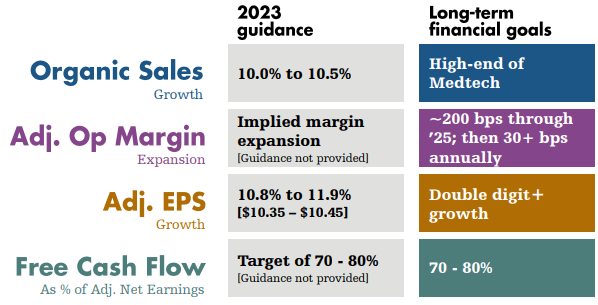

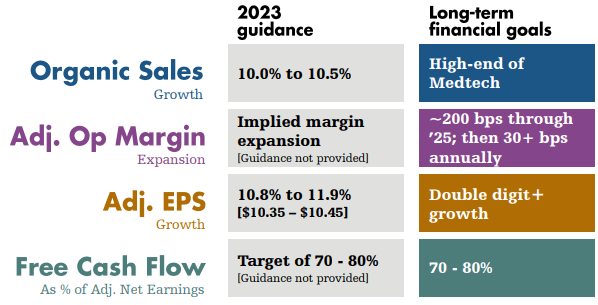

Determine 6: Stryker Working Bills (supply: Created by writer utilizing information from Stryker) Determine 7: Stryker Monetary Targets (supply: Stryker)

Conclusion

Accelerating progress and bettering money flows have pushed Stryker’s valuation larger lately. Whereas Stryker’s earnings a number of has expanded considerably lately, I imagine the standard of the enterprise and the top market alternative assist this a number of. The mixture of excessive single digit income progress and margin enlargement ought to result in continued strong share worth efficiency going ahead, albeit at a extra modest tempo than the current previous.

Determine 8: Stryker Relative Valuation (supply: Revealera.com)