PM Pictures

Abstract

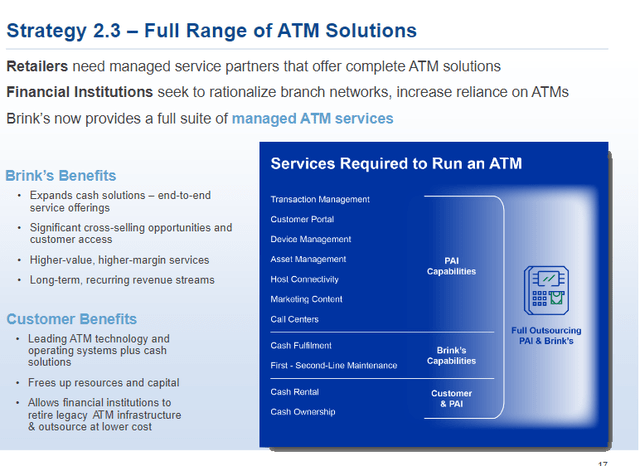

I’m recommending a maintain score for The Brink’s Firm (NYSE:BCO), as the present share worth will not be enticing. BCO offers money and worth administration (core enterprise), ATM managed companies [AMS], and digital retail options [DRS]. The core enterprise consists of the safe transportation of foreign money, valuable metals, and securities for monetary establishments and governments, and ATM companies embody money replenishment, transaction processing, and the and the set up and upkeep of bank-owned ATM networks.

DRS primarily leverages expertise platforms to make money obtainable to clients in a quicker method (together with serving to within the assortment, administration, settlement, and reconciliation of digital funds). The character of BCO companies additionally meant long-term recurring revenues, as core companies typically have multi-year contracts establishing service ranges and pricing.

Feedback

Scale issues lots on this trade, and I imagine BCO’s market share management confers important aggressive benefits and scale economies. For market share data, BCO is the market chief of money administration companies globally and will probably be price ~$20.53 billion in 2023 with round 20+% market share, adopted by the 2nd participant, Loomis, and Prosegur Money, who each have round low-teens share market share.

Scale is essential as a result of it offers sturdy route density that will increase assortment effectivity (per route), improves service turnaround instances (simpler to revisit the identical level of assortment whether it is close to the subsequent or earlier job), will increase gas effectivity (gas value per service drops), and allows higher servicing of nationwide accounts. The final level in servicing nationwide accounts and enormous enterprises is a vital level to notice as a result of subscale rivals can’t compete in opposition to giant gamers like BCO. Nationwide accounts sometimes have a presence throughout the nation, they usually naturally wish to simply take care of one single vendor because it reduces safety threat (money transfers throughout a number of fingers are likely to have extra factors of failure) and likewise makes accounting simpler since reporting and associated stuff will be consolidated earlier than sending to BCO.

From the viewpoint of the service supplier, with out route density throughout the area of focus, it might not be economically viable to service the entire nation’s accounts (e.g., participant A solely focuses on area A, however the shopper requires service for areas B, C, and D the place participant A doesn’t have any routes). BCO model and historical past signify extra aggressive benefits in an trade that locations a premium on threat administration, for my part, noting that BCO has been within the CIT enterprise for greater than 100 years.

The bear thesis revolving round BCO is that the world is transferring towards cashless funds, and as such, money assortment companies may not be as essential anymore. Whereas I agree with the broader traits, I feel there are ample development alternatives for BCO to proceed rising healthily (not less than in keeping with consensus development) ahead due to:

- Loads of market share left to seize: BCO is the biggest participant, and if the broader secular headwind had been to affect the trade, subscale gamers would faucet out first, giving up market share for BCO to seize.

- Growing international locations are nonetheless seeing a 20-30% mix of transactions in money, which suggests there may be nonetheless a big market of accounts to service for BCO. I’d additional word that administration commented that their AMS nonetheless sees a “growing pipeline” of alternatives in 2024.

- Whereas money transactions will go away, money is not going to go away, which suggests ATMs should live on if shoppers don’t have any solution to withdraw money when wanted. This turns into a “liability” for banks as a result of they should spend sources to handle these machines. For BCO, that is music to its ears as a result of it has the proper options and route density to resolve this downside. I may argue that the lowering utilization of money truly advantages BCO from this viewpoint.

It is vitally obvious from 4Q23 results that BCO will not be going through sturdy headwinds provided that DRS and AMS income grew 17% organically on a mixed foundation in 4Q23 which is of comparable magnitude as 3Q23 (18% development). These enterprise segments have additionally grown to signify 21% of BCO income combine, additional diversifying BCO away from its earlier core enterprise.

I imagine that DRS’s development momentum will persist, as the corporate is at the moment experiencing a strong begin to 2024 with installations in North America and a formidable traction in Europe with new buyer onboarding. The gross sales pipeline can also be up 50% year-over-year throughout all areas.

As BCO scales up, I’d anticipate margins to broaden since there are quite a lot of fastened prices within the enterprise. Administration steering is for 80 bps of EBITDA margin growth on the midpoint in 2024, pushed by productiveness enhancements, working leverage, and a better mixture of high-margin DRS and AMS options. This could move by means of properly to extra FCF technology to help capital returns-both dividends and share repurchases.

As per consensus estimates, we’re a possible $1 DPS in FY24 ($44.7 million money required), which mixed with a share buyback of two.2% ($85 million money required) in FY24 (primarily based on the previous 5 years share repurchase trend-a 11% discount between FY18 and FY23), I’m anticipating a capital return yield of ~3.3%. To facilitate this, BCO wants ~$130 million of money, which will be simply offered by present FCF technology. As for the remaining FCF, I anticipate it to be allotted to M&A (BCO acquired 8 targets over the previous 5 years) to scale the enterprise up.

Valuation

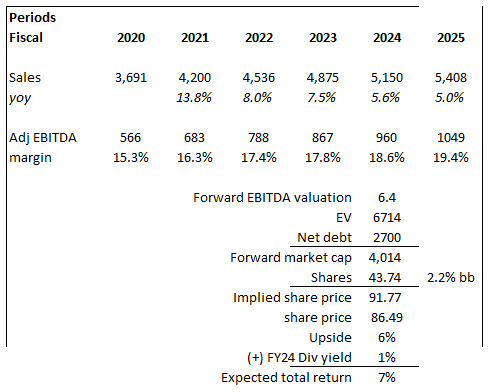

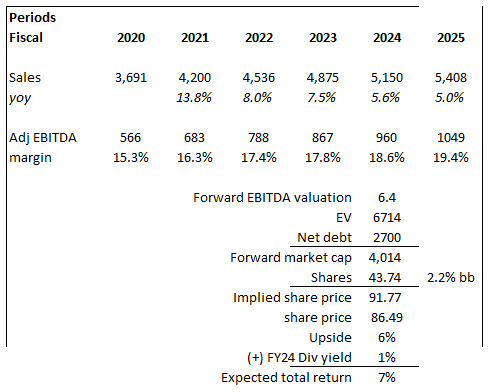

Based mostly on writer’s personal math

Based mostly on my view of the enterprise, BCO ought to be capable of develop at mid-single digits (5.6/5% for FY24/25) with no points given the varied development drivers that I’ve famous in my feedback part above. For word, 5.6% is in keeping with administration steering, and I extrapolated the mid-single-digit pattern into FY25. I assumed EBITDA margins would broaden by 80 foundation factors following the information and by the identical magnitude in FY25 as I anticipated comparable development charges.

Given the comparatively slower development expectation vs. FY21/22/23, I feel it is arduous to justify a better a number of within the close to time period (regardless of the excessive margin profile); therefore, I assumed the present a number of valuation would keep. After together with share buybacks and a 1% dividend yield, I derived an anticipated whole return of seven%, which isn’t compelling. Subsequently, I like to recommend a impartial score, placing this on the watchlist till the share worth will get cheaper.

Danger

Inflation in Argentina may trigger an enormous swing in EBITDA, as BCO may not be capable of match the associated fee improve as shortly as it might like, provided that pricing development sometimes lags enter value development. Concerning development headwinds, BCO is at the moment shedding contracts in North America which have unfavorable pricing economics, which goes to have a damaging affect on volumes and income in FY24.

Conclusion

I’m recommending a maintain score. Whereas BCO boasts a powerful market share and development potential in its core enterprise and rising digital options, present share worth will not be a gorgeous entry level. Headwinds like inflation and shedding of contracts may trigger near-term income development to be unstable – which may trigger some stress on the share worth (offering a greater entry level).