Gantry cranes stand in the APM Terminals yard at the Port of Mobile in Mobile, Alabama, U.S., on Thursday, July 20, 2017.

Bloomberg | Bloomberg | Getty Images

The International Longshoremen’s Association, which represents union workers at East Coast and Gulf Coast ports, said Monday that it has suspended talks scheduled for this week with the United States Maritime Alliance as part of ongoing negotiations over a new labor contract.

The ILA said in a release that it canceled the talks with ports management to discuss a new labor deal after discovering that automated technology was being used by APM Terminals and Maersk, the world’s second-largest shipping company and APM Terminals’ parent company, to process trucks at port terminals without union labor. The union says an “auto gate” system was initially identified at the Port of Mobile, Alabama, but the union indicated that it believes the technology is in use at other ports.

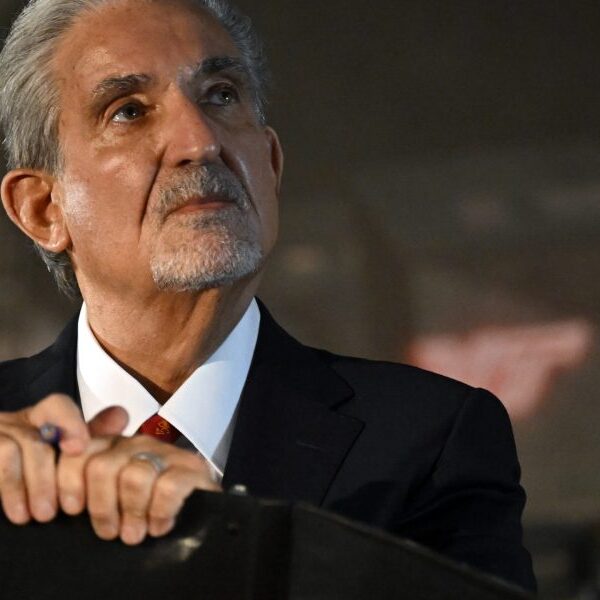

“Here we go again! This is another example of USMX members unilaterally circumventing our coast-wide Master Contract. This is a clear violation of our agreement with USMX, and we will not tolerate it any longer,” the union said in its release. “There’s no point trying to negotiate a new agreement with USMX when one of its major companies continues to violate our current agreement with the sole aim of eliminating ILA jobs through automation,” stated ILA president Harold J. Daggett.

A Maersk spokesman said in an emailed statement that APM Terminals remains “in full compliance with the ILA/USMX Master Contract.”

“We are disappointed that the ILA has chosen to make selected details of ongoing negotiations public in an effort to create additional leverage for their other demands. We will continue to engage with all stakeholders, including the ILA, to address their concerns,” the Maersk spokesman said.

The USMX could not be immediately reached for comment.

The ILA is the largest longshoreman union in North America, representing 85,000 members. The ILA’s master contract with the United States Maritime Alliance — which represents terminal operators and ocean carriers — is set to expire Sept. 30. May 17 was the initial cutoff date set by the union for the local contracts to be agreed to so an overall master contract can then be negotiated.

Back in July, Daggett, the union’s chief negotiator, had said he wanted a good economic deal for his members, which included union opposition to port automation and exclusive port contracts for its members. During a speech before union members that month, Daggett vowed the ILA would not take a back seat to anyone. “It’s time for foreign companies like Maersk and MSC to realize that you need us as much as we need you,” he said.

The ILA indicated in its release that it will not meet with USMX until the “auto gate” issue is resolved.

Despite the history of this union and the ports reaching agreements in recent decades, logistics companies and shippers are showing concern about the risk of a strike, with more cargo orders for peak shipping season moving back to West Coast ports.

During the West Coast International Longshore and Warehouse Union (ILWU) contract negotiations between 2022 and 2023, freight processing was stalled after a series of intentional labor slowdowns and walk-offs. At the ILWU Canadian West Coast Ports, a 13-day strike resulted in over $12 billion in trade stuck at sea and it took months for the backlog of containers to be cleared out. That led to the reverse trade flow situation, with more cargo volume sent to ports including New York/New Jersey and Virginia to avoid the labor strife.

The current ILA contract has union members making a range of $20-$37 an hour, according to previous CNBC reporting. Depending on seniority, skill rate, hazard pay, overtime differential, plus tonnage bonus (which can be anywhere between $15,000-$20,000 a year), a longshoreman can make between $150,000-$250,000 annually. Port insiders told CNBC earlier this year that the ILA is targeting an increase larger than the 32% that was negotiated by the ILWU in its new six-year contract. The ILA is also said to be looking to secure a generous bonus package. In July, the ILA leadership pointed to the Great Lakes District of the union, which secured a 40% increase in wages and benefits for its new six-year contract. No definitive salary increase target has been made by the ILA.

The last six-year contract between the ports and ILA was signed in late September 2018, which Daggett at that time called the “greatest contract in the history of the ILA.”