HandmadePictures/iStock through Getty Photos

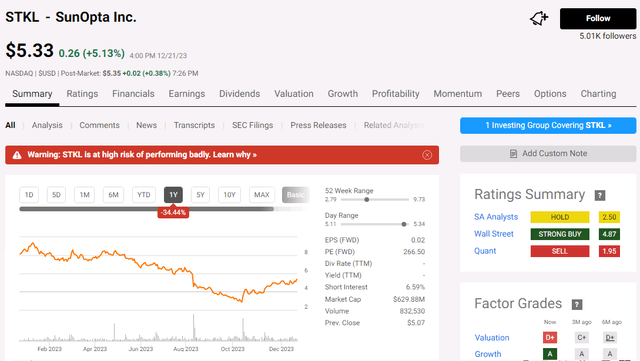

SunOpta’s (NASDAQ:STKL) transformation initiatives seem like a step in the suitable course and will positively help progress and profitability. Prospects seem baked into the inventory.

Firm Overview

SunOpta is a Canadian producer of plant-based drinks and creamers, protein shakes, teas, and broths, in addition to fruit snacks, and smoothie bowls for personal label and nationwide manufacturers offered by means of retail and meals service channels. SunOpta additionally produces merchandise underneath their very own manufacturers together with SOWN® (oat creamer), Dream® (plant milks together with rice milk, coconut milk, almond milk, soymilk for retail and foodservice prospects) and West Life™ (soymilk).

9M 2023 Efficiency

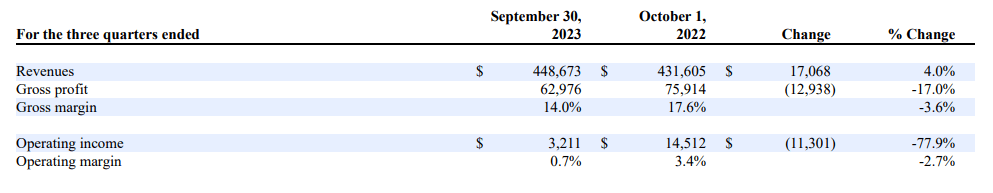

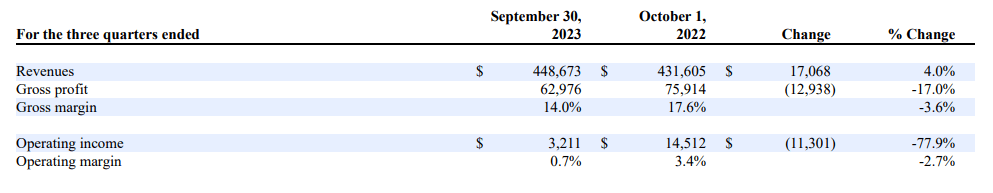

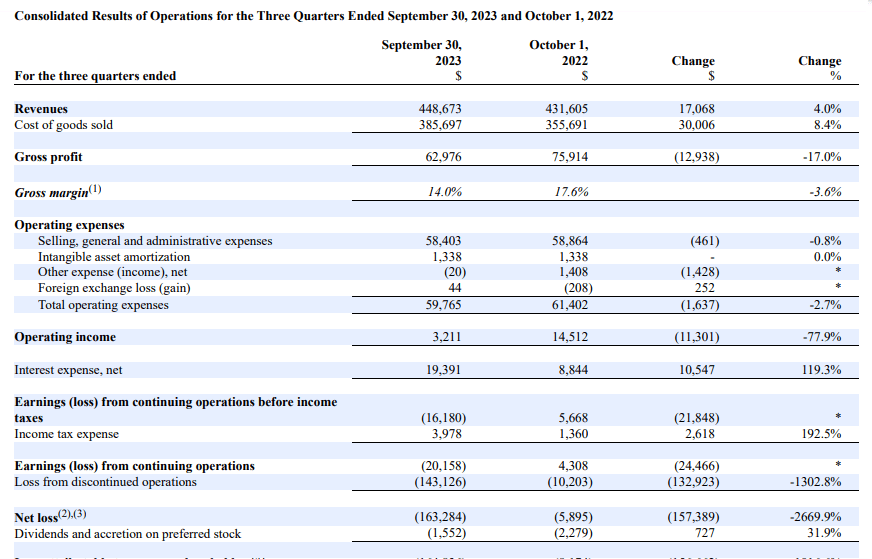

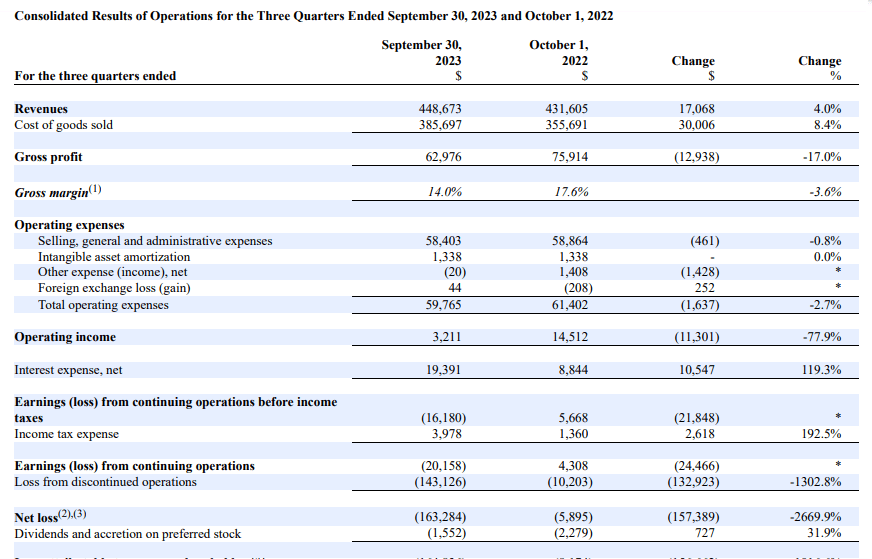

For the nine months ended September 2023, SunOpta’s revenues elevated 4% YoY to $448.7 million pushed by pricing actions and quantity progress, barely offset by decrease exterior gross sales of plant-based components as a result of a buyer transferring a part of their enterprise to a second-source provider.

Gross margin amounted to 14% for the 9 months of 2023 (17% after adjusting for a one-off improve in startup prices associated to capital growth initiatives). Working margin amounted to underneath 1% for 9M 2023 (4% adjusted).

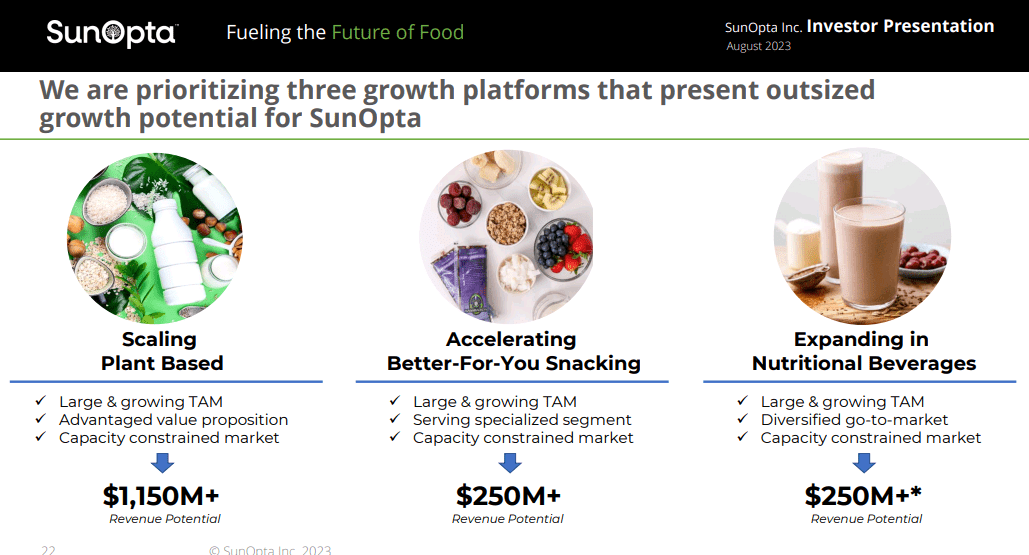

SunOpta Q3 2023, 10-Q

Wanting forward, the corporate is exploring a lot of opportunities to drive progress, notably growing buying new prospects, TAM growth (by means of new markets within the beverage area comparable to protein shakes), and market share beneficial properties with present prospects. Administration is upbeat concerning the firm’s close to time period outlook with income progress expectations within the excessive single digit to double digit vary for 2024. Medium time period, administration initiatives SunOpta’s income potential at over $1.5 billion over the subsequent 5-7 years, a lot of it within the plant-based enterprise which in administration’s view might doubtlessly develop right into a billion greenback enterprise, doubling from that generated in FY2022 (SunOpta generated revenues of $934 million in FY2022 of which plant primarily based meals and drinks generated $557 million, whereas fruit primarily based meals and drinks, which incorporates their lately disposed frozen fruit enterprise, generated the rest). The current opening of SunOpta’s $125 million plant-based beverage facility in Texas “significantly expands” their manufacturing capability, enabling them to satisfy this income goal. Analysis experiences mission plant primarily based beverage gross sales to develop within the double digits over the approaching years within the U.S. the place SunOpta generated most of its revenues.

SunOpta Q3 2023 Investor Presentation

Profitability may benefit from a lot of strategic efforts as nicely. Following the disposal of their sunflower enterprise final 12 months and their lower-margin frozen fruit enterprise this 12 months, SunOpta is now a single section firm targeted largely the plant-based area which isn’t solely a fast-growing sector however has sometimes been the next margin enterprise as nicely (section margins for SunOpta’s fruit primarily based meals and beverage enterprise have hovered within the low single digits or beneath break even over the previous few years whereas plant primarily based meals and beverage section margins are across the mid single digits). Share beneficial properties and capability growth within the plant-based area might doubtlessly additional enhance margins by means of scale economies, whereas their change from commodity manufacturing to worth added manufacturing (by means of their rising portfolio of owned manufacturers in plant meals and drinks) might be margin accretive as nicely. Administration famous of their Q2 2023 earnings name that the corporate has remodeled their portfolio from 70-30 commodity/worth add to 30-70 they usually stay dedicated to continued transformation. Administration expects gross margins to enhance to 20% going ahead. Moreover, continued deleveraging might ease curiosity prices which as a result of rising rates of interest have greater than doubled in 9M 2023 in comparison with the identical interval final 12 months, benefiting web margins.

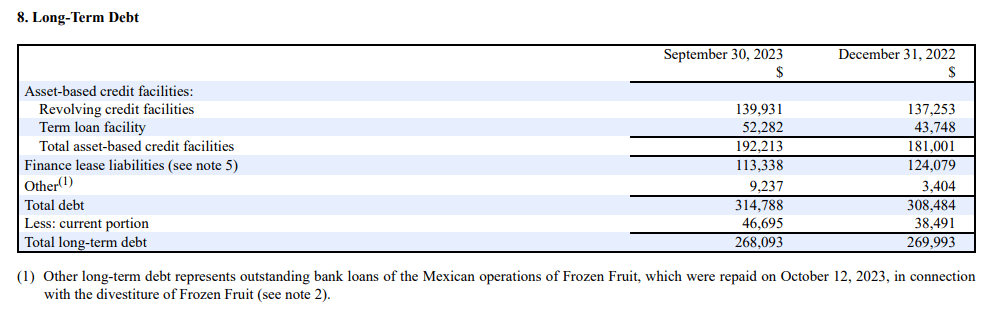

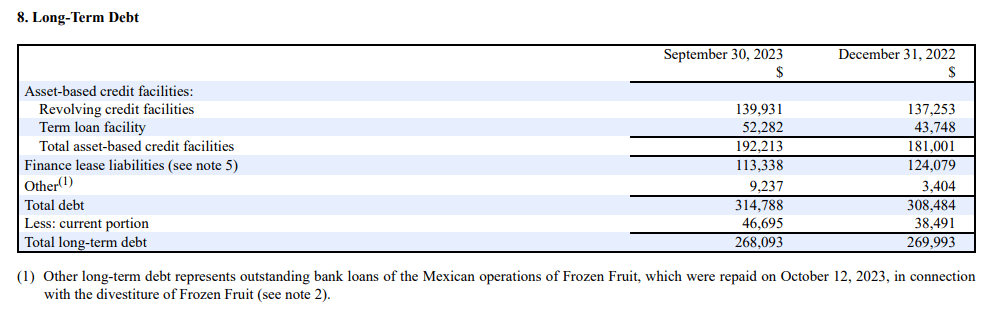

SunOpta Q3 2023, 10-Q

About $75 million of the $141 million gross sales proceeds from the sale of their frozen fruit enterprise in October 2023 was used to pay down debt which post-payment stood at over $240 million and leverage at 3.2x on the finish of October 2023. Administration made clear of their Q3 2023 earnings name that they intend on lowering leverage to a manageable sub-3x stage by subsequent 12 months, partly utilizing free money flows (levered) that are anticipated to be round $35 million to $45 million in 2024.

SunOpta Q3 2023, 10-Q

Dangers

Execution and aggressive dangers

The plant primarily based area is saturated and extremely aggressive and SunOpta is up towards greater gamers like Silk (from Danone) (OTCQX:DANOY) and Nestle (OTCPK:NSRGY) who’ve monetary and scale benefits towards SunOpta. SunOpta administration foresees intensifying competitors and heightened promotion exercise in 2024, and aggressive pressures might intensify long term.

Furthermore, SunOpta’s focus by itself manufacturers competes with their non-public label and co-manufacturing prospects (who embrace gamers like Walmart (WMT) and Nestle), who might in flip shift their enterprise to competing suppliers with out an personal model portfolio. SunOpta’s prospects are fairly concentrated with over 70% of revenues generated from their high 10 prospects leaving them fairly weak to earnings volatility which can hinder progress projections, profitability, free money stream era, deleveraging targets and subsequently doubtlessly growing solvency dangers.

Conclusion

SunOpta has a ‘Sturdy Purchase’ analyst consensus score. In search of Alpha’s Quant system charges it a ‘Promote’.

Taking the next assumptions primarily based on administration’s projections suggests SunOpta is price underneath $700 million, suggesting a excessive single digit upside from their present market capitalization of round $630 million, nonetheless this situation assumes the corporate efficiently reaches a 16% progress price yearly which seems aggressive, might not materialize given aggressive pressures within the plant-based area, and provides little margin for error for an investor. A extra reasonable progress assumption of 12% suggests the corporate is price underneath $600 million.

|

Income progress YoY % |

16% over the subsequent seven years primarily based on administration’s $1.5 billion aim in 5-7 years, which interprets into an annual progress price of round 16% yearly over a seven-year interval beginning in 2023 when revenues are projected at round $600 million |

|

Terminal progress price % |

2% |

|

Internet margin % |

5% in 2024 (being their first full 12 months as a largely plant-based enterprise) step by step bettering to 7% as a result of scale economies, and an growing share of worth added manufacturing. For perspective, Nestle’s powdered and liquid drinks section has a section margin of 20% |

|

Depreciation % |

4% of revenues |

|

CAPEX % |

4.5% of revenues yearly upkeep CAPEX plus an assumed extra $100 million funding in capability growth in 12 months 4 |

|

Low cost price % |

10% |