asbe/iStock through Getty Photos

Hear under or on the go on Apple Podcasts and Spotify

Amrita Roy and Rob Isbitts are each bullish on gold and T-bills (0:25). Inflationary and deflationary tug of conflict, macro volatility and central banks piling into gold (1:25). Why liquidity is the glue that drives every part ahead (5:00). That is an abridged dialog from a latest Investing Consultants podcast.

Transcript

Rob Isbitts: Amrita Roy, you write about two of the most well-liked investing matters of our time, I feel, macro market evaluation and tech shares. Your backside line proper now could be you are bullish on T-bills, hey, me too, and gold.

And though with regards to gold, I’ve to say, it has been a mandatory evil for me over time. So I am actually focused on listening to what you say about that. However what’s high of thoughts for you proper now?

Amrita Roy: Certain. At present, I feel I am going to focus most of my dialog on extra of the defensives in my portfolio, which one among them you talked about is T-bills, given its risk-free fee of 5.25% makes good sense from a money allocation standpoint, which earns risk-free curiosity.

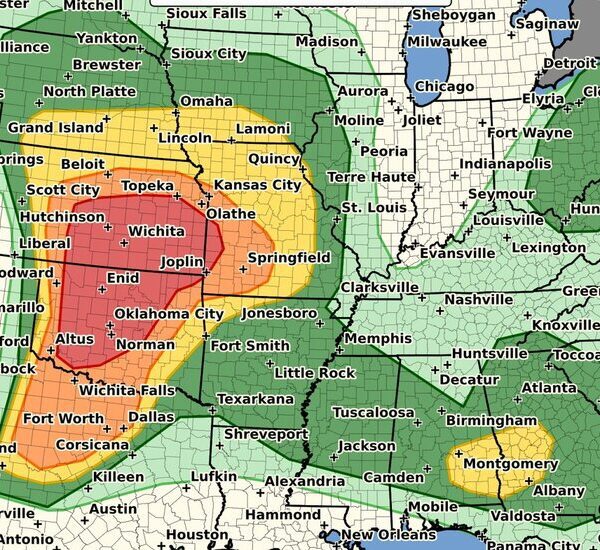

And the second factor is gold. Such as you stated, it is a mandatory evil, however we’re at a really attention-grabbing macro volatility atmosphere proper now the place there’s actually a tug of war between inflationary and deflationary forces.

And my bull case with gold over the long-term primarily is that gold has sniffed out the dynamic that the Fed’s 2% inflation fee is probably not that achievable beneath the form of macroeconomic indicators that we’re presently getting.

RI: You’re a macro strategist. You and I share that. Inform us what’s within the hopper for you proper now.

AR: Certain. So, like I stated earlier than, we live in very attention-grabbing occasions with regards to the general macroeconomic atmosphere. There’s actually a tug of conflict between the inflationary and deflationary forces in the intervening time. We’re in a fiscal dominant period with authorities deficits on the rise, and there’s only a rising divergence between the haves and the have-nots.

And it is simply not about even particular person shoppers, you possibly can see that amongst firms as effectively. The rising divergences between firms which have pricing energy and corporations which might be simply struggling to even meet their financing necessities. So that is truly creating a extremely type of a inventory picker’s atmosphere.

So a few issues. So to tie again to what I had stated earlier in my earlier podcast, I had talked about firms that truly will stand to learn from this entire macroeconomic atmosphere, that are driving their product improvements by way of AI, for instance, and seeing deeper adoption of their platform spend, resulting in greater margins, main to higher working performances.

And people firms I had talked about had been those which might be centered – which might be particularly round industries resembling cybersecurity or DevSec and even sure sorts of client tech firms.

However immediately, I need to focus, as I stated, extra on the defensive facet, which is on the T-bills and gold, which I feel are very attention-grabbing. So to take a step again, I’m a technological optimist. However on the similar time, on this macro atmosphere, I feel it is sensible to be a Pragmatic Optimist first, as a way to just remember to have a portfolio that’s balanced.

So with regards to gold, gold is at a really attention-grabbing cut-off date, as a result of there are two issues which might be taking place that’s making the case for gold. One is macro volatility, and the second is that central banks all over the world are piling into gold.

In terms of the macro volatility, we’re seeing this very attention-grabbing factor the place gold is transferring according to the 10-year actual treasury bond yield. That may be a little bit unusual, however not unusual on the similar time, given type of the period that we’re in.

Basically, when gold goes up according to the 10-year treasury yield, it finally form of signifies that the gold has already sensed out that, or in different phrases, it would not imagine that the Fed goes to fulfill its 2% inflation goal, given the form of scorching CPI prints we’re getting three months in a row and the repricing in rate of interest futures in the intervening time, which is simply pricing in two fee cuts.

So given this dynamic, I imagine that together with the truth that that central banks are additionally pouring in into gold to handle their FX higher or to enhance their high quality of FX, I feel, gold has an actual case in the intervening time for a long-term bull run on this macro atmosphere, the place additionally sure sorts of expertise shares may also stand to learn on the similar time. Attention-grabbing occasions, I do know.

RI: So let me get this straight, Amrita. All that chatter about six or seven Fed rate cuts this 12 months and all that glad discuss and inflation’s gone for good and the Fed bought it proper and all that stuff, that was simply one other cyclical spherical of mainstream Wall Road, massive companies with massive voices, telling us glad discuss, in order that we’d purchase extra stuff?

AR: Nice level. I feel when optimism begins to return, everyone will get very, very optimistic. Like I stated, even within the earlier podcast that I don’t, like I see S&P 500 persevering with to chug alongside within the earlier month, which it did for one more 100 or so factors as a result of there was actually no catalyst at the moment on condition that This fall earnings had been over for S&P 500 to immediately say, oh my God, I will begin to worth in a tough touchdown state of affairs.

It was getting good earnings, like firms had been presenting robust earnings projections; and B, we had been additionally seeing inflation type of steadying out, declining on the similar time. However I feel when markets begin to freak, everybody begins to freak. So that’s what is presently taking place.

A few issues, I feel we regularly are likely to overlook what sort of an enormous fiscal dominant period that we’re in, which is inherently inflationary.

And the second half is that finish of final 12 months, when the Fed virtually type of did not declare, however indicated that the inflation combat was roughly over that it had conquered inflation, the bond market type of virtually declared victory, which is precisely why the rate of interest futures had been pricing in far more fee cuts, I feel, six to eight, far more than the Fed’s three fee minimize projections.

This inherently loosened monetary circumstances and possibly one of many primary drivers of why we’re seeing the CPI print coming scorching as soon as once more for 3 months in a row in the intervening time.

However my pondering is that the bond market is presently doing a lot of the work by retightening as soon as once more. And we could as soon as once more see type of inflation begin to come down once more, hoping that nothing breaks within the banking or within the treasury market, as a result of liquidity is finally the glue that drives every part ahead.