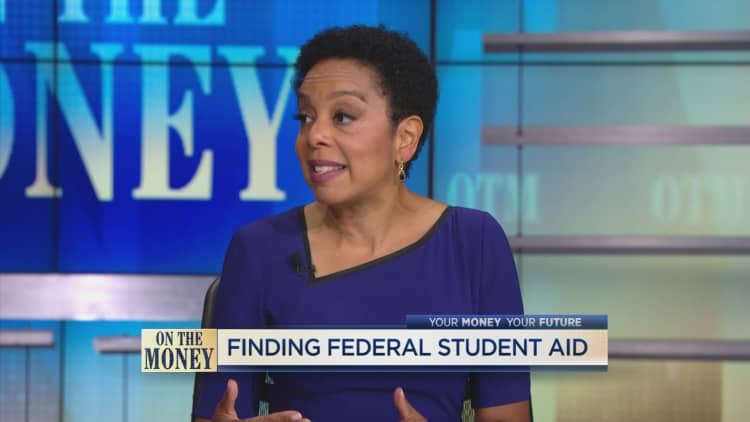

For a lot of households, financial aid is vital relating to paying for college.

However college students should first fill out the Free Application for Federal Student Aid to entry any help. And this 12 months, the FAFSA has been considerably delayed.

For the 2024-2025 faculty 12 months, a brand new, streamlined FAFSA kind might be obtainable on or earlier than Dec. 31, 2023, as much as almost three months later than in earlier years. (The Training Division mentioned it plans to return to an Oct. 1 begin date subsequent 12 months.)

“The irony is they are changing the FAFSA to make it simpler and easier but in doing that, you’ve created a problem,” mentioned Mary Morris, CEO of Virginia529, one of many largest 529 plans within the nation. For households making an attempt to navigate the method, a brand new method and the delay are “intimidating and scary and annoying.”

Extra from Private Finance:

Fewer students are enrolling in college

What to consider before refinancing a student loan

Student loan borrowers should be aware of scams

The FAFSA serves as the gateway to all federal assist cash, together with loans, work examine and grants, that are essentially the most fascinating sorts of help as a result of they sometimes don’t should be repaid.

In strange years, highschool graduates miss out on billions in federal grants as a result of they do not fill out the FAFSA.

Many households mistakenly assume they won’t qualify for monetary assist and do not even hassle to use. Others say a prolonged and overly difficult software is a significant hurdle.

The plan to simplify the FAFSA has been years within the making. In 2020, the Consolidated Appropriations Act was handed to streamline the method. These modifications are lastly going into impact.

Why it is necessary to file the FAFSA early

Regardless of the delay, it is nonetheless advantageous for college students to file the FAFSA as quickly as they’ll, in line with Rick Castellano, a spokesperson for Sallie Mae.

The sooner households fill out the shape, the higher their chances are high to obtain assist, since some monetary assist is awarded on a first-come, first-served foundation, or from packages with restricted funds.

It is doable there might be technical points when the brand new kind lastly turns into obtainable on-line, significantly if there’s a surge in visitors to the positioning, Castellano mentioned. Nevertheless, that should not forestall households from finishing the FAFSA within the days that observe, he added.

“While there may be some hiccups along the way, students and families should do what they need to do to file as soon as possible.”

What’s modified with the brand new FAFSA

Not solely has the timing modified, however the simplified kind now additionally makes use of a calculation referred to as the “Student Aid Index” to estimate how a lot a household can afford to pay.

Traditionally, many components, not simply income, go into how a lot assist college students obtain, together with the full variety of folks within the family and the variety of kids in school, in addition to different monetary commitments equivalent to a house fairness mortgage or baby help funds.

Now, the method will pull federal tax data instantly from the IRS and slims 108 questions right down to lower than 50.

Going ahead, the Division of Training will not give households a break for having a number of kids in school on the similar time, successfully eliminating the “sibling discount.”

“The elimination of the multiple student adjustment is one of the many tectonic changes under FAFSA simplification that will take full effect beginning with the 2024-2025 academic year,” Kalman Chany, a monetary assist marketing consultant and creator of The Princeton Evaluation’s “Paying for College,” recently told CNBC.

Up till now, “the multiple student adjustment has been the single most important data element affecting one’s eligibility for federal student aid,” Chany mentioned.

On the similar time, the brand new FAFSA will elevate the household revenue threshold, making extra college students eligible for federal need-based assist.

Greater than half one million further college students will qualify for a Pell Grant, a sort of assist obtainable to low-income households, in line with increased training professional Mark Kantrowitz. And of people who qualify, greater than 1.5 million will qualify for the utmost quantity.

At the moment, the maximum Pell Grant award is $7,395.

Below the brand new system, extra college students may have entry to federal grants, however some — seemingly wealthier — college students will miss out on the sibling low cost, in line with Kantrowitz.

What college students can do now to prepare

For college kids who really feel pressured by having to submit school functions with out realizing how a lot the colleges will value them, the Federal Student Aid Estimator can present an early estimate of what your federal pupil assist may very well be after submitting the brand new kind.

To facilitate the coed assist calculations, “get your financial house in order,” Virginia529′s Morris suggested. College students and households ought to have their tax types prepared and create a StudentAid.gov account together with a Federal Scholar Help (FSA) ID, which is required to enter and entry your data on-line.

Then, observe Federal Scholar Help on social media for upcoming bulletins, together with an alert when the brand new FAFSA kind is accessible to finish.

That is additionally a superb time to contemplate different sources for merit-based aid, Morris added, by looking web sites like Scholarships.com and the College Board.

Actually, there are greater than 1.7 million non-public scholarships and fellowships obtainable, usually funded by foundations, firms and different impartial organizations, with a complete worth of greater than $7.4 billion, in line with Kantrowitz.

Lastly, there are many free resources to assist information households by the up to date FAFSA course of. “Know that there is assistance out there, and just don’t give up,” Morris mentioned. “It will be worth it in the long run.”