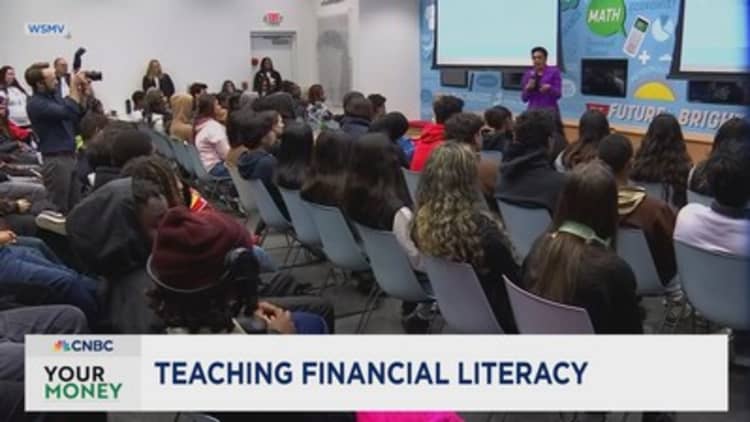

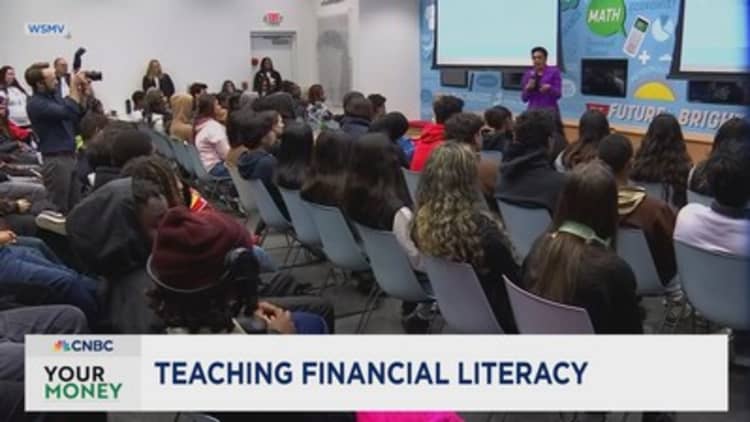

Taking a financial education class in highschool does repay.

Actually, there’s a lifetime good thing about roughly $100,000 per student from finishing a one-semester course in private finance, in line with a latest report by consulting agency Tyton Companions and Next Gen Personal Finance, a nonprofit centered on offering monetary schooling to center and highschool college students.

A lot of that monetary worth comes from studying tips on how to keep away from high-interest credit card debt and leveraging higher credit scores to safe preferential borrowing charges for key bills, equivalent to insurance coverage, auto loans and residential mortgages, in line with Tim Ranzetta, co-founder and CEO of Subsequent Gen.

However then there’s the ripple impact, he added.

“Students bring these lessons home,” Ranzetta stated. “When you take that $100,000 in savings and multiply it across families and communities, it’s an incredible economic engine.”

Extra from Private Finance:

Why transferring from community college isn’t often successful

How the affirmative action decision affects college applicants

Biden administration forgives $4.9 billion in student debt

“I get to show students the value of having a savings and checking account and then they are able to share that with their parents,” stated Kerri Herrild, who has been educating private finance at De Pere Excessive College in Wisconsin for 18 years, referring to what’s generally known as the “trickle up effect.”

“Getting this basic knowledge — that’s powerful,” she stated.

In the meantime, the pattern towards in-school private finance lessons is gaining steam.

As of 2024, half of all states already require or are within the technique of requiring highschool college students to take a private finance course earlier than graduating, in line with the newest information from Subsequent Gen.

As well as, there are one other 35 private finance schooling payments pending in 15 states, in line with Subsequent Gen’s bill tracker.

‘The analysis is overwhelming’

Many research present there’s a sturdy connection between monetary literacy and financial well-being.

“The research is overwhelming,” Ranzetta stated.

College students who’re required to take private finance programs ranging from a younger age are more likely to tap lower-cost loans and grants when it comes to paying for college and fewer more likely to depend on non-public loans or high-interest bank cards, in line with a research by Christiana Stoddard and Carly City for the Nationwide Endowment for Monetary Schooling.

College students are additionally much more more likely to enroll in school when they’re conscious of the financial resources available to help them pay for it.

“Our results show that high school financial education graduation requirements can significantly impact key student financial behaviors,” the authors stated within the report.

Additional, college students with a monetary literacy course underneath their belt have better average credit scores and lower debt delinquency rates as younger adults, in line with information from the Monetary Trade Regulatory Authority’s Investor Schooling Basis, which seeks to advertise monetary schooling.

As well as, a report by the Brookings Institution discovered that teenage monetary literacy is positively correlated with asset accumulation and net worth by age 25.

I inform them that is going to be crucial class they will take of their life.

Christopher Jackson

private finance trainer at DaVinci Communications College

“I start off my class by telling them that my No. 1 goal is to affect their children’s children,” stated Christopher Jackson, who teaches private finance to twelfth graders at DaVinci Communications Excessive College in Southern California.

“I tell them this is going to be the most important class they are going to take in their life,” Jackson added.

As a part of Jackson’s course, college students open Roth individual retirement accounts with an preliminary grant of $100, which many then preserve on their very own.

Amongst adults, these with higher monetary literacy discover it simpler to make ends meet in a typical month, usually tend to make mortgage funds in full and on time and fewer more likely to be constrained by debt or be thought of financially fragile.

They’re additionally extra more likely to save and plan for retirement, in line with information from the TIAA Institute-GFLEC Personal Finance Index primarily based on analysis over a number of years.

“The need is real, the effect is real, and it motivates me as a teacher,” Jackson stated.

Do not miss these tales from CNBC PRO: