President Trump lives on deals: “That’s what I do—I do deals,” he once told Bob Woodward. On the one-year anniversary of his second presidency, he’s pushing hard to make his biggest, most disruptive deal ever, one that would bring Greenland under the control of the U.S.—and the global business community is still scrambling to adapt to his approach. Here are nine of Trump’s most unorthodox deals from the past year.

Nine deals that shook the business world

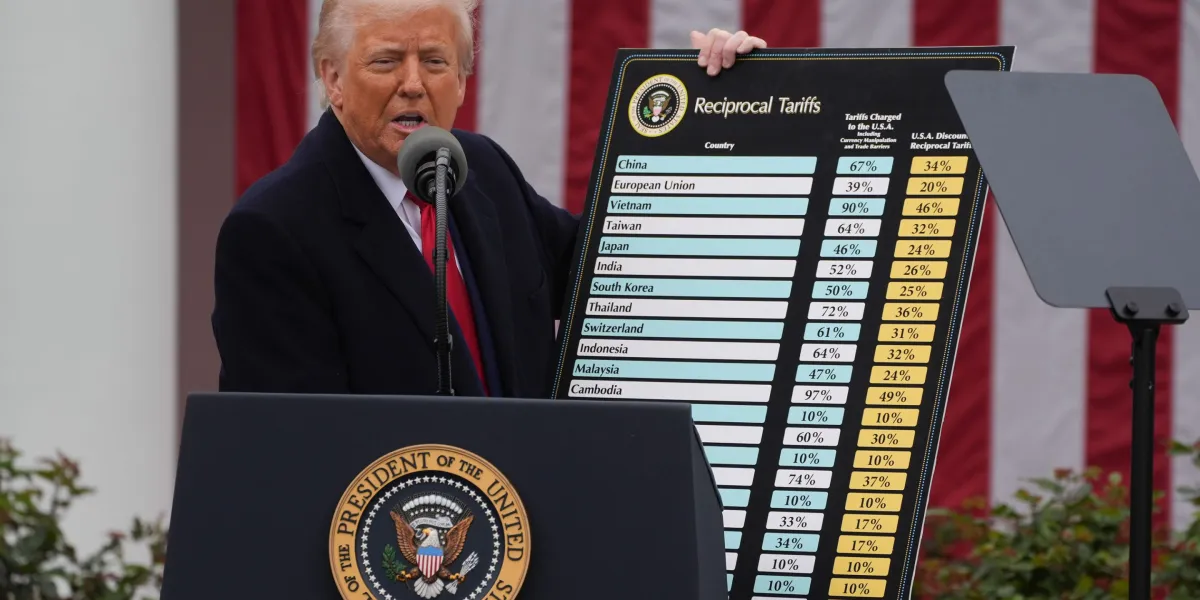

April 2, 2025: Reciprocal tariffs

Trump imposes “reciprocal tariffs” on 57 countries, with each tariff understood as an opening bid in a negotiation. Several countries have since made deals. The one-on-one negotiations, unlike the multilateral system of the past 80 years, can be chaotic for companies and economies

June 13: U.S. Steel “Golden Share”

In return for allowing Nippon Steel to buy U.S. Steel, Trump requires that the U.S. receive several powers over the company, including total power over all the board’s independent directors and vetoes over locations of offices and factories.

July 10: MP Materials

The U.S. pays $400 million for a large equity share in MP and signs a contract to buy all of MP’s rare earth magnets for 10 years. The reason for the equity stake was not disclosed.

July 14: Nvidia, Part 1

JADE GAO—AFP/Getty Images

Trump reverses the U.S. ban on selling Nvidia H20 chips to China in exchange for Nvidia paying the U.S. 15% of the revenue.

July 23: Columbia University

LYA CATTEL/Getty Images

The Trump administration restores $400 million of canceled federal research funding for the university under an unprecedented multipoint deal. For example, Columbia must supply data to the federal government for all applicants, broken down by race, “color,” GPA, and standardized test performance. A few other schools later make similar deals.

August 6: Apple

Bonnie Cash—UPI/Bloomberg/Getty Images

At a public appearance with Trump, CEO Tim Cook announces Apple will invest an additional $100 billion in the U.S. over four years; Trump announces Apple will be exempt from a planned tariff on imported chips that would have doubled the price of iPhones in the U.S.

August 22: Intel

Justin Sullivan—Getty Images

Intel trades the U.S. government a 9.9% equity stake in exchange for $8.9 billion that might already be owed to Intel under the CHIPS and Science Act. The deal is unusual because the company was not in immediate danger or significantly affecting the economy.

December 8: Nvidia, Part 2:

Trump reverses the U.S. ban on selling powerful Nvidia H200 chips in exchange for Nvidia paying the U.S. 25% of the revenue. Both Nvidia deals are unusual because the payments to the U.S., based on exports, appear to be forbidden by the Constitution.

December 19: Pharma

Alex Wong—Getty Images

Nine pharmaceutical companies make deals with Trump that are intended to lower drug prices. This is unusual because Trump negotiated separate deals with each company, and the terms have not been released.

All eyes this week will be watching President Trump at the World Economic Forum in Davos, where the president has hinted he’ll announce some high-stakes agreements. Expect the unexpected.

A version of this piece appears in the February/March 2026 issue of Fortune.