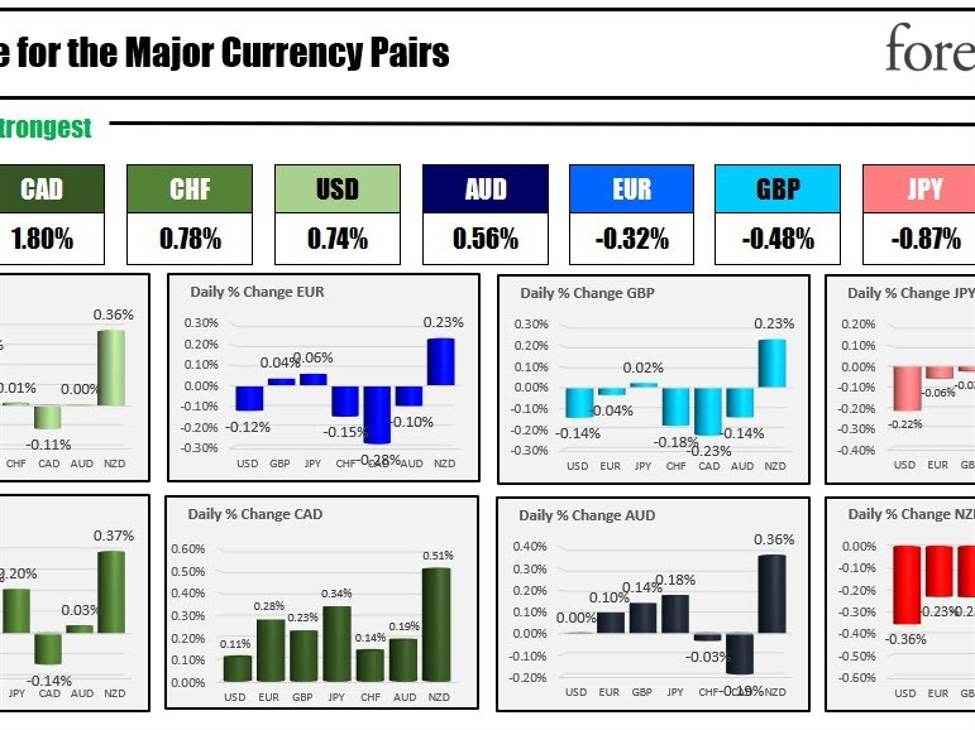

The strongest to the weakest of the most important currencies

The CAD is the strongest and the NZD is the weakest because the North American session begins. The main focus is will probably be on the US jobs report which will probably be launched at 8:30 AM ET. Adam’s preview may be found here.

The snapshot of the expectations reveals:

- Consensus estimate +180K (vary +100 to +275K). 30K are regarded as returning strike staff.

- Personal +158K

- October +150K

- Unemployment price consensus estimate: 3.9% vs 3.9% prior

- Participation price consensus 62.7% prior

- Prior underemployment U6 prior 7.2%

- Avg hourly earnings y/y exp +4.0% y/y vs +4.1% prior

- Avg hourly earnings m/m exp +0.3% vs +0.2% prior

- Avg weekly hours exp 34.3 vs 34.3 prior

What’s at stake? The markets are wanting forward and see Fed cuts as early as March. The market costs at the moment are implying a:

- 10% probability for a January reduce

- 58% probability for a March reduce

- 88% probability for a Might reduce

The market has priced in 130 foundation factors of cuts in 2024.

I’m not certain it will possibly go any additional. If it does, it means a slower financial system (recession) with a lot greater unemployment. In that case, the shares could also be in bother. The Nasdaq closed solely 19 factors from a brand new 2023 excessive shut. One thing has to offer.

Oil costs are greater from close to six-month lows as market merchants anticipate the U.S. nonfarm payrolls information and its potential affect on the American financial system and rates of interest. The costs have been additionally supported by Saudi Arabia and Russia urging OPEC+ members to stick to output cuts. Focus most lately has been anticipated weaker demand from slower international progress.

A snapshot of the markets to kickstart the North American session reveals:

- Crude oil is buying and selling up $1.39 or 2.0% at $70.74. At the moment yesterday, the value was at $69.80

- Spot gold is buying and selling down $-0.90 or -0.04% at $2027.45. At the moment yesterday, the value is at $2032.15

- Spot silver is buying and selling down 4.8 cents or -0.20% at $23.74. At the moment yesterday, the value was at $23.89

- Bitcoin is buying and selling at 43,007 $54. At the moment yesterday, the value was method down at $43,292

Within the US inventory market, the most important indices are implying a decrease opening after closing greater across-the-board yesterday. The Nasdaq index is now marginally greater on the week. The S&P and Dow Industrial Common are nonetheless on tempo for a decrease shut for the week snapping a five-week profitable streak:

- Dow Industrial Common futures are implying a lack of -17.38 factors . Yesterday the Dow Industrial Common rose 62.95 factors or 0.17%. For the week the index is down -0.35%.

- S&P index futures are implying a lack of -3 factors. Yesterday the S&P index rose 36.23 factors or 0.80%. For the week the index is down -0.20%.

- NASDAQ index futures are implying a decline of -37 factors. Yesterday the Nasdaq Index rose 193.28 factors or 1.37%. For the week the index is up 0.24%

Within the European fairness markets, the most important indices are buying and selling greater.

- German DAX, +0.24%. For the week the index is up 1.54%.

- France’s CAC, +0.70%. For the week the decks is up 1.78%

- UK’s FTSE 100, +0.12% %. For the week the index is unchanged

- Spain’s Ibex, +0.22%. For the week the index up 0.08%

- Italy’s FTSE MIB, +0.12% (10 minute delay).

Within the Asia Pacific market, main indices have been largely decrease. For the week, the indices have been decrease apart from the Australia S&P/ASX index:

- Japan’s Nikkei index, -1.68%.. For the week the index fell -3.36%

- China’s Shanghai Composite Index, +0.11%. For the week the index is down -2.04%

- Hong Kong’s Dangle Seng index, -0.07%. For the weekly index was down -2.95%.

- Australia’s S&P/ASX index, +0.30%. For the week the index was up 1.7%

Within the US debt market, yields are buying and selling greater:

- US 2Y T-NOTE: 4.630% +5.1 foundation factors. At the moment yesterday, the yield was at 4.617%

- US 5Y T-NOTE: 4.174% +6.2 foundation factors. At the moment yesterday, the yield was at 4.152%

- US 10Y T-NOTE: 4.179 p.c +5.1 foundation factors. At the moment yesterday, the yield was at 4.192%

- US 30Y BOND: 4.277 p.c +3.1 foundation factors. At the moment yesterday, the yield was at 4.262%

- 2 – 10-year unfold is buying and selling at -45.1 foundation factors. At the moment yesterday, the unfold was at -46.0 foundation factors

- 2 – 30 12 months unfold is buying and selling at – -35.7 foundation factors. At the moment yesterday, the unfold was at -35.6 foundation factors

Within the European debt market, benchmark 10-year yields are buying and selling greater:

European benchmark 10 12 months yields are greater