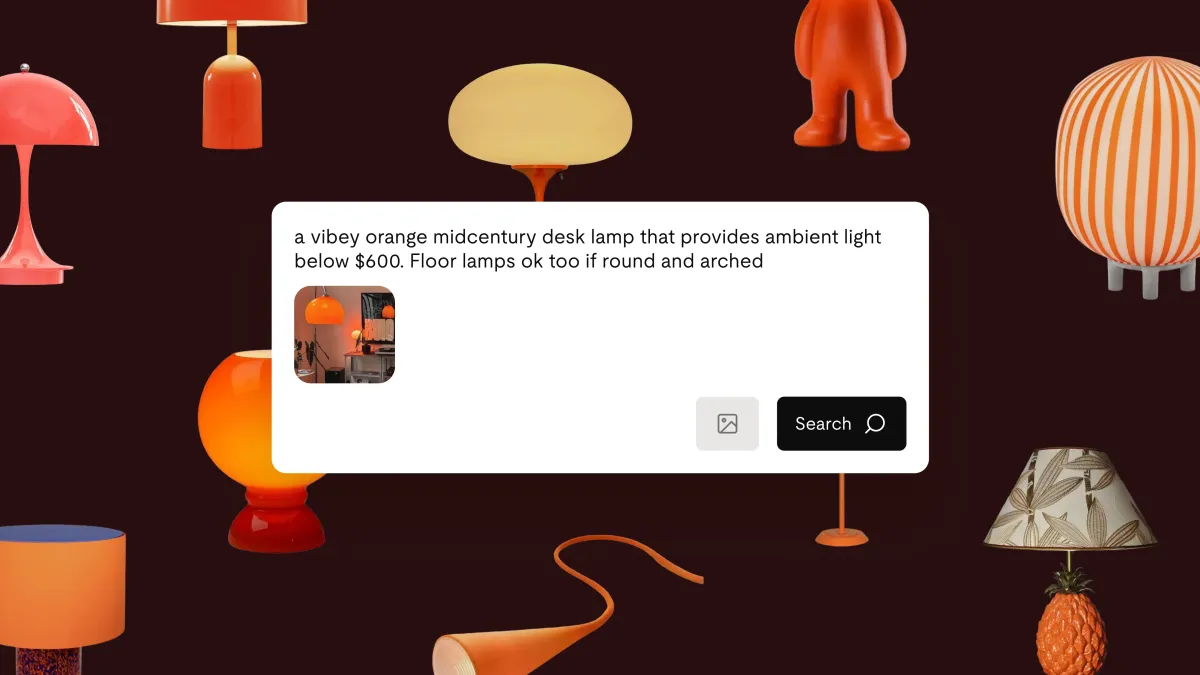

Quick Facts:

- ➡️ Texas allocating $5M into a BlackRock Bitcoin ETF during a dip shows a growing state-level conviction in Bitcoin’s long-term upside.

- ➡️ Broader adoption of spot Bitcoin ETFs by institutions reinforces $BTC as macro collateral, even as on-chain scalability and programmability remain unresolved bottlenecks.

- ➡️ Bitcoin Hyper aims to address these with an SVM-powered Bitcoin Layer 2 offering sub-second, low-fee smart contract execution while using Bitcoin as the settlement backbone.

- ➡️ Its $HYPER token presale has already raised over $28.5M, including a whale buy worth over $500K less than two weeks ago.

When a US state buys the dip, people pay attention.

Texas just allocated $5M into BlackRock’s spot Bitcoin ($BTC) ETF while $BTC trades well below its all-time high. This signals that state-level capital still sees asymmetric upside in Bitcoin’s long-term trajectory.

If you’re a crypto investor, that’s a strongly bullish message. That’s because when public institutions step in during a pullback, they’re effectively saying volatility is a feature, not a deal-breaker.

But simply holding $BTC on a centralized ETF rail isn’t where the real innovation is happening. The next leg of the cycle is increasingly about what can be built on top of Bitcoin: scaling, programmability, and yield-generating infrastructure.

That’s where projects like Bitcoin Hyper ($HYPER) become appealing to more aggressive risk-takers looking to ride institutional narratives.

Bitcoin Hyper pitches itself as a Bitcoin Layer 2 with Solana Virtual Machine (SVM) integration, attempting to blend Bitcoin’s settlement finality with Solana-style performance.

If you’re watching Texas buy the ETF dip, the thesis is straightforward: if state treasuries are comfortable with base-layer $BTC, the upside may shift toward infrastructure that unlocks high-speed payments, DeFi, and dApps on top of that base.

Why Big Money Is Looking Beyond Spot Bitcoin Exposure

Texas’s spot Bitcoin ETF allocation strengthens $BTC’s role as a long-term store-of-value rather than just a speculative trade.

The catch is that Bitcoin’s base layer still processes 7-10 transactions per second, with confirmation times measured in minutes. Meanwhile, its fees regularly spike into several dollars during congestion.

For everyday payments, on-chain DeFi, and gaming, that user experience can’t compete with newer high-throughput chains like Solana that finalize in seconds for fractions of a cent.

That gap has triggered a flood of Bitcoin scaling plays: Lightning for peer-to-peer payments, sidechains like Rootstock and Liquid for smart contracts, and emerging rollup-style or L2 concepts to add programmability anchored in Bitcoin-level secure settlement.

As more institutional money holds passive $BTC exposure via ETFs, the opportunity space shifts to these L2 projects attempting to make Bitcoin usable, not just investable.

Within that landscape, Bitcoin Hyper sits alongside other Bitcoin L2 contenders but takes a more aggressive approach by importing SVM semantics and Solana-style tooling onto a Bitcoin-secured execution layer.

Inside Bitcoin Hyper’s Bet on SVM-Powered Bitcoin Scaling

Where Bitcoin Hyper tries to stand out is in raw performance. The project positions itself as a Bitcoin Layer 2 with SVM integration, aiming to deliver Solana-fast transaction throughput and low-latency execution while still anchoring finality back to Bitcoin Layer 1.

In practice, that means sub-second block times, rapid confirmation, and fees targeted in the sub-cent range for routine transfers.

Under the hood, the architecture is modular: Bitcoin L1 handles settlement and periodic state anchoring, while a high-speed SVM-based Layer 2 processes execution in real time.

A single sequencer orders transactions and commits them back to Bitcoin, while a decentralized canonical bridge allows $BTC holders to move value onto the L2 as wrapped assets.

SPL-compatible token standards are adapted for this environment, giving Rust developers a familiar model to build swaps, lending protocols, and NFT or gaming primitives.

From an adoption standpoint, the team is leaning on tokenonomics and early traction to draw capital.

The presale has already raised over $28.5M, with tokens at $0.013335, indicating that a growing number of investors is already investing in SVM-on-Bitcoin narratives.

Whales are particularly interested in the project. Less than two weeks ago, one purchased a little over $500K worth of $HYPER tokens, which is the strongest signal of support yet on Bitcoin Hyper.

Long-term, $HYPER token could explode, and according to our Bitcoin Hyper price prediction, it could reach a high of $0.20 by the end of 2026. That’s about a 1,399% increase from its current price.

Bitcoin Hyper’s value proposition is simple: if states like Texas are bullish on Bitcoin, then an L2 that builds upon $BTC’s infrastructure can only soar in popularity.

But with a price increase coming up a day from now, it’s best to act quickly and lock in $HYPER at a discounted price.

Join the Bitcoin Hyper presale today.

Disclaimer: Nothing in this article constitutes financial, investment, or trading advice; always do your own research and never invest more than you can afford to lose.

Authored by Bogdan Patru, Bitcoinist — https://bitcoinist.com/texas-bitcoin-etf-bet-boosts-bitcoin-hyper-interest

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.