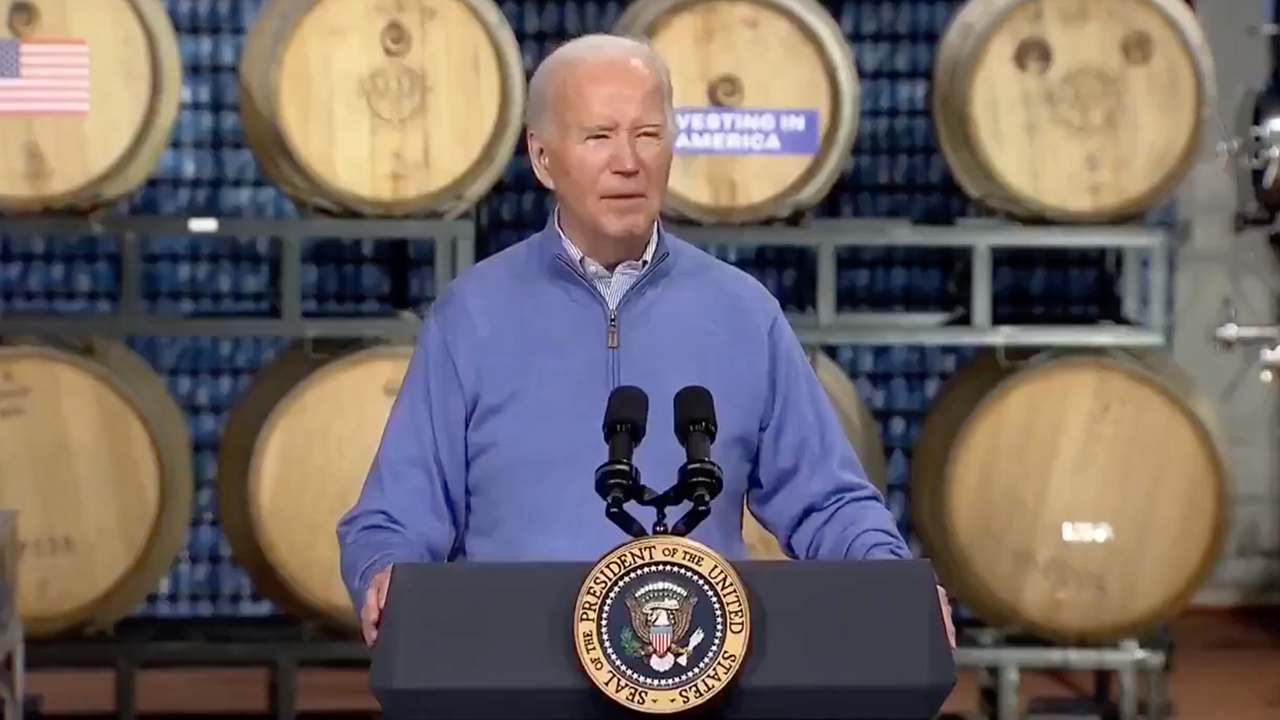

Big gantry cranes and off loading freighter in Haifa container port, Israel.

Ucg | Common Photos Group | Getty Photos

LONDON — Shares of Danish transport large Maersk slumped greater than 11% in early commerce Thursday after it flagged “high uncertainty” in its 2024 earnings outlook amid Purple Sea disruptions and an oversupply of transport vessels.

The corporate additionally stated that it could be suspending share buybacks on the again of the uncertainty.

Maersk stated it anticipated underlying EBITDA (or earnings earlier than curiosity, tax, depreciation and amortization) of between $1 billion and $6 billion this yr, in comparison with the $9.6 billion recorded in 2023.

Shares had been buying and selling 12.2% decrease at 8:14 a.m. London time.

“The impact of this situation is causing new uncertainty for how this is going to play out from an earnings perspective throughout the year,” CEO Vincent Clerc advised CNBC’s “Squawk Box Europe.”

“We have very little visibility as to whether this is a situation that will resolve in a matter of weeks or months, or whether this is something that is going to be with us for the full year,” he added.

In a press release, the corporate added that its board had determined to “immediately suspend the share buy-back programme, with a re-initiation to be reviewed once market conditions in Ocean [division] have settled.”

It comes as the corporate reported fourth-quarter revenue beneath expectations Thursday, with EBITDA for the three-month interval dropping to $839 million versus the $1.13 billion anticipated by analysts.

International provide chains have confronted critical disruption since late 2023 after main transport firms started diverting journeys away from the Purple Sea following a string of assaults by Yemen’s Houthi rebels.

The Iran-aligned group has targetted industrial vessels with drones and missiles in what they are saying is an act of solidarity with Palestinians amid the continued Gaza-Israel struggle.

The diversions round one of many world’s busiest transport lanes have pushed up supply occasions and prices, with the OECD warning Monday that it might enhance inflation.

The Paris-based group stated that the current 100% rise in seaborne freight rates, if persistent, might see import worth inflation throughout its 38 member international locations rise by almost 5 share factors.

The rerouting has boosted freight charges for transport firms, however Clerc stated it was unlikely that these will increase would feed by means of to earnings.

“I don’t think from an earnings perspective, for the industry or for Maersk, when you look at it in its entirety that this is going to be something where we generate significant profit out of the situation,” he stated.

“It is something where today the amount of cost we’re absorbing in order to keep the global supply chain going is still unknown.”