RiverNorthPhotography

Thesis

As investors continue to navigate this AI-driven market where fundamentals seem to take a backseat, many high-quality compounders remain underappreciated and overlooked. Rarely does an opportunity arise to purchase dividend aristocrats trading at 60-cent dollar bill valuations. For value-oriented investors, there’s no better scenario than the majority of market participants turning a blind eye to the “boring” compounders while they quietly position themselves for long-term growth.

This unique, generational dynamic has allowed a best-of-breed company like Sysco (NYSE:SYY) to slip under the radar. With three consecutive quarters of top-line misses, underwhelming investor day guidance, and fears of a consumer slowdown creeping in, investors have written Sysco off for dead. However, while investors continue to view Sysco through the lens of a “show me story,” they continue to expand their competitive advantages and are poised to capitalize on several secular trends. For those able to see the forest through the trees, Sysco appears to be a golden opportunity.

Competitive Advantages

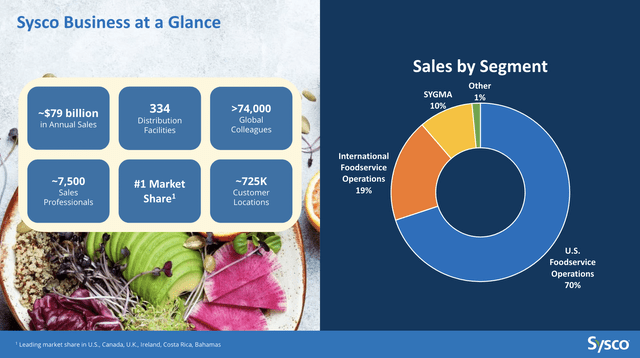

As previously mentioned, I consider Sysco as a best-of-breed company in the food distribution sector. The natural follow-up question is, why? To start, Sysco is the world’s global food service leader, providing a wide range of food and non-food products to restaurants, healthcare and education facilities, and government organizations. The food distribution industry, though not flashy, is an undeniable necessity and will remain in high demand as long as people continue to eat. This fundamental and irreplaceable nature is a key characteristic that I look for in new investment opportunities.

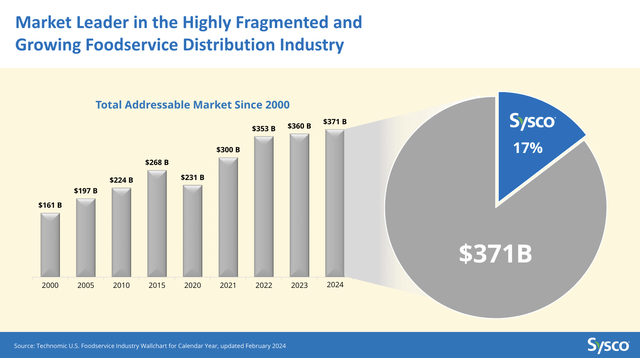

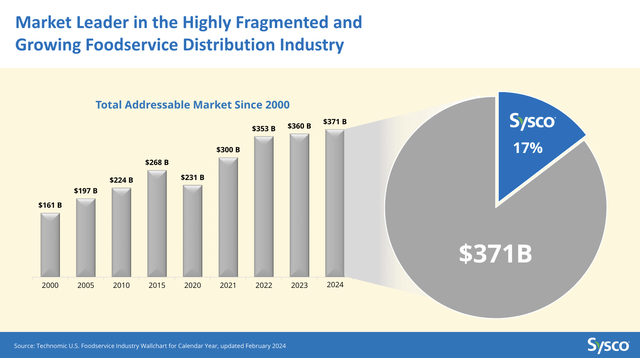

In addition to benefiting from an irreplaceable product, Sysco also leverages its extensive economies of scale to widen the moat further. The food service distribution industry, valued at $371 billion, is highly fragmented and is one where size and scale are critical.

Sysco Investor Relations

The sector is dominated by the “Big 3” —Sysco, US Foods (NYSE:USFD), and Performance Food Group (NYSE:PFGC)—holding approximately 40% of the market, with smaller regional distributors controlling the remaining 60%. Sysco commands a whopping 17% market share, dwarfing its competitors as they are double the size of US Foods and 25% larger than Performance Food Group.

As the Q3 earnings call highlighted, all three industry giants continue to outpace broader market growth. It was no coincidence that each “Big 3” member attributed this outperformance to advantages achieved through size and scale. Sysco is the biggest beneficiary of these scale-related advantages, operating a global network of 334 distribution facilities and boasting a workforce of over 74,000.

Sysco Investor Relations

In comparison, Performance operates 78 facilities and US Foods operates 70 facilities, figures not even in the ballpark range of Sysco. This highly efficient, scaled network of facilities gives Sysco a significant edge as it ensures close proximity to the massive customer base of 725,000. This proximity leads to faster, more cost-effective delivery times; an advantage competitors struggle to replicate and a key driver of incremental market share gains.

These scale advantages extend far beyond distribution and logistics, causing a significant ripple effect on purchasing power and other scale-enabled cost advantages. By purchasing food products from thousands of suppliers and in volumes that no existing company matches, Sysco benefits from having the lowest procurement costs in the industry.

This advantage was recently highlighted during the Q3 earnings call, particularly regarding commodity products. While competitors grapple with today’s highly competitive, price-sensitive market, Sysco has turned the environment to its advantage. By having the cheapest commodity procurement costs, Sysco has strategically priced its products at the most competitive rates. This approach has enabled Sysco to gain incremental market share while maintaining industry-leading gross margins of 18.6%, compared to Performance’s 11.3% and U.S. Food’s 16.7%.

The M&A Revival

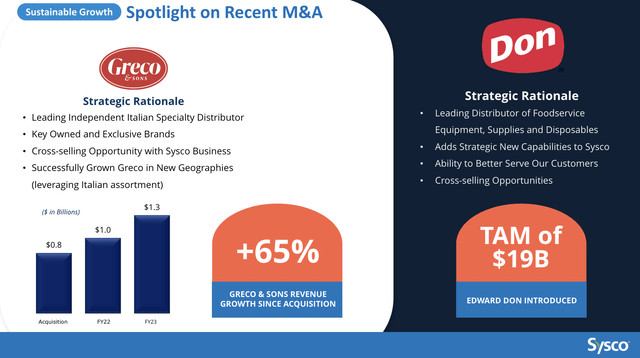

The area where I feel Sysco’s potential is most overlooked lies in its key financial advantages amidst a potential resurgence in mergers and acquisitions (M&A) across the industry. Throughout its history, Sysco has leveraged M&A as the cornerstone of its growth strategy, evidenced by the 200 strategic deals since its inception. Management has consistently demonstrated exceptional capital allocation skills, driven by having 33% of their compensation linked to the three-year average Return on Invested Capital (ROIC). This compensation plan ensures management’s incentives are properly aligned with maximizing shareholder value, contributing to Sysco’s industry-leading 16.4% ROIC.

Sysco’s track record in M&A is quite impressive, highlighted by successful deals such as Greco & Sons and Edward Don. Since acquiring Greco & Sons in 2021, revenues have surged over 65% from $800 million to $1.3 billion.

Sysco Investor Relations

This expansion into the higher margin, speciality Italian market has allowed Sysco to capitalize on cross selling opportunities and expand into new geographical markets. The 2023 acquisition of Edward Don, the leading food service equipment distributor with $1.3 billion in annual sales, has significantly expanded Sysco’s Total Addressable Market (TAM) by over $19 billion. This acquisition substantially increased Sysco’s footprint in equipment and supplies, opening the door for cross-selling potential amongst large Edward Don customers who currently do not use Sysco’s food distribution services.

I believe we are on the cusp of a resurgence in M&A activity, especially within the food distribution sector. As previously noted, smaller distributors, who currently account for 60% of the total market share, continue to grapple with rising labor costs and reduced restaurant traffic. Without the benefit of scale advantages, these regional distributors become highly vulnerable and ripe acquisition targets. Sysco, as the sole investment-grade player in the industry, stands uniquely positioned to capitalize on this consolidation trend.

While I do not foresee large-scale mergers such as the $3.5 billion bid for US Foods in 2013, which the FTC halted, I anticipate Sysco pursuing numerous small to medium-sized bolt-on acquisitions. This challenging macro environment has created a “lion in the winter” opportunity for Sysco, with a robust pipeline of potential deals. While smaller competitors are forced to play defense, Sysco remains on the offensive. This dynamic is a testament to Warren Buffett’s timeless advice to “be greedy when others are fearful.”

Despite cautious guidance of a modest 50 basis point impact from M&A (down from previous expectations of 50 to 100 basis points), the market continues to underappreciate Sysco’s M&A potential. This conservative guidance has set the stage for beats and raises over time, all while Mr. Market continues to overlook this hidden gem.

Sales Force Investments

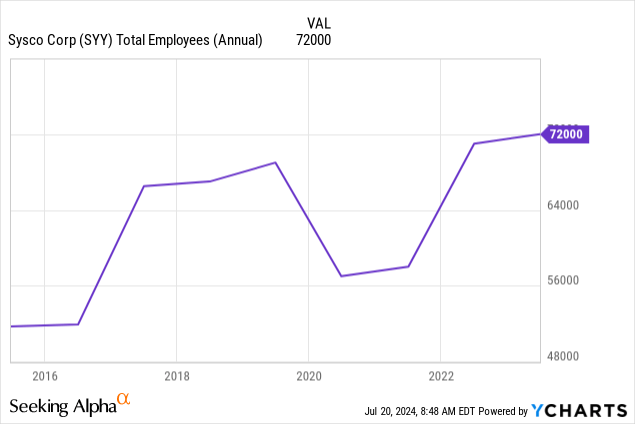

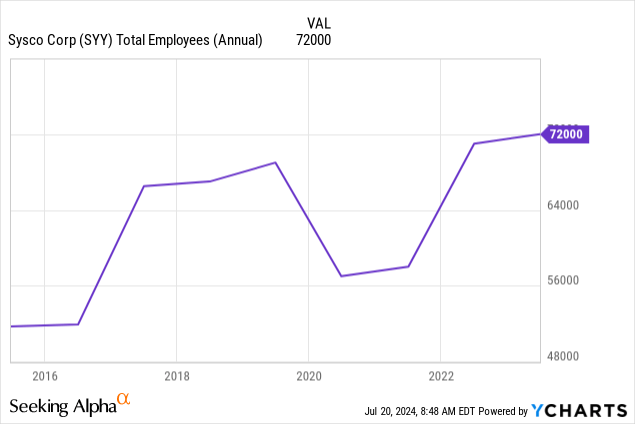

Over the years, Sysco has made significant investments in several key areas, with a primary focus on expanding its sales force. Before the COVID-19 pandemic, Sysco employed a workforce of approximately 69,000. However, due to reduced restaurant activity and shutdowns, this number dropped to a low of 57,000 in 2021. While the global workforce has since rebounded to 74,000, Sysco’s recovery post-Covid has been sluggish, considering the substantial growth since 2019.

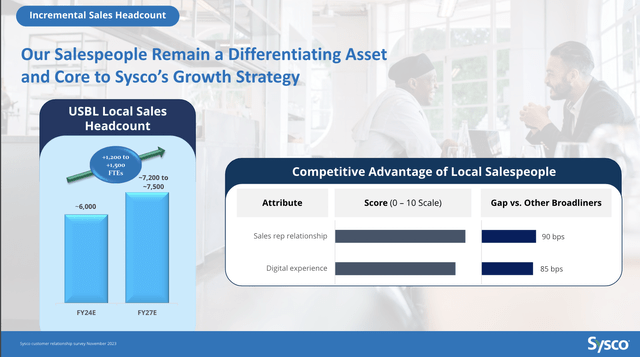

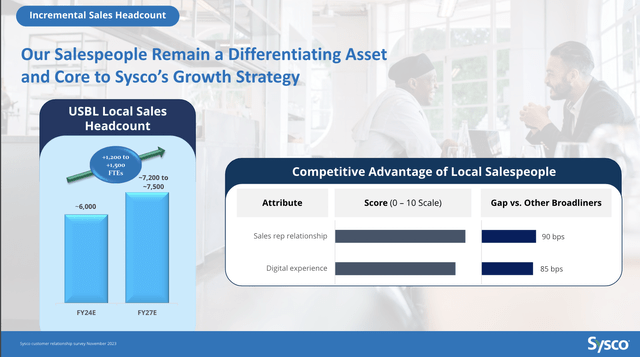

In response, Sysco is doubling down on its investments in the sales force now and for the foreseeable future. In FY2024, Sysco plans to recruit an additional 400 broadline sales representatives and is on track to achieve this target as of Q3 earnings. While FY2024 will center on training and integrating new hires into their roles, Sysco expects substantial growth benefits in FY2025 and beyond.

Sysco Investor Relations

Looking further ahead, Sysco has guided to expand its local sales team by 1,200 to 1,500 positions by FY2027. Achieving this target would bring the total number of US broadline sales reps to 7,200 to 7,500, marking a 20% increase from the current headcount and representing the largest expansion in company history.

At the surface level, investors’ natural instinct and takeaway may be that operating expenses will increase and remain under pressure until FY2027. While this assumption may be correct, the rationale behind Sysco’s emphasis on its sales force can be explained through two simple data points. As highlighted in the recent investor day presentation, maintaining face-to-face customer visits once a week yields an additional 240 basis points in top-line growth. Moreover, each sales consultant makes between 8 to 10 prospective calls per week with a closure rate of approximately 20%. Assuming the lower end of the hiring projection through FY2027, adding 1200 new positions would translate into 12,000 more weekly calls and 2,400 new customers. Simply put, maintaining a strong sales force is critical in the industry, and Sysco is well aware of the fruits of its labor.

Financials

As mentioned earlier, one of Sysco’s primary competitive advantages lies in its robust financial position. Sysco leads the industry for its ability to generate free cash flow, totaling $2 billion in free cash flow over the last twelve months alone. This starkly contrasts US Foods’ trailing twelve-month free cash flow of $791.4 million and Performance Food Group’s $812.4 million, both figures less than 50% of Sysco’s FCF generation. While free cash flow is my favorite metric when searching for new investment opportunities, it’s essential to understand that not all free cash flow is created equal. Generating free cash flow is one thing; effectively deploying it in a shareholder-friendly manner is another. In this regard, Sysco’s management has rightfully earned a reputation for exemplary capital allocation and has set a top-tier example across the industry.

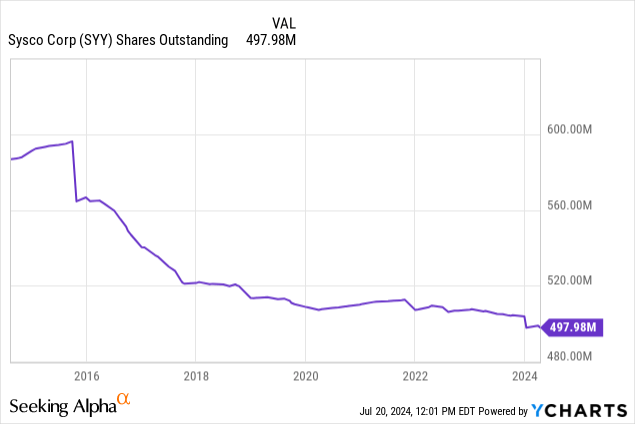

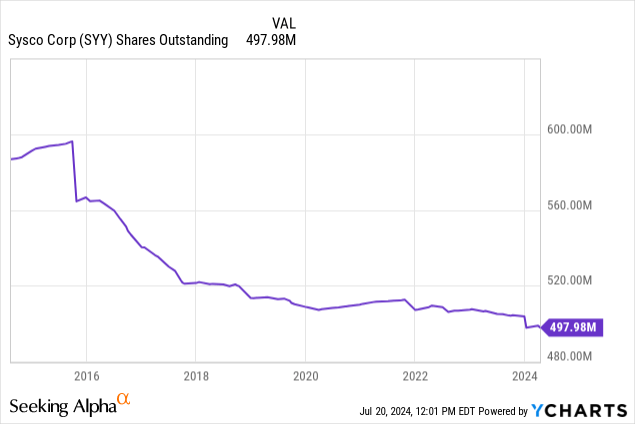

Starting with share repurchases, management has reduced the share count by 16% over the past decade. With $3.3 billion remaining under the current share repurchase agreement, management has conservatively guided for $1 billion in annual buybacks through FY2027. Given the current depressed market price and below-average historical multiple, I expect management to meaningfully accelerate these buybacks and capitalize on bargain prices.

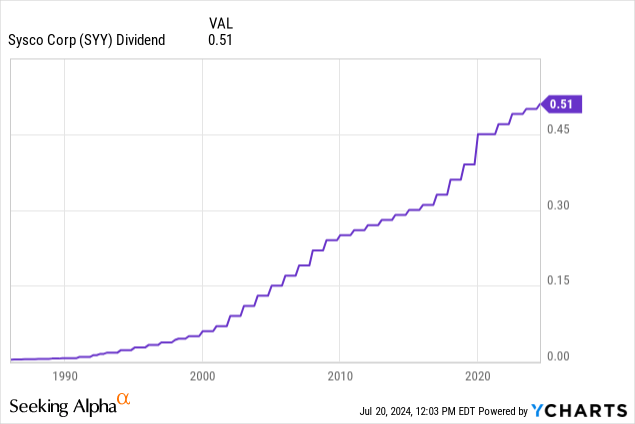

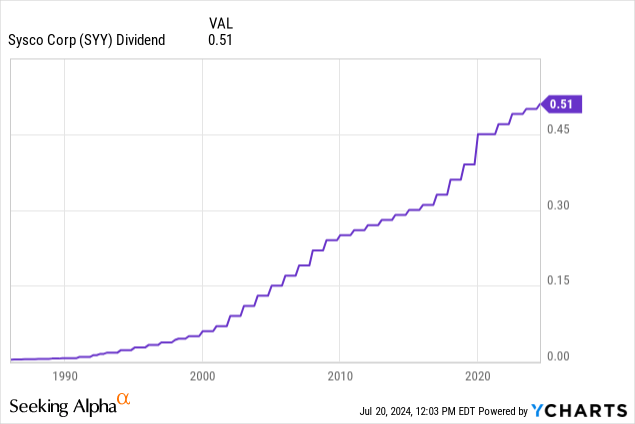

Sysco also holds the highly esteemed title “dividend aristocrat,” having increased its dividend for 54 consecutive years. With a current yield of 2.77% and a healthy payout ratio of 46.95%, I consider this dividend unquestionably safe and a nice “cherry on top” reward for patient investors while awaiting a price recovery. Moreover, I expect dividend stocks, especially aristocrats, to get a bid as we see the first interest rate cuts. With lower yields on treasuries, dividend stocks should become highly attractive and remain in demand for the foreseeable future.

Combining this 2.77% dividend yield with the assumed annual reduction of 2.5% of shares outstanding through the $1 billion in repurchases (based on an average repurchase of $75 per share) results in a total shareholder yield of 5.27%. Investors essentially receive a yield comparable to a Treasury bill alongside the strong potential for significant share price appreciation.

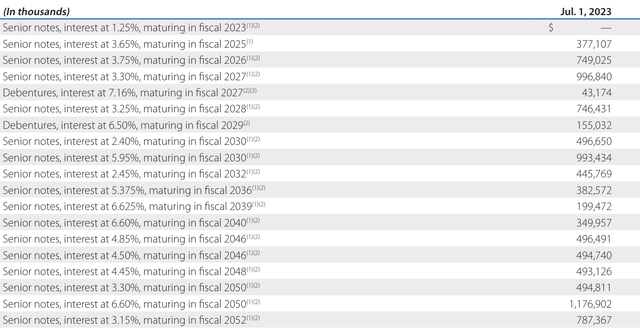

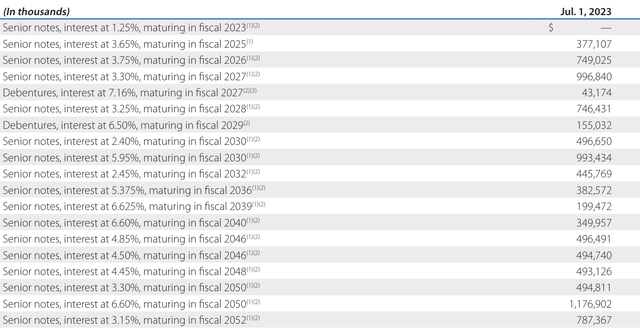

Sysco 2023 Annual Report

The last aspect of Sysco’s balance sheet I would like to highlight is its long-term debt. Sysco has $12.2 billion in long-term debt, 96% of which is secured at attractive fixed rates. Given Sysco’s robust annual free cash flow generation of $2 billion or more and $598 million cash on hand, I am confident in Sysco’s ability to manage debt obligations. The upcoming maturities in FY2026 and FY2027, totaling $749 million and $996 million, should not present any issues. Sysco remains committed to maintaining a solid investment-grade balance sheet, and I do not anticipate this changing in the foreseeable future.

Valuation

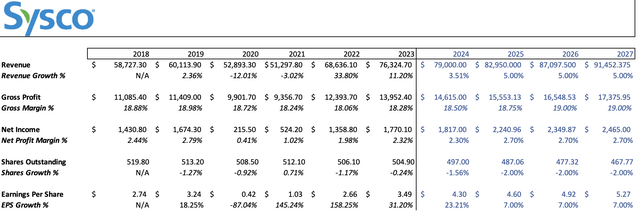

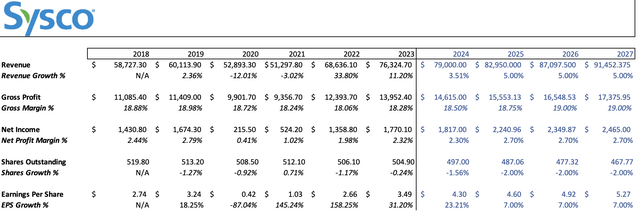

Sysco Earnings and Author’s Calculations

Starting with Sysco’s FY2024 top-line sales, I elected to use management’s previously issued guidance of $79 billion, considering this is the fiscal year’s final quarter. I then opted for a 5% revenue growth rate through FY2027, the midpoint of management’s investor day guidance. While I believe that this investor day guidance was deliberately conservative and constructed to rebuild credibility, it is best to be modest with projections. This 5% revenue growth target is also well below Sysco’s five-year average of 6.45%, again highlighting the conservative approach.

Moving to gross margins, I projected a modest expansion from 18.5% in FY2024 to 19% by FY2027. This expansion is predicated upon inflation stabilization and increased sales of higher-margin specialty products, a core focus for Sysco.

Next, I projected net margins of 2.3% for FY2024, then an expansion to 2.7% through FY2027. This expansion will be driven by continued gains from specialty products and the realization of further cost savings that management has guided for. I forecasted a reduction in shares outstanding to 467.77 million shares, reflecting a 2% annual decrease through FY2027. Given the $3.3 billion remaining under the current share repurchase agreement and the $1 billion in annual buyback guidance, this forecast is likely conservative. Lastly, I applied the midpoint of management’s EPS growth guidance of 6% to 8% through FY2027. This leaves us with an FY2027 EPS of $5.27. By assigning a 20x P/E multiple, well below Sysco’s five-year average of 24.65x, I arrived at a share price of $105.40. This price target implies a 45% upside potential from the current share price. Over three years, this boils down to a 13.02% compounded annual growth rate (CAGR) before considering any quarterly dividend payments.

Bottom Line

Given the current market environment, I believe now is an excellent moment for investors to get defensive and add exposure to consumer staples. Sysco stands out as a prime opportunity for patient investors and is poised for a rebound. I recommend SYY as a strong buy with a target price of $105.40.