Tim Robberts/DigitalVision through Getty Photographs

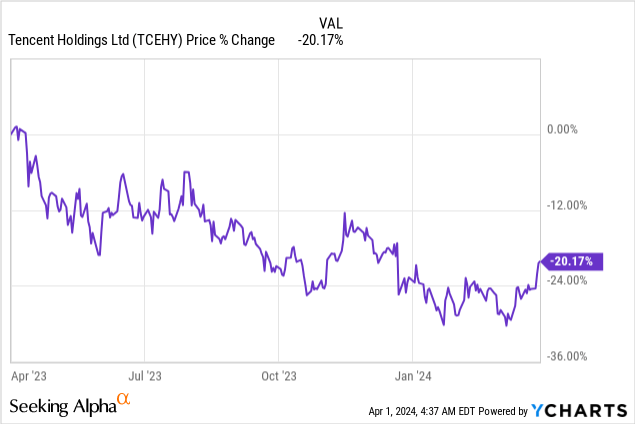

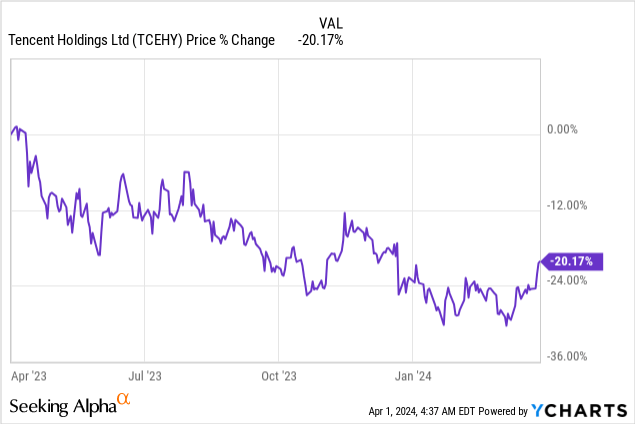

Tencent Holdings Restricted (OTCPK:TCEHY) is a promising progress funding in FY 2024 as the corporate returned to double digit prime line progress in FY 2023 and the internet advertising enterprise is seeing an acceleration of progress as nicely. Though U.S.-based traders could also be hesitant to contemplate Tencent as an funding as a result of operational concentrate on China, the gaming and social media firm is extraordinarily worthwhile on a free money circulation foundation. Shares are additionally very attractively valued and have a threat profile that’s skewed to the upside!

Earlier ranking

I final lined Tencent in November 2023 which is after I additionally rated the web expertise firm as a powerful purchase for progress traders due to the momentum within the Fintech enterprise. The internet advertising enterprise is now rising the quickest and Tencent generates a big quantity of free money circulation from its core companies. I see main revaluation potential for Tencent in FY 2024.

Robust progress in FY 2023

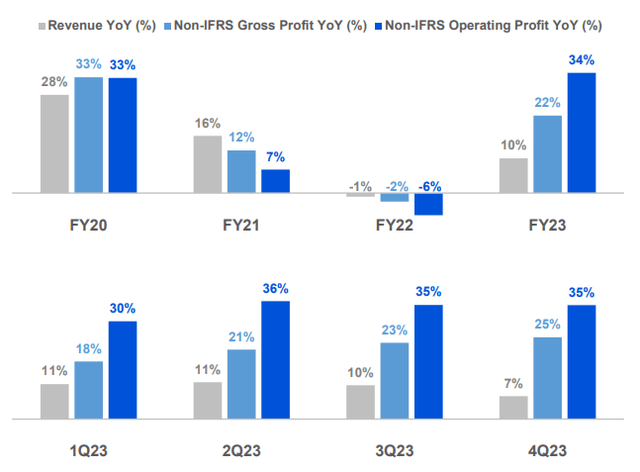

Tencent had a reasonably profitable FY 2023 which noticed 10% prime line progress and whole revenues of 609.0B Chinese language Yuan ($86.0B). The worth-added service section — which incorporates the corporate’s social media community and gaming enterprise — generated simply 4% prime line progress as a result of indicators of maturity available in the market for Chinese language social media firms.

The Fintech enterprise, which I singled out final time as a crown jewel for Tencent, generated 15% prime line progress in FY 2023. The fastest-growing enterprise in FY 2023, nevertheless, was neither the core enterprise nor the Fintech enterprise: it was the internet advertising enterprise which monetizes the rising consumer bases of Tencent’s core social media networks.

The net advertising and marketing enterprise generated 23% yr over yr progress in FY 2023 and whole revenues of 101.5B Chinese language Yuan ($14.3B) which calculates to a income share of 17%. Development in digital promoting on Tencent’s on the spot messaging platforms was pushed by three sectors particularly, based on Tencent’s earnings launch for the fourth quarter: web companies, healthcare and client items classes.

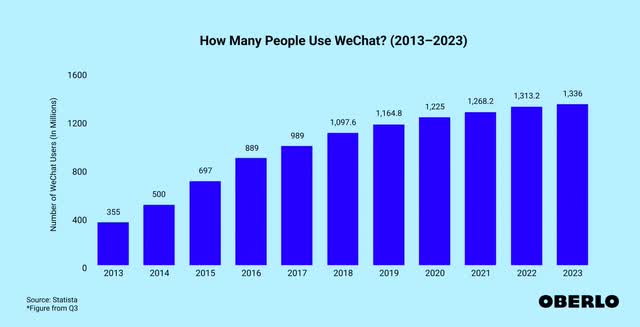

Tencent owns two of the biggest social media/messaging apps in China, WeChat and QQ. WeChat had 1.34B customers as of the tip of FY 2023 and it stays by far the biggest and hottest social media platform in China. WeChat has seen continuous progress in its consumer base within the final decade, however the platform has matured and consumer progress has normalized (FY 2023 consumer progress was solely +2% Y/Y). It’s this social media community that gives Tencent with the monetization alternatives within the digital promoting market that I mentioned above.

FY 2023 was a rebound yr for Tencent as the corporate benefited from robust promoting spending in its on-line enterprise, leading to Tencent reported 10% prime line progress in comparison with a decline of 1% within the income base in FY 2022. With internet advertising strengthening in FY 2023 and key metrics rebounding persistently all year long, I consider Tencent might be a probably rewarding funding for progress traders, particularly those that prefer to concentrate on free money circulation.

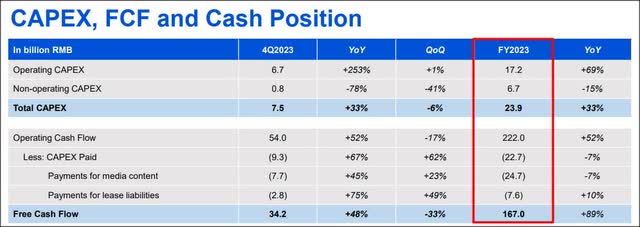

Surging free money circulation and near-30% FCF margins

Tencent, like its U.S.-rival Meta Platforms (META), is enormously free money circulation worthwhile. The Chinese language web firm generated 167.0B Chinese language Yuan ($23.6B) in free money circulation in FY 2024 (+89% Y/Y) on revenues of 609M Chinese language Yuan ($86.0B) which calculates to a formidable free money circulation margin of 27.4%. Meta Platforms, the biggest U.S.-based social media firm, generated a free money circulation margin of 31.9% in FY 2023. As a result of Meta Platforms is introducing a dividend and returning a good portion of its free money circulation to shareholders, I dubbed META a dividend growth play.

Tencent’s low P/E valuation makes shares a steal…

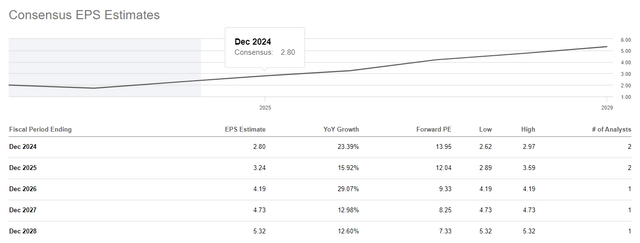

Tencent is worthwhile and attractively valued primarily based on earnings. The social media platform is at present buying and selling at a price-to-earnings ratio of 12X which compares towards a (FY 2025) P/E ratio of 21X for Meta Platforms.

Meta Platforms is predicted to develop its EPS at a median annual price of 12% within the subsequent 4 years in comparison with an EPS common progress price of 17% for Tencent… so the Chinese language social media firm is rising sooner and, on a P/E foundation, is 43% cheaper than its U.S. counterpart. I consider Tencent, given the rebound in its fundamentals in FY 2023, power in digital promoting and massive free money circulation, might moderately commerce at a 15X P/E ratio with out being overvalued. This honest worth P/E ratio implies a good worth of $49 and 25% upside revaluation potential. On condition that Tencent is a Chinese language firm, I do not count on shares to commerce as much as a Meta-kind of valuation stage.

Dangers with Tencent

Tencent is a China-based firm and subsequently considered fairly often as suspicious or uninvestable by U.S.-based traders. There are additionally rising tensions between China and Taiwan which might make an invasion of the latter at the least theoretically a risk. Nonetheless, I do not consider that China’s social media platforms are financially susceptible financially to such occasions. What would change my thoughts about Tencent is that if the corporate noticed a severe decline in its free money circulation margins.

Closing ideas

Tencent is a well-run web expertise firm with a gaming enterprise, a social media enterprise and a fintech crown jewel at its core that has improved the agency’s diversification profile over time. Moreover, Tencent is seeing robust fundamentals within the digital advertising and marketing enterprise which generated the best progress price in FY 2023 of all companies as a result of a broad-based digital promoting market restoration. FY 2023 was clearly a rebound yr for Tencent as the corporate’s prime line progress returned to the double-digits and free money flows soared 89% Y/Y. I like Tencent’s low P/E valuation, which appears to be largely pushed by investor considerations about investments in China. The precise enterprise, nevertheless, is doing fairly nicely and with Tencent proudly owning the most-popular on the spot messaging app, WeChat, I consider Tencent has appreciable progress potential in FY 2024 and past!

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.