Amazon has been No. 1 within the cloud for years, ever because it invented the idea in 2006. However now the corporate finds itself in a spot it may not be used to: enjoying catch-up to Microsoft on the subject of AI.

Full TechCrunch+ articles are solely out there to members.

Use discount code TCPLUSROUNDUP to avoid wasting 20% off a one- or two-year subscription.

Microsoft has hitched its wagon to OpenAI, and Amazon is betting on Bedrock. To not point out what Microsoft has achieved with Copilot versus Amazon’s Q debut. AI continues to be a nascent know-how, and enterprise consumers are going to buy round, avoiding vendor lock-in, simply as they’ve within the cloud. However for now, it appears, “Microsoft seems to have won the perception battle,” writes TechCrunch’s Ron Miller.

Thanks for studying,

VC Workplace Hours: Unlocking the Farmers’ Market with Black Farmer Fund

Picture Credit: Bryce Durbin

Buyers love agtech and have been pumping cash into the sector for years. However based on Crunchbase, $98.6 million out of $39.4 billion has gone to only 5 Black-owned agtech corporations since 2018. To assist fight these inequalities, Black Farmer Fund is elevating its second spherical concentrating on $20 million to supply financial and social alternative to Black farmers and agricultural and meals companies within the Northeast, experiences Dominic-Madori Davis.

Betting on magnificence fads is massive enterprise

Picture Credit: PM Pictures / Getty Pictures

Medical spas are projected to be a $30 billion enterprise by the top of this decade, and traders and personal fairness companies are beginning to take be aware. However TechCrunch+ senior reporter Rebecca Szkutak wonders: How are traders enthusiastic about the dangers?

“The success of these businesses is entirely based on the strength of underlying beauty fads and largely whatever unrealistic beauty standards consumers are currently trying to achieve,” she writes.

Pitch Deck Teardown: Scalestack’s $1M AI gross sales tech seed deck

Scalestack closed its $1 million spherical utilizing 18 slides. And that shouldn’t come as a shock, because it has three issues going for it, writes Haje Jan Kamps: a killer staff, spectacular traction, and a buyer testimonial to die for.

However even nonetheless, it’s lacking some fairly essential data.

Get the TechCrunch+ Roundup publication in your inbox!

Click here to subscribe

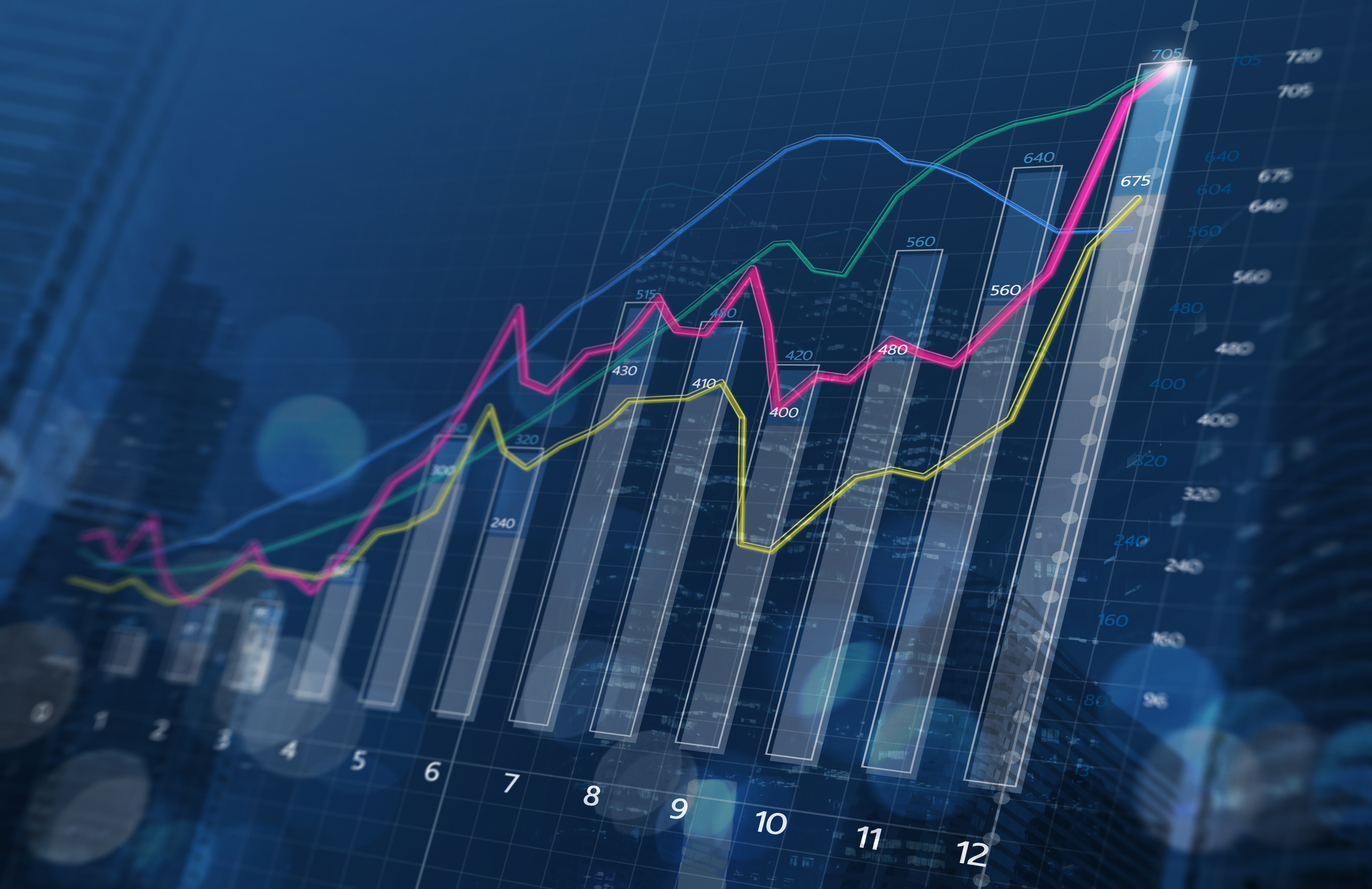

Crucial metrics for SaaS funding in 2024

TAM (whole addressable market) and income progress simply don’t minimize it anymore on the subject of predicting the viability of a startup, says Capchase CEO and co-founder Miguel Fernandez. Firms are specializing in sustainable progress, and for SaaS corporations, which means one factor: product scalability. And that’s not measured by only one metric.

Negotiating cross-border investments: Insights from a seasoned investor

It’s straightforward to offer away 30% or 40% of fairness in early levels of fundraising, particularly when determined for funding. H2O Capital Innovation co-founder and basic companion Daniel Lloreda writes that it’s typically much more troublesome to search out cheap phrases when doing cross-border investing.