Justin Paget/DigitalVision via Getty Images

Introduction

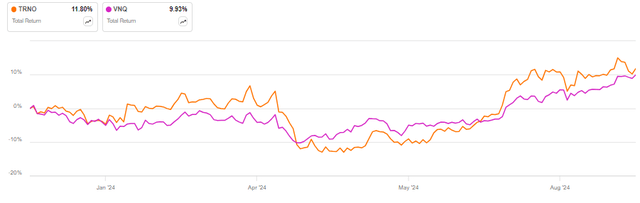

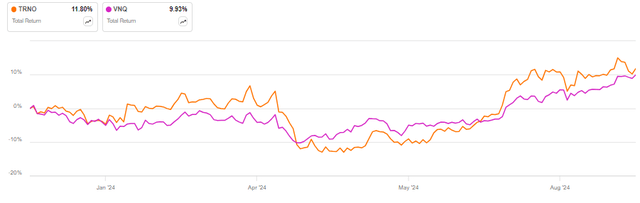

Terreno Realty Corporation (NYSE:TRNO) has marginally outperformed the Vanguard Real Estate Index Fund ETF Shares (VNQ) so far in 2024, delivering a ~12% total return against the ~10% gain for the benchmark ETF:

TRNO vs VNQ in 2024 (Seeking Alpha)

I think the shares will continue to deliver a return close to that of major real estate ETFs, driven by a quite elevated valuation in terms of FFO multiple (~27.6x) and market-implied cap rate (~3.64%), but also potential for above-average net operating income /NOI/ growth for a few more years. The low gearing employed in the capital structure will also hurt returns if the Fed cuts interest rates, at least compared to other more levered REITs.

Company Overview

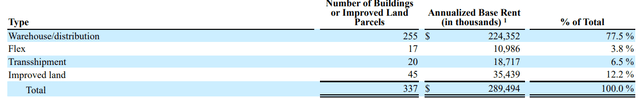

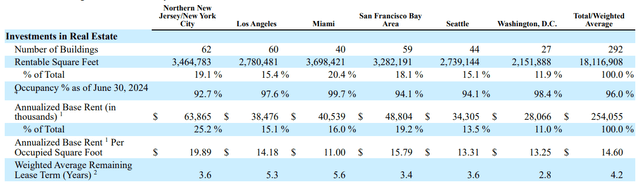

You can access all company results here. Terreno Realty is an industrial REIT focused on Warehouse/distribution properties which account for 77.5% of annualized base rent (ABR), followed by Improved land at 12.2%, Transshipment properties at 6.5%, with Flex (encompassing light industrial and R&D) making up the remaining 3.8% of ABR:

Portfolio overview by property type (Terreno Realty Form 10-Q for Q2 2024)

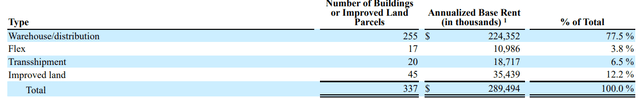

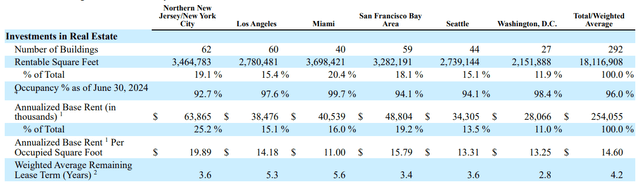

The company operates in six real estate markets, with Northern New Jersey/New York City its largest exposure at 25.2% of ABR, followed by the San Francisco Bay Area at 19.2%:

Portfolio breakdown by property market (Terreno Realty Form 10-Q for Q2 2024)

Operational Overview

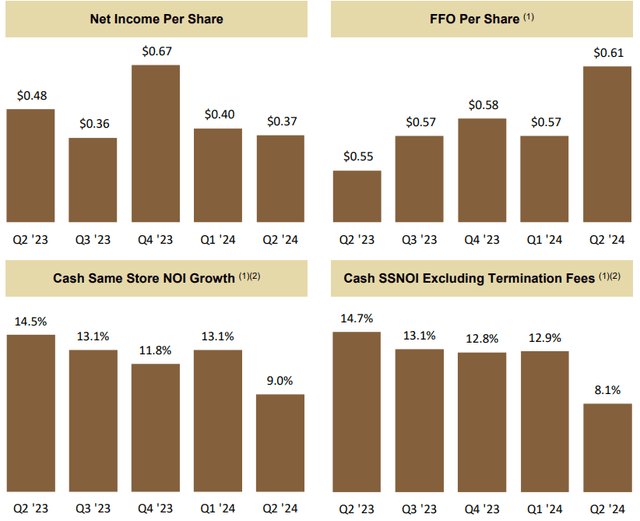

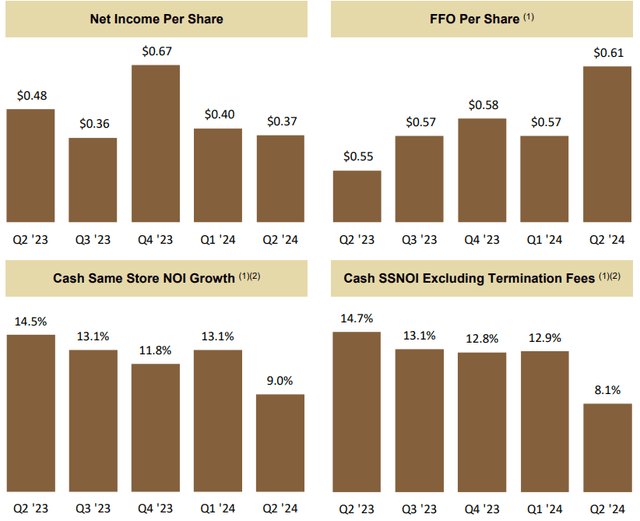

In Q2 2024, Terreno Realty reported an FFO of $0.61/share, up 11% Y/Y, driven by both increases in same-store net operating income (+9% Y/Y on a cash basis), as well as a larger portfolio.

Occupancy developments were less robust – occupancy stood at 96.2%, down 1.6% Y/Y. Leasing spreads remain exceptional, with the company reporting 45.9% higher rents on new and renewed leases.

Financial Highlights (Terreno Q2 2024 Results Presentation)

Overall Terreno Realty’s operating performance metrics closely mimic those observed at its largest peer Prologis, Inc. (PLD) which I covered here. Both companies are seeing a strong increase in FFO powered by rent growth, but we are also noticing cracks in occupancy emerging as tenants face much higher rent rates on renewals.

Capital Structure

Terreno Realty ended Q2 2024 with a net debt of $590 million. As a result, net debt accounts for just 8% of the REIT’s $7.3 billion enterprise value. 25.8% of the debt is floating rate, indicating some benefits for the company’s cash flows as soon as the Fed starts cutting rates. That said, the low gearing of the company will make the effect of Fed rate cuts much more limited compared to other REITs that employ leverage of 40-60% in their capital structure.

The weighted average interest cost of the debt stood at 4% at the end of Q2 2024, but has since marginally increased as the REIT repaid a $100 million 3.8% term loan in July 2024.

Market-implied cap rate

In Q2 2024 the portfolio generated a cash NOI of $64 million. As the amount excludes $2 million in straight-line rents, I reckon it is better to add it back to arrive at a run-rate NOI of about $66 million/quarter, or about $265 million annually. Against the $7.3 billion enterprise value, the amount represents a market-implied cap rate of around 3.64% – extremely low for a commercial REIT.

General and administrative expenses are running at about $10.5 million a quarter, implying a circa $42 million burden from management overhead on annual enterprise-level cash flows. This would reduce the market-implied cap rate by 0.58%, indicating an efficient operating structure.

Valuation and prospects

Terreno Realty’s quarterly FFO run rate should result in ~$2.50/share in annual FFO. This would imply the company currently trades a 27.6x FFO multiple, among the highest valuations I have seen for a commercial REIT.

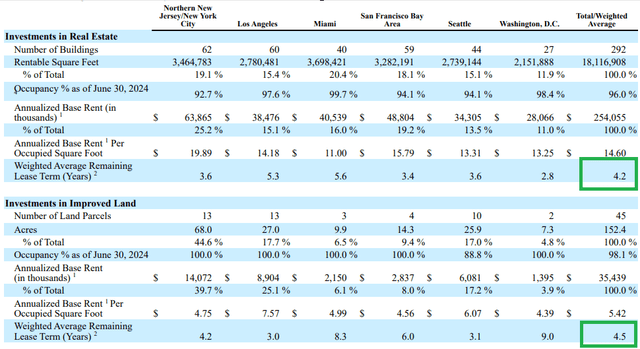

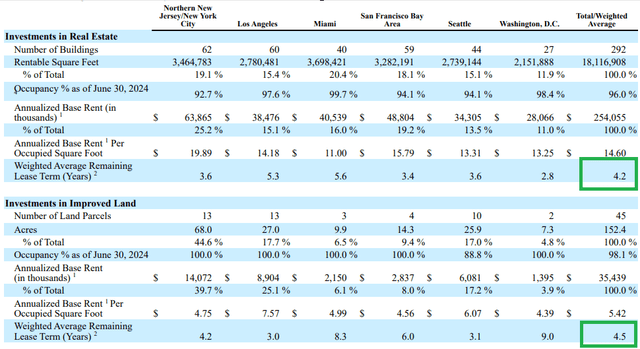

The explanation, of course, lies in its strong net operating income growth pipeline, with cash NOI growth currently running at 9% Y/Y. We should note that this has already decreased from last year’s 14.5% pace and I would fully expect the trend to continue moving down. Even so, NOI will continue growing at an above-inflation pace as legacy leases are repriced to market rates. Considering that the remaining average lease term sits at 4.2 years for Real Estate and 4.5 years for Improved Land, the process should play out over the next few years:

Lease expiration profile (Terreno Realty Form 10-Q For Q2 2024)

Even if we assume NOI increases at the Q2 2024 pace of 9% for the next four years (something I do not expect), the market-implied cap rate would only increase to 5.1% in 2028, and would still be quite elevated. Hence, I am happy to rank the shares a Hold.

Risks

The main risk facing Terreno Realty is that it will see continued declines in occupancy as the company adjusts rents to market levels. This will undermine the REIT’s ability to grow NOI, which would pull the rug out from under its valuation since strong NOI growth is basically taken for granted at the current valuation. Hence, I would pay attention to whether the company quickly manages to fill its vacant units.

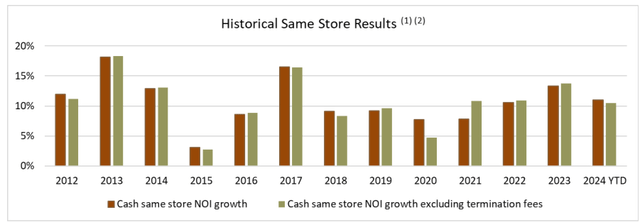

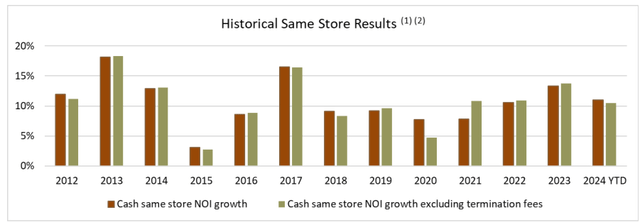

Since I am neutral on the shares and skeptical they can continue their strong NOI growth in the long term, it is worth playing devil’s advocate and highlighting that the company has seen above-average NOI growth since 2012. Hence, it may continue to do so in the future as well:

NOI growth history (Terreno Q2 2024 Results Presentation)

I would argue that the legacy superb NOI growth was achieved with a much smaller portfolio. Therefore, it is not very indicative of future growth potential above peers. For instance, total assets were $1.1 billion in 2014, $2.1 billion in 2019, and $4.5 billion in H1 2024. As portfolio size increases, it is harder to find real estate bargains that move the needle on the new much bigger portfolio level.

Conclusion

Terreno Realty reported strong FFO and NOI growth in Q2 2024. However, considering the company’s ~27.6x FFO multiple and sub 4% market-implied cap rate, these are already priced into the shares.

The REIT also runs a very conservative capital structure, with net debt making up just 8% of enterprise value. Considering the outlook for Fed rate cuts, I think the company needs nothing short of a real estate tsunami to outperform peers which are usually employing leverage anywhere between 25% and 60% to beef up common shareholder returns.

All in all, considering the elevated valuation and the conservative capital structure, I think a Hold rating is appropriate for the shares. I simply do not see them outperforming other real estate peers in the medium term.

Thank you for reading.