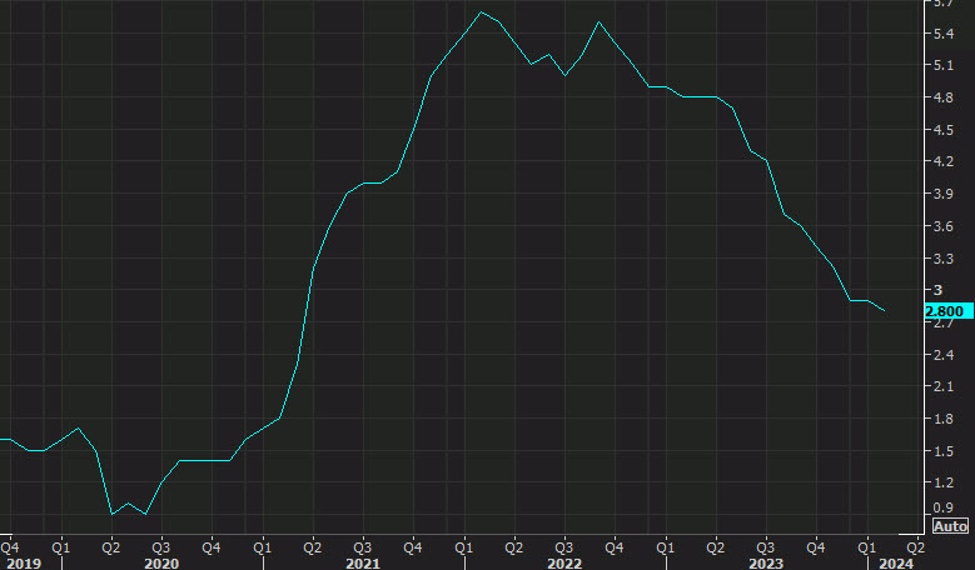

US core PCE yy

TD Securities underscores the importance of Friday’s core PCE knowledge, contemplating it pivotal for shaping market expectations and actions in 2024. Amid fluctuating market sentiments and various financial indicators, this launch is anticipated to be a vital determinant of future financial coverage and forex valuations.

Key Factors:

-

Significance of Core PCE Knowledge: TD Securities posits that this week’s core PCE print might be one of many yr’s most important knowledge releases, doubtlessly setting the stage for financial coverage course and market actions for the rest of the yr.

-

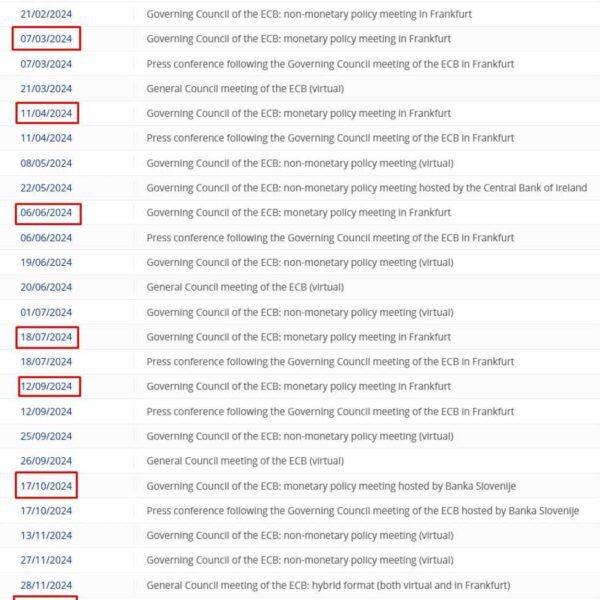

Market Uncertainty and Sentiment: Current discussions with shoppers throughout Europe reveal a normal lack of conviction in present market instructions, although there’s a consensus {that a} important pivot level could also be close to. This sentiment is mirrored by the market’s combined reactions to varied financial indicators comparable to development divergence, threat correlations, and central financial institution insurance policies.

-

Affect on USD and Threat Belongings: The core PCE knowledge is especially essential because it immediately influences perceptions of inflation and, consequently, the Fed’s fee selections. A end result that aligns with expectations of cooling inflation might assist a average reversal in USD energy by the third quarter, benefiting threat property and doubtlessly realigning Fed fee expectations with these of different G10 central banks.

-

Implications of an Unexpectedly Excessive Inflation Print: Conversely, a higher-than-expected inflation determine might diminish prospects for Fed fee cuts this yr, doubtless resulting in additional USD appreciation and opposed impacts on threat property. This situation would reinforce the greenback’s energy on the again of persistent inflation and diverging central financial institution insurance policies.

Conclusion:

The upcoming core PCE print is pivotal in figuring out short- to medium-term market dynamics and central financial institution actions. Traders and merchants ought to put together for potential volatility following this launch, because it might considerably affect market sentiment and strategic positioning. The result might both affirm a trajectory towards easing financial circumstances or herald continued restrictive insurance policies pushed by persistent inflationary pressures.

For financial institution commerce concepts, check out eFX Plus. For a restricted time, get a 7 day free trial, fundamental for $79 per 30 days and premium at $109 per 30 days. Get it here.