Andrii Yalanskyi/iStock by way of Getty Photographs

Tesla Is Struggling

The hype surrounding electrical automobiles (EVs) is cooling down. Whereas EV gross sales soared in 2021 and 2022, there are a number of examples of that development slowing considerably. Some analysts level to a considerable decline in EV inventory costs, with sure corporations experiencing severe income declines up to now yr. This might point out a extra cautious market outlook on the short-term trajectory of the electrical automotive adoption.

Tesla, Inc. (NASDAQ:TSLA), as a front-runner of the revolution within the automotive business, is within the midst of a tricky battle when it comes to automobile costs, powerful competitors, lower-than-expected demand, falling margins, and all the problems characterizing an business with horrible economics. Furthermore, Tesla simply missed earnings expectations huge time with the largest income decline YTD since 2012.

Little over a yr in the past, I posted an article, “Tesla And Terrible Business Economics,” presenting a bearish thesis for the corporate and its midterm future. The piece stays legitimate one yr later, and the EV maker has dropped 27.93% since then, being at the moment the worst-performing inventory YTD within the S&P Index (SP500). CEO Elon Musk retains portray a futuristic imaginative and prescient of a world dominated by renewable sources of vitality and alternative routes of powering automobiles. But, the truth seems totally different, particularly contemplating areas apart from Silicon Valley, the New York metropolitan space, or a number of different rich components of the world.

Tesla just isn’t the one and solely EV maker anymore. The competitors retains tempo within the race and fights an equal struggle for the patron. The pricing energy for the Texas-based automotive producer does not exist anymore. But, revenues and income develop. The controversial CEO who has executed miracles continues to be in cost, though a bit distracted with X – previously Twitter. Are the business dangers, mixed with company-specific points and most of all, excessive valuation, well worth the reward an investor could reap by investing in Tesla right this moment? In all probability not, and a number of other stable arguments assist the bearish thesis on the American EV maker.

Tesla’s Shrinking Margins: No Pricing Energy

When an business with a repute for tough economics meets a supervisor with a repute for excellence, it’s normally the business that retains its repute intact.

– Warren Buffett.

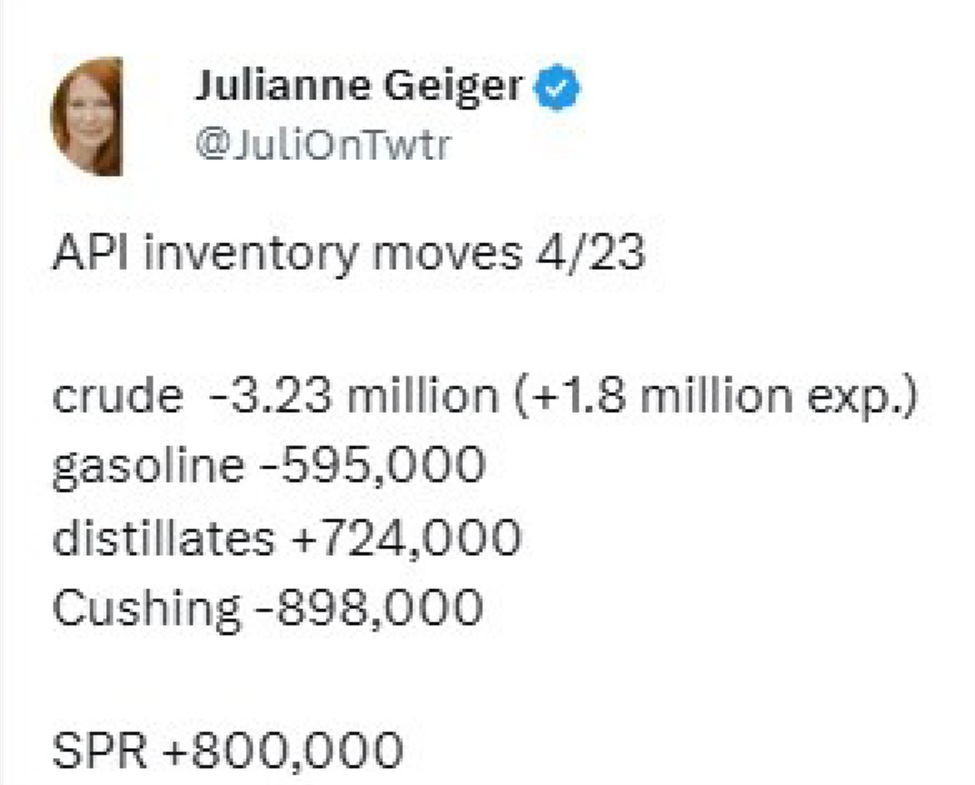

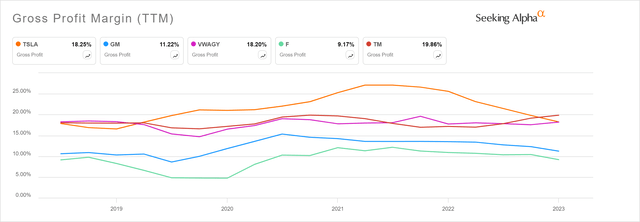

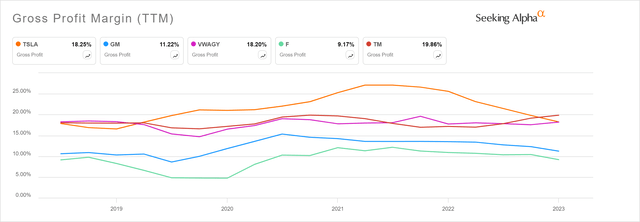

What characterizes the auto business is excessive competitors, which forces producers to contend ferociously for a buyer. This results in comparable costs of automobiles providing related options and efficiency ranges. Conversely, this causes profitability metrics of varied carmakers in the identical slim vary. Tesla is an effective instance of this phenomenon. As soon as the EV hype light, so did the corporate’s margins. Tesla’s gross margin for This autumn 2023 was 17.6%, the bottom since 2019, down greater than 600 foundation factors from the yr earlier than.

Gross Revenue Margin of Tesla vs. Toyota vs. Ford vs. GM vs. Volkswagen (In search of Alpha)

Tesla as soon as loved record-breaking revenue margins, reaching as excessive as 25.6% in FY 2022. Nevertheless, a succession of value reductions has led to a decline in its beforehand celebrated profitability, inflicting concern amongst traders as they strategy extra typical ranges.

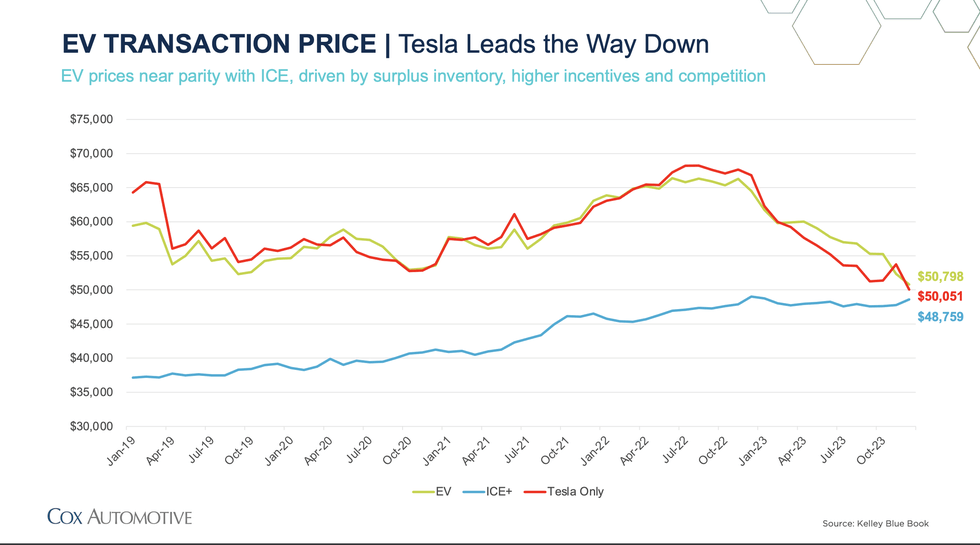

EV Transaction Value (Kelly Blue E-book)

By now, it ought to have change into clear that Tesla is a automotive firm, producing over 85% of its revenues from the automotive section. Because the firm has matured, its automobile costs have come down and margins have adopted, at the moment trailing Toyota Motor Company (TM). Inside a yr, between January 2023 and January 2024, the worth of the best-selling mannequin within the new EV market – the Tesla Model Y plunged over 21% – tumbled from almost $63,000 to lower than $50,000. In distinction, the variations in transaction costs amongst Tesla’s opponents had been within the low single digits.

On April twentieth, 2024, almost two weeks after releasing numbers of its deliveries, Tesla again slashed the prices of its automobiles Y, S, and X by $2,000 within the U.S. This transfer simply reaffirmed the present development and does not give a lot hope that it’ll reverse quickly.

The consequence of those value cuts just isn’t solely the decline of margins, but additionally decrease gross sales and earnings numbers. These have simply been seen within the reported Q1 results, with revenues down 9% YTD from $25.17 billion final yr to $21.3 billion. Earnings per share plummeted 53% to $0.34 from $0.73 a yr in the past.

Tesla Going through Fierce Competitors

BYD Outsells Tesla

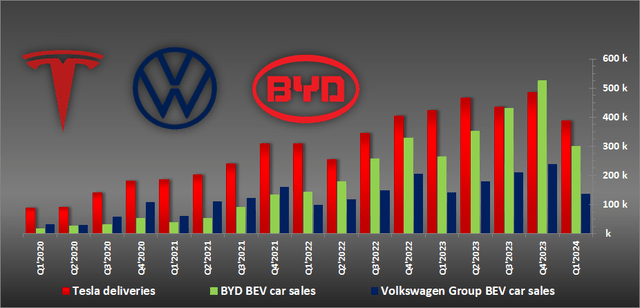

Within the electrical automobile market, an exhilarating competitors is unfolding between Tesla and BYD Firm Restricted (BYDDF). Tesla, as soon as the undisputed champion, now faces a relentless challenger within the Chinese language automaker BYD. BYD has stormed ahead in global sales, outselling Tesla within the essential fourth quarter of 2023 with 526,000 battery electrical automobiles (BEVs) in comparison with Tesla’s 484,500. Whereas Tesla nonetheless holds the crown for the total yr 2023 with a record-breaking 1.8 million EVs delivered, BYD is catching up quickly, promoting over 1.57 million BEVs, with six automobiles within the prime ten best-selling EVs globally in 2023.

There’s a strategic distinction between the 2 opponents: Tesla focuses on premium, high-performance automobiles with a beginning value of round $46,000 for the Mannequin 3, whereas BYD presents a wider vary of fashions at extra accessible value factors, responding to the surging demand for reasonably priced EVs. That is notably vital in China, the world’s largest automotive market, with excessive value sensitivity.

Volkswagen Takes Over Tesla in Germany

Volkswagen AG (VWAGY), the legacy automaker producing the very best income amongst automotive producers, held 4.6% of the global EV market share in 2023. Though the corporate sells a lot fewer electrical vehicles than Tesla (0.77 million models offered in comparison with Tesla’s 1.80 million in 2023), the German behemoth expects dynamic development in 2024 on account of new editions of a few of its best-selling fashions, and likewise by updating its EV portfolio.

The ID.4 and ID.5 have lately undergone vital updates, that includes a very up to date working idea and drive system. Moreover, Volkswagen is ready to introduce the brand new ID.7 Tourer, the variant of its flagship all-electric mannequin, the ID.7, later this yr. Furthermore, Tesla could quickly really feel the competitors from Volkswagen within the U.S. market. In response to the rising demand for SUVs, the German producer plans to provide a completely electrical SUV in the high-volume A-segment beginning in 2026. This can be a direct competitor to the Tesla Mannequin X. It is value noting that 81% of vehicles offered by Volkswagen within the U.S. in 2023 had been SUVs.

In Germany, Volkswagen surpassed the U.S. automaker because the main electrical automotive model with 70,628 new registrations in 2023, a rise of just about 12%. Tesla skilled a 9 % decline with 63,685 new registrations, though the American firm’s Mannequin Y remained the most well-liked EV mannequin forward of VW’s IDs.

Different Tesla Rivals Do not Sleep, Both

Established automakers like Ford Motor Firm (F), which closed a document EV gross sales yr with the F-150 Lightning turning into the best-selling electrical pickup, and Basic Motors Firm (GM), which introduced deliberate EV investments value $35 billion, are current within the EV house with aggressive choices. Their initiatives are additional squeezing Tesla’s market share. To take care of its place, Tesla must adapt by doubtlessly introducing extra reasonably priced fashions, optimizing manufacturing prices, and defending its technological edge, none of which is straightforward within the automotive business, often known as an business with horrible economics. The approaching years can be a take a look at of Tesla’s capacity to adapt in a quickly evolving EV house. But, Tesla does stay modern, aggressive, and environment friendly and there aren’t any indicators it is backing off from its mission.

It took us 12 years to construct the primary million, and about 18 months to the second million. The third million, 11 months. Then lower than seven months to construct the 4 millionth.

– Senior Vice President Tom Zhu on the Tesla 2024 Investor Day.

EV Hype Collapse

Through the Q1 FY2024, Tesla delivered 386,810 all-electric automobiles, marking a 9% lower in comparison with the earlier yr. The numbers had been met with a serious disappointment amongst traders. Regardless of this decline, Tesla remained the leader in EV sales, with no different automotive group surpassing its numbers. BYD, which has a special buyer base, skilled a reasonable 13% development year-over-year, reaching 300,114 EV deliveries in Q1.

In the meantime, Volkswagen Group additionally confronted challenges in passenger all-electric automotive gross sales, with Q1 outcomes totaling 136,136 models, down roughly 3% from the earlier yr.

Abstract of all-electric automotive gross sales in Q1 ‘2024 (YoY):

- Tesla: 386,810 (down 9%).

- BYD: 300,114 (up 13%).

- Volkswagen Group: 136,136 (down 3%).

Tesla vs. BYD vs. Volkswagen All-Electrical Automobile Gross sales (InsideEVs)

The slowdown in EV gross sales is attributed to varied components, together with shopper considerations, provide chain disruptions, and financial uncertainties. Regardless of a surge in EV manufacturing, gross sales are slowing. Shoppers are hesitant on account of value, vary anxiousness, and lack of charging infrastructure. This has led to a glut of EVs on supplier tons.

Whereas authorities incentives push for electrification, and billions of {dollars} are being dedicated by automakers (over $616 billion by 2027) shopper demand appears to be wavering, resulting in an oversupply of EVs out there. Based on Cox Automotive’s Business Insights 2024 report, the automotive business ended 2023 with an EV inventory equivalent to 113 days, contrasting with the extra typical 69 days for ICE automobiles, which incorporates hybrids.

With relative optimism about the way forward for electrical automobiles, considerations stay concerning the present state of the market. Used EV costs have seen vital declines, indicating potential challenges in EV resale worth and total market demand. Nevertheless, some argue that this decline could also be non permanent and never indicative of a broader slowdown in EV adoption.

It is value noting that the used EV market is younger and continually evolving, presenting some uncertainties. Battery life and its influence on resale worth are nonetheless being understood. Future coverage adjustments, notably concerning tax credit, can even considerably have an effect on the market. Moreover, anxieties concerning the availability and reliability of public charging infrastructure persist for a lot of potential EV consumers.

The expectations for EV development within the U.S. market have shifted from ‘rosy to actuality’ as gross sales enhance, however buyer acceptance of EVs is not holding tempo.”

Cox Automotive famous in its 2024 forecast report.

The industry’s EV strategy may change significantly in the coming months, driven by political pressures. Proposed increases in fuel economy standards could result in substantial fines for automakers, potentially exceeding $14 billion collectively. The potential role of hybrids and plug-in hybrids in meeting these regulations remains unknown, as the standards were designed with rapid EV adoption in mind.

Besides that, the upcoming U.S. presidential election also poses risks to the industry, with potential implications for fuel economy mandates. In Europe, stricter EV regulations aim to phase out traditional fossil-fuel vehicles by 2035, though there have been calls to reconsider or drop this ban.

Tesla’s Valuation

Tesla And Its Elevated Earnings A number of

Many investors, especially from the retail crowd, look at Tesla’s revenues and extrapolate them into the future. This approach might work in some cases. However, applying it to a company with such a short history of profitability, and such an unpredictable path forward considering all the risks and obstacles mentioned in the article, the result may get skewed significantly.

First, the past doesn’t indicate the future, and it’s crucial to keep it in mind when investing in anything. Secondly, there are hints in the company’s financials on why this approach might lead to inaccuracies.

One of the indications worth keeping an eye on in terms of Tesla’s sales is a discrepancy between its revenue growth and revenue per share growth.

| 2020 | 2021 | 2022 | 2023 | |

| Revenue Growth | 28 % | 71 % | 51 % | 19 % |

| Revenue per Share Growth | 22 % | 61 % | 43 % | 17 % |

In the last four years, Tesla kept diluting its investors. However, the differences have been decreasing, which is a positive development.

Moreover, Tesla’s EPS growth plummeted from 676% in FY 2021 to 19% in FY 2023. Currently, analysts are estimating a fairly sluggish EPS increase of 8.41% CAGR over the next 3-5 years. At first glance, it seems much too low for a company whose P/E ratio is 34.2

P/E GAAP of Tesla vs. Volkswagen vs. Ford vs. GM vs. BYD (Seeking Alpha)

Compared to four other competitors, Tesla seems to be far ahead of itself in terms of the stock price, since it doesn’t justify current growth. The valuation exceeds the typical range for companies in the automotive industry. Even contrasting Tesla with its fiercest competitor BYD, the Texas-based manufacturer looks two times more expensive on a P/E basis.

Analyst Estimates on Tesla

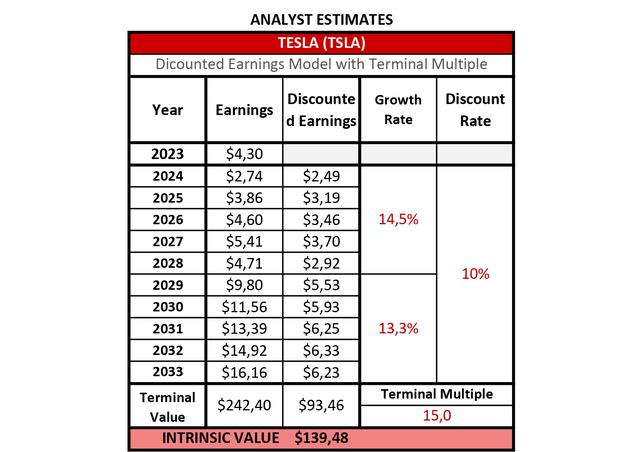

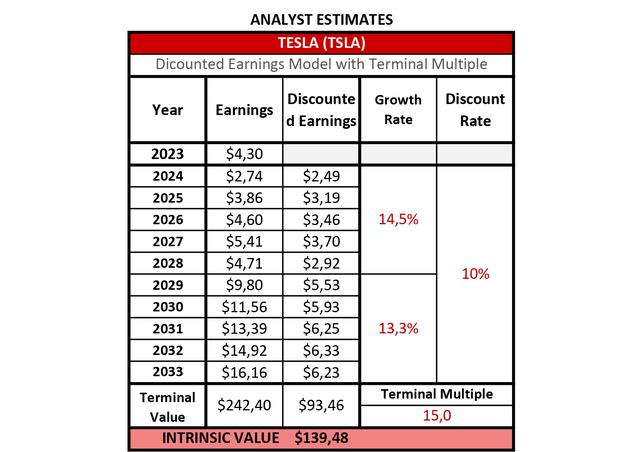

Based on analyst estimates, Tesla will earn $16.16 per share in 2033. By applying earnings predictions for the company from now until 2033, the following valuation model can be built.

Tesla Discounted Earnings Model – Analyst Estimates (Author – Data: Seeking Alpha)

One can see that Tesla is assumed to grow 14.5% CAGR in the first five years and only slightly less in the following five. A terminal multiple of 15 was applied, which corresponds with a long-term market average. It might be seen as very conservative by those who see Tesla conquering the world with its technological solutions beyond electric cars and solar systems. For those who consider the company a car manufacturer, this P/E ratio will be very optimistic. However, by sticking to the long-term market average, Tesla looks fairly valued right now, as the stock price is hovering around $140.0 per share as of April 22, 2024.

Normal Case for Tesla

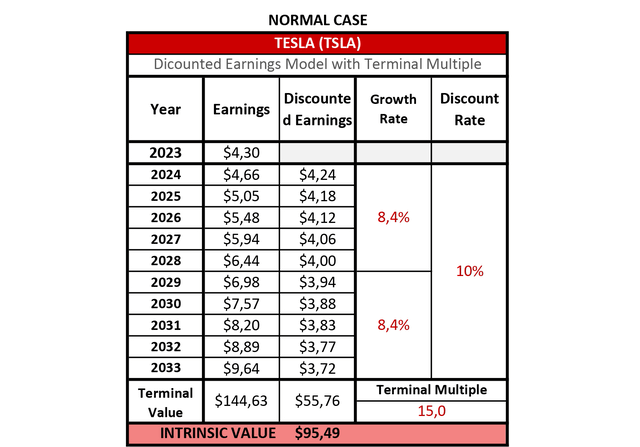

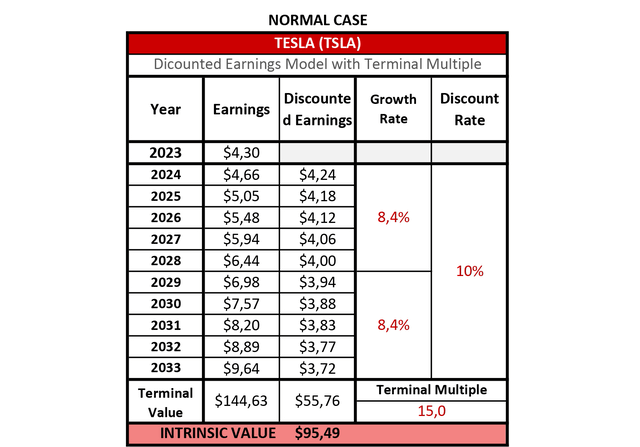

In the normal case, a growth of 8.4% CAGR for the next 10 years is assumed. If this scenario materializes, Tesla’s stock price is likely ahead of itself.

Tesla Discounted Earnings Model – Normal Case (Author – Data: Seeking Alpha)

A share price of $95.49 might seem very low for many. Yet, the fact that Tesla stock was on an enormous run, fueled by the post-pandemic EV hype, could indicate that a lot got priced in. While many EV companies, such as NIO Inc. (NIO), Rivian Automotive, Inc. (RIVN), and Mullen Automotive, Inc. (MULN) are hitting new all-time-lows or Fisker Inc. (FSRN) being on the verge of bankruptcy, Tesla is still holding up. Yet, if the normal case scenario became real, and Tesla delivered such EPS numbers over the next 10 years, the company would be overvalued by 47.7%.

Tesla’s Earnings

The sentiment around Tesla ahead of its Q1 2024 earnings was dull. Missing delivery numbers induced disappointment among investors, which could be seen from the beginning of the year, sending the stock 42.7% down YTD.

Besides that, Tesla confirmed layoffs affecting over 10% of its global workforce, recalled more than 3,000 Cybertruck vehicles, and has just cut prices of its cars again. That’s not the best setup before the earnings. Any miss may send the stock price sharply lower.

Tesla disappointed investors by lacking the estimates and reporting considerably decrease numbers YTD:

- Earnings per share: $0.45 adjusted vs. expected $0.51 per share.

- Revenue: $21.30 billion vs. $22.15 billion expected.

The revenue decline was influenced by several factors, including a decline in the average selling price of vehicles compared to the previous year, along with an unfavorable mix impact. Additionally, there was a reduction in vehicle deliveries, partly due to disruptions in production at the Fremont factory and Giga Berlin, as well as a negative currency exchange impact.

However, there were areas of growth in other parts of the business, and an increase in Full Self-Driving (“FSD”) revenue recognition YTD, attributed to the release of the Autopark feature in North America.

Despite this, operating income also decreased YTD to $1.2 billion, leading to a 5.5% operating margin. This decline was primarily due to factors such as reduced vehicle ASP, increased operating expenses related to AI and R&D projects, the expenses related to the Cybertruck production ramp, and lower vehicle deliveries causing updates and disruptions.

Yet, on a positive note, there were mitigating factors, including a decrease in cost per vehicle, growth in gross profit in Energy Generation and Storage, and higher FSD revenue recognition resulting from the Autopark feature release.

Tesla May Surprise Everybody Again

Tesla is facing a wave of challenges – stricter regulations, the Cybertruck recall, price cuts due to competition, and a global slowdown in demand. To navigate these hurdles, Tesla will need to execute efficiently at the highest level. Having Elon Musk and a highly innovative work culture might help beat the odds and deliver stronger-than-expected performance across its segments.

Price cuts and competition demand advanced strategies. First, Tesla needs to focus on cost reduction through production efficiencies and supply chain optimization. Second, the company must start appealing to a broader range of customers who can’t afford vehicles from the premium price segment. Moreover, fast expansion of the Supercharger network, monetization of software features, and data-driven services can create new revenue streams.

A global demand slowdown demands geographic expansion into new markets with high EV adoption and less competition. This could be achieved with a more affordable Tesla model or a strong certified pre-owned program.

Competition can be tackled by staying ahead in battery technology, autonomous driving, and other innovative features. Prioritizing exceptional customer service could be the cherry on top which would encourage potential buyers to go for a Tesla vehicle.

Beyond these immediate challenges, Tesla could increase investments in exploring opportunities in battery storage solutions or renewable energy products. There are, of course, unknown potential revenue streams that might be in the making while being kept highly confidential.

Tesla’s history suggests it’s comfortable taking risks and pushing boundaries. If some of Elon Musk’s visions materialize and Tesla becomes the pioneer in other technological segments, the company should be back on the fast lane and generate high growth again. Yet, there are a lot of question marks and unknowns in this rosy scenario. Thus, it’s difficult to quantify it and make any reasonable predictions.

Conclusion

Tesla’s challenges appear to be mounting, with investors expressing disappointment as the stock plummeted nearly 42.7% YTD. This decline follows a series of events that have been unfolding for roughly a year and was confirmed in the newly reported quarterly numbers. Falling margins, strong competition, low demand, and a general slowdown in the EV market only confirm that no matter how innovative and well-run a company is, it will finally get hit by the reality of the industry it’s in. And if the industry has terrible economics, the odds are against the company.

Besides that, internal issues from confirming significant layoffs, a recall of the Cybertruck, as well as cutting vehicle prices, have been affecting the automaker. All these developments reflect a broader picture of uncertainty surrounding Tesla’s future trajectory, as it navigates regulatory, financial, and operational hurdles in the fiercely competitive electric vehicle market.

On top of all that, Tesla seems to be overvalued, and its stock is prone to a further decline in the current environment. Valuation will finally matter. Tesla stock might be currently in the process of being reevaluated by market participants. Unless the leadership doesn’t announce breaking news bringing back euphoria, the near-term future will probably remain rough for Tesla and its investors.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.