Key Notes

- Galaxy Ventures led the $7M round with participation from Wintermute, GSR, and FalconX for blockchain gold infrastructure.

- The startup plans to launch yield-bearing tokenized gold in early 2026 through Hidden Road and Ripple Prime partnerships.

- Bitcoin’s correlation with gold dropped to zero in January 2026 as gold prices are projected to reach $4,000-$5,000 per ounce.

Galaxy Ventures, a division of Galaxy Digital, led a $7 million seed funding round for Tenbin Labs, a startup building blockchain infrastructure for tokenized gold and foreign exchange markets, with a different approach from the traditional wrapped tokens.

The funding round attracted participation from major crypto market makers, including Wintermute Ventures, GSR, and FalconX, as well as venture firms Nascent, Variant, and Bankless Ventures, according to their announcement. Tenbin differentiates itself by connecting on-chain assets directly to CME futures markets rather than using traditional custodial wrapping methods.

Galaxy Ventures is proud to have led @tenbinlabs’ $7M seed round as the team builds next-generation infrastructure for onchain capital markets. https://t.co/yXViDxETiF

— Galaxy (@galaxyhq) January 27, 2026

“We don’t think tokenization is just about putting things onchain,” Yuminaga said in an interview with CoinDesk. “It’s about making those assets better than they were before—faster to settle, more liquid, and more usable.”

The company plans to launch its yield-bearing tokenized gold product in early 2026 through partnerships with Hidden Road and Ripple Prime, followed by expansion into emerging-market currencies, including the Brazilian Real and Mexican Peso.

“We can capture all those yields and offer to the users without even touching the Brazilian bank,” Yuminaga noted. “All of it is done through our proprietary CME hedging system.”

Why Gold Appeals to Crypto Investors

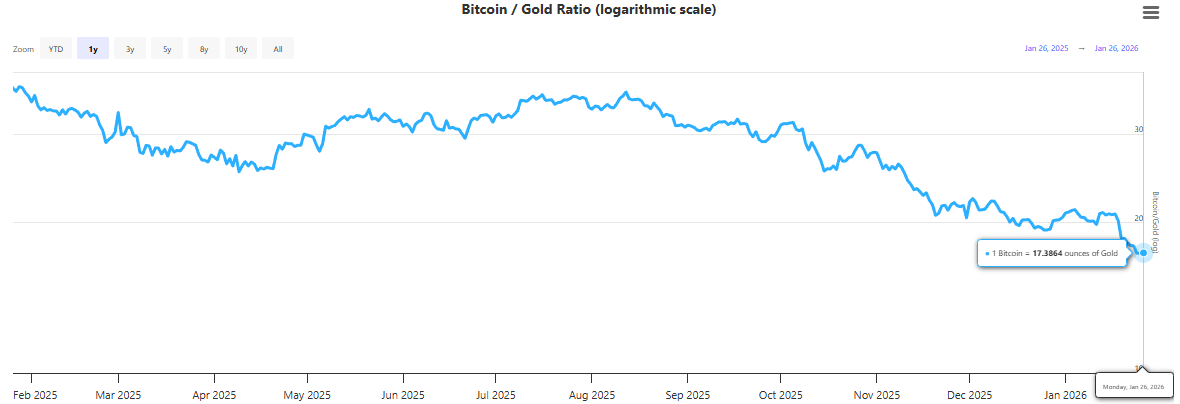

Bitcoin’s 52-week correlation with gold dropped to zero in January 2026 for the first time since 2022, breaking the pattern where both assets historically moved together during market uncertainty. We can see how Bitcoin has devalued against gold: 1 year ago, 1 BTC could buy about 37.11 ounces of gold, and now it’s only worth about 17.39 ounces.

Graph of Bitcoin / Gold ratio in 1 year | Source: LongTermTrends.com

Gold is reasserting itself as the primary safe-haven asset with prices projected to reach $4,000-$5,000 per troy ounce in 2026, driven by Federal Reserve rate cuts and geopolitical tensions. For crypto traders seeking stability without exiting crypto ecosystems, tokenized gold offers exposure to these gains while maintaining on-chain speed and composability. Even companies like Binance already allow trading gold on their platform.

The investment comes as tokenized real-world assets, excluding stablecoins, surpassed $33 billion in market value in 2025. Tenbin’s launch will test whether futures-backed tokenization can address the liquidity and utility gaps that have limited the adoption of existing tokenized commodities.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

José Rafael Peña Gholam is a cryptocurrency journalist and editor with 9 years of experience in the industry. He wrote at top outlets like CriptoNoticias, BeInCrypto, and CoinDesk. Specializing in Bitcoin, blockchain, and Web3, he creates news, analysis, and educational content for global audiences in both Spanish and English.