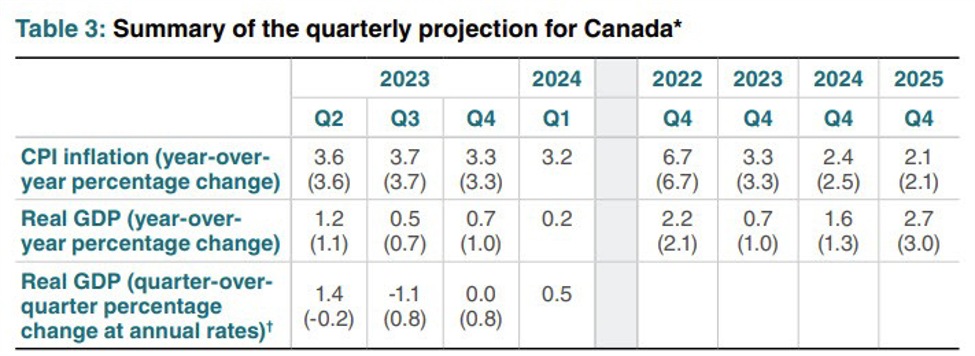

The abstract of the quarterly projections for Canada from the Financial Coverage Report exhibits:

Wanting on the prior report,

CPI for 2024 sees an increase to 2.5%. Within the final report, the expectation was 2.4% In 2025, the inflation charge is predicted to dip to 2.1%. That’s unchanged from the final report’s estimate.

For actual GDP YOY, 2024 development is seen at 1.6% vs 1.3% within the final report. In 2025, the expectations is for two.7% which is down from 3.0% from the final reviews estimate.

A overview of the MPR from the BOC:

- World financial system is slowing down however is stronger than anticipated, particularly because of the US financial system’s efficiency.

- Development is predicted to reasonable additional in 2024.

- Inflation is lowering in most main economies and is predicted to proceed declining in direction of central banks’ targets.

- In Canada, Shopper Worth Index (CPI) inflation is excessive however regularly easing.

- Financial coverage in Canada is successfully moderating spending and decreasing value pressures in varied sectors, although shelter value inflation stays excessive.

- Canada skilled stalled financial development in mid-2023, resulting in a state of affairs the place provide has caught up with demand, creating modest extra provide.

- Labour market situations in Canada are enhancing, however wage development stays round 4% to five%.

- Forecast for 2024 in Canada contains weak financial exercise in Q1, adopted by gradual enchancment, with GDP development just below 1%. Authorities spending considerably contributes to this development.

- GDP development in Canada is projected to extend to about 2.5% in 2025.

- Inflation in Canada is predicted to be round 3% within the first half of 2024, lowering to 2.5% within the second half, and returning to focus on in 2025.

- The financial outlook stays unsure, though it aligns largely with projections from the October Report.

- Dangers to inflation outlook are thought-about balanced, however there’s concern about persistent underlying inflation and the potential for it to stay above goal longer than anticipated.

On the Canadian financial system, the BOC says:

- CPI inflation in Canada eased to three.3% in This fall 2023.

- Financial coverage is successfully slowing development and decreasing extra demand pressures on inflation.

- Inflation stays excessive, with continued robust inflation in shelter and meals costs.

- Financial development is predicted to be near zero by way of Q1 2024, then regularly choose up.

- Previous rate of interest will increase and up to date easing in monetary situations are influencing this financial pattern.

- Inflation is predicted to remain shut to three% within the first half of 2024, then regularly ease and return to the two% goal by 2025.

- There may be appreciable uncertainty in regards to the charge of future inflation decreases.

- The financial slowdown ought to cut back inflationary pressures, however there are issues about different elements doubtlessly maintaining inflation above the goal for longer than anticipated.