selimaksan/E+ through Getty Photos

Introduction

Eight years in the past, after I was writing below a special title, I made the case that analysts’ scores weren’t price a complete lot. Within the work, I used to be reminded of David Dreman and Michael Berry stating, “On average, 56 percent of the estimates measured as a percent of actual fall outside a plus or minus 10 percent range, a level that many Wall Street professionals consider minimally actable, approximately 45 percent fall outside a plus or minus 15 percent range. These results indicate that on average, large earnings surprises are the rule rather than the exception.” The most important upshot of my work was that analysts’ scores have been nugatory. It left me to marvel why individuals even hassle paying them any consideration.

I wish to revisit the efficiency of rated shares over the previous 5 years and make the case for a easy efficient display. Right here goes.

5-12 months Efficiency

Utilizing knowledge from FactSet, right here is the distribution of the typical scores of the 499 elements of the S&P 500:

- Robust Purchase: 28

- Purchase: 351

- Maintain: 115

- Promote: 5

- Robust Promote: 0

To be frank, I’m shocked that there’s not one firm that earned a median score of Robust Promote. I additionally marvel why the S&P 500 doesn’t have 500 firms, however I digress. I ran annual knowledge of the S&P 500 based mostly on common scores of every firm for the final 5 years (April 1, 2019-March 31, 2024). These are the outcomes based mostly on every score.

|

Interval |

Robust Purchase |

Purchase |

Maintain |

Promote |

SPDR S&P 500 Belief (ARCX: SPY) |

|

04/01/2019-3/31/2020 |

-16.1% |

-19.8% |

-20.2% |

-10.4% |

-8.4% |

|

04/01/2020-03/31/2021 |

59.5% |

61.9% |

62.1% |

38.5% |

46.9% |

|

04/01/2021-3/31/2022 |

12.9% |

11.7% |

8.6% |

-1.2% |

11.9% |

|

04/01/2022-03/31/2023 |

-11.0% |

-7.9% |

-3.0% |

-8.6% |

-9.3% |

|

04/01/2023-3/31/2024 |

19.0% |

18.8% |

13.6% |

7.0% |

25.4% |

|

Avg Return |

13.7% |

13.8% |

13.0% |

5.2% |

14.2% |

|

Deviation |

30.9% |

32.4% |

31.7% |

19.5% |

23.7% |

|

Return/Danger |

0.44 |

0.43 |

0.41 |

0.27 |

0.60 |

What I discover shocking about these outcomes is that not one single score class outperformed the market as measured by SPDR S&P 500 Belief (ARCX: SPY). In each conceivable means, every score didn’t match the efficiency of the market, a lot much less beat it.

Now, I don’t wish to bash the efficiency of the scores an excessive amount of. The Promote-rated shares considerably underperform the remainder of the index, as they need to. It is usually price noting that there isn’t any important distinction between Robust Purchase-, Purchase-, and Maintain-rated shares. But, every nonetheless underperformed the general index. I do have a working concept, and it has to do with the weighting of the index.

Every of my analyzed scores assumes an equal weighting of the businesses. If one have been to match the respective ETFs of the S&P 500 and the Equally Weighted S&P 500, one can see that the general efficiency of the primary index is influenced by the bigger elements. Extra particularly, it has to do with the Magnificent Seven. Since April 1, 2019, the S&P 500 has yielded a complete common return of (14.2% ± 23.7%). If one compares this to the representing Invesco S&P 500 Equal Weight ETF (ARCX: RSP) and its common return of (12.0% ± 30.4%), one can see that equal weighting has not carried out properly. To place a finer level on this, if one had invested within the seven largest firms, held them for one 12 months, after which rebalanced, that technique would have crushed the remaining constituents by an element of two (24.46% ± 25.57% v. 12.78% ± 20.11%).

A Easy Focused Method

I’m not a fan of index ETFs due to their lack of focus. I’ve no urge for food for getting a basket of 500 shares figuring out that a number of of them are actual canines. As one can see from the case of the Magnificent Seven, it’s doable to have outsized features with only a few shares based mostly on a theme. I favor a extra focused method. As a part of that method, I reserve a section of my portfolio for large-cap earnings shares. Right here is my easy screening course of.

- US large-cap shares

- Exclude all mining firms.

- Exclude all grasp restricted partnerships.

- Exclude all REITs.

- Financially safe

- Debt-to-equity < 0.4

- Present ratio > 1.5

- Optimistic free money move

- Optimistic web earnings

- Robust dividend historical past

- Present yield > 2%

- Historic payout ratio < 50%

- Annual dividend will increase for ten years.

- Working margin (TTM) > Historic working margin

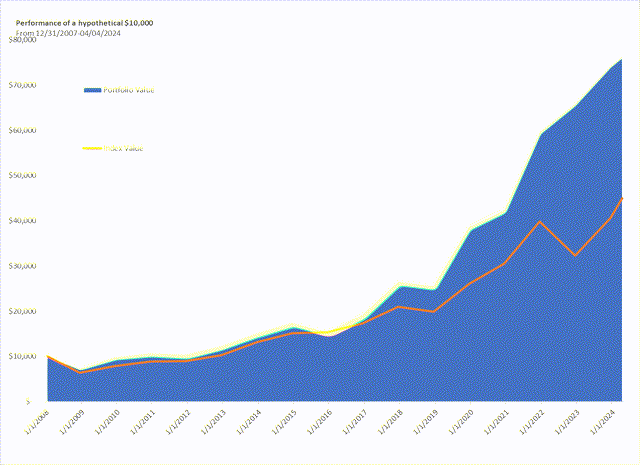

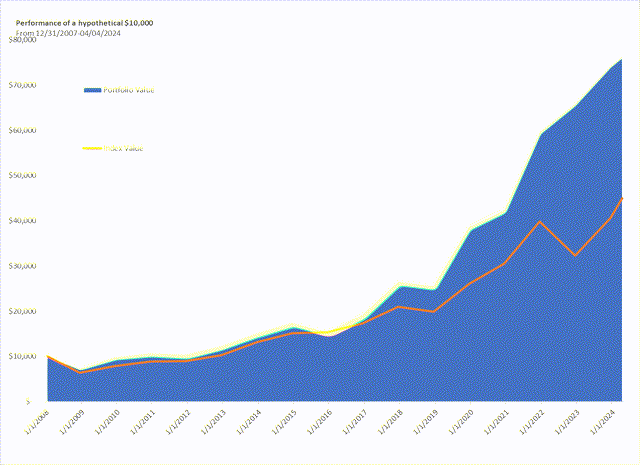

Right here is the historic knowledge to indicate the efficacy of the method.

|

Common annual complete return (for the interval ended on 12/31/2023) |

Common Portfolio Dimension |

Massive Cap Revenue Display |

S&P 500 |

Extra |

|

|

1-year |

4.0 |

12.64% |

26.00% |

-13.36% |

|

|

3-year |

2.0 |

11.51 |

10.05 |

1.46 |

|

|

5-year |

2.6 |

19.91 |

15.42 |

4.49 |

|

|

10-year |

4.3 |

15.02 |

11.94 |

3.08 |

|

|

15-year |

5.9 |

15.26 |

13.14 |

2.12 |

|

|

(01/01/2008-04/04/2024) |

4.8 |

13.52 |

9.86 |

3.67 |

|

|

Commonplace Deviation |

19.67 |

20.58 |

-0.90 |

||

|

Return/Volatility Ratio |

0.62 |

0.47 |

0.15 |

||

|

Supply: FactSet through Portfolio123 |

|||||

|

All averages geometric |

|||||

|

12-Month Rolling Common Knowledge |

Years |

From |

To |

Common Variety of Holdings |

Massive Cap Revenue |

S&P 500 Index |

Extra |

|

|

Common |

772 |

12/29/2007 |

4/2/2024 |

5.63 |

16.42% |

11.95% |

4.47% |

|

|

Up Markets |

647 |

6.06 |

20.29% |

17.07% |

3.22% |

|||

|

Down Markets |

125 |

3.42 |

-3.61% |

-14.54% |

10.92% |

|||

|

Return/Danger |

0.81 |

0.77 |

0.04 |

|||||

|

All averages arithmetic |

||||||||

Massive Cap Revenue Efficiency (FactSet)

What I recognize about his method is its simplicity. It doesn’t require advanced algorithms. One simply seems for sturdy yields based mostly on financially safe dividends. Clearly, the info exhibits that this method has held up in opposition to the general market; particularly during the last 5 years. I particularly like the way in which it holds up throughout down markets. As one can see from the typical variety of holdings, the display offers a manageable-sized portfolio.

What Passes Now

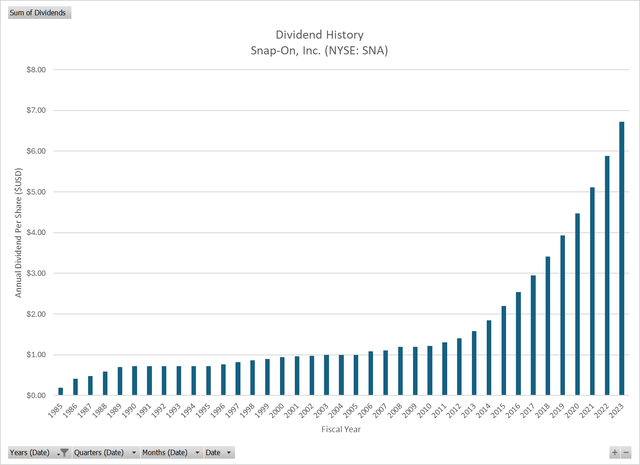

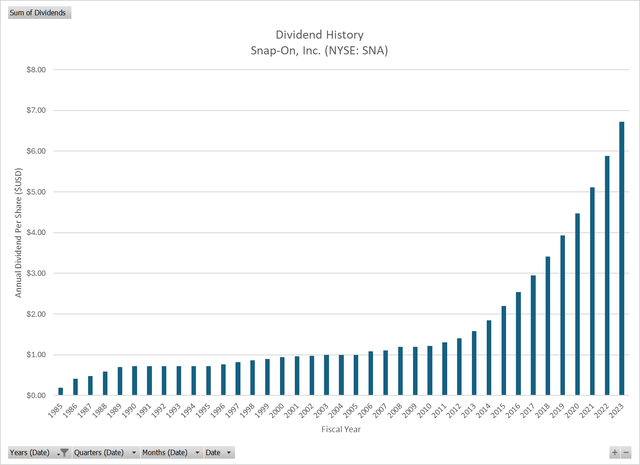

At the moment, the one passing firm is Snap-on, Inc. (NYSE: SNA). As a part of my disclosure, I’ve owned it for 2 years. Within the age of tech and AI, its enterprise in instruments and gear, in addition to diagnostics and restore info, has allowed one to greater than double their funding within the final 5 years. My mentor, the late Ken Kam, would have authorized. My different mentor, Harry, would approve of its safe 2.54% dividend yield. Right here is why Snap-on passes:

- Its trade is Machine Manufacturing. Financially steady

- Debt-to-equity is 0.25.

- Present ratio is 3.88.

- Present free money move (TTM) is $1.14B

- Internet earnings (TTM) is $1.01B Dividend Historical past

- Present yield > 2.54%

- Historic payout ratio is 34.79%.

- Elevated dividends yearly since 2009 Present working margin is 25.65% which is bigger than its historic five-year common of 24.30%.

Snap-on, Inc. Historic Dividends (Yahoo Finance)

My Take

I’m definitely able to performing slick algorithms with discounted money move fashions, discounted dividends fashions, and the like. For the typical investor who needs to play exterior the index universe, I consider you will need to develop absolutely back-tested screens that anybody can use. I supplied that form of display.

My evaluation views Snap-on as a financially safe firm that arms out pay raises yearly. If I have been to provide it a score based mostly on earnings, it must be a “Buy.” This might be based mostly on its monetary power, dividend historical past, and its free money move. It has had a pleasant worth achieve currently, however to not the purpose the place a long-term investor ought to draw back. That is how others view Snap-on:

- Morningstar—Promote

- Worth Line—Maintain

- Zacks—Maintain

- Consensus—Purchase

Good luck and have enjoyable.