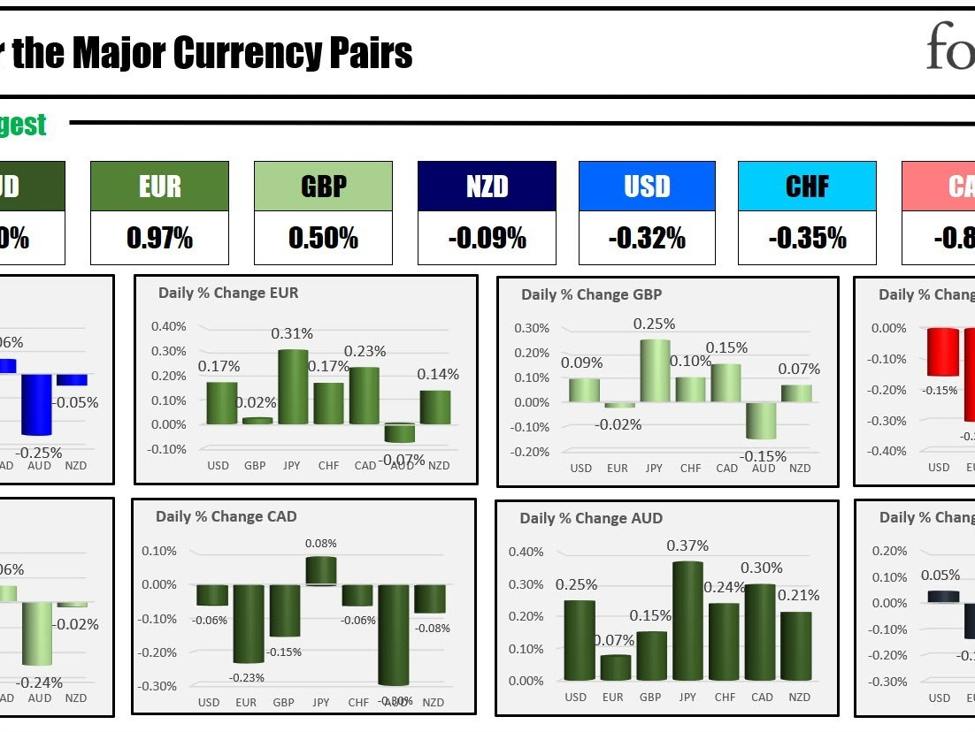

The strongest to the weakest of the most important currencies

Because the North American session begins, the AUD is the strongest and the JPY is the weakest. The vacation shortened week will hold the motion restricted. THe main currencies are scrunched collectively. The order can shift pretty simply. The US greenback is blended and little adjustments. The 0.25% decline versus the AUD the largest mover for the buck. The USD is increased by 0.15% versus the JPY which represents the largest gainer for the USD.

At the moment, the Richmond Fed composite index for December might be launched at 10 AM. The U.S. Treasury will public sale off five-year notes at 1 PM. Yesterday the treasury auctioned off 2-year notes with OK demand.

US shares rose yesterday with the Nasdaq index main the most important three indices with a acquire of 0.54%. The Russell 2000 of small-cap shares enhance by 1.24% as buyers continued the shift to the extra riskier smaller corporations. These corporations profit from the sharp fall in yields during the last month of buying and selling. US yields are decrease once more right now with the 10-year yield down round -2.7 foundation factors.

A stepchild market presently exhibits:

- Crude oil is down $1.08 or -1.43% at $74.49.

- Gold is buying and selling up $0.50 or 0.03% at $2068.10.

- Silver is down $0.12 or -0.51% at $24.08

- Bitcoin is buying and selling at $42,890. It is excessive reached $43,224. It is low reached $42,121.

Within the premarket for US shares, the most important indices are marginally increased. The main indices have been up for eight consecutive weeks. They bought off to a constructive begin yesterday:

- Dow Industrial Common futures are implying a acquire of 23.00 factors. Yesterday the index rose 159.36 factors or 0.43%.

- S&P futures are implying a acquire of 4.75 factors. Yesterday the index rose 20.10 factors or 0.42%. The excessive value yesterday bought inside about 12 factors of its all-time excessive closing degree at 4796.57.

- Nasdaq futures are implying a acquire of 26.79 factors. Yesterday the index rose 81.60 factors or 0.54%. It reached and closed at a brand new excessive going again to January 2022.

Within the European fairness market, main indices are again open after yesterday’s prolonged vacation:

- German DAX +0.28%

- France CAC +0.21%

- UK FTSE 100 +0.58%

- Spain’s Ibex +0.15%

- Italy’s FTSE MIB +0.33% (10 minute delay)

Trying on the US debt market, yields are decrease:

- 2-year yield 4.282%, -0.6 foundation factors

- 5-year yield 3.854% -2.1 foundation factors

- 10-year yield 3.50% -3.6 foundation factors

- 30-year yield 4.001% -4.2 foundation factors

Within the European debt market, the benchmark 10-year yields are decrease:

European benchmark 10-year yield’s